Elastic: FY24 Is Promising

Summary

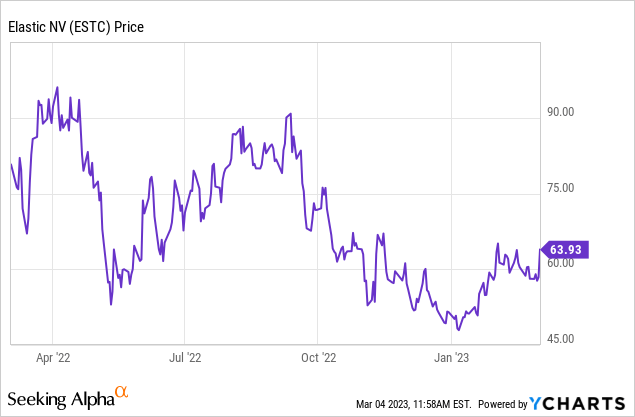

- Shares of Elastic jumped nearly 10% after the company reported fiscal Q3 results and issued guidance.

- The company offered an early look at FY24 (which begins in May), promising mid/high-teens revenue growth amid significant operating margin expansion.

- Elastic continues to grow revenue at a >20% y/y pace, driven in part by strong momentum from cloud partners.

- Trading at just ~4.5x FY24 revenue, Elastic is a strong value opportunity that is difficult to pass up.

shulz

Amid this year's surge in tech stocks, a common questions among investors is: is it too late to invest in the uptrend? I certainly think it's not too late, but this is the year that careful stock selection is more critical than ever: and in particular, I think there are a number of "growth at a reasonable price" (GARP) trades that are still very attractive to dive into.

Look in particular at Elastic (NYSE:ESTC). This infrastructure software company, known for powering the search functions within applications, has enjoyed a nearly 30% lift since the start of the year: a healthy gain for sure, but lagging behind many of its tech peers. At the same time, however, Elastic has posted strong quarterly results as well as offering a confident glimpse into the next fiscal year. It's a good time, in my view, for investors to re-assess the bull case for Elastic.

FY24 outlook calls for meaningful profitability expansion; vibrant long-term bull case

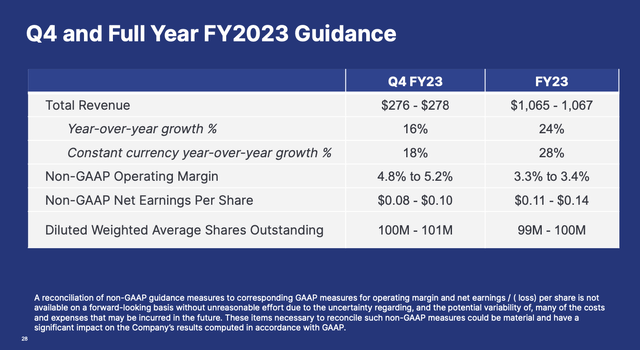

Elastic just finished its fiscal Q3 earnings print (January quarter) and is closing out FY23 in April. For the entirety of FY23, the company is expecting to exit Q4 at a 16% y/y growth rate while landing full-year pro forma operating margins in the 3.3-3.4% range.

Elastic FY23 outlook (Elastic Q3 earnings deck)

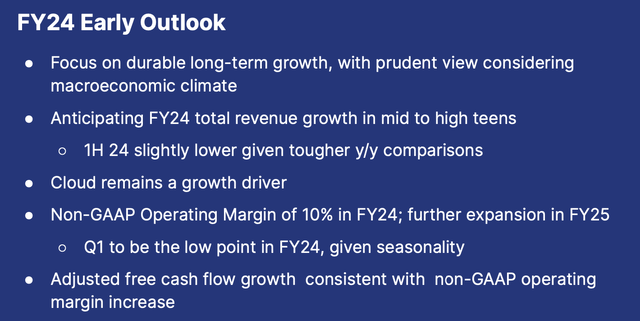

But it's looking ahead to FY24 that sparked investors' enthusiasm. Though the company has not yet offered full guidance targets, it is expecting "mid to high teens" growth (implying an improvement over 16% y/y growth in FY23, though possibly driven by softer FX impacts). The big kicker, however, is the company's expectation of 10% pro forma operating margins in FY24, which implies a tripling of operating margins (and more than tripling of operating profit dollars, given mid-high teens revenue growth) versus FY23. In a market where investors have started to care a lot more about tech-company profits, this is a major win for Elastic.

