Acushnet Holdings Still Has Room To Roll

Summary

- The management team at Acushnet Holdings continues to post strong financial results for the company, both on its top and bottom lines.

- The future for the business also looks bright, with sales, profits, and cash flow likely to rise this year.

- Shares are also priced low enough to warrant additional upside from here despite rising so much already.

- Looking for a helping hand in the market? Members of Crude Value Insights get exclusive ideas and guidance to navigate any climate. Learn More »

D. Lentz

Although I am far from the most athletic person you ever meet, I do enjoy a bit of golf from time to time. Frankly, I wish I could play the game more. But given my work, as well as other passions that compete with it, I only hit the course a few times a year. Naturally, this would make me interested in any company there has some connection to the game. And few firms are as intimately involved in that market as Acushnet Holdings (NYSE:GOLF). As the owner of the Titleist brand name, as well as the owner of the FootJoy performance wearables business, the company's fate is really tied to the game. Recently, shares of the business have been moving higher, driven by robust financial performance on both its top and bottom lines. With growth expected to continue throughout at least 2023, investors do seem optimistic about the firm. But it's also no secret that the stock is not exactly as cheap as it was previously. Moving forward, why do you think upside would be more difficult than it was just a few months ago. But given how shares are priced, I do think it still warrants a soft 'buy' rating at this time.

A great shot so far

in the middle of November of 2022, I decided to revisit my thesis regarding Acushnet Holdings. Leading up to that point, the company had experienced some mixed financial performance throughout the 2022 fiscal year. However, data associated with the then-most-recent quarter had come in rather strong. All things considered, I believed that the outlook for the company was promising and that shares were trading at a low enough level to justify some upside moving forward. Because of that, I ended up rating the company a 'buy' to reflect my view that shares should outperform the broader market for the foreseeable future. Looking back on that assessment, I can say that I am happy with the outcome. While the S&P 500 is up 1.7% since the publication of that article, shares of Acushnet Holdings have enjoyed upside of 10.4%. And since my first bullish article on the company in May of last year, shares are up an impressive 32.4% compared to the 2.8% rise the S&P 500 experienced.

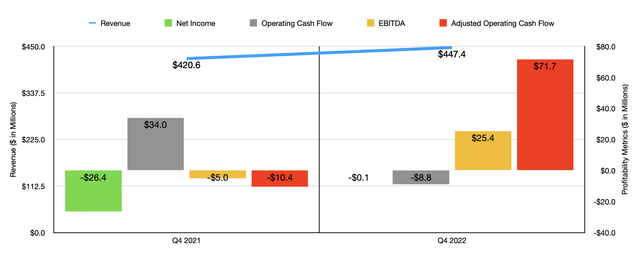

To understand why the company continues to perform so well against the market, we should touch on the most recent data provided by management. Revenue in the final quarter of the 2022 fiscal year, for instance, came in at $447.4 million. That's 6.4% higher than the $420.6 million reported for the final quarter of 2021. Sales growth would have been even higher had it not been for foreign currency fluctuations. On a constant currency basis, revenue spiked 14.3%. This was largely driven by an increase in Titleist golf clubs that benefited from the company's newly introduced TSR drivers and fairways. An increase in Titleist golf balls also was experienced because of higher sales volumes across all models. Titleist golf gear also increased during this time, driven by both higher volumes of golf bags and headwear, and higher average selling prices. On a percentage basis, the greatest increase here involved Titleist golf clubs. Revenue here spiked 21.9%, or 32.1% on a constant currency basis. The firm did see some weakness though. The FootJoy golf wear that the company sells saw sales contract by 6.5% (though they rose 0.2% on a constant currency basis) Because of lower sales volumes in footwear and gloves.

The increase in sales also brought with it improved profits. The firm went from generating a net loss of $26.4 million in the final quarter of 2021 to generating a net loss of only $0.1 million in the final quarter of 2022. It is true that operating cash flow worsened, going from $34 million down to negative $8.8 million. But if we adjust for changes in working capital, it would have surged from negative $10.4 million to positive $71.7 million. Meanwhile, EBITDA for the company went from negative $5 million to positive $25.4 million. Management used this drastic improvement in profits and cash flows to buy back additional stock. During the quarter, it repurchased just over 1.13 million shares for roughly $51 million. Then, in January of this year, they repurchased 2.17 million shares for $100 million before, in February, authorizing the repurchase of up to an additional $250 million worth of stock.

