Altria: Marlboro Continues To Light Up Its Performance

Summary

- Despite the Juul fiasco and the underperforming oral tobacco segment, it is apparent that MO can count on Marlboro's legacy.

- The brand continued to grow its market share to 58.2% in the premium segment in FQ4'22, expanding by 1 percentage point over the past three years.

- Particularly, the smokeable tobacco products delivered $10.68B (+2.7% YoY) of operating income in FY2022, helping cement the safety of MO's forward dividend.

- Therefore, we recommend existing investors continue holding on to MO stock due to the forward yield of 8.56% based on projected FY2024 dividends of $4.04.

- Investors keen to find out more about MO's smoke-free strategy may also tune in to its upcoming Investor Day, with market rumors already suggesting a potential NJOY acquisition.

byerenyerli/iStock via Getty Images

We previously discussed Altria Group (NYSE:MO) here in January 2023. After the Juul and Cronos (CRON) impairment, it appeared that the company was shifting gears and exploring other smoke-free options. It had announced a joint venture with Japan Tobacco (OTCPK:JAPAY) for the potential launch of Ploom HTS in the US by 2025. Despite this, its near-term prospects in the smoke-free segment were still uncertain, due to the intense competition in the US market.

In this article, we shall explain why we think its smokeable tobacco products will remain MO's saving grace. The company's top and bottom line performance still heavily relied on Marlboro's legacy branding, which continued to grow its market share in the premium segment, despite the tightened discretionary spending thus far. We shall discuss this further.

Marlboro Remains MO's Saving Grace

The smokeable tobacco segment comprised $22.47B (-1.7% YoY) or the equivalent of 89.5% (+1.7 percentage points YoY) of its revenues in FY2022, with the oral tobacco products accounting for the balance.

Notably, the smokeable products delivered a stellar operating income of $10.68B (+2.7% YoY) as well, comprising 89.6% (inline YoY) of the latest fiscal year's profitability. The expansion was partly attributed to the increase in Marlboro's net retail pack price by +6.4% YoY in FQ4'22.

Most importantly, MO competently boosted the leadership of the Marlboro branding, with a stellar market share of 58.2% in the premium segment in FQ4'22, growing by 1 percentage point over the past three years. This development was highly encouraging in our view, despite the continuous decline in the US smoker population by 4 percentage points at the same time.

Perhaps this is why the company has been able to expand the profitability of its smokeable products by $1.68B or +18.6% over the past three years, despite the segment's minimal top-line growth of only $0.48B or 2.18%.

This naturally built upon Marlboro's stellar premium branding, which continued to command great consumer loyalty no matter the rising inflation. Therefore, it was unsurprising to see the product's market share in the US remain stable at 42.5% (-0.6 percentage point YoY or -0.6 from FQ4'19 levels).

In addition, MO proved expedient in offering improved value in its discount category, attributed to the reduced discretionary spending thus far. The market has been intensely competitive to capture "smoker's disposable income" during this economic downturn.

However, investors need not fret in our opinion, since the company's discount category market share had risen to 27.8% (+1.8 percentage point YoY) by FQ4'22. The growth naturally demonstrated the strength of the company's offerings across different price points indeed.

Particularly, the January 2023 CPI had reported an expansion of the consumer spending index in the tobacco and smoking products by +0.7% sequentially and +6.3% YoY, against December 2022 levels of -0.1% and +5.5% respectively. It appeared that the tobacco industry as a whole proved somewhat resilient, despite our previous fears.

Therefore, despite the Juul fiasco and zero growth in the oral tobacco sales over the past two years, MO's dividends remain more than safe moving forward, in our view. The company managed to record excellent Free Cash Flow [FCF] generation of $8.05B in FY2022, a figure that had remained stable for the past four years (in other words - zero growth).

It allowed the company to pay out dividends of $6.59B (+2.3% YoY) while similarly embarking on $1.82B (+8.9% YoY) of stock repurchases at the same time. This was on top of the consistent retirement of -3.2% of its share count, from FQ1'20 levels of 1.85B to FQ4'22 levels of 1.79B, suggesting that shareholder returns have been more than decent in this respect.

