Reconnaissance Energy: Potential Liquidity Issues Ahead

Summary

- Reconnaissance Energy released the YE-2022 results and liquidity could be a risk ($47M cash balance).

- 5-1 well drilling operations have been postponed.

- Additional 2D seismic and enhanced full tensor gravity survey ongoing.

olrat/iStock via Getty Images

Reconnaissance Energy Africa (OTCQX:RECAF) (TSXV:RECO:CA) recently released its 2022 annual results, with financials that were largely in line with predictions made by analysts. Reconnaissance Energy Africa (also known as ReconAfrica) is a Canadian company engaged in hydrocarbon exploration activities in the Kavango Basin, which spans Namibia and Botswana.

In this piece, I will examine the 2022 results and explain why I think ReconAfrica is now a HOLD stock rather than a buy. If you are not familiar with ReconAfrica, you can find more information in this previous article I wrote a while back.

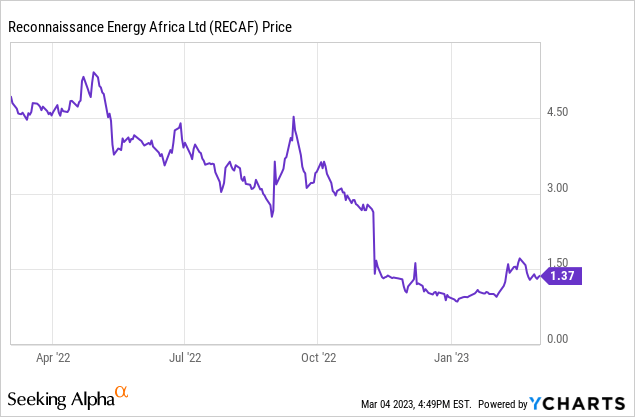

Stock Performance

ReconAfrica is currently trading at $1.37/share, equivalent to a market cap of $276M. Since the beginning of the year, the stock has increased by 44% and is gradually recovering after the steep decrease of last October/November. The 52-week maximum is $5.4/share, recorded on May 29th, 2022, while the 52-week minimum is $0.86/share, recorded on January 5, 2023. As one can see from the chart below, ReconAfrica is characterized by strong volatility since - being an O&G company with no production and no stable cash flow - all the value relies on future exploration results.

FY2022 Financial Results

Revenues after royalties were $5M in 2022, $3M more than the previous year: revenues were $28M (+167% year-on-year) while royalties were $23M (+174% y-o-y). These royalties are in relation to the Chiapas assets, ReconAfrica's Mexican properties, and they have been due since October 2019: however, the company has been delaying this payment with a consequent large accruing financial interest.

Moving to the cost side, operating expenses were much lower than in 2021 due to the absence of options settlements. G&A was the biggest expense, coming in at $23 million (+59% y-o-y) of which $8M was for consulting activities, $4M for marketing activities, $3M for offices and $8M was spent on professional fees. The other relevant cost item was represented by share-based payments, $19M, due to stock options that ReconAfrica granted to officers and executives of the company.

Finance expenses - related to the Chiapas royalties - increased by $13M year-on-year to $17M. Overall, ReconAfrica reported a net loss of $53M.

Cash flow from operations was slightly negative at -$0.6M while cash flow from investing activity was largely negative at -$43M due to investments in drilling and seismic activities carried out in Namibia. Cash flow from financing was +$47M thanks to proceeds from the issuance of shares.

Overall, net cash flow was +$2.9M with a cash balance of $47M (year-end 2022) plus $17M of restricted cash. ReconAfrica has no outstanding financial debt.

Catalysts ahead

- Seismic: between 2021 and 2022, ReconAfrica carried out two seismic acquisition campaigns (Phase 1 and Phase 2) comprising 497 and 761 linear kilometers respectively. These two phases enabled ReconAfrica to identify several leads and expand the portfolio of opportunities. The Phase 2 Extension program, which aims to gather additional 1,400 kilometers of 2D seismic data, was launched in November 2022. This campaign aims to de-risk future drilling targets by having a greater understanding of the previously identified leads.

- Enhanced Full Tensor Gravity Survey (eFTG Survey): during H2-2022, ReconAfrica started an eFTG survey over an area of about 2,000 square kilometers in northeastern Namibia. The eFTG is a survey performed with the support of an aircraft to identify relevant changes in subsurface density with the purpose of delineating stratigraphic or structurally controlled hydrocarbon traps. The survey was supposed to be finished by the end of January, and the first preliminary results were to be released soon after. However, there has been no further information as of yet. Since there has been no announcement to date, I think ReconAfrica will issue a press statement with the findings within the next one to two months.

- Well 5-1: in the previous article, I mentioned that ReconAfrica was planning to spud the next well - the 5-1 well - in December 2022. However, the company has not started the drilling operations yet because it preferred to wait for the results of the additional seismic data and the eFTG Survey since it believes that this additional information will reduce the risk associated with the well. According to the updated guidance provided by ReconAfrica, the drilling operations should have started towards the end of February but no news has been released so far. However, the access road to the drilling pad has already been built and the rig is already in place: once the seismic interpretation is concluded, ReconAfrica should be able to quickly start drilling.

- JV partner: in September 2022, ReconAfrica started a process to find a JV partner that could provide financial and technical support to the activities. So far, no news has been released.

Risks

I consider liquidity risk to be the most significant concern for ReconAfrica. ReconAfrica, as previously stated, has a cash balance of $47M, which the company claims to be enough to cover the costs of the 5-1 well drilling operations, the eFTG survey, and the 2D seismic Phase 2 Extension. To complete extra tasks and manage working capital, it appears that more funding will be needed. I am particularly concerned about the $85 million large royalty payable linked to the Chiapas assets, which is almost twice the present cash balance.

It is now more crucial than ever to find a JV partner who can assist with expenses and technology.

Conclusion

All things considered, ReconAfrica might have slightly lost the momentum that was characterizing the stock in the past months but the project is still sound. However, the continuous delay of activities and the potential liquidity issues make me lean toward a more conservative approach: if you currently own ReconAfrica, I would suggest not selling, but if you are not already a shareholder it is probably better to wait before investing in the company.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.