Intra-Cellular's Caplyta Is Likely A Blockbuster For Bipolar Depression Barring Generic Entry

Summary

- Intra-Cellular Therapies develops small-molecule drugs targeting the central nervous system for neuropsychiatric and neurological disorders. Caplyta is their lead drug, approved by the FDA for schizophrenia and bipolar depression.

- Caplyta's exceptional tolerability sets it apart from other antipsychotics, with a low incidence of weight gain, metabolic abnormalities, and movement disorders like tardive dyskinesia, making it an appealing treatment option.

- In the fourth quarter of 2022, Intra-Cellular Therapies reported net product sales of $87.4 million for Caplyta, representing a year-over-year increase of 243%.

- Intra-Cellular expects Caplyta to generate $430-$455 million in revenue this year, driven by strong growth and demand. With a projected 30% growth, Caplyta is on track to become a blockbuster drug in the near future.

- Intra-Cellular will face a significant challenge when Caplyta's NCE patent expires in December 2024, relying on Orange Book patents for exclusivity. With no significant value drivers beyond Caplyta for bipolar depression, Intra-Cellular is currently reasonably valued at $4 billion, making it a "Hold" recommendation until further developments arise.

champpixs/iStock via Getty Images

Introduction

Intra-Cellular Therapies (NASDAQ:ITCI) is a biopharmaceutical company that focuses on developing and commercializing innovative small molecule drugs that address unmet medical needs, particularly in neuropsychiatric and neurological disorders, by targeting intracellular signaling mechanisms within the central nervous system. Their lead drug, Caplyta (lumateperone), was approved by the US Food and Drug Administration [FDA] in December 2019 for the treatment of schizophrenia in adults. In December 2021, Caplyta was also approved by the FDA for the treatment of bipolar depression in adults. Lumateperone is currently in phase 3 clinical trials for the treatment of major depressive disorder.

Intra-Cellular Therapies' Caplyta Sales Soar, Reports Net Product Sales of $87.4 Million in Q4 2022 with 243% Year-Over-Year Increase

In the fourth quarter of 2022, Intra-Cellular Therapies reported net product sales of $87.4 million for Caplyta, representing a year-over-year increase of 243%. The net loss for the fourth quarter of 2022 was $44.0 million compared to a net loss of $85.7 million for the same period in 2021. Cost of product sales for Caplyta was $6.8 million in the fourth quarter of 2022 compared to $2.5 million for the same period in 2021. Selling, general, and administrative expenses for the fourth quarter of 2022 were $94.6 million, while research and development expenses were $33.9 million. Cash, cash equivalents, restricted cash and investment securities totaled $593.7 million at December 31, 2022, compared to $413.7 million at December 31, 2021.

Caplyta's Unique Mechanism of Action and Advantages Over Other Antipsychotic Drugs

Caplyta differs from other antipsychotic drugs in its mechanism of action. It functions as a modulator of serotonin, dopamine, and glutamate receptors, with a particular focus on presynaptic D2 receptors and postsynaptic 5-HT2A receptors. This modulation of receptors is believed to enhance neurotransmitter signaling and promote a more balanced pattern of brain activity. Unlike many other atypical antipsychotics, Caplyta has a lower affinity for dopamine receptors and lacks antimuscarinic or antihistaminergic properties. These characteristics help to minimize side effects associated with other antipsychotics, such as extrapyramidal symptoms, weight gain, and blurred vision.

Caplyta Shows Efficacy in Two Clinical Trials for Schizophrenia Treatment; Also Effective in Treating Depressive Episodes in Bipolar Disorder: Study Results

Caplyta, an antipsychotic, was evaluated for the treatment of schizophrenia in two placebo-controlled clinical trials. In Study 1, patients receiving Caplyta 42 mg showed a statistically significant reduction in the Positive and Negative Syndrome Scale [PANSS] total score compared to the placebo group. However, the treatment effect in the Caplyta 84 mg group was not significant. In Study 2, patients receiving Caplyta 42 mg also showed a statistically significant reduction in the PANSS total score compared to the placebo group, while the treatment effect in the Caplyta 28 mg group was not significant. Studies 1 and 2 did not include patients aged 65 or older.

