5 Years From Now, You'll Probably Wish You Grabbed These REITs

Summary

- REITs are priced at the lowest valuations in years.

- Even high-quality REITs trade at large discounts to net asset values.

- We highlight a few blue-chips that we are buying (and you probably should too).

- We're currently running a sale at my private investing ideas service, High Yield Landlord, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

chaofann

The Biggest Opportunity of 2023 Awaits You

Imagine being able to invest in top-quality real estate at an unbeatable price of just 50 cents on the dollar. It sounds too good to be true, right? But what if I told you that this incredible deal also comes with passive income, liquidity, diversification, limited liability, and highly efficient management? That's exactly what the REIT (VNQ) market is offering today.

REIT share prices crashed in 2022 and they are now priced at steep discounts relative to the fair value of the real estate they own.

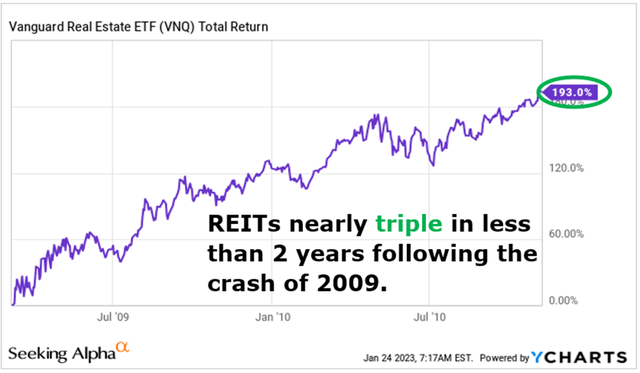

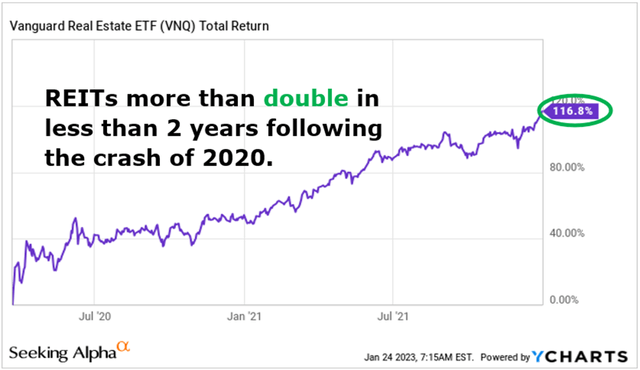

The last two times they were so cheap were following the Great Financial Crisis and the Pandemic. Both times, savvy investors made fortunes in the aftermath as REITs nearly tripled in less than two years following the Great Financial Crisis, and more than doubled in just over a year following the Pandemic:

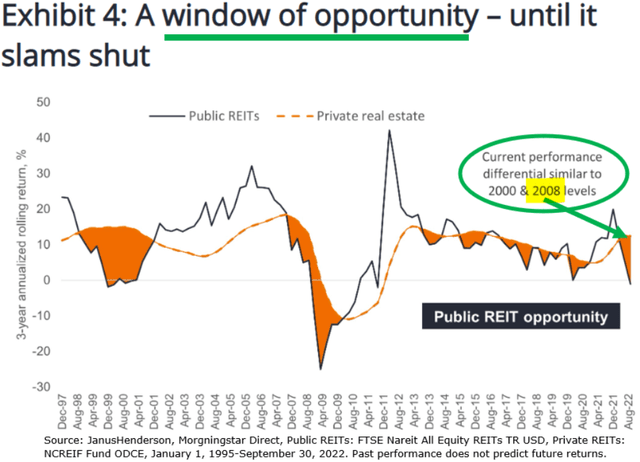

Today, the market conditions are reminiscent of 2008, with REITs heavily discounted and offering the potential for substantial returns in the years ahead:

The opportunity is so big that even the biggest private equity players, like Blackstone, are loading up on them. They bought $10s of billion worth of REITs shortly after making the following remarks in 2022:

"Market volatility is creating opportunities, including several public company situations." - Jonathan Gray, President/COO, Blackstone Q1 2022 Earnings Call

"The best opportunities today are clearly in the public markets on the screen and that's where we're spending a lot of time." - Jonathan Gray, President/COO, Blackstone Q2 2022 Earnings Call

They invest so heavily in REITs because they essentially allow them to buy real estate at a steep discount to its fair value.

Of course, it isn't possible to predict what the market will do in the short run, but in the long run, it has always been a good idea to buy high-quality REITs when they were offered at such low valuations.

