C3.ai: Earnings Beat But Watch Out For The Hype

Summary

- C3.ai is a Forrester Wave leader in AI and Machine Learning and has a major focus on enterprise customers.

- The company reported non-GAAP earnings per share of negative $0.06, which surpassed analyst expectations by ~72%, according to Google Finance data.

- C3.ai has 26 patents and an additional 96 patents pending, which could give the company a competitive advantage in the AI industry.

- My valuation model and forecasts indicate the stock is overvalued after the recent exuberance in its share price.

- I estimate the market is pricing in a 30% growth rate for the next year and a rapid 50% growth rate per year in years 2 to 5, to make the stock fair value.

BlackJack3D

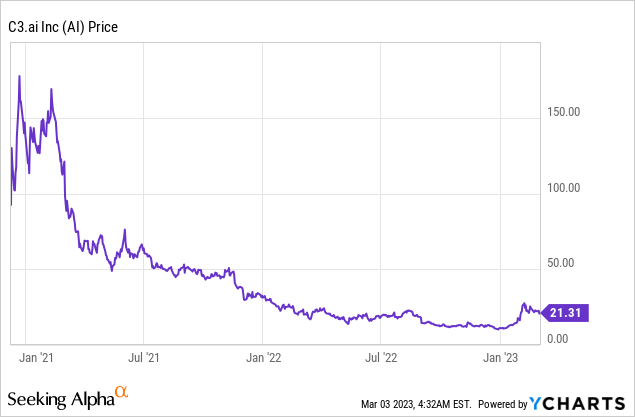

C3.ai (NYSE:AI) is a Forrester Wave leader in enterprise AI. The company has been ahead of its time in developing a "platform" approach to AI with a multitude of applications across various industries from the energy sector to aerospace and defense. The business is poised to benefit from the growth in the AI industry which was valued at $136.55 billion in 2022 and is forecast to grow at a rapid 37.3% compounded annual growth rate up until 2030. So far, the company has produced strong results as it beat both revenue and adjusted earnings expectations for Q3 FY23. C3.ai has also rapidly released a new product, its "Generative AI suite" which leverages the viral platform GPT-3. It should be no surprise that with a ticker such as "AI" and products related to GPT-3, the company's stock price has been at the heart of a perfect storm. In fact, AI stock price skyrocketed by over 164% between late December 2022 and early February 2023. We then saw a correction downwards but now the stock looks to be on the move up again after the recent earnings report. In this post, I'm going to break down the latest financials before revealing my valuation model for the stock to understand exactly what "exuberance" the market is pricing in, let's dive in.

Excitable Financials

C3.ai generated revenue of $66.7 million, which beat analyst estimates by 3.38% year over year, despite revenue actually declining by 4.28% year over year relative to Q2 FY23. This was a surprise to see as if you looked at C3.ai's stock price or mainstream news headlines, you would have likely suspected "roaring" growth. A positive is as the company is targeting large organizations or enterprises, often its contracted revenue is not realized as actual revenue initially. For example, C3.ai reported 35% deal growth year over year. In addition, the company reported a 7% quarterly increase in its remaining performance obligations (current) to $176 million.

