Azul: Maintain Hold Rating Despite Strong Q4

Summary

- Azul share price soared on the back of strong Q4 numbers, encouraging outlook, and the renegotiation of lease terms.

- Most if not all of Azul's key operating metrics suggest a healthy business. Even bears must recognize that the carrier has been executing well.

- The problem is that AZUL remains a very risky stock ahead of the global economic deceleration that I expect to witness next.

- Looking for a helping hand in the market? Members of EPB Macro Research get exclusive ideas and guidance to navigate any climate. Learn More »

RenatoPMeireles/iStock Editorial via Getty Images

Azul S.A. (NYSE:AZUL) has been hit hard in the past three years by many challenges, COVID-19 being only one in a long list. The Brazilian airline also has suffered from rising crude oil prices, devaluation of the Real, and inflation in the home country that, through mid-2022 at least, has been higher than in most developed nations.

Given this backdrop, Azul's Q4 results were robust, in my view. The key operating metrics point to a strong recovery across the board, from capacity to pricing power and cost management.

While it's easy to be excited about Azul's execution in the holiday period, I maintain a hold rating on this stock due to the increased risk of investing in a foreign airline in the midst of what I believe to be the early stages of a global economic slowdown.

Azul's solid Q4 numbers

Shares of the Brazilian carrier soared by as much as 60% on earnings day before pulling back to $5.85 apiece. Bullishness was probably justified by (1) strong operating metrics in Q4 that support an optimistic view for 2023 and beyond, and (2) renegotiation of most of the company's commercial agreements, which helps to improve cash flow in the short-to-medium terms.

Regarding the former, Azul delivered revenues of R$4.45 billion that were 19% higher than 2021 and a whopping 45% better than the 2019 holiday period. The strong top-line performance was supported by a 10% YOY increase in capacity (something that US-based carriers can only dream of achieving currently), 5% rise in revenue seats, and sizable 16% bump in passenger yield (a measure of per-unit revenue).

On the cost side, Azul also benefited from an increasingly fuel-efficient fleet. Excluding the impact of much higher crude oil prices, per-unit operating expenses, or CASK-ex, pulled back 4%. Given the momentum, Azul's management team now estimates 2023 revenues to reach R$20 billion for implied growth of 26% YOY, and EBITDA of more than R$5 billion that would be at least 40% higher than 2019 levels.

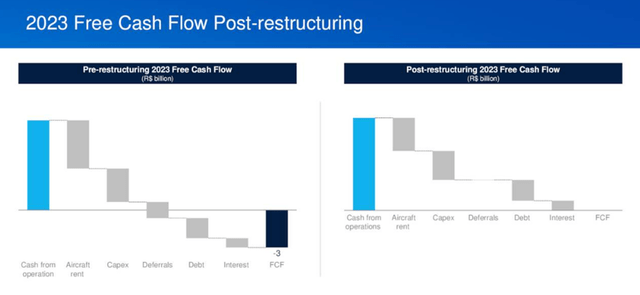

Regarding lease term negotiations, Azul announced that it has agreed with many of its lessors and OEMs to swap short-term commitments associated with COVID-19 deferrals and lease rates for longer-term debt obligations and equity. By doing so, Azul pushes forward some of its planned cash outflows and saves on lease costs.

Azul's earnings presentation

The end result is highlighted above: projected breakeven FCF in 2023, up from a previous outflow estimate of R$3 billion, followed by positive cash flow starting next year. It's perhaps Azul's liquidity-management initiative, more so than Q4 numbers, that drove the share price past $6 during parts of Monday's trading session.

The stock remains risky

Even Azul bears must recognize that the company has plenty going for it. Most if not all key operating metrics suggest a healthy business, as capacity, traffic and per-unit revenue last quarter were all higher than the pre-pandemic levels of Q4'19.

The airline operates what's likely the best network in Brazil. With a diversified fleet, Azul services profitable regional markets to which its competitors have limited access. Compared to other Latin American airlines, Azul continues to be among the best, in my opinion.

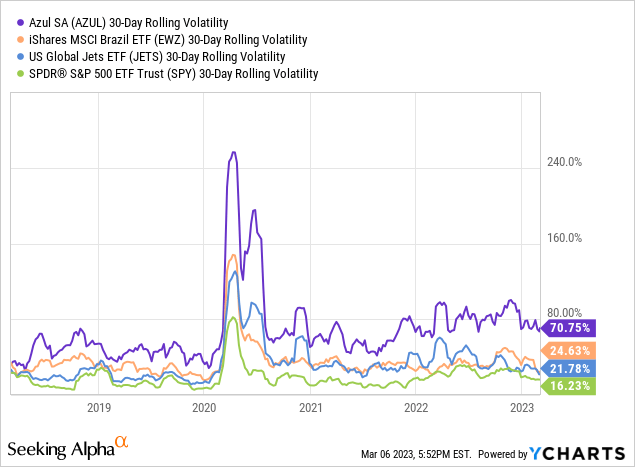

The problem is that AZUL remains a very risky stock due to a combination of (1) the procyclicality that is a trademark of the airline space and (2) the exposure to nearly unpredictable movements in crude oil prices and the Brazilian Real. The chart above shows that annualized volatility in AZUL has traditionally been much higher than that of the airline space at large (light blue line), with a staggering 71% today being nearly three times as high as the Brazilian stock index (orange line).

Looking forward, it does not help that we are very likely in the early stages of global economic deceleration — I expanded on this argument in my most recent article about crude oil. The Federal Reserve in the US and other central banks around the world seem to be working hard to ensure that economic stagnation is, in fact, what happens next.

To be fair, Azul's valuations are far from overly stretched. In its earnings presentation, the company itself pointed out that 4.2x EBITDA pre-earnings was nearly half the pre-pandemic average of 8.1x. But (1) AZUL's single-day 40% rally on March 6 substantially chips away at the upside potential, and (2) the discounted valuation multiple may be quite appropriate given the risks and economic cycle argument presented above.

In summary, I find it hard to be an AZUL bear when the company seems to be making the right moves to ensure a swift recovery from the depths of the COVID-19 crisis. At the same time, the market landscape does not instill much confidence that an investment in a foreign airline is the right strategy at this moment. For these reasons, I maintain my hold rating for AZUL stock.

Join EPB Macro Research

EPB Macro Research is a thriving community of investors seeking better risk-adjusted returns, while optimizing their portfolios to benefit from the next economic cycle. I invite you to join EPB, where you can read more about multi-asset diversification and participate in the discussions about the markets, the economy and investment strategies.

This article was written by

Daniel Martins is a Napa, California-based analyst and founder of independent research firm DM Martins Research. The firm's work is centered around building more efficient, easily replicable portfolios that are properly risk-balanced for growth with less downside risk.

- - -

Daniel is the founder and portfolio manager at DM Martins Capital Management LLC. He is a former equity research professional at FBR Capital Markets and Telsey Advisory in New York City and finance analyst at macro hedge fund Bridgewater Associates, where he developed most of his investment management skills earlier in his career. Daniel is also an equity research instructor for Wall Street Prep.

He holds an MBA in Financial Instruments and Markets from New York University's Stern School of Business.

- - -

On Seeking Alpha, DM Martins Research partners with EPB Macro Research, and has collaborated with Risk Research, Inc.

DM Martins Research also manages a small team of writers and editors who publish content on several TheStreet.com channels, including Apple Maven (thestreet.com/apple) and Wall Street Memes (thestreet.com/memestocks).

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.