5 years from now, I predict that many of these REITs will trade at much higher share prices because I expect interest rates to eventually return to lower levels as we get the inflation back under control... but rents will now remain at persistently high levels, resulting in record cash flows and valuations.

Today, you get to buy REITs at discounted prices while everyone focuses on the rising interest rates, but this narrative will change again because the positive impact of high inflation is ultimately a lot greater than the negative impact of rising interest rates.

Here are two REITs that you will probably wish you grabbed 5 years from now:

Crown Castle (CCI)

CCI is potentially the highest-yielding blue-chip high-growth REIT in the entire marketplace right now.

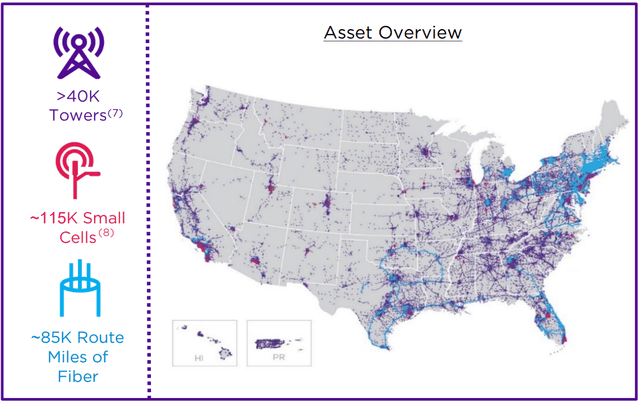

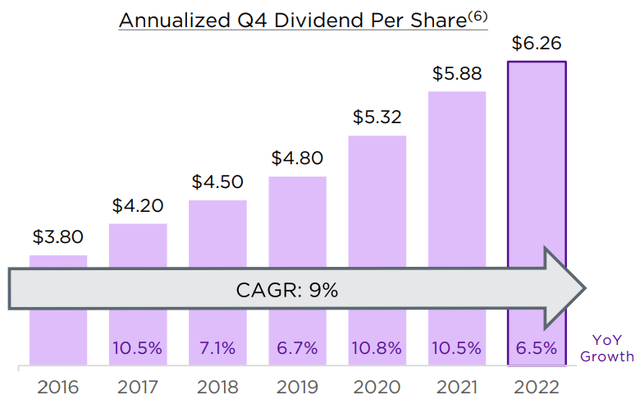

Historically, its yield has been in the 2.5-3.5% range during most times, which makes sense for an investment-grade rated blue-chip REIT that invests in cell towers. But following its recent dip and its 6.5% dividend hike, it now yields more than ever at nearly 5%.

The market has repriced CCI at a higher dividend yield because it is expected to grow slower than usual in the coming years. The management has been open about their slow-down and hasn't tried to hide from the market.

The reason why its growth is slowing down is that CCI had some lease cancellations after T-Mobile bought Sprint. Tower REITs profit when they can add additional tenants to a tower, but this also means that they suffer from carrier consolidation. Previously, CCI may have leased space to both, T-Mobile (TMUS) and Sprint, but it will lose the revenue coming from Sprint going forward as leases expire.

This will be a headwind in the next few years, but even despite that, CCI is still expected to keep growing, albeit just at a lower rate.

More importantly, what the market appears to forget is that this is just a temporary headwind. Here is what the CEO commented on their most recent conference call:

So to wrap up, we are excited about the strength of our business and our ability to execute on our strategy to deliver the highest risk-adjusted returns for our shareholders by growing our dividend over the long-term and investing in assets that will help drive future growth. We have delivered 9% compound annual and dividend per share growth since we established our 7% to 8% dividend per share growth target in 2017. And I believe that we are positioned well to return to 7% to 8% dividend per share growth as we move beyond the Sprint decommissioning impacts in 2025.

So they expect slower growth for just 2 years. After that, they expect to return to their 7-8% annual dividend growth target, which they have historically outpaced:

High-quality REITs like CCI that are able to grow their dividend at 7-8% per year are typically priced at closer to a 3% dividend yield. To return to that yield level, its share price would need to appreciate by 50%, and while you wait you earn a 4.5% dividend yield that's safe and growing. The shares are also priced at a 30% discount to NAV, which is very unusual for a blue chip like CCI.

It is hard to beat that in terms of risk-to-reward and this is why we are today making CCI the largest holding of our Retirement Portfolio.

Alexandria Real Estate (ARE)

Alexandria Real Estate is the only REIT that specializes in life science buildings and it currently represents 12.56% of our Retirement Portfolio.

