EssilorLuxottica: A Well-Managed Company, But Too Expensive For Me

Summary

- EssilorLuxoticca designs and produces lenses and glasses and is one of the most important companies in its sector.

- The cash flows remain robust, but the free cash flow yield is rather disappointing.

- The business model is great, and the company is in good hands. But I'm on the sidelines as I don't want to chase the stock.

- Looking for a helping hand in the market? Members of European Small-Cap Ideas get exclusive ideas and guidance to navigate any climate. Learn More »

Andrii Iemelyanenko/iStock via Getty Images

Introduction

I have been interested in EssilorLuxottica (OTCPK:ESLOY) (OTCPK:ESLOF) for several years now. I used to have a (small) long position in Grandvision (OTCPK:GRRDY) (OTC:GRRDF) which was acquired by Essilor. In a January 2021 article I mentioned how that acquisition actually created a win/no lose scenario for Grandvision shareholders in case the deal would be blocked by antitrust authorities. Either the deal would go ahead (which it did), or Grandvision would have been entitled to a 400M EUR break fee. The deal eventually did close and I think this ultimately was a good move for Essilor. But as I saw so many opportunities in 2021, I didn't reinvest my proceeds into Essilor but I have always kept an eye on the company and its performance.

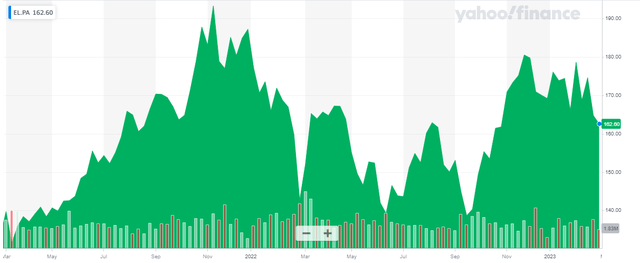

Essilor's primary listing is on Euronext Paris where the company is trading with EL as its ticker symbol. The average daily volume in Paris is approximately half a million shares. Considering the stock is trading at in excess of 160 EUR per share, this represents a daily monetary value of approximately 80M EUR, making the Paris listing the preferred option.

The inflation didn't bother Essilor too much yet as the operating margin increased

Essilor reported a total revenue increase of almost 14% compared to 2021 on a like for like basis. That's hardly surprising as most companies all over the world have been able to increase their revenue by raising prices to adjust them for inflation. Unfortunately this usually doesn't mean those companies are able to post net profit increases as the price hikes only compensate a portion of the inflation-related setbacks.

EssilorLuxottica did better than that. Its adjusted operating margin increased from 16.1% to 16.8% (adjusted for the pro-forma inclusion of Grandvision as of January 1 2021). While that would be marginal and almost negligible in normal circumstances, it's a good performance during these uncertain times.

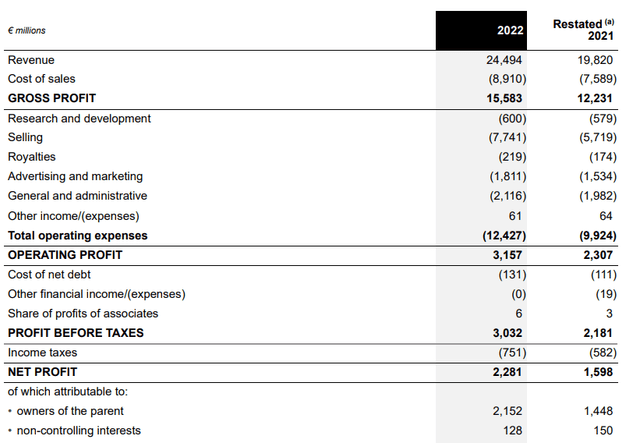

As you can see in the image below, the revenue increased by almost 24% on a reported basis (which uses the restated financials for 2021, including the final purchase price allocation of the Grandvision acquisition) while the COGS increased by "just" 17.4%. this caused the gross profit to increase by more than 25% to 15.6B EUR.

EssilorLuxottica Investor Relations

As some of the other operating expenses barely increased (R&D expenses increased by just 3%, G&A expenses by just 7%), Essilor was able to compensate for the 35% increase in the selling expenses. The operating profit for the year was 3.16B EUR, still an increase from the 2.3B EUR in FY 2021 but not as pronounced as the gross profit increase.