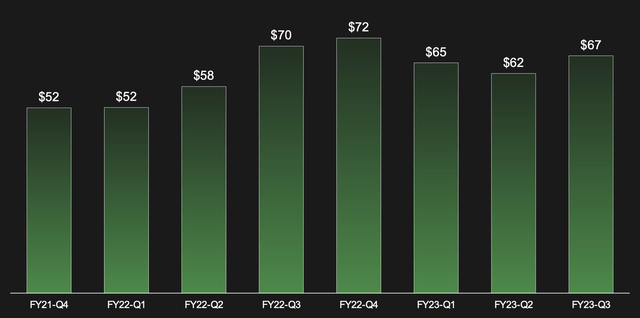

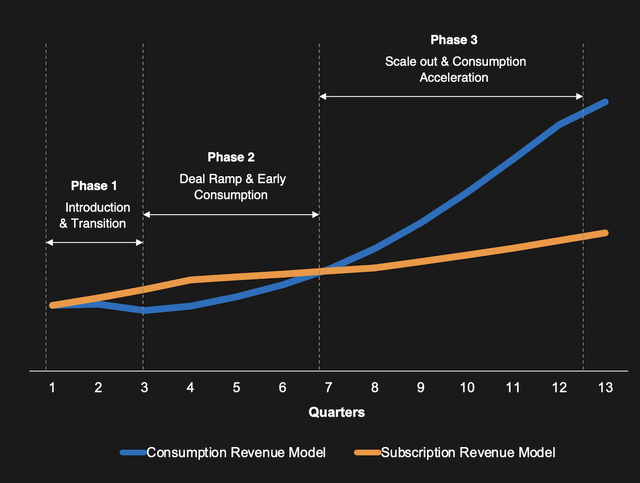

C3.ai is also going through a business model "transformation" as it converts from a subscription model to a consumption-focused model (similar to AWS). This type of pricing model has positives and negatives. The positive is during "good times", C3.ai can capture more of the upside. However, the negative is during "bad times" of lower demand, revenue can drop. In addition, there is a "ramp-up" period where lower revenue growth is expected, you can see this on the chart below. Long-term, I believe this is a better model as it makes the purchase of the product a "no-brainer" for customers, as it effectively flexes with demand. In fact, in the C3.aI earnings call, management forecast "increasing" revenue growth rates for the fiscal year of 2024 and "beyond", thanks to the new model which has now been "validated".

Consumption vs Subscription Model (C3.ai)

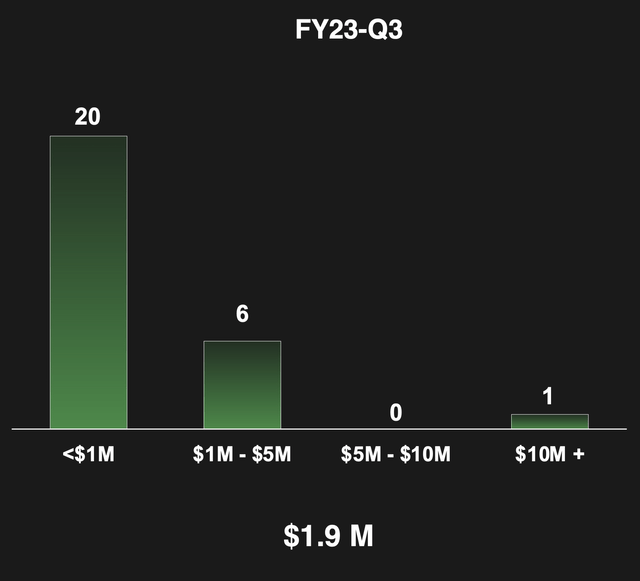

C3.aI has increased its total number of customers by ~8% year over year from 218 to 236. This may not sound like a lot but remember these are larger enterprises of which some are paying millions of dollars for the product. For instance, in the third quarter of 2023, C3.ai scored 20 contracts worth less than $1 million, with 6 contracts worth between $1 million and $5 million, in addition to one large contract at over $10 million which is substantial.

Average Contract Value (C3.ai)

I believe targeting enterprises is a solid strategy as in my experience, these larger organizations tend to have higher customer retention and of course larger account expansion opportunities. Of course, the most challenging part for a salesperson is getting that initial deal over the line, as the sales cycles can extend on for many months or even years. These deals usually consist of multiple members of a buying committee. In order to help expedite this sales process, C3.ai has scored a number of partnerships with the major cloud infrastructure providers and many large consultancies. For example, in Q3 FY23, the company closed eight new customer deals with Google Cloud and expanded its combined pipeline. In addition, the company has added its products to the Google Cloud marketplace, which offers a low-friction way for customers to purchase products.

