Prudential Financial: An Undervalued Stock Sending More Cash To Shareholders

Summary

- Prudential Financial's after-tax adjusted operating income per share payout ratio will improve from 50.7% in 2022 to just 40.7% in 2023.

- The company's after-tax adjusted operating income fell 23.9% year-over-year in the fourth quarter.

- Prudential's credit ratings remain firmly investment-grade.

- My inputs into the dividend discount model and discounted cash flows model imply that the stock is trading at a 12% discount to fair value.

- Prudential's combination of a 5% dividend yield, approximately 5% annual after-tax adjusted operating income per share growth potential, and valuation upside could make the stock a buy for income investors.

A heap of money with a seedling, representing growing investments. malerapaso

If you're a dividend growth investor, watching your dividends consistently grow may make you feel warm and fuzzy inside. At least, that's my experience after news of a dividend raise.

The best way to experience this feeling as often as possible is to pick great businesses that are providing goods and/or services that are in high demand. This allows a company's profits to trend higher over the long run, which supports a growing dividend.

Prudential Financial (NYSE:PRU) is a financial sector business that I believe fits this description. For the first time since my article last October, I will go over why the stock has earned a place as a core holding within my portfolio.

The Safest Dividend Is The One Just Raised

Prudential's 5.04% dividend yield is well above the life insurance industry average dividend yield of 3.12%. But the stock's dividend appears to be rather safe.

That's why in early February, Prudential announced a 4.2% raise in its quarterly dividend per share to $1.25. This was the 15th consecutive year that the company raised its dividend.

Prudential recorded $9.46 in after-tax adjusted operating income per share in 2022. Compared to the $4.80 in dividends per share that were paid during the year, this is equivalent to a 50.7% payout ratio.

And this already reasonable payout ratio is poised to improve significantly in 2023: Analysts expect $12.28 in after-tax adjusted operating income per share for the year. Stacked against the $5.00 in dividends per share that will be paid this year, the payout ratio will be a modest 40.7%.

Prudential will likely generate mid single-digit annual after-tax adjusted operating income per share growth over the long haul. Paired with a payout ratio that has some room to expand, I am confident in maintaining my long-term annual dividend growth rate of 5%.

Long-Term Fundamentals Remain Intact

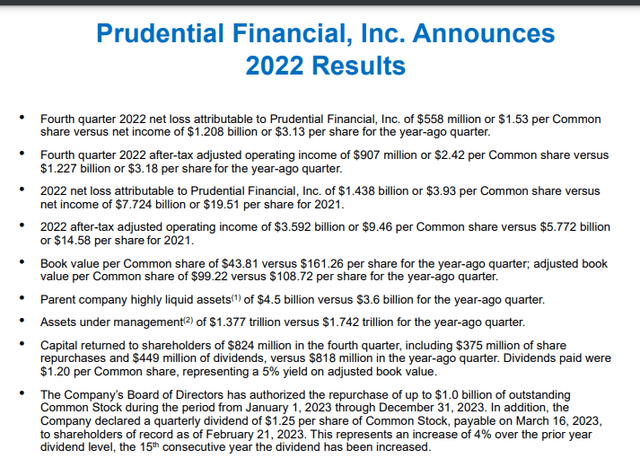

Prudential Financial Q4 2022 Earnings Press Release

Prudential's financial results for the fourth quarter that ended Dec. 31 may be discouraging at first blush. But there's more to the story that suggests these results are part of the ebb and flow that goes along with the financials sector. The company's after-tax adjusted operating income per share dropped 23.9% over the year-ago period to $3.18 (info sourced from page 1 of 11 of Prudential Q4 2022 earnings press release).

The company's results were driven by reduced adjusted operating income in each of its three core segments: PGIM, U.S. businesses, and international businesses.

PGIM reported $230 million in adjusted operating income during the fourth quarter, which was 34.3% lower year-over-year. This was caused by a 19% decline in the company's assets under management to $1.2 trillion from the equity market downturn, as well as lower incentive fees.

U.S. businesses logged $864 million in adjusted operating income in the fourth quarter. That was down 3.5% over the year-ago period, which was due to lower variable investment income and lower net fee income.

International businesses produced $618 million in adjusted operating income for the fourth quarter, which was 25.5% lower year-over-year. This was the result of lower variable investment income, unfavorable insurance underwriting results, and higher expenses (details in previous four paragraphs according to pages 2-3 of 11 of Prudential Q4 2022 earnings press release).

