Summit Midstream Partners: Can You Live In The Jaws Of Bankruptcy?

Summary

- Summit Midstream Partners, even with perfect execution, will face bankruptcy for the rest of the decade depending on how the market executes.

- The company continues to have a uniquely strong portfolio of assets and the DJ Basin assets add to that, although we feel it wasn't prudent to add debt at this time.

- Summit Midstream Partners needs to aggressively pay down its debt and attempt to increase its FCF as much as possible.

- Despite the company's risk, we still feel that the risk-reward balances out an investment. The company's 2023 guidance looks promising.

- We're currently running a sale at my private investing ideas service, The Retirement Forum, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

hirun

Summit Midstream Partners (NYSE:SMLP) is a volatile midstream company that we've discussed numerous times. The company has a strong portfolio of assets but it's been heavily punished over the last several years by its debt load. The company's valuation of $170 million has significant room to expand, but patient investors must face a constant risk of bankruptcy.

Summit Midstream Partners 2022 Results

Summit Midstream Partners provided strong 2022 results and initial 2023 guidance.

Summit Midstream Partners Results - Summit Midstream Partners Press Release

The company saw 1.1 billion cubic ft / day of natural gas and 64 thousand barrels / day of liquids move throughout its system. Both numbers were down slightly QoQ, although declines from divestments made up a substantial part of that. The company generated $212 million of adjusted EBITDA and $73.5 million of FCF for 2022, both numbers that were weaker on the 4Q.

However, the company did manage to exceed the midpoint of its guidance. It continues to opportunistically use both acquisitions and divestments, including the DJ Basin investment for just over $300 million. Here, Summit Midstream Partners needs to stay true to their debt plan. It's easy to get caught up by acquisitions, but it's more important to manage the finances.

Assuming the company can pay down the majority of its debt, it has the ability to deliver massive value on the common stock. Still the company's EBITDA guidance is strong at $305 million (roughly $100 million FCF is our view) and the company expects a reasonable 4.35x leverage ratio, which implies $1.3 billion in net debt.

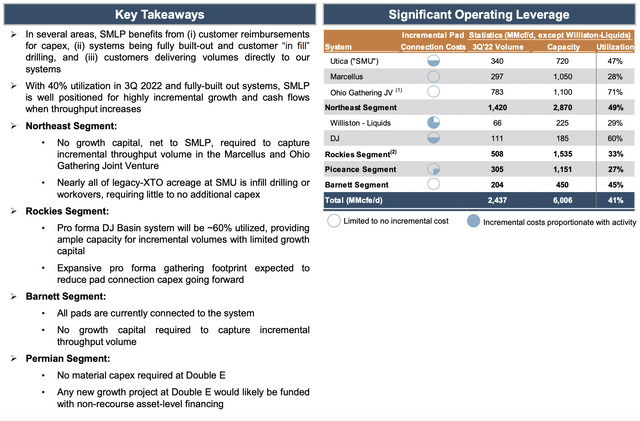

Summit Midstream Partners Spare Capacity

The running question for the company long-term is how many "stranded assets" does it have.

The company's northeast segment is at 49% capacity and one of its largest segments where no growth capital is required to capture incremental throughput volume. It was also the segment of the company with the strongest decline in volume from 2021 to 2022. The company's 2023 guidance is for a midpoint of 2021 to 2022 showing a potential recovery.

However, with the current state of the market it's clear that the company has significant assets that might never again move back towards normal volume. That means that these assets, despite their potential, could be partially useless to the company. Natural gas prices did incredibly well in 2022 as a result of the Russia-Ukraine war but the long-term is uncertain.

Summit Midstream Partners Debt

Summit Midstream Partners is still a debt-laden company despite some opportunistic movements during the COVID-19 price collapse and the DJ Basin acquisition didn't help that.

The company has $259 million in 5.75% senior notes due 2025 and $785 million in 2026 8.5% senior secured 2nd lien notes. The company also has $330 million withdrawn on its ABL revolver costing it roughly 8%. That's a huge amount of debt, the refinancing of which almost drove the company bankrupt the last time. There's also roughly $80 million in Series A preferred that's been accruing substantial debt.

It's clear from an initial look why the company's market cap is $175 million.

