Workhorse: Has Positive Delivery, Positive Outlook, And Attractive Multiples

Summary

- Workhorse is starting to gain momentum on its top-line growth again.

- It is set for long-term growth thanks to its new key operational focus and growing manufacturing capacity.

- Positive catalysts in both its EV truck and drone businesses support its growing top line forecast.

- Workhorse trades at a logical support zone and is trading at attractive multiples, making this stock a good speculative buy.

evandrorigon/E+ via Getty Images

After all the drama and doubt surrounding the company and failing to secure a multibillion-dollar contract, Workhorse Group (NASDAQ:WKHS) surprised investors with a strong 2023 outlook. The management remains confident that they are liquid and can finance legal settlements regarding related lawsuits. In fact, according to the management, the court granted preliminary approval of the legal settlement on February 14, 2023, and set the final approval hearing for July 24, 2023. WKHS continues to show progress in both the EV and drone spaces. With its improving manufacturing capabilities, WKHS is poised for long-term growth.

Company Overview

WKHS is attempting to put matters in order, like dealing with class action lawsuits, to avoid possible enforcement action from SEC. The management plans to settle this with $15 million cash funded by insurance and $20 million payable in WKHS stock. Hence, the company can potentially avoid material indebtedness.

Additionally, it has decided to discontinue the C1000 program in order to focus on its core products and streamline its operations. WKHS incurred an additional $19.5 million in inventory charges to fully dispose of its C1000-related inventory. However, according to the management, they are still expecting additional unusual expenses as quoted below.

In Q4, we made the tough decision to discontinue the C1000 program. Our team did a thorough engineering view and conducted extensive durability testing. However, we decided that platform could not be resigned or repaired sufficiently to safe, reliable and durable vehicle on the road for our customers.

Therefore, the best step for our company was to reallocate engineering and supply chain resources towards the development and production of our other products. We expect previously built C1000 units will be decommissioned, disassembled and disposed of by the end of Q1 2023. Source: Q4 2022 Earnings Call Transcript

This move will enable the company to concentrate on its profitable products and avoid incurring further problems related to the C1000 program. In fact, the management seems excited about updates regarding their improved manufacturing facility.

…we have completely transformed our Union City manufacturing facility into a world-class operation with open, flexible, space with room to grow. I was amazed yesterday when I was there, watching 4 different vehicles be put together by our new team up at Union City.

The plant continues to ramp up production of the W4 CC, the W750 pilot bills, Tropos vehicles and soon the W56-line will open up. I am pleased we are finally getting the plant into production mode. We will be installing the end-of-line Dino in Q2, our new assembly line and a dedicated paint line is being installed ahead on site of the W56 production in Q3.

Additionally, we are in the process of installing production lines for our drones at our engineering technical design and production facility in Mason, Ohio, so we can start regular production in Q2 this year. Source: Q4 2022 Earnings Call Transcript

As part of their key priorities, the upcoming production of the W56, a Class 5/6 work truck, in 2023 potentially positions them to secure government contracts, including with the US Postal Service and other agencies, as quoted below.

We do think there's opportunity at some point with us with the U.S. Postal Service and other government agencies for our Class 5, Class 6 trucks and potentially for our drones. Source: Q4 2022 Earnings Call Transcript

The management expects WKHS to be able to make more than 10,000 trucks per year by 2025, which is a good sign for its long-term growth potential. For the record, in FY22, WKHS only delivered 360 E-series Electric Delivery Vans.

WKHS remains attractive not only on its EV truck potential but also with its Aero business, which I believe will be another source of growth for the company. WKHS's Horsefly, a potential game changer in last-mile delivery, had a successful field test, as mentioned below.

…Horsefly during the first two months of 2023, first, by flying simultaneous package deliveries by multiple aircraft for prospective last-mile delivery customer; and secondly, conducting a successful field test for internal operations of a separate last-mile delivery customer. I will say that both of the potential customers are highly impressed with what our Workhorse product and our flight team can do. Source: Q4 2022 Earnings Call Transcript

Furthermore, its humanitarian and logistics operations ("HALO") also underwent a successful field test and have the potential to win a long-term government contract, as detailed below.

We also successfully field-tested humanitarian and logistics operations or HALO Drone internationally. The Aero team also want to state a grant to support beyond visual line of sight work in Michigan, and we continue to fly and support of the U.S. Department of Agriculture.

We will continue to work on securing additional new federal and state level grants or long-term contracts for our Aero business. We expect to start the production of drones and generate revenue in this business later this year. Source: Q4 2022 Earnings Call Transcript

Despite ongoing litigation issues, the positive catalysts have the potential to bring a turnaround for WKHS, making the stock attractive.