C3.ai has also expanded its "go to market" partnership with the world's largest cloud infrastructure provider AWS. It was interesting to discover that AWS has even "funded" an AWS-optimized version of C3.ai's product for law enforcement. Selling to law enforcement agencies is no easy task, but once C3.ai scores a few deals, it can "verticalize" its offering and expand across other agencies.

Moving onto the consultancy side, C3.ai scored a strategic partnership with Booz Allen (BAH) in Q3 FY23 in order to offer solutions for government and defense sectors. I believe this is a major deal as governments are a lucrative customer type that offers huge account expansion opportunities.

C3.ai also renewed its partnership with a leading consultancy, Accenture (ACN). This isn't just a high-level partnership; the companies have trained Accenture employees on the C3.ai platform together. I believe this is a major positive as Accenture employees will likely feel some sense of "ownership" and a sunk training cost that would make the consultancy unlikely to partner with a competitor AI provider (even at a slightly better commission).

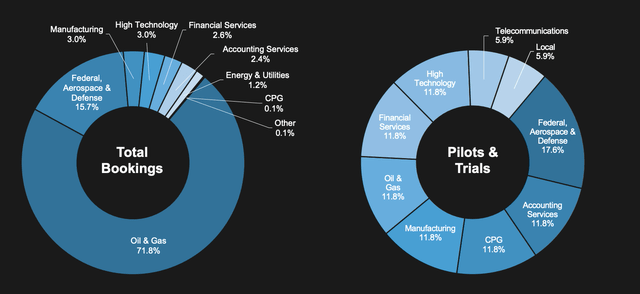

In its earnings call, C3.ai reported it had renewed its strategic partnership with Baker Hughes, a leading reseller in the oil and gas industry. This may seem like a random industry, but it is actually C3.ai's most popular so far. The company has previously scored 71.8% of its total bookings from the Oil and Gas Industry. This includes 87 contracts across many major customers from Exxon Mobil to Shell, Petronas, Saudi Aramco, and more. Given oil prices are still at fairly healthy levels (~$70 per barrel) at the time of writing and energy security is an increasing concern, I believe this industry could offer huge growth potential for C3.ai.

Product Release Frequency

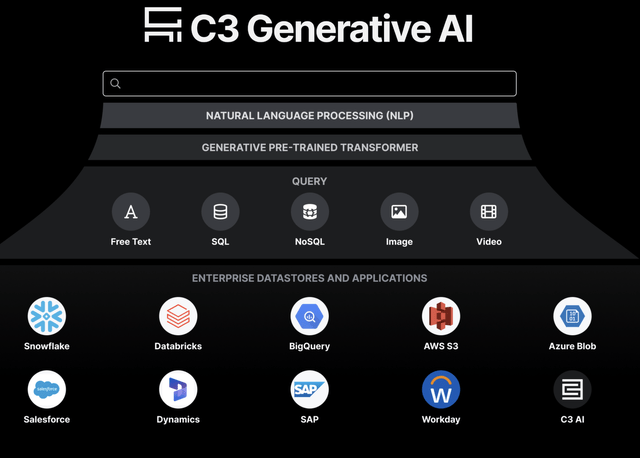

C3.ai is quick to pivot and release new products as trends rise. For example, in January 2023, the company launched its Generative AI Product Suite. This effectively leverages OpenAI's popular GPT-3 model which went viral recently thanks to the growth of the ChatGPT. Now I believe C3.ai's product is not massively innovative, given OpenAI offers an API connection to anyone directly into its model. However, I believe the company's rapid release is a sign of an efficient organization and gives them a competitive advantage as a "first mover".

Then of course, as the company improves its product, it can truly start to innovate effectively. So far its product is focused on using AI to help rapidly "locate, retrieve and present" data across an entire organization.

