Bilibili's Decade Of Losses Casts Doubt On Valuation

Summary

- The company has not achieved profitability despite increasing revenue from 20 million in 2015 to 3.2 billion in 2022.

- BILI is a popular Chinese online entertainment platform similar to YouTube, established in 2009, generating revenue through advertising, mobile games, live streaming, value-added services, and e-commerce.

- Q4 results show solid growth in user metrics and net revenues and a net loss of RMB1.5 billion.

- Bilibili faces potential competition from more prominent players like Tencent and ByteDance.

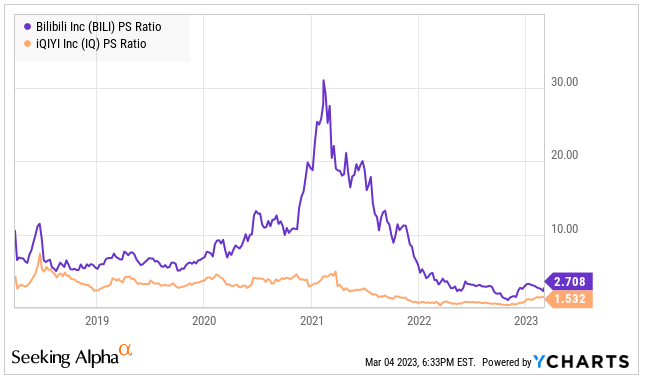

- BILI is trading at 2.7x sales while iQIYI is trading at 1.5x; iQIYI's revenues are larger than Bilibili's, and iQIYI's EBITDA is positive, BILI's is still negative.

zeljkosantrac

Bilibili Inc. (NASDAQ:BILI) is a popular Chinese online entertainment platform similar to YouTube, established in 2009. Initially, the platform focused on long-form videos related to anime, comics, and gaming, known as ACG content, which gained popularity among Gen Z users. However, as time passed, BILI diversified its content to cater to the interests of a broader audience, attracting users of all ages in China. The platform generates revenue through five primary sources: advertising, mobile games, live streaming, value-added services, and e-commerce.

Q4 Results

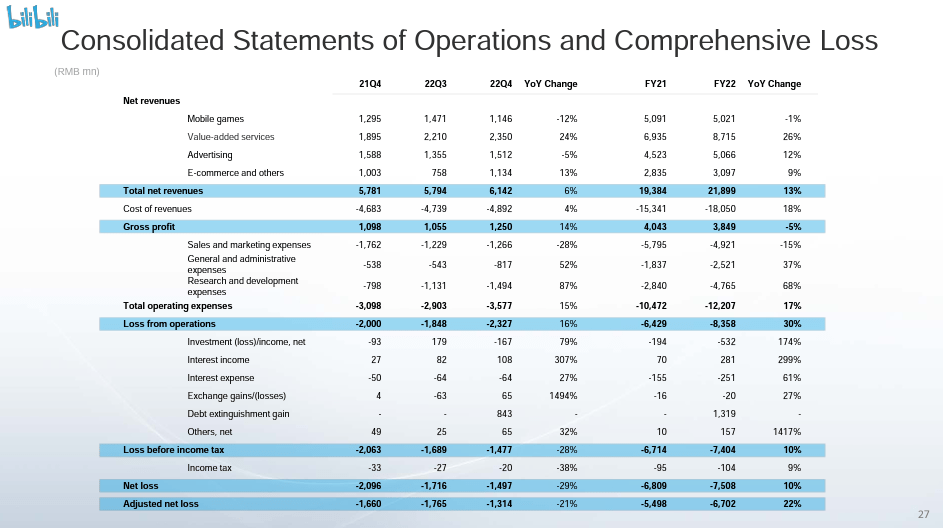

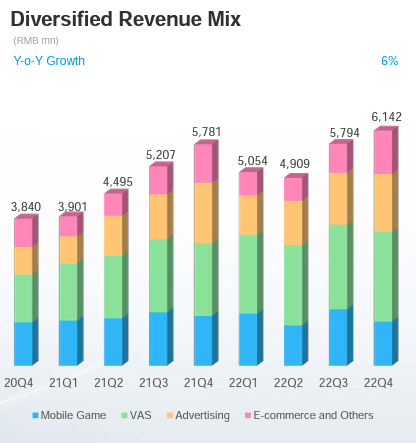

On March 2, BILI announced its fourth-quarter and fiscal year 2022 financial results, reporting solid growth in user metrics and net revenues. Total net revenues were RMB6.1 billion in the quarter, up 6%, and RMB21.9 billion for the full year, up 13%.