Caplyta was also evaluated in a clinical trial for the treatment of depressive episodes associated with bipolar I or II disorder. In this study, Caplyta showed efficacy as monotherapy based on the change from baseline in Montgomery-Asberg Depression Rating Scale [MADRS] total score at Week 6. The secondary endpoint was the change from baseline in Clinical Global Impression-Bipolar-Severity of Illness scale [CGI-BP-S] total score at Week 6.

Caplyta has also been found to be effective as adjunctive therapy with lithium or valproate in a 6-week study of adult patients who met DSM-5 criteria for depressive episodes associated with bipolar I or bipolar II disorder. The study involved 529 patients who were randomized to receive Caplyta 28 mg, Caplyta 42 mg, or placebo. Patients receiving Caplyta 42 mg showed a statistically significant improvement in the MADRS total score and CGI-BP-S depression score compared to the placebo group. However, the treatment effect in the Caplyta 28 mg group was not statistically significant.

Moreover, there were only minimal treatment-related side effects such as extrapyramidal symptoms, metabolic dysregulation, and weight gain, which were comparable to those observed in the placebo group.

Current Treatment Recommendations for Bipolar Depression

As the market for bipolar depression is significantly larger than that of schizophrenia, our attention will be directed towards this topic, particularly considering the swift increase in revenue following FDA-approval.

According to UpToDate:

Bipolar disorder is marked by episodes of mania and hypomania and nearly always includes episodes of major depression. Observational studies consistently show that depressive episodes predominate the clinical course of bipolar disorder. Compared with manic and hypomanic episodes, bipolar depressive episodes and residual bipolar depressive symptoms account for a greater proportion of long-term morbidity, impaired functioning, and risk of suicide

Mood stabilizers like lithium or valproate are the mainstay medications used in the treatment of bipolar disorder. When managing episodes of bipolar depression, treatment recommendations generally involve a combination of medication and psychotherapy.

Below is a list of medications commonly employed in the treatment of bipolar disorder:

| Agent | Adjunct to mood stabilizers? | Most common adverse reactions in clinical trials (incidence > 5% and greater than twice placebo) |

|---|---|---|

| Quetiapine | Yes | Somnolence, dry mouth, dizziness, constipation, asthenia, abdominal pain, postural hypotension, pharyngitis, weight gain, lethargy, ALT increased, dyspepsia |

| Olanzapine + Fluoxetine | Contraindicated | Disturbance in attention, dry mouth, fatigue, hypersomnia, increased appetite, peripheral edema, sedation, somnolence, tremor, vision blurred, and weight increased |

| Lurasidone | Yes | Akathisia, extrapyramidal symptoms, and somnolence |

| Cariprazine | Not mentioned on label, but utilized in practice | Extrapyramidal symptoms, akathisia, dyspepsia, vomiting, somnolence, and restlessness |

| Caplyta (lumateperone) | Yes | Somnolence/sedation, dizziness, nausea, dry mouth |

Caplyta's exceptional tolerability profile is a distinguishing characteristic that sets it apart from other antipsychotic drugs. Unlike some other atypical antipsychotics, Caplyta has a low incidence of side effects such as weight gain, metabolic abnormalities, and movement disorders like tardive dyskinesia. This makes Caplyta an appealing treatment option for individuals with bipolar depression who may be concerned about the potential side effects of other antipsychotic drugs.

Revenue Projections for Caplyta and Analysis of Patent Strength

Intra-Cellular has projected revenue to range from $430-$455 million this year for Caplyta, which is supported by the strong revenue growth the drug has experienced, indicating a significant demand for it.

| Year | Revenue ($ millions) | YOY % Change |

|---|---|---|

| 2021 | 81.7 | N/A |

| 2022 | 249.1 | 205% |

| 2023 | 430-455 (company estimate) | 73%-80% |

Assuming modest 30% growth here on out, Caplyta is projected to be a blockbuster drug within a few years.

| Year | Revenue ($ millions) | YOY % change |

|---|---|---|

| 2024 | 559.0 | 30% |

| 2025 | 726.7 | 30% |

| 2026 | 944.7 | 30% |

| 2027 | 1228.1 | 30% |

| 2028 | 1593.5 | 30% |

It should be noted that Caplyta's new chemical entity exclusivity will expire in December 2024, which could be a major confounding factor in projecting revenue. Intra-Cellular has provided the following information regarding Caplyta's patents:

Lumateperone tosylate is FDA-approved as CAPLYTA® for the treatment of schizophrenia and for the treatment of bipolar depression. We have extensively characterized this compound and related compounds and filed additional patent applications on salt forms, polymorphs, pharmaceutical formulations, new indications, improved methods of manufacture, metabolites, derivatives, and structurally related novel compounds. As of February 1, 2023, our lumateperone program consisted of approximately 36 patent families that we own or control, filed in the United States and other major markets, including 49 issued or allowed U.S. patents, 29 pending U.S. patent applications, 213 issued or allowed foreign patents and 155 pending foreign patent applications. Thirteen patents are currently Orange Book listed in the United States. In addition to patent protection, lumateperone has five years of new chemical entity data exclusivity with the FDA, until December 2024.

Being listed in the Orange Book can provide additional protection against generic competition for a drug by allowing the drug manufacturer to prevent the approval of a generic version of the drug for a certain period of time, typically until the expiration of the relevant patents or exclusivity provisions.

Overall, the strength of the patents and exclusivity provisions for Caplyta appear to be relatively strong, suggesting that the company may be able to effectively prevent generic entry and protect their market position in the treatment of schizophrenia and bipolar depression. However, it is important to note that the strength of the patents ultimately depends on various factors, including the specific claims of the patents, the potential for legal challenges, and the expiration dates of the patents.

Expanding Lumateperone's Labeling: Intra-Cellular's Endeavor to Treat Major Depressive Disorder with Adjunctive Therapy Faces Challenges

Intra-Cellular is endeavoring to expand the labeling of lumateperone, with two registrational phase 3 trials as adjunctive therapy in treating patients with Major Depressive Disorder [MDD] who have had an inadequate response to conventional antidepressants after at least six weeks.

Intra-Cellular Therapies

However, this is expected to be a challenging task since patients who do not respond effectively to traditional antidepressant therapy pose a significant treatment challenge. Moreover, even if lumateperone receives FDA approval and demonstrates clinical success, its use is likely to be infrequent due to the current MDD treatment paradigm, which favors SSRI/SNRI/atypical antidepressants over antipsychotics.

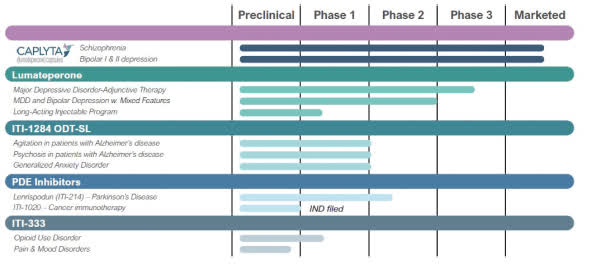

Furthermore, assessing the value of Intra-Cellular's other products (ITI-1284 ODT-SL, PDE inhibitors, and ITI-333) is difficult as they are currently either in preclinical development or undergoing phase 1 clinical trials. Therefore, the success of Intra-Cellular largely depends on the performance of Caplyta in treating bipolar depression.

Conclusion

Caplyta, the medication developed by Intra-Cellular, has proven to be a highly effective and popular treatment option for bipolar depression. Unlike other antipsychotic drugs, Caplyta offers relief from symptoms without many of the negative side effects commonly associated with such medications. This has resulted in rapid revenue growth and the potential for Caplyta to become a blockbuster medication.

However, there is a significant challenge that Intra-Cellular will face in the near future. The NCE patent for Caplyta is set to expire in December 2024, which means that the company will need to rely on Orange Book patents to maintain its exclusivity. At present, it also appears that Intra-Cellular lacks significant value drivers beyond Caplyta for bipolar depression.

Taking these factors into account, I believe that Intra-Cellular stock is currently reasonably valued at around $4 billion. While there is potential for upside, it is a "Hold" recommendation until there are further developments.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is intended to provide informational content only and should not be construed as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions made in this article regarding clinical, regulatory, and market outcomes are the author's opinions and are based on probabilities, not certainties. While the information provided aims to be factual, errors may occur, and readers should verify the information for themselves. Investing in biotech is highly volatile, risky, and speculative, so readers should conduct their own research and consider their financial situation before making any investment decisions. The author cannot be held responsible for any financial losses resulting from reliance on the information presented in this article.