BigCommerce: With Growth Grinding To A Halt, It's Time To Back Off

Summary

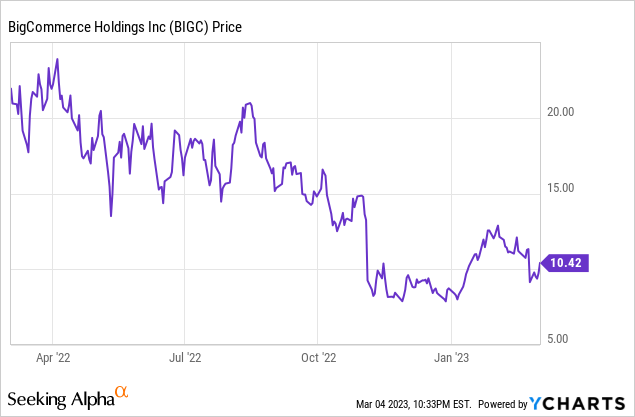

- Shares of BigCommerce have cratered dramatically since reporting Q4 results, yet the stock is still up >20% year to date.

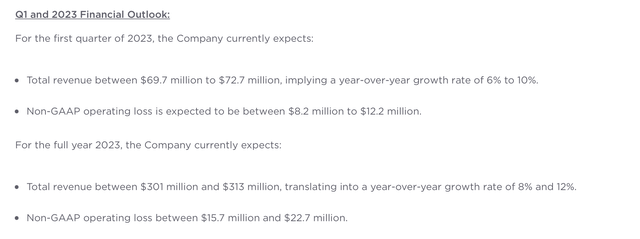

- The company expects growth to slow to just 6-10% y/y in Q1 of 2023. Earlier in 2022, BigCommerce was still growing revenue north of >40% y/y.

- With the possibility of single-digit growth, BigCommerce's double-digit operating loss margins have much less of a chance of scaling to profitability.

- Evidently, BigCommerce's large concentration to enterprise clients was not enough to shield it from recessionary volatility.

- Though cheap at ~3x forward revenue, BigCommerce is best left alone.

MStudioImages/E+ via Getty Images

Recessions impact all companies differently, and the tech sector is no exception: some are hit harder than most. Such is the case with BigCommerce (NASDAQ:BIGC), an e-commerce services platform that rivals its better-known competitor Shopify (SHOP). BigCommerce has seen a massive slowdown in growth as its customers' own sales slowdown in the wake of belt-tightening by both businesses and consumers.

The company recently released fourth-quarter results and, more importantly, issued rather soft guidance for the upcoming year. Shares are down significantly since the late-February earnings report; yet BigCommerce still is holding onto a >20% year to date gain.

Though previously bullish on BigCommerce, my views on the company have shifted after parsing through the latest results and the rather dim outlook for FY23. I am now neutral on BigCommerce and see the company as a relatively balanced bag of positives and negatives.

On the bright side for BigCommerce are these bullish drivers:

- E-commerce is a massive market opportunity. This hardly needs to be said: BigCommerce expects global e-commerce spend to reach ~$7.4 trillion by 2025, up from $4.9 trillion in the current year. Of that, merchants' spending on software platforms like BigCommerce is expected to hit $9.9 billion by 2025. In other words, BigCommerce has barely scratched the surface of this opportunity.

- Multiple routes to monetization. Like Shopify, BigCommerce's main revenue streams come from sellers' subscription fees and transaction fees, but the company also stands to gain greater wallet share by doubling down on ad/product placements, shipping services, payment processing, and other seller services.

What has me scratching my head, however, is this question: if BigCommerce's market is indeed so large, it is far too early for BigCommerce to potentially decelerate to single-digit growth in Q1. Moreover, with BigCommerce's pro forma operating margin losses still in the mid-teens, its path to profitability looks a lot more dire.

Here is the company's latest outlook for FY23, showcasing a slowdown to 6-10% y/y growth in Q1 (with a potential rebound to 8-12% y/y growth for the full year, implying back-half acceleration):

BigCommerce outlook (BigCommerce Q4 earnings release)

Now, the good news is this: at the very least, BigCommerce is cheap (after all, the market didn't like the company's deceleration expectations, and hence the company's multiple got slashed). At current share prices just north of $10, BigCommerce trades at a market cap of $767.8 million - a veritable small-cap name. After we net off the $303.5 million of cash and $333.5 million of debt on the company's most recent balance sheet, BigCommerce's resulting enterprise value is $737.5 million.

This puts the stock's valuation at just 2.4x EV/FY23 revenue. This multiple is certainly cheap - but then again, given the crash in growth rates and the persistently wide pro forma operating losses (BigCommerce isn't expecting to pass breakeven until the fourth quarter of this year, a slight pull-in from a prior expectation of breakeven in 2024), I think a discounted multiple is warranted. Even when BigCommerce does scale above breakeven (if it can hit its new target of breakeven by Q4), the fact that growth has slowed to a high single-digit / low-teens pace means that the profit expansion will also be limited.

In my view, there are far better companies to invest in at the moment. Lock in gains here and move to the sidelines on BigCommerce.

Q4 download

Let's now discuss BigCommerce's latest Q4 results in greater detail, starting with the revenue trends.

