SPYD: 'High Dividend' Stocks Offer Poor Risk-Reward Tradeoffs Today

Summary

- Investors continue to flock toward high-dividend stocks due to their outperformance last year.

- The popular dividend ETF SPYD outperformed the S&P 500 due to the negative impact of rising interest rates on growth stocks last year.

- SPYD continues to trade near a peak despite the negative impacts interest rates and supply-side inflation may have on its constituents.

- SPYD's weighted-average valuation is much lower than the S&P 500's, but the two are nearly identical after accounting for its weaker EPS growth forecast.

- With the yield curve facing near-record inversion levels, investors may want to brace their portfolio for an impending shock with short-term bonds - which have higher yields than SPYD today.

IvelinRadkov

The surge in interest rates over the past year has dramatically altered the income-investing landscape. Bond yields are the most attractive in over a decade and generally pay much higher returns than dividend stocks. That said, as discussed in "EDV: Beware The Coming Yield Curve 'Re-Steepening,'" long-term bonds remain risky due to a potential rise in the Federal Reserve's inflation target and the eventual steepening of the yield curve. Although popular dividend stock funds like (NYSEARCA:SPYD) have much lower yields, they have less direct inflation risks as corporate profits often rise with inflation. Of course, supply-side inflation that disproportionately increases costs may negatively impact profits, as we see in many firms today.

SPYD is an interesting ETF today because it has outperformed the S&P 500 over the past year. Despite the rise in comparable bond yields, SPYD has maintained its assets under management and remains very popular among income investors. That said, many of the companies in the fund have higher cyclical risk exposure and could face dividend cuts if the economy continues to stagnate. While the valuations of many of its constituents are slightly below that of the S&P 500, economic slowdowns often cause "cheaper" stocks to fall further due to their elevated risk exposures. For this reason, income-oriented investors may want to avoid high exposure to SPYD over the coming months.

How Does SPYD Compare to the S&P 500?

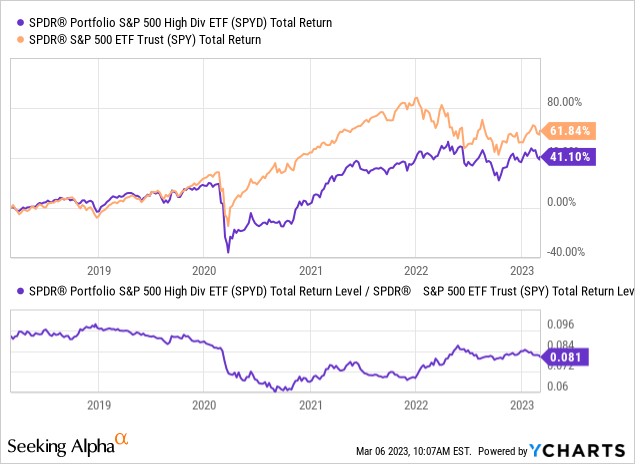

The S&P 500, as seen in the ETF (SPY), has performed similarly to SPYD over the past five years despite significant volatility. The two traded closely before the "lockdown crash" three years ago. During that period, SPYD underperformed significantly due to its elevated cyclical risks but quickly rebounded over the following year. See below:

The sharp rise in interest rates has been a comparable benefit to SPYD over the past year and a half. Higher rates caused the valuations of growth stocks, such as technology, to decline disproportionately to cheaper dividend-paying stocks. Comparatively, SPYD has not seen any significant decline since 2022 and continues to trade near its all-time high. That said, SPYD has not outperformed SPY over the past ~6 months as the S&P 500 has stabilized.

SPYD's dividend yield is much higher than the S&P 500's at 4.45% today (based on SEC yield), while SPY's is just 1.55%. The valuation of SPYD's holdings is lower, but its firms also have much weaker growth expectations. SPYD's weighted average "P/E" is 13X with a 4.7% 3-5 year EPS growth outlook; the S&P 500's is 20.3X with a 12% EPS growth outlook. The analyst consensus believes the S&P 500's weighted-average EPS will grow by 40% over the next three years (or 12% compounded over three years), while SPYD's will increase by ~15% (or 4.7% compounded over three years). Adjusting their valuations for the three-year growth target EPS, SPYD's "three years forward "P/E" is 11.3X (13X/1.15), while SPY's is 14.5X (20.3X/1.4). If we use five years of compounded EPS growth, those figures fall to 10.3X for SPYD (or 13X/1.047^5) and 11.5X for SPY (or 20.3/1.12^5).

Put simply, there is a significant real valuation difference between SPYD and SPY if we account for EPS growth expectations. SPYD is much cheaper based on its TTM EPS, but its growth outlook is comparatively worse, such that its long-term valuations are nearly the same. In my view, it is doubtful that the S&P 500 will achieve a 12% EPS growth rate over the next three to five years due to economic turbulence negatively impacting its earnings. However, SPYD faces the same challenge, so I do not believe its comparatively more attractive than SPY despite its lower valuation and higher dividend yield. SPYD is not likely to outperform the S&P 500 as long as long-term interest rates do not quickly rise again.

How Will SPYD Perform in A Recession?