Company presentation

The company also reported a net loss of RMB1.5 billion for the quarter and a net loss of RMB7.5 billion for the full year. Adjusted net loss was RMB1.3 billion in the fourth quarter and RMB6.7 billion for the full year, up 22%.

Company presentation

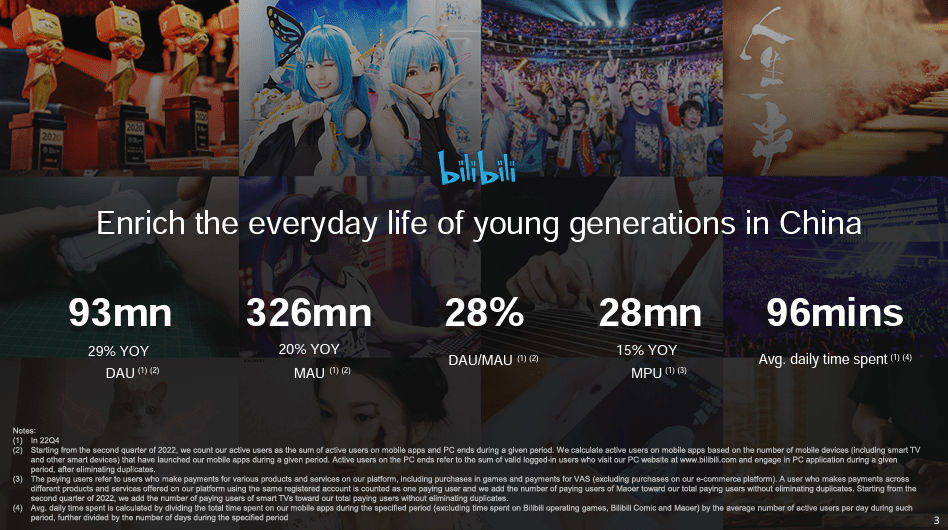

BILI saw a significant increase in user metrics in the fourth quarter, with average daily active users (DAUs) reaching 92.8 million, up 29% year-over-year, and average monthly active users (MAUs) reaching 326.0 million, up 20% year-over-year. The company also reported an increase in average monthly paying users (MPUs), which reached 28.1 million, up 15% year-over-year.

Company presentation

The CEO, Mr. Rui Chen, attributed the growth in DAUs to the company's shift in priority towards DAU growth. He also highlighted the company's highly engaged community, with the average daily time spent per user reaching 96 minutes in the fourth quarter, driving the total time spent on the platform up by 51% year-over-year.

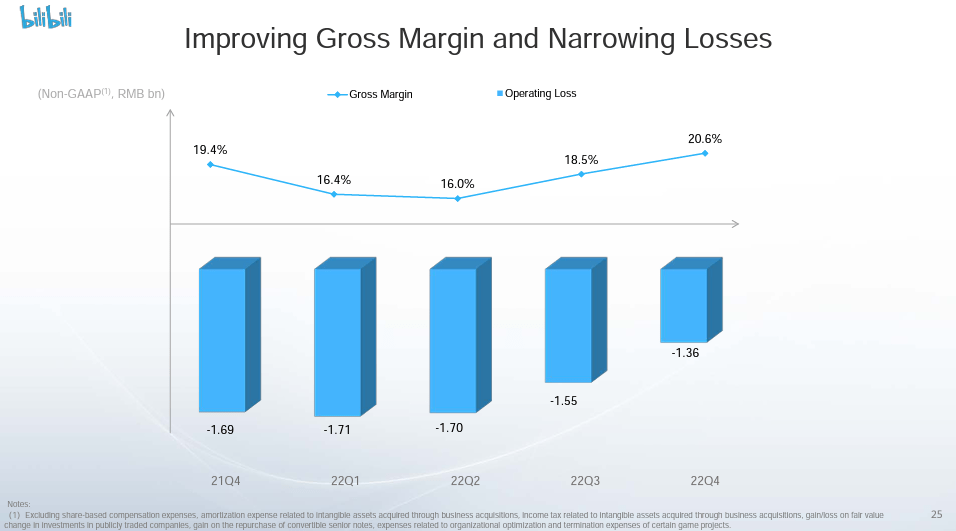

The CFO, Mr. Sam Fan, reported that the company had reduced its sales and marketing expenses by 28% year-over-year while continuing to grow its DAUs. He also noted that the company had taken a more active stance towards balance sheet management through convertible senior notes repurchases, reducing the aggregate principal amount of outstanding convertible senior notes by US$932 million. Moving forward, BILI plans to maintain strict cost control measures while improving margins and narrowing losses.