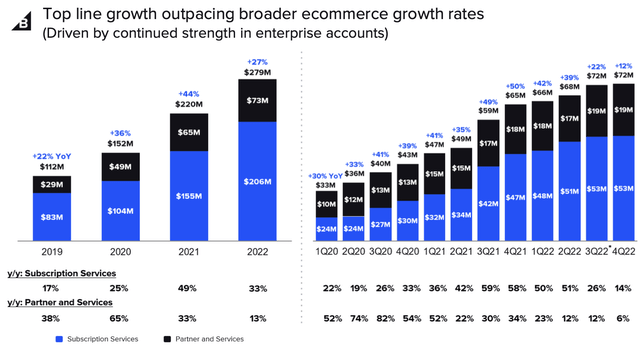

BigCommerce's overall revenue grew 12% y/y to $72.4 million in the quarter, missing Wall Street's expectations of $71.5 million by a two-point margin. Even more importantly, growth has slowed dramatically from 22% y/y growth in Q3 and 39% y/y growth in Q2.

BigCommerce Q4 revenue trends (BigCommerce Q4 earnings deck)

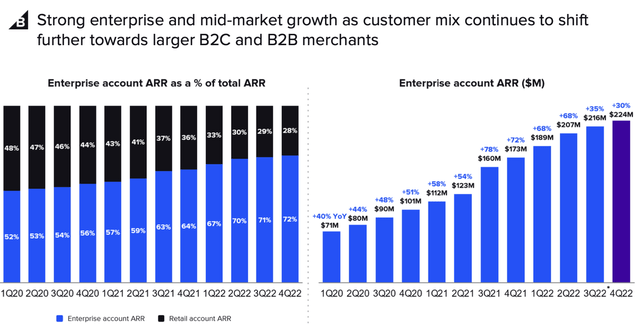

A common adage among software companies is that in a recession, having a high concentration of SMB customers (who are much more likely to churn or go out of business during hard times) is less favorable than having a solid base of enterprise clients, who are unlikely to change their IT stack due to sheer bureaucracy even in a pinch.

BigCommerce has long touted its strong enterprise concentration and large blue-chip customers across industries such as Sharp Electronics, Vodafone, Reebok, and Mazda. Yet even enterprise performance slowed to 30% y/y ARR growth in Q4, and the $8 million net-new ARR add in the quarter is the slowest in the past three years:

BigCommerce enterprise ARR (BigCommerce Q4 earnings deck)

Evidently, a >70% ARR mix in enterprise clients was no salve against a slowdown in both ARR growth and total revenue.

Here is some additional qualitative commentary from CEO Brent Bellm's remarks on the Q4 earnings call, highlighting the slowdown the company observed in the quarter:

Without a doubt, 2022 was a challenging year in Global Ecommerce. As macroeconomic conditions deteriorated in the first half, we took decisive action to reduce planned spending and focused efforts on our enterprise business. I am confident these choices are yielding the proper balance between necessary tactical adjustments to near-term economic conditions and steady long-term investments in the strategic initiatives that will drive profitable growth in the years ahead.

Our results reflect this challenging climate and our response to it. We continue to see market progress moving upmarket into larger, more complex enterprise opportunities. However, as a reflection of the macro economy, enterprise opportunities have longer sales cycle times and reduced aggregate deal pipeline relative to before 2022. Those are 2 common themes we all hear across many enterprise software segments. Inflation and consumer spending also remain difficult to predict [...]

We chose to focus our time and go-to-market spend on the superior economics of the enterprise segment. Last quarter, we shifted sales and marketing resources away from nonenterprise prospects with shorter sales cycles to enterprise prospects with longer sales cycles. We did this knowing it may impact bookings growth in the first half of 2023 because the superior retention profile of enterprise businesses makes this the right priority for the medium and long term. We saw that effect in our Q4 results as well."

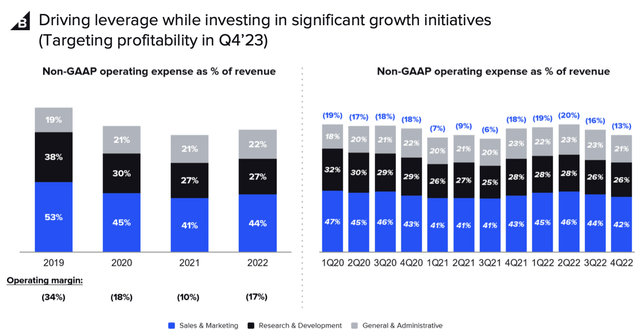

Management also noted that enterprise net retention rate fell to 111% in 2022, down from 118% in 2021 as the slowdown in e-commerce purchases led to fewer order-driven subscription upgrades. Profitability was also down for the year. Pro forma operating margins in 2022 were -17%, seven points worse than in 2021:

BigCommerce opex trends (BigCommerce Q4 earnings deck)

The company's guidance for the full year 2023 implies margins improving to -5%, but with top-line growth so limited, I'm wary to believe in substantial expansion of profits.

Key takeaways

With growth screeching to a halt, operating margins still negative, and severe macro headwinds in front of it with no near-term cure, my expectations for BigCommerce have dramatically lowered. Steer clear here and invest elsewhere.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.