Many large companies are known to have lots of "big data", trapped in silos, and thus accessing this easily can be challenging. Large companies such as Snowflake (SNOW), specialize in this space (but from a data warehouse angle) and have been growing at a screaming pace. C3.ai actually integrates with Snowflake and offers a more internally focused product.

C3.ai Generative Suite (Q4 22 report)

C3.ai also offers a Sustainability suite of applications that is continually being enhanced. Its original product focused on energy management and helped the tracking of energy and greenhouse gas footprints of businesses across the world. According to a PwC report, ESG assets under management are expected to soar by 84% to a staggering $33.9 trillion globally by 2026. Given the increasing regulatory pressure surrounding carbon tracking, C3.ai should be poised to benefit from its ESG product.

Margins and Balance Sheet

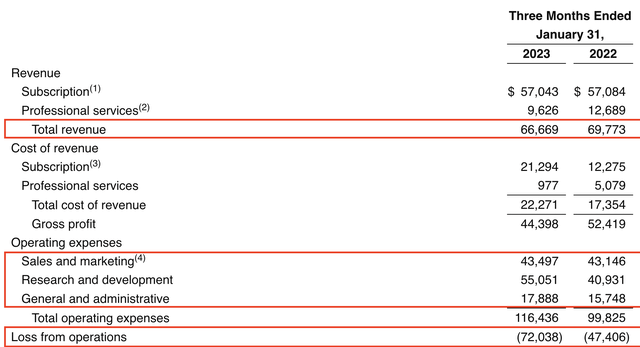

C3.ai is struggling with profitability as its losses have widened substantially. In Q3 FY22, the company reported an operating loss of $47.4 million. In Q3 FY23, this loss expanded to an eye-watering $72 million. A positive is this increase looks to have been mainly driven by a ~$14 million increase in Research and Development [R&D] expenses, which overall I don't believe is necessarily a bad thing. If anything, I believe this is necessary given the recent popularity of the AI industry and C3.ai's rapid product releases in the generative AI market. General and administrative expenses only increased by ~$2.19 million which is not too bad, while its Sales and Marketing expenses were only a few hundred thousand dollars higher. Overall, I believe as the company begins to grow again and benefit from the AI industry tailwinds, it should benefit from increased operating leverage. I will discuss more on that in the "Valuation and forecasts section".

Profitability (Income statement)

A positive is C3.ai reported non-GAAP earnings per share [EPS] of negative $0.06, which surpassed analyst expectations by ~72%, according to Google Finance data.

The company also has a solid balance sheet with $311 million in cash and cash equivalents. In addition, the company reported $461 million in short-term investments. C3.ai has virtually no interest-bearing debt. However, the business does have ~$25 million in current liabilities and $24 million in long-term liabilities.

Valuation and Forecasts

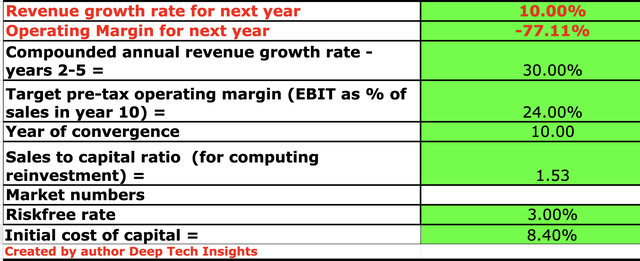

In order to value C3.ai, I have plugged its latest financial data into my discounted cash flow valuation model. I have forecast 10% revenue growth for "next year" or the next four quarters in my model. This is based upon an enhancement of the 4% and 5% revenue growth guidance given for the fiscal year of 2023. Given the major tailwinds across the AI industry and new product releases, I see no reason why a faster growth rate cannot be achieved. For years 2 to 5, I have forecast an even faster growth rate of 30% per year. I forecast this to be driven by sales driven by its consultancy and cloud partnerships, in addition to the aforementioned growth trends in the Artificial Intelligence industry.