Slowing Bearish Momentum

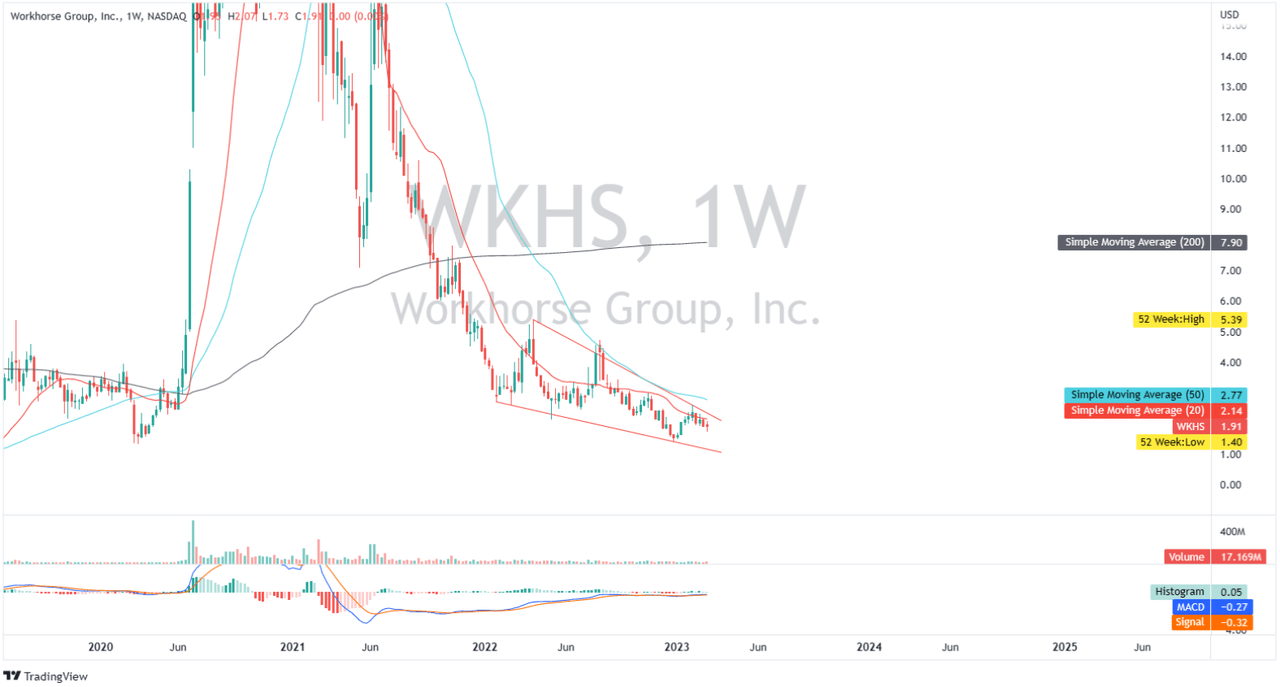

WKHS: Weekly Chart (Source: Author's TradingView Account)

Looking at its weekly chart, I see a potential bullish reversal here, as shown in its wedge trading pattern. This pattern is formed when the price consolidates between two converging trend lines over time. A potential breakout above its upper trend line could attract bulls and weaken today's bearish momentum. In fact, looking at its simple moving averages ("SMA"), we can see a significant difference between today's price and its 200-day SMA, suggesting an over-extended bearish momentum. The MACD posted a bullish crossover earlier this year and remains above its signal line as of this writing, suggesting the same sentiment regarding slowing bearish momentum.

Improving Top Line, Hence improving Multiples

One of WKHS's value adding catalyst is the positive top line outlook of the management in FY'23, as quoted below.

We expect to generate significant revenue growth in 2023 and with revenue expected in the range of $75 million to $125 million based on the current supply chain lead times. We believe we have the resources to ensure the financial position to execute our strategic plan will allow us to deliver on our goals and generate value for our customers and shareholders. Source: Q4 2022 Earnings Call Transcript

This catalyst will make a record figure for the company in the future. In fact, on a midpoint basis, this will translate to $100 million in FY'23. This is actually attractive compared to its 5-year average negative cash flow from operation of $71 million. If managed properly, this should result in a corresponding increase in cash flow from operations. In fact, analysts already projected positive earnings per share of $0.10 in full year 2025. This positive catalyst makes WKHS attractive despite its high trailing multiples and its negative cash flow as of this writing.

Today, WKHS trades at a trailing EV/Sales of 47.34x, despite a huge price drop from its 2021 high. However, with a forward EV/Sales of 2.66x, the stock seems attractive right now. Assuming that the price will continue to grow in FY'25 amounting to $333.16 million, this could easily translate to a 0.98x forward EV/Sales. This unlocks a significant discount, making the company attractive as of this writing.

Conclusive Thoughts

Potential dilution from legal settlement as mentioned earlier remains a key risk for the Workhorse Group. However, potential improvement on its profitability as it ramps up production outweigh this risk. If it can deliver positive results and begin to outperform expectations, Q1'23 will be an interesting quarter for WKHS.

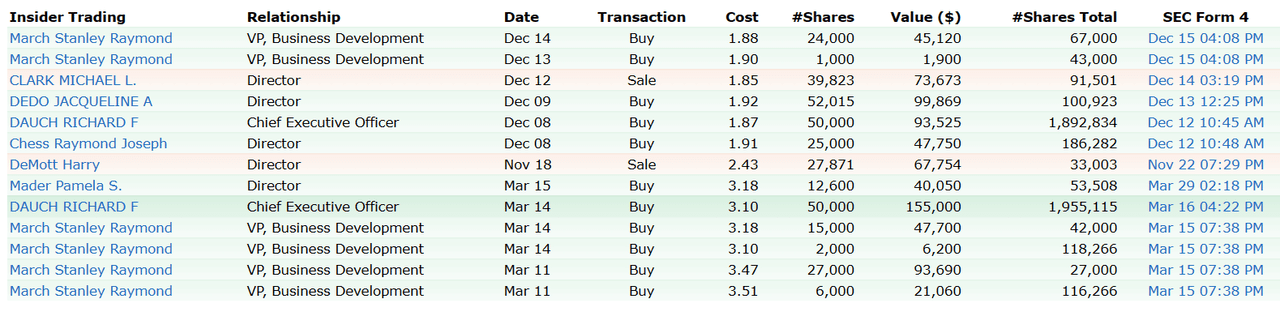

WKHS: Positive Insider Activity (Source: Finviz)

As shown in the image above, insiders are still bullish on WKHS and a potential catalyst regarding government contract wins could trigger a significant short squeeze, making the stock a good speculative buy as of this writing.

Thank you for reading and good luck everyone!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in WKHS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.