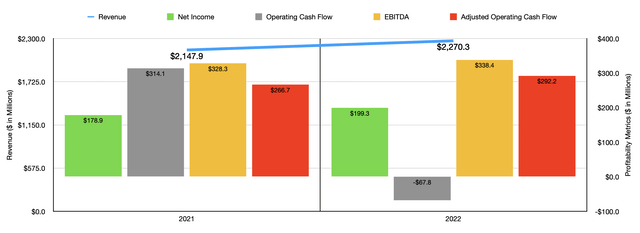

The final quarter of 2022 was not the only positive time for the company. All of 2022, as a whole, seemed to have been robust. Sales of $2.27 billion came in higher than the $2.15 billion reported for 2021. Net income increased from $178.9 million to $199.3 million. Once again, operating cash flow did worsen, falling from $314.1 million to negative $67.8 million. But on an adjusted basis, it actually rose from $266.7 million to $292.2 million. And finally, EBITDA for the company expanded from $328.3 million to $338.4 million.

When it comes to the 2023 fiscal year, management said that revenue should rise further, totaling between $2.325 billion and $2.375 billion. That would represent a year-over-year increase of between 2.4% and 4.6%. But on a constant currency basis, sales should climb by between 5% and 7.2%. On the bottom line, management is forecasting EBITDA of between $345 million and $365 million. If we use the midpoint as guidance here and apply that to the other profitability metrics, we would get net income of $209.1 million and adjusted operating cash flow of $306.5 million.

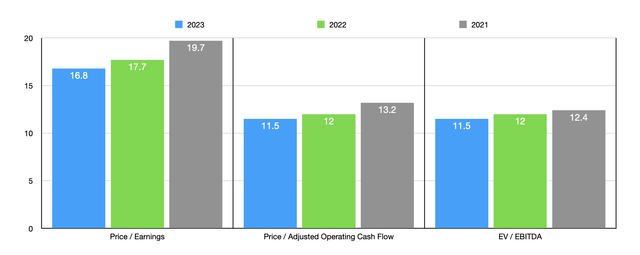

Based on these numbers, the company seems to be trading at a forward price-to-earnings multiple of 16.8. The forward price to adjusted operating cash flow multiple comes in lower at 11.5, while the EV to EBITDA multiple should match that at 11.5. But of course, the end of the 2023 fiscal year is quite a way off. So instead, we should value the firm using the 2022 figures. These, as well as the valuation using data from 2021, can be seen in the chart above. As part of my analysis, I also compared the company to five firms that have some similarities to it. On a price-to-earnings basis, the four companies with positive results had trading multiples of between 3.6 and 27.8. Two of the four were cheaper than Acushnet Holdings. Using the price to operating cash flow approach, the range would be from 3.9 to 106. Three of the five firms, in this case, were cheaper than our target. And finally, using the EV to EBITDA approach, we would get a range of between 3.9 and 15.5. In this scenario, four of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Acushnet Holdings | 17.7 | 12.0 | 12.0 |

| Vista Outdoor (VSTO) | 3.6 | 3.9 | 3.9 |

| Topgolf Callaway Brands (MODG) | 27.8 | 8.7 | 9.6 |

| YETI Holdings (YETI) | 19.5 | 77.3 | 11.8 |

| Latham Group (SWIM) | N/A | 106.0 | 15.5 |

| Sturm, Ruger & Company (RGR) | 9.1 | 9.3 | 4.8 |

Takeaway

For the most part, I believe that the 2022 fiscal year was a really great time for Acushnet Holdings and its investors. If management ends up being accurate, 2023 should also be solid. The stock has gone up in recent months. Because of that, is no longer as cheap or as appealing as it was previously. The stock also looks fairly valued compared to similar businesses. But because the stock does still look fundamentally appealing on an absolute basis, and thanks to the rosy guidance from management, I would say that it still justifies a soft 'buy' rating at this time.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!

This article was written by

Daniel is an avid and active professional investor. He runs Crude Value Insights, a value-oriented newsletter aimed at analyzing the cash flows and assessing the value of companies in the oil and gas space. His primary focus is on finding businesses that are trading at a significant discount to their intrinsic value by employing a combination of Benjamin Graham's investment philosophy and a contrarian approach to the market and the securities therein.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.