The company's total interest on its debt, which will need to be refinanced in another few years, is $108 million. That's almost its market capitalization that it's spending on debt every year, and it's a big part of why the company's $212 million in EBITDA last year turned into just under $74 million worth of FCF. In a rising interest rate environment, at this time, the company will struggle.

Summit Midstream Partners Story

Summit Midstream Partners exemplifies the risk with small midstream companies. They're forced to make much more of a bet on the market as their assets are restricted to producing regions versus non-producing regions and not only that, but they're forced to make bets on the capital plans of individual producers.

The company's debt fueled binge growth in that regard put it in an incredibly tough position with COVID-19 and the company's intelligent management, buying debt at a discount on the open market, along with a little bit of luck, enabled the company to survive. Still, despite surviving an initial refinancing round, it's definitely not out of the woods yet.

The company needs to keep growing its EBITDA, but more importantly, it needs to avoid new acquisitions and pay down its debt. We anticipate that the company will be able to pay off ~$350 million of debt, with neutral-optimistic market conditions, by the time its refinancing comes in 2026, assuming it doesn't get distracted along the way.

That could save the company roughly $30 million in annual interest. At that point the company's survival isn't fully within its hands. Prevailing interest rates and market dynamics will have a much larger say. For most of the rest of the decade, we expect the company to teeter on bankruptcy, with a poorly timed market downturn enough to push it over the edge.

So why invest?

Because investing is about calculated risk. Management showed a unique intelligence and skill within the decisions it made during the COVID-19 market impacts. We feel, given the current market positioning, it's unlikely the company's next refinancing adventure is harder than the last, despite the risks posed.

At the same time, the upside if the company can manage its debt successfully is enormous. The company's 2023 FCF per our estimate is $100 million, not counting an extra $100 million going to the debt. That's obviously incredibly low for a $175 million company. Should the company's debt go towards $0 we can see its market cap go towards $1 billion.

Since we see the company's chance of bankruptcy at still <50%, and more determined on the market, that makes the potential upside well worth it to us.

Thesis Risk

The largest risk to our thesis of the company's success is of course bankruptcy. Interest rates have risen since the company's last refinancing and the company still has a massive slate of debt. While we expect its leverage ratio to improve and its YE target of 4.35x is a reasonable number, we think the company needs to get that down to <2.5x for the market to re-evaluate it.

At the same time, the company's more limited asset footprint in an industry with multi-decade time-period risk means it'll continue to struggle to get the robustness needed to insulate itself from market weakness.

Conclusion

Summit Midstream Partners defined expectations when it emerged from a debt restructuring last year. Unfortunately, the market didn't re-evaluate the company in the way it had hoped and it still faces another looming debt deadline going into 2026 that will require refinancing for the company. In the meantime, rising interest rates remain risky.

The company needs a resurgence in the natural gas market to drive up volumes, but even without it, it needs patient investors. It also needs a little bit of luck from the macro environment both from interest rates and natural gas prices. While bankruptcy will continue to be a risk, we feel that the company's long-term potential justifies investing.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don't miss out because you didn't know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.

This article was written by

#1 ranked author by returns:

https://www.tipranks.com/experts/bloggers/the-value-portfolio

The Value Portfolio focuses on deep analysis of a variety of companies across a variety of sectors looking for alpha wherever it is to maximize reader returns.

Legal Disclaimer (please read before subscribing to any services):

Any related contributions to Seeking Alpha, or elsewhere on the web, are to be construed as personal opinion only and do NOT constitute investment advice. An investor should always conduct personal due diligence before initiating a position. Provided articles and comments should NEVER be construed as official business recommendations. In efforts to keep full transparency, related positions will be disclosed at the end of each article to the maximum extent practicable. The majority of trades are reported live on Twitter, but this cannot be guaranteed due to technical constraints.

My premium service is a research and opinion subscription. No personalized investment advice will ever be given. I am not registered as an investment adviser, nor do I have any plans to pursue this path. No statements should be construed as anything but opinion, and the liability of all investment decisions reside with the individual. Investors should always do their own due diligence and fact check all research prior to making any investment decisions. Any direct engagements with readers should always be viewed as hypothetical examples or simple exchanges of opinion as nothing is ever classified as “advice” in any sense of the word.

Disclosure: I/we have a beneficial long position in the shares of SMLP either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.