TC Energy: An Excellent High Yield Ignored By The Market

Summary

- TC Energy is a strong Canadian midstream player with a long history of dividend growth.

- It's seeing strong demand for natural gas transport and should benefit from growing global demand for LNG.

- I also highlight the dividend, balance sheet, valuation, and other important points.

- Looking for a portfolio of ideas like this one? Members of Hoya Capital Income Builder get exclusive access to our subscriber-only portfolios. Learn More »

turk_stock_photographer

Many baby boomers are ill-equipped for retirement, as indicated in a recent survey by Fortune Magazine. Who can blame them? As financial education is mostly self-taught and not covered in schools.

Schools are there to teach you how to be an employee, not how to become financially independent one day. That's why it's up to each and every individual investor to see the light and learn how to become passive income investors.

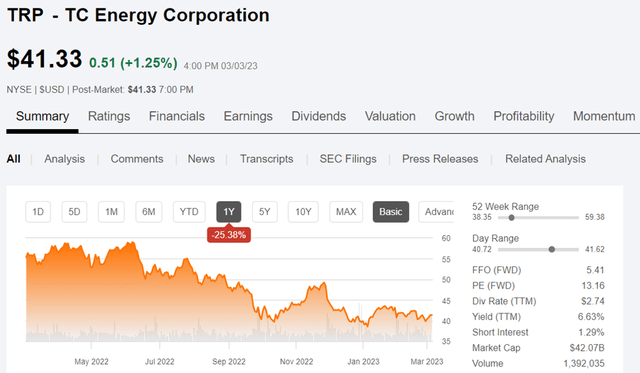

This starts by picking a basket of high quality dividend stocks that have stood the test of time. This brings me to TC Energy (NYSE:TRP), which currently trades well under its 52-week high and a 6.6% yield. Let's explore why TRP may be a great choice at present for long-term income and growth.

Why TRP?

TC Energy is a leading energy infrastructure company operating pipelines, storage, and power generating assets in Canada, U.S., and Mexico. It has over 60K miles of oil and natural gas pipelines, more than 650 BcF of natural gas storage, and generates 4,200 MW of electric power.

TRP has a strong presence in the bitumen-rich Athabasca oil sands of the province of Alberta, Canada. Beyond that, TC also has presence in the gas-rich Marcellus and Utica shale basins in Appalachia, and its pipelines also carry gas to the U.S. Gulf Coast for export. This mission critical and moat-worthy collection of assets have enabled TC to deliver annual dividend growth for its shareholders for more than 2 decades.

TRP recently capped off a strong 2022, with comparable EBITDA growing by 6% YoY to $9.9 billion. This was driven by strong natural gas demand, as volumes grew by 5% YoY for the full year. This was capped off by a record delivery of 36.6 BcF of natural gas near the end of last year, on December 23rd.

Moreover, TRP is making good headway in the LNG business, as its share of U.S. feed gas deliveries grew from 25% to 30% last year, with management aiming to increase share to 35% over the next 5 years. The LNG business appears to be attractive considering its capacity for seaborne transport to Europe, which has faced natural gas supply disruptions from Russia. In fact, European countries including the UK imported 121 million tons of LNG last year, up 60% from 2021.

Looking ahead, TRP could see meaningful growth from its Coastal GasLink project. This project would carry natural gas across British Columbia from the Western Canadian Sedimentary Basin at Dawson Creek to the Canadian west coast, where it can be converted into LNG for export, opening up new markets for natural gas in Asia. This project is ahead of schedule with a high completion rate thus far. Management noted this and other capital deployments during the recent conference call:

The Coastal Gaslink project has now reached 84% overall progress, and we have line of sight to our mechanical completion target of year-end 2023. While we have faced significant challenges, our teams in the field are working tirelessly to complete the project in the highest safety and quality standards in the pipeline industry while executing the remaining scope at the lowest possible cost.

We sanctioned $8.8 billion of projects that are expected to generate a weighted average unlevered after-tax IRR that is above our historical range. While we expect to sanction additional high-quality opportunities, novel projects sanctioned will have significant capital requirements over the next few years.

Meanwhile, TRP carries a BBB+ rated balance sheet with an expected net debt to EBITDA ratio of 5x by the end of this year. While this is somewhat higher than the preferred 4.5x level for midstream companies, it's not unreasonable considering the number of projects currently in pipeline. Management has also targeted bringing down the leverage to 4.75x in the near term after reaching 5x.

Importantly, TRP has raised its dividend for 23 consecutive years, including the recent 3.3% increase this year. The dividend also appears to be well-covered, with the new rate being 53% of its 2022 operating cash flows.

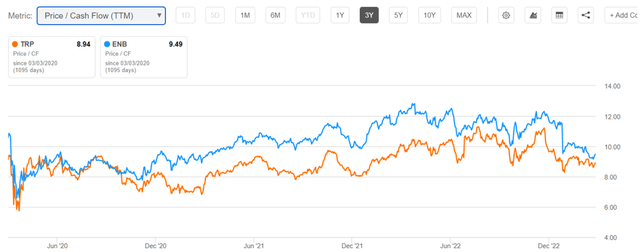

I also see value in TRP at the current price of $41.33 with a 6.6% TTM dividend yield. It also currently trades at a price to cash flow ratio of 8.9x, sitting at the low end of its recent range and below that of peer Enbridge (ENB), as shown below.

Morningstar has a fair value estimate of $47 and analysts have a more conservative price target of $41.55. Even with the more conservative price target, TRP could be expected to deliver at least market performance, with its 6.6% dividend yield and 3 to 5% long-term annual EBITDA growth.

Investor Takeaway

TC Energy is a strong Canadian midstream player with a long history of dividend growth. It's seeing strong demand for natural gas products, and could see continued growth in LNG through heightened global demand.

Moreover, it has a strong pipeline of projects that should meaningfully contribute to top and bottom line results down the line. As such, I find TRP to be an attractive energy stock to own at present, while it's trading at an attractive price with a high dividend yield.

Gen Alpha Teams Up With Income Builder

Gen Alpha has teamed up with Hoya Capital to launch the premier income-focused investing service on Seeking Alpha. Members receive complete early access to our articles along with exclusive income-focused model portfolios and a comprehensive suite of tools and models to help build sustainable portfolio income targeting premium dividend yields of up to 10%.

Whether your focus is High Yield or Dividend Growth, we’ve got you covered with actionable investment research focusing on real income-producing asset classes that offer potential diversification, monthly income, capital appreciation, and inflation hedging. Start A Free 2-Week Trial Today!

This article was written by

I'm a U.S. based financial writer with an MBA in Finance. I have over 14 years of investment experience, and generally focus on stocks that are more defensive in nature, with a medium to long-term horizon. My goal is to share useful and insightful knowledge and analysis with readers. Contributing author for Hoya Capital Income Builder.

Disclosure: I/we have a beneficial long position in the shares of TRP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am not an investment advisor. This article is for informational purposes and does not constitute as financial advice. Readers are encouraged and expected to perform due diligence and draw their own conclusions prior to making any investment decisions.