Petco Health And Wellness Company: Still Appealing Despite The Market's Reaction

Summary

- Petco Health and Wellness Company has not fared all that well compared to the broader market.

- This comes even as sales continue to climb and as bottom line results are mixed but still positive.

- Shares are cheap and do seem to offer attractive upside from here.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

Delmaine Donson/E+ via Getty Images

Generally speaking, I have a pretty good track record when it comes to investing. Unfortunately, though, the timing of calls is not always what you might want it to be. There can be long stretches of time where a company underperforms, sometimes materially, compared to what you anticipated. One good example of this that has yet to see the upside that I believed and still believe exists, can be seen by looking at Petco Health and Wellness Company (NASDAQ:WOOF), a business that's dedicated to providing health and Wellness offerings like veterinary care, grooming, and pet training, to pet centers across the markets in which it operates. Even though shares of the business have fallen over the past few months, financial performance has not been awful. Yes, profits and cash flows have seen some pressure. But revenue still continues to climb. Given the path that revenue has taken, combined with how shares are currently priced, both on an absolute basis and relative to similar firms, I do believe that some upside still exists for investors moving forward. So while I acknowledge that the firm might not be quite as appealing as I initially thought, I do believe that it warrants a ‘buy’ rating at this time.

Mixed results have caused pain

In early October of last year, I found myself revisiting my bullish thesis on Petco Health and Wellness Company. In that article, I talked about how times had been tough for the company, with declining profits sending shares lower. Even so, management remained hopeful about the future, even though they revised guidance for the 2022 fiscal year lower. Normally, this kind of change would cause me to become very cautious about the company. But given how cheap the stock was at the time, I believed that some attractive upside awaited investors. Because of this, I kept the company at the ‘buy’ rating that I assigned it previously. Since then, things have not gone according to plan. While the S&P 500 is up 10.9%, shares of Petco Health and Wellness Company have dropped 4.4%.

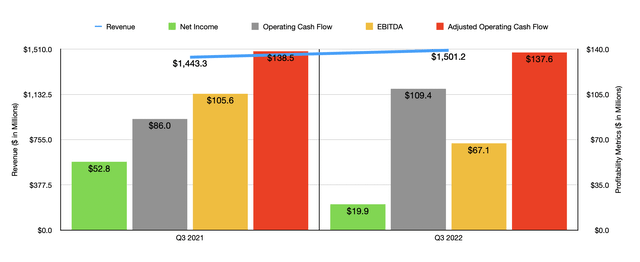

To understand why this kind of pain persists, we should touch on the fundamental performance reported by management for the third quarter of the company's 2022 fiscal year. This is the most recent quarter for which data is available. Revenue during that time came in at $1.50 billion. That's 4% higher than the $1.44 billion the company reported only one year earlier. The driver here behind this growth was a 4.1% increase in comparable sales. It was, unfortunately, offset to some degree by a decline in the total number of pet care centers the company operates in. This number dropped from 1,449 in the third quarter of 2021 to 1,428 in the third quarter of 2022. On the comparable sales side of things, the biggest upswing came from a 12% increase associated with consumables. Management attributed this to the increase in new pets, as well as strategic investments in customer acquisition and retention. The continued expansion of the firm's product assortment and a shift toward more premium consumables like fresh and frozen food were all contributors to the rise. Services and other revenue rose 24.6%, thanks largely to the increase in new pets, growth in its membership offerings like Vital Care, and growth in its grooming services and veterinary hospital business. The only weakness for the company came from its supplies and companion animals. Revenue there dropped by 9.4% because of things like a decline in spending on non-essential items.

Even though revenue increased nicely, the company saw its bottom line worsen. Net income fell from $52.8 million to $19.9 million. One of the contributors to this was a decline in the company's gross profit margin from 41.2% to 39.8%. This, management said, was largely due to the impact of strong consumables sales, and lower supplies and companion animal sales year over year. Additional pain came to the company in the form of increased interest expense. This actually spiked 45.5%, impacting the company's pretax profits by $8.5 million. Higher interest rates on the company's term loan happened to be the primary cause here. Unfortunately, other profitability metrics for the company also worsened. Although operating cash flow for the company managed to rise from $86 million to $109.4 million, this figure, after stripping out changes in working capital, would have dipped from $421.5 million to $383.6 million. However, as I mentioned in my prior article on the business, I do believe that it makes sense to remove non-cash lease expense adjustments from the equation. Doing this, we would get a further adjusted operating cash flow for the company of $67.1 million. That's down from the $105.6 million reported one year earlier. And finally, EBITDA for the company declined from $138.5 million to $137.6 million.