Alexandria Real Estate

We invested so heavily in it because:

- It owns very attractive assets: Life science buildings can be great investments because (1) there is high and growing demand for space as lots of money is pumped into research, especially in the post-covid world, but the supply of space is limited and the barriers-to-entry are greater than for other properties. To build new properties, you need specialized skills, relationships, and getting permits is also harder. (2) This has historically resulted in rapid rent growth and high occupancy rates. (3) Tenant relocations are also rare because it is impractical to move the equipment/set up. Over the past 5 years, Alexandria retained >80% of its existing tenants at the time of lease expirations and was able to push for large rent hikes in most cases. (4) The credit quality of tenants are strong. 90% of its top 20 tenants are investment-grade rated or public companies. (5) Its rents are today deeply below market, providing margin of safety and a "bank of growth" for the future.

- It has a fortress balance sheet: Alexandria has one of the strongest balance sheets in the REIT sector with a low 25% LTV (incl. preferred equity), 99% fixed rate, and a long 13.2 year average term with no maturities until 2025, and over $5 billion of liquidity available to pay of future maturities if needed. It also retains a lot of cash flow with its low 52% payout ratio. It then isn't surprising that it has a BBB+ credit rating. Its leverage is now at an all-time low and it probably isn't far from earning an A- credit rating.

- It was (and remains) discounted: We estimate that the shares are priced at a 30% discount to its net asset value and 16x its 2023 FFO. That's on the low side for a REIT with such a strong balance sheet, resilient properties, and predictable growth prospects. We believe that it should trade at closer to 22x FFO, which would bring its share price closer to $200 per share. It traded at $220 in early 2022 when its cash flow was 10% lower. Yet, it is today priced at just $143 per share. We think that one reason why Alexandria is discounted is that it is generally included in the "office" peer group and it hurts its market sentiment. In reality, traditional offices and life science buildings have completely different fundamentals.

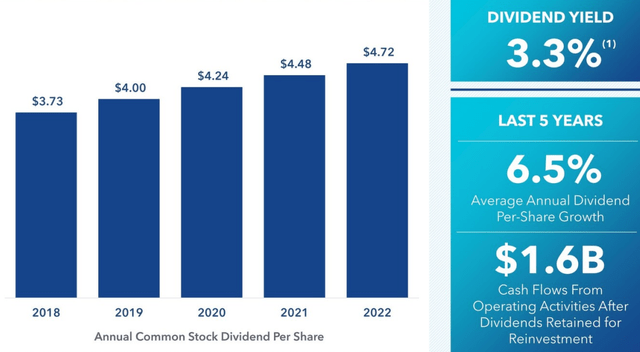

- It pays a rapidly-growing dividend: The dividend yield is not particularly high today at 3.4%, but the payout ratio is low at 52%, and the company's cash flow is growing rapidly. Over the past 5 years, the average annual dividend hike has been 6.5% and we think that this could accelerate in the future as they increase their payout ratio.

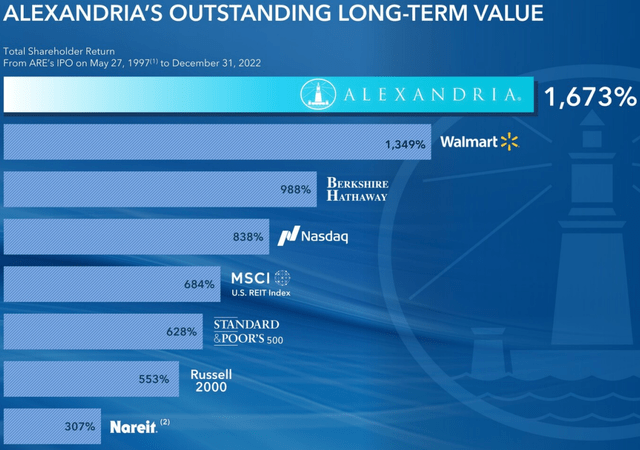

- It has a great track record: Owning Class A life science buildings is attractive on its own, but Alexandria does not stop there. It creates additional value by developing its own properties. It is able to develop new properties at a 6-7% stabilized yield, but these assets can then be sold at a 4-4.5% cap rate, creating lots of value for shareholders. Moreover, Alexandria also has a Venture capital arm, buying equity stakes in some of its tenants and these investments have been very successful in the past. Being the biggest landlord in the life science space gives it a competitive advantage for venture capital investments because it has relationships with most biotech companies. All of this has resulted in market-beating returns since going public, outperforming even Berkshire Hathaway (BRK.B) and Walmart (WMT):

Alexandria Real Estate Alexandria Real Estate

Just the other day, the company released its full-year results and issued its guidance for 2023. Typically, we don't post updates immediately after earnings come out because we like to wait to see the results of peers to compare results.

