Crescent Point Energy: Strong Yield For Those That Buy Now

Summary

- Crescent Point Energy Corp. is to pay out a 4.3% dividend yield to investors who hold the stock as of 10 March.

- If oil prices average $75 WTI, Crescent Point stock is priced at 5x free cash flow.

- On top of Crescent Point Energy's dividend payout, there's also significant capital being deployed to repurchase shares.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

Zerbor

Investment Thesis

Crescent Point Energy Corp. (NYSE:CPG) is an oil and gas E&P based in Canada. Therefore, my figures mostly discuss Canadian dollars (''CAD'').

Crescent Point Energy's share price hasn't actually gone anywhere in the past year. However, I believe that CPG is a compelling investment, particularly given the strength of its balance sheet and its attractive dividend yield. This stock won't remain on sale forever. In time, investors should return to CPG, given its very attractive free cash flows.

What's Happening With Oil?

There are two different aspects impacting oil prices. There are global recession fears, creating a headwind to oil prices. Also, in the U.S., there's a possibility that interest rates could remain elevated for longer than originally expected, which would also dampen demand for oil.

Together, these are two significant considerations that could keep a lid on oil prices.

That being said, I maintain, as I have for months, that if oil prices average $70 WTI, that's more than enough for CPG to be a compelling investment.

In fact, at $70 WTI, CPG will make CAD$800 million of free cash flow, putting the stock at less than 7x free cash flows.

Truly, if you compare with other areas of the market, outside of oil and gas, you won't find too many companies where the bearish argument leaves a stock priced at 7x free cash flow.

With that in mind, let's delve further into CPG's prospects.

Strong Financial Footing

I strongly believe that when one invests in a commodity company, the first and most important aspect to consider is the company's balance sheet. You can buy a company with great management, or with a compelling valuation, but if you don't have a balance sheet that supports the company's efforts, everything else falls apart.

On this front, CPG doesn't disappoint. Assuming oil prices average $75 WTI in 2023, CPG's net debt position will exit 2023 with net debt of CAD$1.1 billion, or 0.5x net debt to adjusted funds flow (a proxy metric for cash flows from operations, before capex).

Meaning that CPG's balance sheet doesn't cause any problems for investors. Hence, we can now turn our focus to CPG's capital allocation framework.

CPG's Dividend in Focus

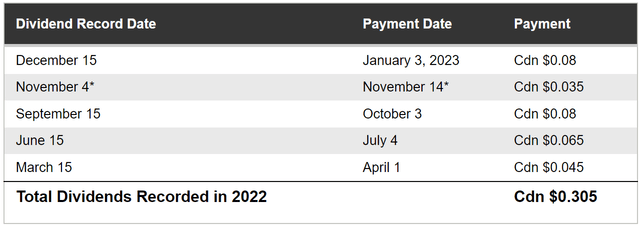

CPG recently raised its dividend by 25% to CAD$0.10 per share. This equates to CAD$0.40 per year. This puts its base dividend yield at 4.0% (on its Canadian shares).

That being said, for this upcoming quarter, CPG also is providing a one-off base dividend of CAD$0.032, payable in March, for investors on record on 10 March. This one-off dividend equates to a 0.3% yield, on top of the 4.0% yield.

Now, to be clear, this one-off dividend can't be banked on as recurring. So, investors should only expect a 4.3% yield to be a one-off event.

That being said, such a blanket dismissal doesn't do any justice to the special dividend payout last quarter of CAD$0.035 per share.

So, what can we conclude from this? We can conclude that as investors in the stock right now, we'll get at least a 4.3% yield. And perhaps, if oil prices remain stable, there may be more special dividends later in the year, although we can't really bank on that consideration.

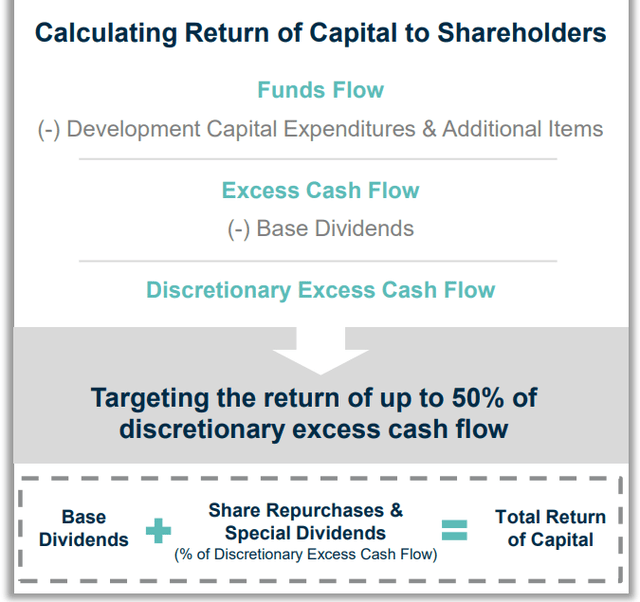

On top of its dividend, CPG is also committed to repurchasing its shares. In fact, during 2022, CPG share repurchases accounted for 60% of the total capital returned to shareholders.

Consequently, we should be reminded that CPG's priority is on repurchasing shares, rather than favoring its dividend payout. However, given that its shares are so cheaply valued, CPG's capital return framework means that "there's something for everyone."

To echo this stance, management said on the call,

We continue to focus on share repurchases as our primary tool within this framework, given our current valuation.

Indeed, in the slide that follows, we can see CPG's capital framework on display.

50% of CPG's free cash flows, after its base dividend payout, are to be returned to shareholders.

The Bottom Line

I put the bulk of my investment thesis on Crescent Point Energy Corp.'s dividend payout, which for investors jumping on board before 10 March will come up to a 4.3% yield. But on top of that figure, CPG is determined to repurchase shares.

Altogether, assuming oil prices average out at $75 WTI or higher, Crescent Point Energy Corp. will return to investors 9% of its market cap this year via repurchases and dividends.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.