BILI's Business Model and Future Prospects.

BILI's diversified revenue model includes advertising, mobile games, live streaming, subscriptions, and e-commerce.

Company presentation

The company's focus on building a platform for user-generated content has allowed it to create a self-maintainable ecosystem, significantly reducing content costs compared to other streaming players such as iQIYI (IQ).

However, BILI faces potential competition from more prominent players like Tencent and ByteDance, who can potentially run at break-even or even as loss leaders while monetizing users via other products and services. Additionally, the company has yet to generate a profit after over a decade of existence, as it has not been able to monetize its users effectively.

Valuation

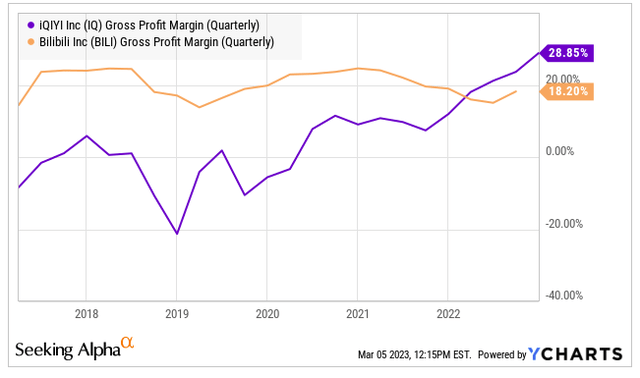

Since 2015, 2017 was the only year that EBITDA was positive despite revenues having grown from 20 million USD to 3.2 billion USD. Thus a DCF valuation is irrelevant, and I opted for a comparison of the Price to Sales ratio. BILI is trading at 2.7x sales while iQIYI is trading at 1.5x.

Ycharts

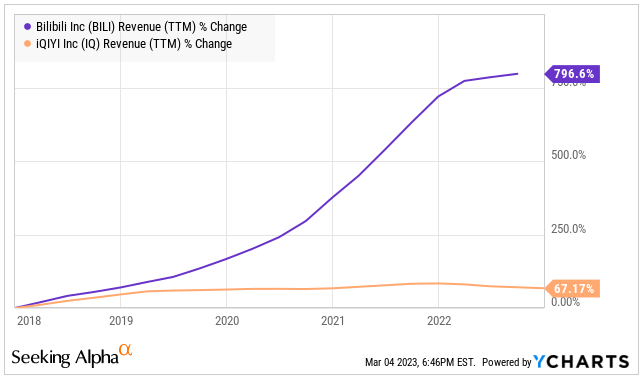

I think the market values BILI’s sales more than iQIYI’s because BILI’s growth has been astronomical compared to iQIYI’s.

Ycharts

However, the two items the market is ignoring are that in absolute terms, iQIYI’s revenues are still larger than BILI's (4.2 billion vs. 3.2 billion), and iQIYI’s EBITDA is positive while BILI’s still negative (197 million vs. -858 million). Unless BILI turns profitable soon, I do not see how the current multiple could be justified.

Risk

The most significant risk for BILI is competition, particularly in mobile games and live streaming. There is uncertainty surrounding whether BILI can effectively monetize its large user base, as the company has kept advertising to a minimum to protect the user experience.

Competition: BILI faces intense competition in mobile games and live streaming from large firms like Tencent and ByteDance. While its core video platform also faces competition from ByteDance, Tencent, and iQIYI, its platform network effect provides better protection from competitive threats.

Monetization: BILI has kept advertising to a minimum to protect the user experience, but it will have to increase ad load to become profitable. Doing so could lead to declining users and engagement, negatively impacting revenue growth and margins.

Dual-Class Voting Structure: BILI has a dual-class voting structure, with Chairman and CEO Rui Chen holding around 43% voting power despite owning approximately 13% of the listed share capital. Yi Xu, Founder, Director and President of the company, controls almost 24% of voting power with just 7% of beneficial ownership. With Rui Chen and Yi Xu holding over 60% voting power, they have significant control over the company's management. They may take actions that are not in the interests of minority shareholders.

Conclusion

BILI's video-sharing platform has significant growth potential as it expands its user base, particularly among younger demographics who are attractive to advertisers. However, there is uncertainty about whether the platform can be monetized massively, which could lead to extended operating losses. Despite revenue growth of 8x since 2018, the current sales multiple may no longer be justifiable and may have downside risks.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.