But Alexandria doesn't have peers, and besides, this is our largest position, so we figured we would provide an update since many of you have asked me questions.

The main takeaway here is that Alexandria keeps performing very well and we are reaffirming our Strong Buy rating:

Firstly, the growth remains exceptionally strong:

- FFO per share rose by 8.5% in 2022, all while the company deleveraged its balance sheet.

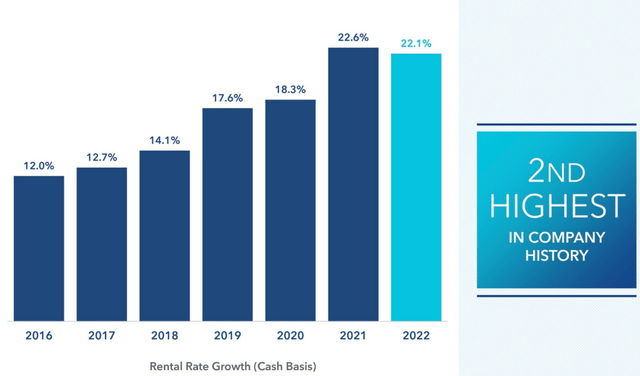

- Its rents were hiked by 22% on lease renewals, the second-highest growth rate in the company's history.

- Its leasing volume was also the second highest in the company's history in 2022, demonstrating strong demand, and its occupancy rate rose slightly.

- Its development pipeline is largely pre-leased already, reducing risk and providing a predictable path to further growth.

- The company is guiding growth to continue in 2023 with a 5-6% FFO per share growth rate. This is a bit less than in 2022, but keep in mind that 2022 FFO came ahead of expectations.

Secondly, the balance sheet is now stronger than ever before and they continue to have good access to capital to grow externally even despite the discounted share price and the higher interest rates:

- Net debt and preferred stock to Adjusted EBITDA of 5.1x, the lowest ratio in Company history.

- They have no debt maturities in 2023 or 2024.

- They can access equity by selling stabilized assets at low cap rates and reinvesting the proceeds into higher-yielding development projects. In 2022, they sold $2.2 billion worth of assets at a 4.4% average cap rate, realizing a gain of $1.2 billion (!!!).

- They have a low payout ratio of 52%, which allows them to pay off debt and/or reinvest in growth organically:

Finally, its valuation remains discounted. Its share price is up a bit lately, but this is well-justified when you consider that the bear thesis hasn't played out.

Here's what the CEO said on the most recent earnings call:

Now looking back at 2022, the stats truly speak for themselves regarding the enduring strength of the life science industry. First, despite widespread commentary that VC funding hit the pause button in 2022, life science venture deals totaled nearly $58 billion.

Other than 2021's record year, it was the second highest amount of capital ever deployed. Of note, over 70% of VC dollars deployed went into an Alexandria cluster, and with VC funds across tech and life science raising nearly $160 billion in 2022, a record eclipsing 2021 is $150 billion, significant dry powder is on hand to deploy over a multiyear time horizon. [emphasis added]

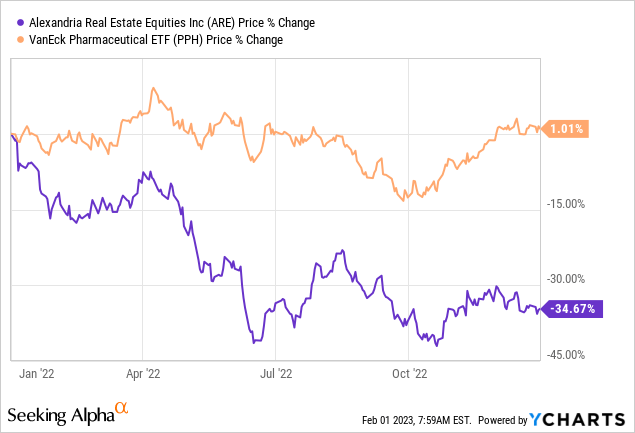

Interestingly, this strong growth is reflected in the share prices of pharma companies, but not in that of Alexandria:

Second, large pharma continues to be one of the best performing sectors in the market. In a year where total returns for market indices such as the NASDAQ and Dow ended the year down 10%, the top 20 biopharma ended the year up an average 12%, with 8 of the top 20 pharma ending the year with total returns over 20%. With historic levels of cash on hand, over $300 billion to deploy into R&D and M&A, biopharma has the firepower to continue to innovate and grow. [emphasis added]

YCHARTS

We think that this huge disparity is an opportunity.