Elastic FY24 early outlook (Elastic Q3 earnings deck)

Alongside this robust preview into FY24, I'd encourage investors to remember the long-term bull case for Elastic and its mission-critical technology. As a reminder for investors who are newer to the name, here is my full long-term bull thesis for this company:

- Elastic has three powerful tools in its suite, powering enterprise search, security, and APM. Search is Elastic's bread and butter, and the company is the best-in-breed leader at infrastructure that allows you to essentially perform a Google-like search within the confines of a certain application. Security is a natural extension of Elastic's data-monitoring ability, with companies using Elastic to protect against fraud and cyber threats. The latter category (APM), meanwhile, is the same space that hotshot Datadog (DDOG) is in, and helps companies maintain their tech stack uptime and monitor performance. The basic point is this: Elastic's core platform supports a variety of use cases and one that has been adopted by major corporations. It estimates its global TAM at $78 billion, suggesting only ~1% current penetration. This TAM has grown significantly versus $45 billion at the time of Elastic's IPO in 2018.

- Purely recurring, high-margin software product. 90+% of Elastic's revenue comes from subscriptions, meaning the company has very high revenue visibility. It has net revenue expansion rates of ~120%, meaning the majority of its customers upsell dramatically (versus ~110% net expansion rates for most other software companies). On top of that, Elastic's revenue comes in at a high-70s gross margin. The math on this works out like a charm: as more and more Elastic customers renew and expand, Elastic can take advantage of its huge gross margin to scale profitably, given that renewal deals to existing customers cost far less in terms of sales dollars to achieve.

- Very sticky technology base. Elastic is in a category of software considered "infrastructure software," which means that it sits at the heart of a company's IT stack. This kind of software is very difficult to rip out (versus a top-end application, like a CRM system, that is relatively easier to stop using and migrate to another solution).

- Strong cloud growth. Elastic's hosted cloud solutions are seeing much stronger (~40% y/y) growth rates relative to the rest of the company, which serves as an additional upside catalyst for investors to be excited about. It also gives Elastic an easy route to market for customers who are on services like Amazon AWS, where Elastic now features very native integrations.

I remain stoutly bullish on Elastic and am holding onto the stock in my portfolio (and will add more on dips), especially given how cheap it is.

Opportunistic valuation

At current share prices near $64, Elastic trades at just a $6.11 billion market cap. After we net off the $877.7 million of cash and $567.3 million of debt on Elastic's most recent balance sheet, the company's resulting enterprise value is $5.80 billion.

Let's assume that Elastic's guidance language of "mid to high teens" revenue growth in FY24 implies a midpoint of 17% y/y revenue growth. This would put FY24 revenue at $1.25 billion, and the stock's valuation at just 4.6x EV/FY24 revenue.

Needless to say: this is quite cheap for a company that is still currently growing revenue at a >20% y/y clip, is expecting to hit double-digit pro forma operating margins and cash flow, and has a strong mid-70s pro forma gross margin profile.

Q3 download

While Elastic is certainly seeing some macro impacts on growth deceleration, there are still strong highlights to note in Elastic's most recent results - particularly around profitability.

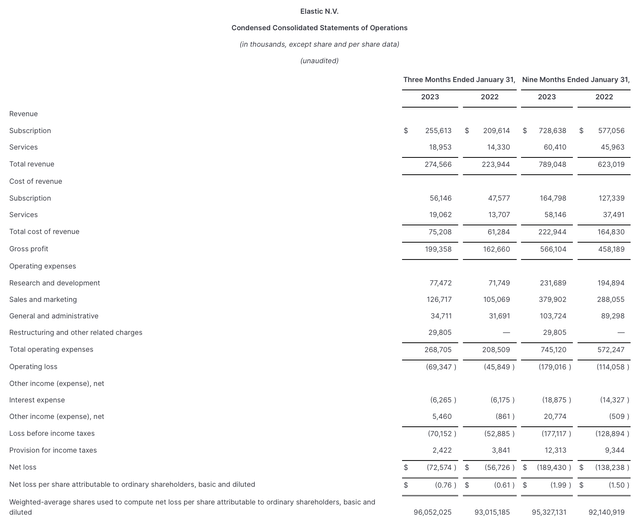

The Q3 earnings summary is shown below:

Elastic Q3 results (Elastic Q3 earnings deck)

Elastic's revenue grew 23% y/y to $274.6 million in the quarter, beating Wall Street's expectations of $273.4 million (+22% y/y). Revenue growth did, however, decelerate seven points relative to 30% y/y growth in Q2. Negative currency impacts were a major factor here; on a constant-currency basis the company would have seen 27% y/y growth.

