Manulife: Time For A Little Caution

Summary

- We rated Manulife with a buy rating on our last coverage.

- The stock has delivered.

- The stock still appears cheap, but the risks are now higher at this stage of the cycle.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

BalkansCat/iStock Editorial via Getty Images

Note: All amounts discussed are in CAD unless specified otherwise.

On our last coverage of Manulife Financial Corporation (NYSE:MFC) (TSX:MFC:CA), we covered the business and the impact of the newly introduced IFRS 17. While we felt that the stock was not a "slam dunk" as many bulls have implied, we still gave it the green light.

We rate the shares a buy and have a $20 USD price target on them.

Source: A Quality 5.4% Yield

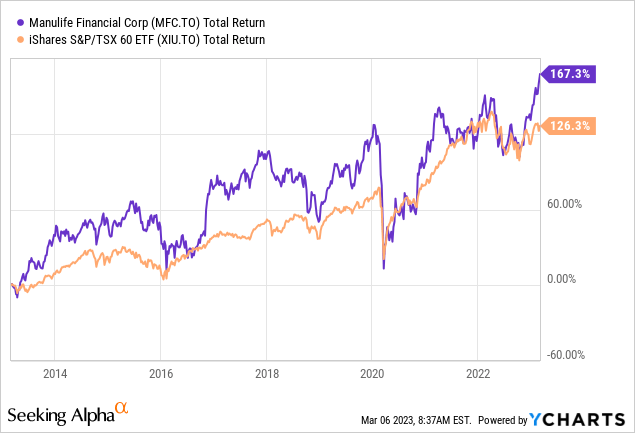

The stock has handily outperformed the broader markets by over 17% since then. The picture below also should show you why we are revisiting things.

Seeking Alpha - Returns Since Last Article

We look at recent Q4-2022 results and update our outlook for the company.

Q4-2022

The fourth quarter was a solid performance, with MFC stock reporting 88 cents a share and beating estimates by a wide margin. While the estimates were handily beaten, there were some weak spots. Total earnings, for example, were still down 2% on a constant currency basis. Global Wealth and Asset Management ("Global WAM") saw net outflows of $8.3 billion in the fourth quarter, and estimates were for a solid increase. The insurance segment was the key driver of the beat as earnings were up here 7% year over year. By comparison, Global WAM was down 28% on the back of much higher expenses.

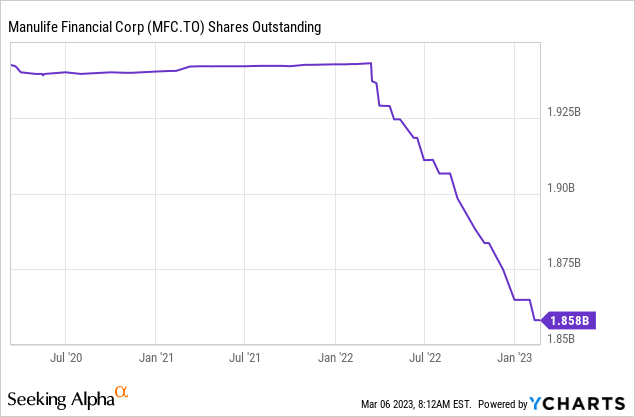

MFC did offer some positive news on the capital return front. After buying back slightly more than 4% of outstanding shares over the course of 2022, it renewed its NCIB to repurchase more shares.

One great thing to see here is that share counts are actually falling. In many firms, the buybacks are basically an offset to the stock-based compensation. MFC further enhanced its capital return by one of the most solid bumps to the dividend. It raised it by 11%.

