Housing Market 2023 - Some Growth Picks For The Upswing In Demand

Summary

- The housing demand index is showing signs of improvement in 2023, with the highest single month jump (from January to February) in over a decade.

- Several high-quality growth stocks are highlighted in this article that offer the potential to benefit from the growing demand for building supplies such as lumber, specialty products, and glass.

- Based on Q422 earnings results, the 3 stocks covered herein are demonstrating strong returns despite the short-term downturn in housing demand.

adamkaz

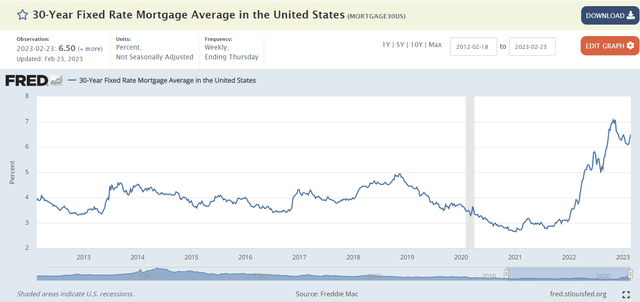

According to several sources, the housing demand index is rising in 2023, with homebuilder sentiment seeing the biggest monthly jump in February 2023 in about a decade. Part of the reason for that was due to mortgage rates pulling back from over 7% back in late October 2022, to the mid-6% range in mid-February. Along with homebuilders offering incentives and demand picking up from cyclical lows, the outlook for the next few months looks positive for homebuilders. Even though mortgage rates are still higher than they have been in the past 10 years, the rates are starting to level off around 6.5% but could remain volatile for the next few months.

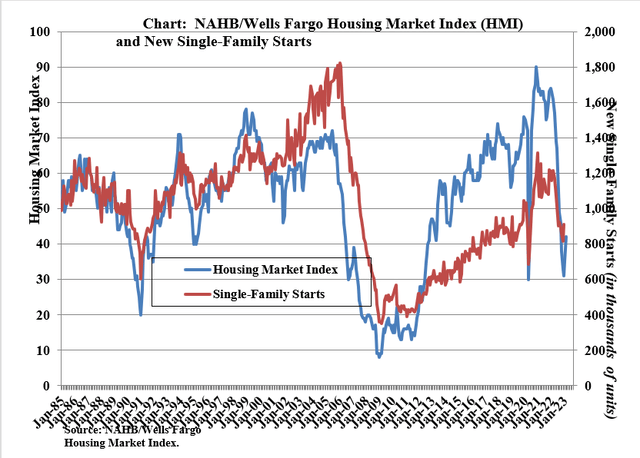

Meanwhile, since about the end of 2021, housing starts have been declining from a post-Covid surge in demand that took new housing starts to peak levels due to unheard of price appreciation, before reversing course and plummeting back to new lows.

The chart below from NAHB/Wells Fargo shows how the Housing Market Index shot to record high levels from the historic lows in 2009 after the GFC. Then the HMI peaked in late 2021 as the post-Covid demand surge led to higher inflation and rising interest rates driving homebuyers out of the market. Now that trend is beginning to reverse upward again in the first couple months of 2023. New single family starts also dropped precipitously in 2022 but are also starting to show signs of a rebound.

Builders FirstSource

While some still believe that we are heading into another recession later in 2023 and interest rates are likely to continue rising for the next few months before levelling off, I am seeing signs in earnings reports that Q422 was the beginning of a turnaround for several home construction related stocks. For example, Builders FirstSource (BLDR) reported solid earnings on February 28 and guided for an improved outlook for Q123. From the company press release:

"Over my more than two decades with Builders FirstSource, we have never been better positioned to compete in a highly fragmented industry and execute on our strategy to capture share and create long-term profitable growth," commented Dave Rush, CEO of Builders FirstSource.

And although net sales decreased slightly in the quarter compared to the year ago period, the company is well positioned to continue strong growth into the future with free cash flow of $800 million in Q4.

Peter Jackson, CFO of Builders FirstSource, added:

"I am proud of our ability to deliver solid financial results in the fourth quarter and record performance for the full year. We generated exceptional free cash flow of approximately $800 million in the fourth quarter and repurchased over $650 million of shares while maintaining a strong balance sheet capable of investing in future growth.