Here's some further context on go-to-market momentum from CEO Ash Kulkarni's remarks on the Q3 earnings call:

First, consistent with Q2, third quarter deal cycles continue to be elongated with additional levels of approvals, and the SMB segment remained challenging. Also, as we had anticipated, customers continue to optimize their usage. We saw this across customers of all sizes and across industries. We anticipate that consumption optimization will continue in the near term. Despite these challenging times for everyone, we are focused on consistent execution.

This leads me to the second topic. The steps we have taken to adjust and optimize our investments across the business, demonstrate our solid execution and give us continued confidence in the long-term market opportunity. We have continued to selectively invest in our enterprise and commercial sales capacity and have seen those portions of the business perform well with a healthy pipeline and strong customer commitments. On the SMB side, we continue to refine our customer acquisition and expansion motions and remain focused on attracting customers that have a higher propensity for growth. Janesh will touch on this shortly. The balance between growth and margins is a key focus for the company, and we are demonstrating healthy margin expansion as we drive stronger return on investments across our investments."

Overall customer growth, unsurprisingly, slowed; Q3 net-new customer adds were only 200, versus an average of ~500 over the trailing four quarters. This is largely an SMB-driven trend, however, as Kulkarni pointed out in his remarks. Among large customers, Elastic's performance continues to be strong.

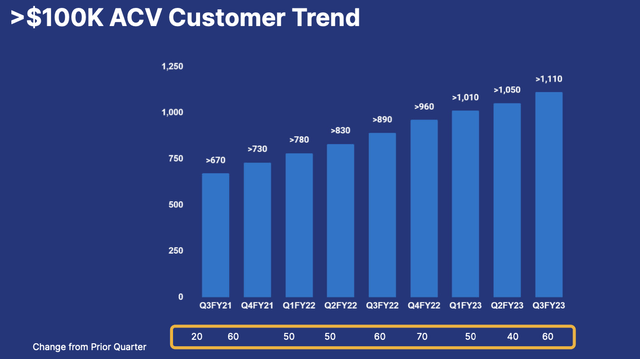

The chart below shows that the company's count of customers generating >$100k in ACV grew by 60 in the quarter, the strongest showing so far in FY23:

Elastic customer trends (Elastic Q3 earnings deck)

The company also noted that momentum in partnerships is growing, stemming from the company's go-to-market agreements with Amazon AWS, Microsoft Azure, and Google Cloud. Revenue from cloud marketplaces is up by 100% y/y in Q3.

We also find it encouraging that net revenue retention rates remained above 120%, indicating that the average customer is still upgrading their usage of the Elastic platform and increasing their spend by a healthy amount.

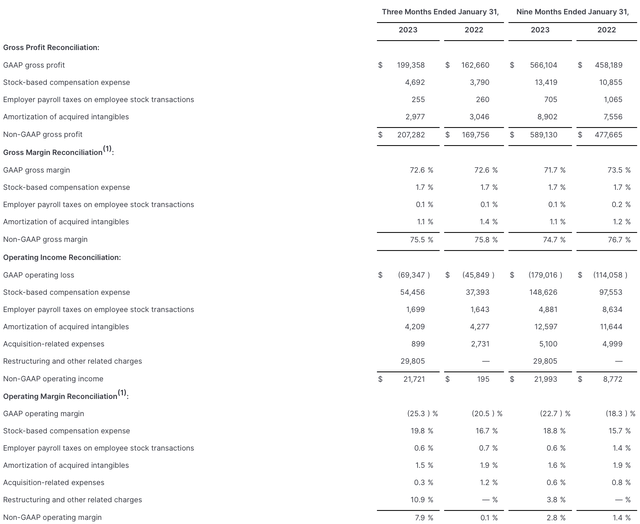

Elastic is also gearing in on profitability amid this macro slowdown. As shown in the chart below, pro forma operating margins in Q3 soared to 7.9%, a 780bps improvement over just 0.1% in the year-ago Q3:

Elastic profitability (Elastic Q3 earnings deck)

This was driven by earlier than expected exits from employees impacted by the recent restructuring plan - which bodes well for Elastic achieving a 10-12% margin in FY24 once these cost-down actions are fully in place.

Key takeaways

To me, the opportunity to buy Elastic at a <5x FY24 revenue multiple at the exact moment that the company is honing in on profitability is too good to pass up. Stay long here and continue to ride the upward wave.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of ESTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.