In addition, market analysts expect MO's FCF generation to moderately expand by 4.8% to $8.44B in FY2024, sustaining the growth of its annual dividends per share to $4.04. Therefore, we recommend that existing investors continue holding on to this stock, due to the excellent projected forward yield of 8.56% against its 4Y average of 7.46% and sector median of 2.44%, based on the current stock prices.

Nonetheless, we concur that MO's future growth will be closely tied to the innovation of its smoke-free approach, which previously depended on Juul. Market rumors have suggested that the company may be acquiring NJOY, a company producing vaping products, for $2.75B on top of a $500M bonus once regulatory approvals are achieved.

However, it is uncertain how much value NJOY may bring to the game. The brand only commanded 3.2% of market share in the US e-cigarette market in 2022, compared to Juul at 37.2% and Vuse by Reynolds American Tobacco at 30.2%. At the same time, NJOY has been reporting declining sales YoY by -15%, according to US scanner data.

Therefore, assuming that the deal goes through, we may see MO expand its marketing expenses or even embarking on price cuts to boost NJOY's market share. In our view, these efforts may suggest further headwinds in the company's profitability and balance sheet moving forward, impacting its stock performance.

In the meantime, as hinted in the recent earnings call, the management will be providing more color on its pipeline, including an oral tobacco product and a heated tobacco capsule product, during the upcoming Investor Day this month. As a result, keen investors may want to tune in to that event for more clarity.

So, Is MO Stock A Buy, Sell, or Hold?

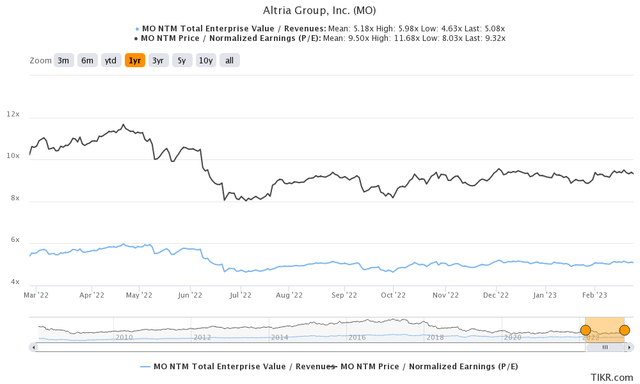

MO 1Y EV/Revenue and P/E Valuations

For now, MO is trading at an EV/NTM Revenue ratio of 5.08x and NTM P/E of 9.32x, lower than its 3Y pre-pandemic mean of 6.50x and 15.62x, respectively. Otherwise, it is relatively in line with its 1Y mean of 5.18x and 9.50x, respectively.

Based on its projected FY2024 EPS of $5.30 and current P/E valuations, we are looking at a moderate price target of $49.39. This number nears the consensus price target of $49.50 as well, suggesting minimal upside potential from current levels.

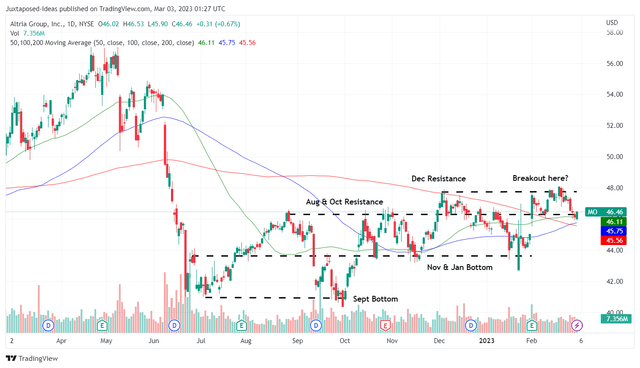

MO 1Y Stock Price

However, despite the bottom line beat in FQ4'22 and $1B in its new share repurchase program, MO stock has continued to trade sideways over the past few weeks. Therefore, due to the potential underperformance and the upcoming event in March, we do not recommend anyone to add here.

Interested investors may prefer waiting for another attractive entry point to dollar cost average, possibly at the September 2022 bottom in the low $40s for an improved margin of safety to our price target.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.