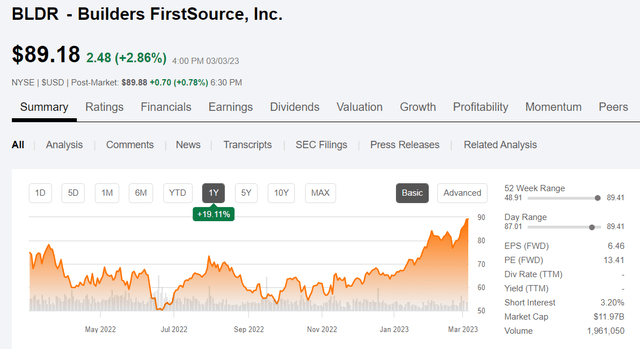

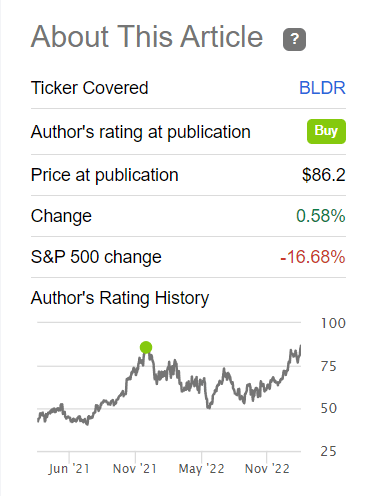

I had previously written about BLDR back in December 2021 when I expected the company to offer strong growth in 2022, before things changed dramatically in February with the Russian invasion of Ukraine and the market downturn that followed. At that time, the stock was trading for about $86, and I rated it a Buy.

Seeking Alpha

My timing was off due to unforeseen events, but my rationale for the company's growth potential remains intact, and now I believe that BLDR again represents a Buy opportunity for those investors willing to take on a bit of risk given the uncertainty in the economy. The competitive advantages that lead me to that conclusion were outlined in my previous article and are still very relevant today.

- National leader and consolidator in a fragmented industry

- One-stop shop with innovative solutions and breadth of product offerings

- Expanding cash flow generation

- Extensive geographic footprint with end customer diversity and market reach

- Strategic investing in value-added capacity

- Experienced management team.

The share price has begun to recover after being down in 2022 from the previous range of the mid-$80s and is now back above $89 after the latest earnings report. According to SA the forward P/E is still a reasonable 13.4 and represents a good value given the momentum and cash flow growth.

BlueLinx Holdings

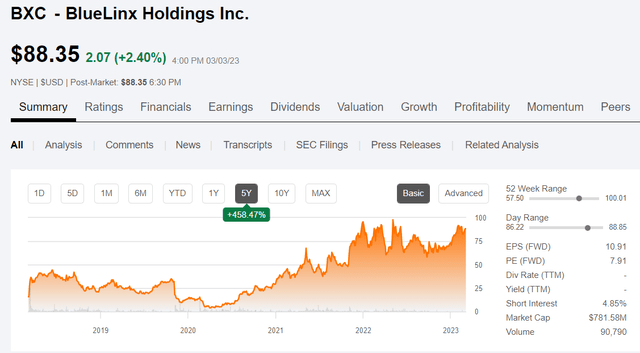

Next up is BlueLinx Holdings (BXC), which I also wrote about back in December 2021. At that time, the stock price topped out at $91 and then started to drop shortly after my article was published on New Year's Eve and continued to vacillate between a low of about $60 and as high as $100 all through 2022, before resuming the rise in price in 2023. On March 3, BXC traded for $88.35 at the close and has a forward P/E of less than 8. I rate BXC a Buy also at the current price given its growth trajectory over the past 5 years and recent earnings results.