The increase in interest expenses remained pretty low and the 131M EUR in interest expenses is very reasonable. This resulted in a pre-tax income of 3.03B EUR and a net income of 2.28B EUR, of which approximately 2.15B EUR was attributable to the shareholders of Essilor.

This resulted in an EPS of 4.87 EUR based on the average share count of 442M shares but the total current share count is approximately 446M (447.7M issued minus the 1.4M shares owned by Essilor) and using the current share count rather than the weighted average would reduce the EPS by approximately 1% to 4.83 EUR per share.

This means the stock is currently trading at more than 30 times the 2022 earnings and unfortunately the cash flow statement didn't offer a materially different interpretation.

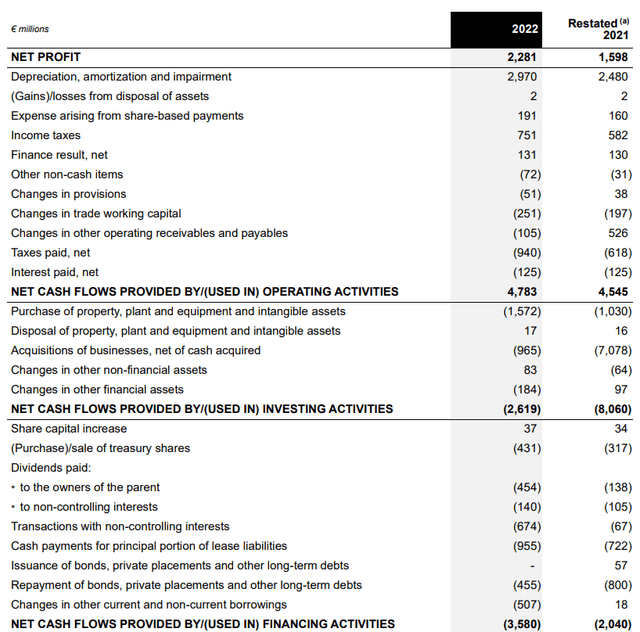

The total operating cash flow was 4.78B EUR, which includes about 356M EUR in working capital and other operating receivables/payables. We also see the company paid 940M EUR in cash taxes although only 751M EUR was due, based on the income statement.

EssilorLuxottica Investor Relations

We also should deduct the 128M EUR of income attributable to non-controlling interests (rather than the 140M EUR in dividends paid, as this was likely related to the higher 150M EUR attributable net income in FY 2021) while the cash payments for leases came in at 955M EUR.

After taking all these elements into consideration, the adjusted operating cash flow in 2022 was approximately 4.25B EUR. The total capex, excluding acquisitions, was 1.57B EUR which means the underlying free cash flow result was approximately 2.7B EUR. Divided over 446M shares outstanding, the underlying free cash flow was approximately 6.05 EUR per share. That's higher than the reported net income as the combination of capex (1.57B EUR) and lease payments (955M EUR) is lower than the almost 3B EUR in depreciation, amortization and impairment charges.

Investment thesis

But despite seeing how the free cash flow result is higher than the reported net income, I'm still not too keen on paying in excess of 25 times the underlying free cash flow for EssilorLuxottica. The company is very well-managed and the market obviously thinks it deserves a premium valuation. I agree with that, but I don't think the premium should be this high. At a required FCF yield of 5.5%, the fair value of Essilor would be approximately 110 EUR per share.

It is of course very important to look to the future rather than looking back over the shoulder to the past. The EBITDA will for sure increase from the 6.1B EUR it reported in 2022 and both organic growth as well as bolt-on acquisitions will likely help the company to post a high single digit annual EBITDA increase over the next few years. That being said, I don't anticipate the EPS to exceed 7 EUR before 2025 and even at 7 EUR per share the stock is currently trading at in excess of 23 times earnings.

The combination of all these elements means I'm on the sidelines. I completely missed the opportunity in 2021 to use the proceeds from the sale of Grandvision to buy Essilor stock. But even in the first half of 2021 Essilor already was trading at 125-135 EUR per share so I don't really have any regrets.

I will keep an eye on EssilorLuxottica and I hope to see weakness in the stock but I am not holding my breath.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.