Fortunately, it's anticipated that these headwinds will ease in 2023 and 2024. That will allow Prudential to return to growth. And the company remains financially healthy, with $4.5 billion in liquid assets (figure per page 1 of 11 of Prudential Q4 2022 earnings press release). This is why Prudential enjoys respective credit ratings of AA-, Aa3, and AA- from Standard & Poor's, Moody's, and Fitch.

Risks To Consider:

Prudential is a quality business due for a rebound shortly. But even the best companies face their share of risks.

The biggest risk that could materialize is a global recession. The International Monetary Fund expects global economic growth to slow down to 2.7% in 2023. While this is still a far cry from a global economic contraction, the possibility remains on the table. If this were to occur, Prudential's recovery in fundamentals could be further delayed.

A Favorable Valuation

When purchasing ownership stakes in slower-growing businesses such as Prudential, it's important to get the valuation side of the equation right. Overpaying for a stalwart is a surefire way to encounter underwhelming investment results.

That's why I'll use two valuation models to assess the fair value of the stock.

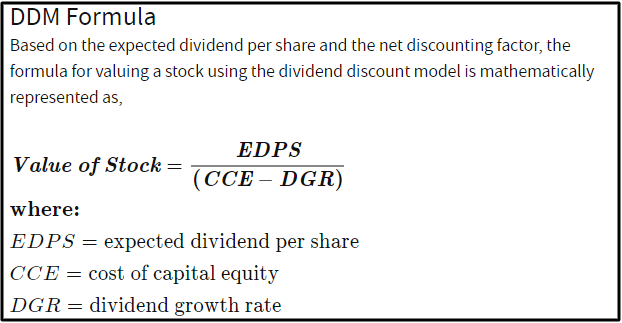

Investopedia

The first valuation model that I will employ to value shares of Prudential is the dividend discount model or DDM. This consists of three inputs.

The first input into the DDM is the expected dividend per share, which is simply the annualized dividend per share. Prudential's annualized dividend per share is currently $5.00.

The next input for the DDM is the cost of capital equity, which is the annual total return rate required by an investor. My personal preference is 10% annual total returns, so that's what I'll utilize for an input.

The final input into the DDM is the annual dividend growth rate or DGR. I will assume a 5% annual DGR for Prudential.

Plugging these inputs into the DDM, I arrive at a fair value output of $100.00 a share. This means that Prudential's shares are trading at a 0.9% discount to fair value and offer a 0.9% upside from the current price of $99.08 a share (as of March 3, 2023).

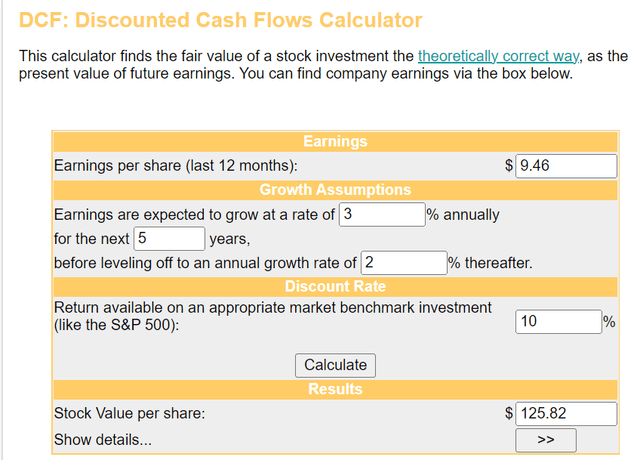

The second valuation model that I will utilize to assess shares of Prudential is the discounted cash flows model or DCF model. This also has three inputs.

The first input for the DCF model is trailing-12-months after-tax adjusted operating income per share. That amount is $9.46 in the case of Prudential.

The second input into the DCF model is growth assumptions. For the sake of conservatism, I will use a 3% annual earnings growth rate for five years and 2% thereafter.

The third input for the DCF model is the discount rate, which is another term for the required annual total return rate.

Using these inputs for the DCF model, I get a fair value of $125.82 a share. That indicates that Prudential's shares are priced at a 21.3% discount to fair value and can provide 27% capital appreciation from the current share price.

Averaging these two fair values out, I compute a fair value of $112.91 a share. This suggests that shares of Prudential are trading at a 12.2% discount to fair value and offer a 14% upside from the current share price.

Summary: The Stock Is A Solid Dividend Growth Pick

Prudential has been a steady dividend grower over the last decade and a half. And considering that the payout ratio is quite low, this dividend growth shouldn't stop anytime soon.

Prudential also appears to be undervalued by a double-digit margin based on my inputs into the DDM and DCF model. This is why yield-oriented investors should consider picking up Prudential and its 5% dividend yield for their portfolio.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of PRU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.