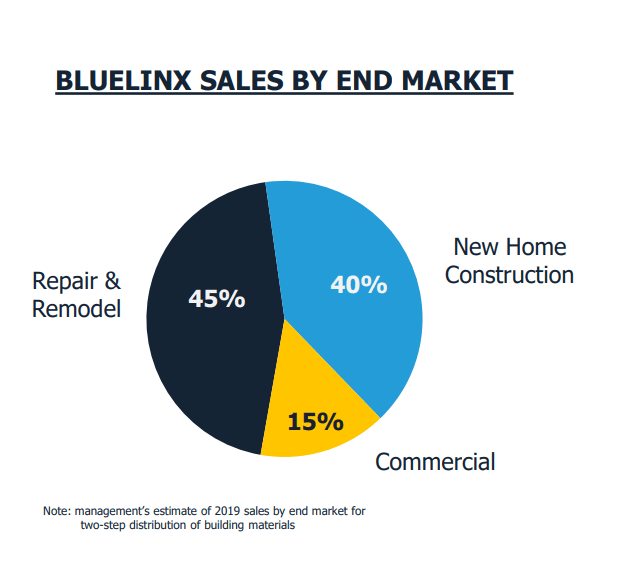

BXC is a leading wholesaler of building supply products, and not necessarily a homebuilder or dependent on the residential housing market, although much of their business comes from new home construction and remodels as shown in this slide from their Q422 and FY22 investor presentation.

BlueLinx Holdings

While they saw net sales and profit margins decline in Q4, the year end results were impressive given the overall economy in 2022 with 4% YOY net sales growth and 7% growth in YOY gross profit. The company had strong net sales in Q4 despite slowing growth and a decrease in CapEx due to lower repair and maintenance expenses. Net leverage was reduced from 1.1x in FY2021 to 0.6x at the end of FY22.

Although there are expectations of slowing housing demand in 2023 the market has an estimated $40B TAM and BXC has captured about 10% of the market share. They are in a strong financial position and have been leveraging growth to optimize productivity and drive performance via a performance-based culture that focuses on creating value for their customers.

According to the investor presentation, the exceptional results in 2022 were due to:

✓ Net sales of $4.5b, up 4% year-over-year

✓ Adjusted EPS of $32.55, up 10% year-over-year

✓ Adjusted EBITDA of $478m, up 3% year-over-year

✓ Operating cash of $400m, up ~3x year-over-year

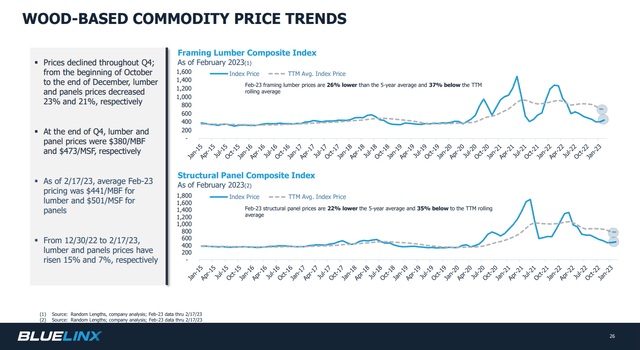

Looking farther out into the future, BXC identifies several macro trends that could impact the housing market in the next several years, including a growing supply of new homes on the market, a slowdown in new single family housing starts below the 25-year average (but well above 2009 - 2011 levels), continued growth in remodeling activity, and mortgage rates remaining below historical averages. Lumber prices have also come down from historically high levels and are starting to show signs of leveling off.

BlueLinx Holdings presentation

Summarizing the Q4 and FY22 results, the President and CEO of BXC, Dwight Gibson, stated:

"Our fourth quarter and full year 2022 were highlighted by strong margin performance and record operating cash flow, demonstrating our ability to generate solid results despite more challenging macro conditions. We continue to strengthen our financial position through robust cash generation, increasing our available liquidity. Throughout 2022, we allocated approximately $170 million of capital towards the acquisition of Vandermeer, capital expenditures that improved the effectiveness of our facilities and our fleet, and share repurchases."

The outlook for 2023 according to BXC on the Q4 earnings call is expected to be relatively flat with respect to remodeling activity, although, even if there is no or slow growth in remodeling the company expects to be able to adjust pricing for structural and specialty products to help drive bottom line performance. But expectations for continued earnings growth needs to be moderated somewhat based on those forecasts. The CFO, Kelly Janzen had this to say about the current environment:

We're in a fairly severe downturn right now in the short term. And so that being said, we still delivered 7.5% EBITDA margin in the fourth quarter. And like I said, we're maintaining margins pretty well through the first seven weeks.