Alexandria directly profits from the growth of these companies as it results in more demand for space, new development opportunities, and higher rents.

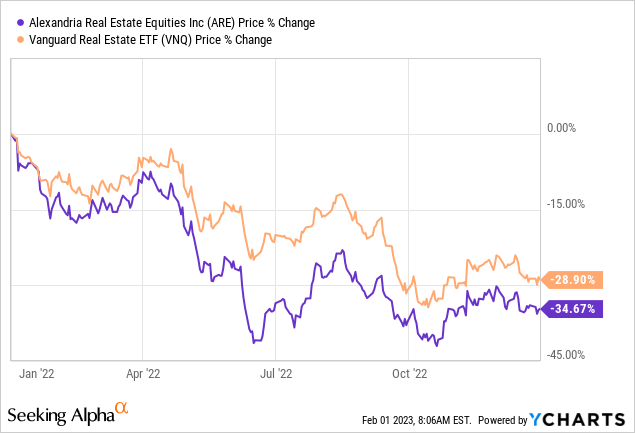

But Alexandria appears to have sold off with the rest of the REIT market as if it was going to suffer from rising interest rates and a recession, which isn't the case. It actually sold off even more than the rest of the REIT sector, despite enjoying better growth prospects and having one of the strongest balance sheets:

YCHARTS

So with that in mind, we are happy to keep Alexandria as one of the largest positions in our Retirement Portfolio.

We believe that its fair value is around $200 per share and you can buy it today at $160. We expect its fair value to keep growing rapidly in the long run, providing a path to 13-16% annual total returns with below-average risk in the years ahead.

3.4% dividend yield + 5-8% annual growth + 5% annual repricing upside

= 13-16% annual total returns

Bottom Line

Most investors appear to ignore that REITs aren't materially impacted by rising interest rates because their balance sheets are the strongest ever with a low 35% LTV on average and long debt maturities at 8 years. In many cases, these REITs won't feel any impact for many years to come.

Meanwhile, their rents keep on rising as a result of the high inflation and dividends keep getting hiked.

Eventually, the narrative will change and the time to invest is now while everyone else is fearful.

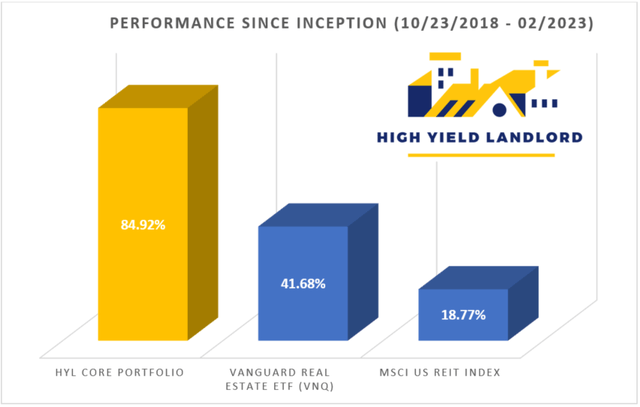

If you want full access to our Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the fastest-growing and best-rated stock-picking service on Seeking Alpha with 2,500+ members on board and a perfect 5/5 rating from 500+ reviews:

You won't be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!

This article was written by

Jussi Askola is a former private equity real estate investor with experience working for a +$250 million investment firm in Dallas, Texas; and performing property acquisition in Germany. Today, he is the author of "High Yield Landlord” - the #1 ranked real estate service on Seeking Alpha. Join us for a 2-week free trial and get access to all my highest conviction investment ideas. Click here to learn more!

Jussi is also the President of Leonberg Capital - a value-oriented investment boutique specializing in mispriced real estate securities often trading at high discounts to NAV and excessive yields. In addition to having passed all CFA exams, Jussi holds a BSc in Real Estate Finance from University Nürtingen-Geislingen (Germany) and a BSc in Property Management from University of South Wales (UK). He has authored award-winning academic papers on REIT investing, been featured on numerous financial media outlets, has over 50,000 followers on SeekingAlpha, and built relationships with many top REIT executives.

DISCLAIMER: Jussi Askola is not a Registered Investment Advisor or Financial Planner. The information in his articles and his comments on SeekingAlpha.com or elsewhere is provided for information purposes only. Do your own research or seek the advice of a qualified professional. You are responsible for your own investment decisions. High Yield Landlord is managed by Leonberg Capital.

Disclosure: I/we have a beneficial long position in the shares of CCI; ARE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.