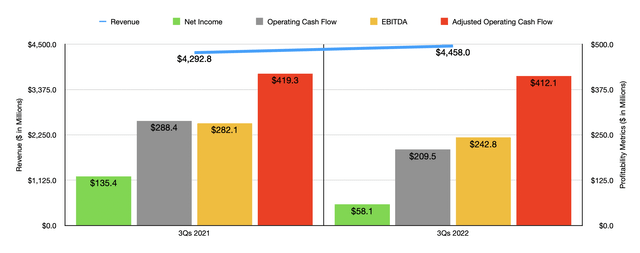

The results experienced during the third quarter of the year were very similar to what the company reported for the first three quarters of the year in their entirety. Revenue of $4.46 billion came in higher than the $4.29 billion reported one year earlier. Net income shrank from $135.4 million to $58.1 million. Operating cash flow fell from $288.4 million to $209.5 million. On an adjusted basis, it dipped from $598 million to $559.3 million, with the further adjustment taking it from $282.1 million to $242.8 million. And finally, EBITDA declined from $419.3 million to $412.1 million.

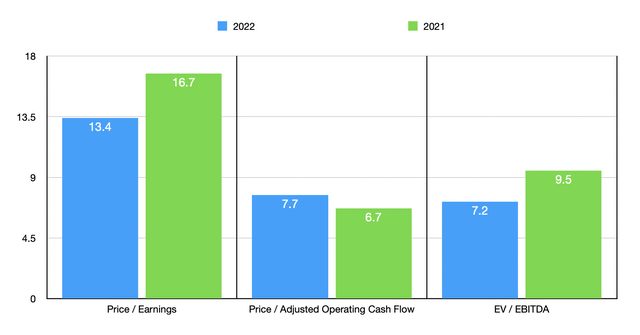

For the 2022 fiscal year as a whole, management said that revenue should be between $5.975 billion and $6.05 billion. Earnings per share of between $0.75 and $0.79 should translate to net income, at the midpoint, of $204.8 million. And by my estimate, the further adjusted operating cash flow for the company should come out to about $354.1 million. Using these figures, I calculated that the company is trading at a price-to-earnings multiple of 13.4. The price to further adjusted operating cash flow multiples should be 7.7, while the EV to EBITDA multiple should come in at 7.2. Two of the three metrics here make the company cheaper than if we were to use the data from 2021, while the other makes it more expensive. As part of my analysis, I compared the company to five similar businesses. On a price-to-earnings basis, only two of the companies had positive results, with multiples of 16.5 and 32.1, respectively. And when it comes to the EV to EBITDA approach, the range should be between 10.3 and 3,145. In both of these cases, Petco Health and Wellness Company was the cheapest of the group. Using the price to operating cash flow approach, the range would be from 6.6 to 6,961.8. In this scenario, only one of the five companies was cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Petco Health and Wellness Company | 13.4 | 7.7 | 7.2 |

| Chewy (CHWY) | N/A | 92.9 | 295.2 |

| Freshpet (FRPT) | N/A | 6,961.8 | 3,145.0 |

| Central Garden & Pet Co. (CENT) | 16.5 | 22.9 | 10.3 |

| PetMed Express (PETS) | 32.6 | 14.1 | 18.2 |

| PetIQ (PETQ) | N/A | 6.6 | 42.0 |

Takeaway

Based on all the data provided, I understand why some investors might be concerned about Petco Health and Wellness Company from an investment perspective. Bottom line results have been somewhat disappointing as of late. On the other hand, it is nice to see sales continue to grow. But at the end of the day, it's the bottom line that matters most. With that said, it is also true that, on February 15th of this year, management did announce something that should prove positive for the company and its investors in the long run. This was the announcement that the firm would be opening shop-in-shop locations with a company called Canadian Tire. This will see the opening of 450 additional outlets for the company so that it can more easily capture some of the $5.3 billion market opportunity that exists in the pet care space in Canada. Add on top of this expansion the fact that shares do look cheap, both on an absolute basis and relative to similar firms, and I believe that WOOF stock still warrants a ‘buy’ rating at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.