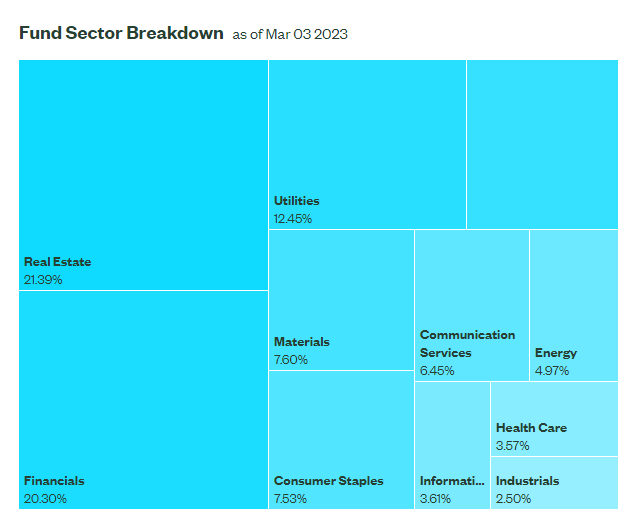

Dividend stocks are often seen as "lower risk" due to the maturity of most higher-dividend companies. Indeed, SPYD owns a diversified portfolio of many established companies with stable earnings. That said, it is not a "low-risk" investment and likely carries higher exposure to economic pressure than most. The fund also has high exposure to sectors that are negatively impacted by a prolonged increase in borrowing costs, such as real estate, utilities, and (to a varying extent) financials. See below:

SPYD Sector Exposure (State Street SPDR)

On the surface, these sectors have varying exposure to economic challenges. Financials and materials often decline disproportionately during recessionary crashes, while utilities and consumer staples often outperform. However, with interest rates elevated, utilities and consumer staples offer lower relative value and may eventually face some income strain due to rising interest expenses, so they're not necessarily "low risk" today. In my view, its REIT exposure may also hamper performance since the sector seems to face high revaluation risk due to slowing commercial property sales (due to the sharp rise in mortgage rates).

Since SPYD is a bit younger, it has not been tested through many periods of significant market volatility. During the 2020 crash, SPYD lost around 46% of its value over the six weeks, while the S&P 500 slid 33%. Of course, that is just one instance, but it points to SPYD being a comparatively riskier investment. Fundamentally, its holdings are not growth-oriented, so they do not have a substantial "earnings cushion" in a recessionary scenario. SPYD also carries greater financial exposure, which is highly exposed to financial shocks and turbulence.

The economic situation today is much different than that of 2020. At that time, the economic outlook was precarious and rapidly declined due to exogenous shocks. Today, the economy is slowing, but much more slowly and primarily driven by rising business and household cost factors such as supply-side inflation and higher interest rates. That said, we're seeing the same key recessionary signals today as in late 2019, such as yield-curve inversion and a falling manufacturing PMI. See below:

The yield curve inverted in 2019 while the manufacturing PMI declined below 50, signaling an impending economic contraction. Of course, if there was going to be an "organic recession" in 2020, it was heavily confounded by the enormous exogenous shock from global lockdowns and subsequent mass stimulus. In my opinion, the market was heavily primed for a recession in late 2019, but the substantial QE and other stimulus efforts in 2020 significantly delayed the inevitable slowdown until today. This factor relates to my view that supply-side inflation is not caused by COVID lockdowns and stems from long-term US manufacturing capacity and efficiency declines. However, the lockdowns certainly exacerbated the issue.

The stock market has not suffered a prolonged decline in fifteen years, far longer than most economic cycles. US corporate profits have also not faced an extended contraction since ~2008-2009 and have had the most substantial EPS growth in over a decade since 2020. In my view, the US economy is due for a prolonged contraction, as it is likely necessary to clear out the many inefficient "zombie companies" today. The ongoing contraction in the yield curve and manufacturing (and services) PMI indicates a more prominent and longer economic slowdown will likely occur this year. While it is true that employment data remains strong, unemployment usually rises after a recession is well underway.

The Bottom Line

Overall, I am bearish on SPYD ETF and believe it is due for a material decline over the coming months. In my view, investors are over-weighting SPYD due to interest in higher dividend firms but may not fully account for the elevated risks faced by most constituents in SPYD. These risks include sales declines from an economic demand decline, and the negative impact higher interest rates will likely have on these firms' cash flows. Ongoing pressure from supply-side factors, such as labor, energy, and materials costs, may also negatively impact the profitability of SPYD's holdings.

I believe SPYD should be trading at a more considerable discount due to its elevated risk exposure. The ETF continues to trade near its all-time-high valuation despite a material decline in the fundamental economic outlook of most of its constituents. That said, I do not believe SPYD is much worse than the S&P 500, as the two trade at similar long-term valuations. However, the S&P 500 is arguably at a slight discount due to its decline last year, while SPYD is not.

Superior Income Alternatives

Income-seeking investors may be better suited to short-term Treasuries or corporate bonds. The iShares short-term Treasury ETF (SHY) has a similar yield to SPYD at 4.6%. The short-term corporate bond ETF (VCSH) has a higher dividend yield of 5.1%. Indeed, the best risk-reward tradeoff may be found in short-term high-yield bond funds like the iShares ETF (SHYG), which currently pays an 8% yield. In my view, while short-term high-yield bond funds like SHYG carry greater economic risk exposure, they're much less risky than dividend equities like SPYD and pay superior returns. Additionally, SPYD has negative (albeit indirect) exposure to the yield curve, while short-term bonds are the few that benefit from the immense inversion today. Considering the near-record curve inversion level is the most enormous "red flag" in the market, it seems income investors are best suited by taking an advantageous exposure to it through short-term bonds.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.