Outlook

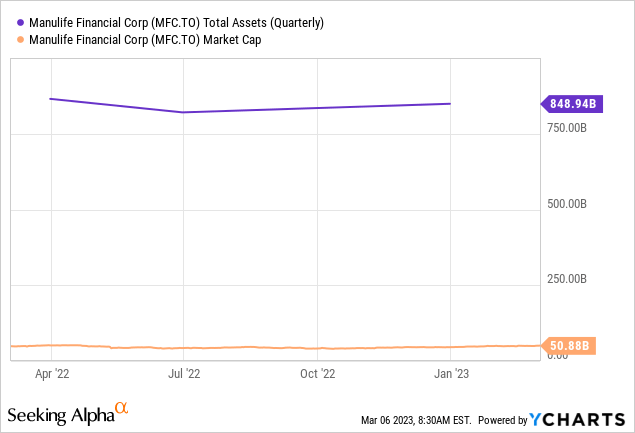

For MFC, the positive aspects in today's environment come from the high interest rates and the growth potential in Asia. The former helps in income as its balance sheet bonds roll off. The latter remains one of the last places where insurance products have poor penetrations and MFC can really expand. The primary negative comes from the asset management side, where the passive ETF industry continues to pressure margins and fees. We have been optimistic on that front, as in we envision the ultimate bursting of the passive investment bubble at some point. That said, it has not yet happened and investors still remain clueless about the dangers of pouring money into indices at these valuations. The secondary negative here is that we are in the latter part of the economic cycle and, at some point, we will get a recession. The policies written by MFC, like all other insurance firms, have complex actuarial assumptions built into them. Alongside that, there are derivatives and hedges employed to ensure a smooth functioning and margin capture. In almost all cases, these don't work exactly as planned. Hedging for tail events alongside managing the base business is difficult when your asset side is huge in relation to your equity base.

To MFC's credit, it has reduced risk where feasible.

Our capital position remains strong with a LICAT ratio of 131% and we delivered $6.9 billion in remittances, the highest in our company's history and an increase of $2.5 billion compared with the prior year, benefiting from the reinsurance of our legacy U.S. variable annuities block.

Source: MFC Q4-2022 Earnings Press Release

But is it enough? We will only truly know that answer on completion of this business cycle

Valuation & Verdict

At about 8.5X to 9.0X 2023 earnings, MFC continues to ring in as cheap. The company has delivered over the last decade through simplification of its business and a total return that has beaten the iShares S&P/TSX 60 ETF (XIU:CA).

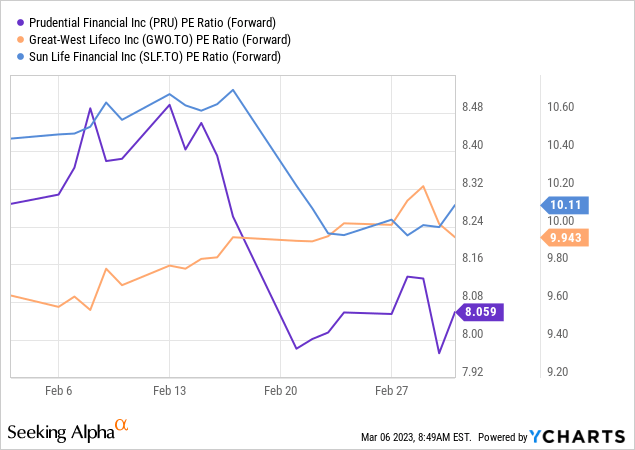

Of course, the counterargument is that P/E is useless at this stage of the cycle and all of its competitors are very cheap as well.

In our opinion, this number here, near 9.0X, is fair. One could perhaps argue here that MFC deserves a small premium for having the highest LICAT ratio among the 3 Canadian majors. Sun Life Financial Inc. (SLF) was at 130%, a shade below MFC's 131%. Great-West Lifeco (GWO:CA) was at 120% in Q4-2022. While those are relatively small differences, MFC does have the lowest P/E ratio here out of the 3, despite having the highest LICAT ratio. Yes, the businesses are not identical but all three face similar pressures and risks. That is the point. So, on a relative basis, you could argue for some outperformance here. For our money, though, we think the trade is done or close to done. It has delivered great results considering the challenging environment. We are downgrading the shares to a Hold and think the upcoming financial market turmoil will create better entry points for all financial stocks. We still own the shares, and our version of reducing risk is to have covered calls on the stock.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have a beneficial long position in the shares of MFC:CA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Long position has covered calls sold against it.