C3 stock valuation 1 (Created by author Deep Tech Insights)

To increase the accuracy of my valuation model, I have capitalized R&D expenses which has boosted net income. In addition, I have forecast a pre-tax operating margin of 24% over the next 10 years. This may seem optimistic but that level is only 1% higher than the average margin for the software industry, according to NYU data. Given C3.ai's large number of enterprise customers with vast expansion opportunities, this is achievable long term. As mentioned prior, its main expense increase in the prior quarter was R&D.

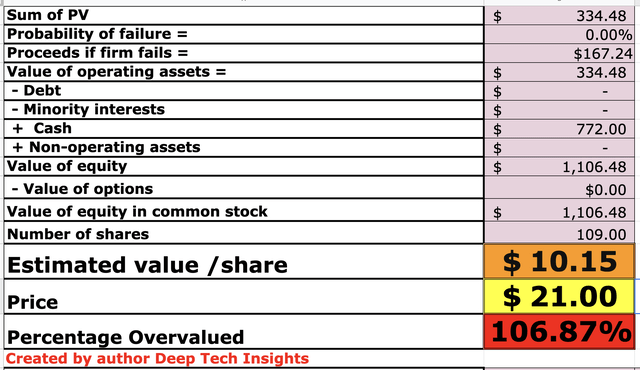

C3.ai stock valuation 2 (Created by author Deep Tech Insights)

Given these factors, I get a fair value of $10.15 per share. The stock is trading at ~$21 per share at the time of writing, and thus it is over 106.87% overvalued. Keep in mind, this is not including the 16% increase in share price (pre-market trading) at the time of writing.

For those who are curious, the market is pricing in 30% revenue growth for next year and a rapid 50% revenue growth in years 2 to 5. If the company can achieve these exuberant growth rates, AI stock would be close to "fair value". This isn't impossible given the company has previously grown its revenue at a 37% growth rate in the 12 months ending April 2022, pre the "AI hype".

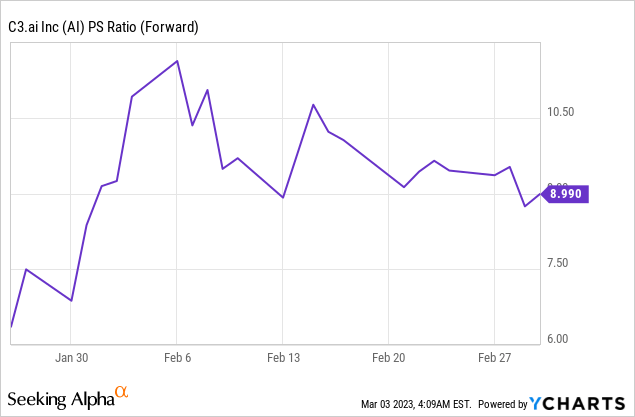

Surprisingly, even with the "hype," its price to sales [P/S] ratio = 8.9, which is slightly lower than the P/S ratio over 10 achieved in January 2023.

Risks

Recession/Longer Sales cycles/Hype

Many analysts have forecast a recession for 2023 and thus this may impact C3.ai's revenue growth. Decision-makers are likely to delay vast spending as they "wait and see" how things play out. There is a lot of "hype" surrounding the AI industry currently which can lead to "irrational exuberance" in stock prices and valuations. I personally believe AI is a game-changing technology, but so was the internet and we had the dotcom bubble (and crash) in 1999.

Final Thoughts

C3.ai has scored a number of great partnerships in the quarter and is poised to benefit from the growth in the AI industry. The company has the opportunity to become the industry standard for enterprise AI, and its recent product releases complement this strategy. Despite the tailwinds, its stock looks to be overvalued intrinsically after the major run-up in share price. However, as the market is currently pricing in growth which isn't impossible, I will label the stock as a "hold" for now and one for the watch list.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.