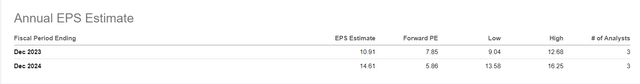

Thus, even if the overall housing market continues to be volatile in 2023, BXC appears to be well positioned to leverage their existing products and customers to generate decent returns. The stock may not be as inexpensive as it might at first appear if earnings growth does slow down over the next few quarters, but based on what I am seeing so far in 2023, I believe that those earnings forecasts may end up being adjusted upward. And if you look out even farther into 2024, the earnings estimates are much improved from a range of $9.04 to $12.68 in 2023 EPS to a range of $13.58 to $16.25 in 2024 as shown on the SA Earnings Summary page for BXC.

If you take the mid-range estimate of about $10.50 for 2023 EPS, the stock price could easily fetch a value of $105 by the end of 2023 using a relatively conservative 10x multiple. By year end 2024, if earnings come in the middle of the predicted range at about $14.75, the price could reach $145 or higher.

Tecnoglass

Another growth company that I first wrote about just over a year ago is Tecnoglass (TGLS), an integrated glass manufacturing company based in Barranquilla, Colombia. Back in February 2022 there was a wave of new construction taking place in Florida and TGLS was benefitting from the high demand for specialty glass and window products. The stock price tanked in December 2021 after a short report from Hindenburg trashed the company and accused them of having ties to the cartel in Colombia, among other accusations.

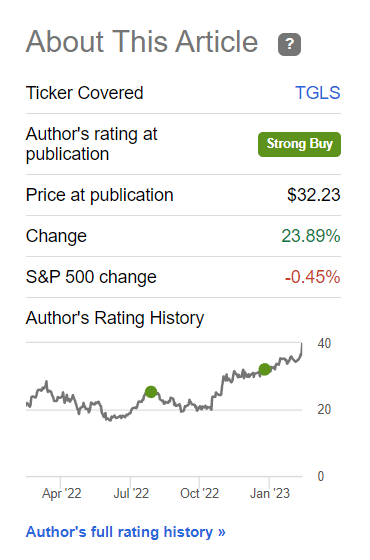

Since that time, I have penned two additional articles describing the growth prospects for TGLS, most recently in January. In that article, I again mentioned the Florida construction forecast, now updated for 2023, and prospects for continued outperformance by TGLS stock. This time I rated the stock a Strong Buy at a price of $32.23.

Seeking Alpha

Since then on March 2, TGLS reported Q422 results, and they knocked it out of the park. The highlights from the press release included:

- Record Fourth Quarter Revenues and Adjusted EBITDA Up 60% to $211.1 Million and 107% to $87.2 Million, Respectively -

- Also Achieves Record Fourth Quarter Gross Margin, Operating Margin, Net Income, Adjusted Net Income, Adjusted EPS and Operating & Free Cash Flows -

- Strong Results Driven by Organic Growth in Both Single-Family Residential and Multifamily/Commercial Businesses, Up 59% and 61%, Respectively -

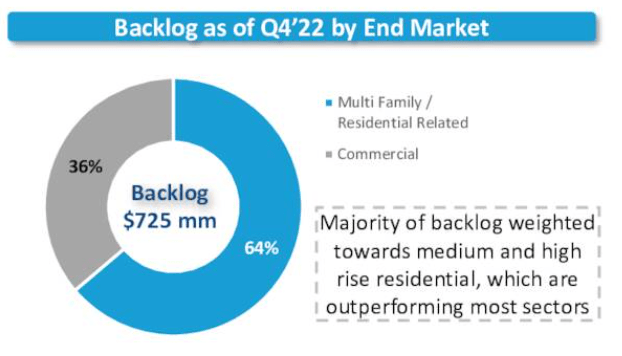

- Backlog Expanded 24% Year-Over-Year to an All-Time High of $725.2 Million -

- Facility Investments Remain on Track to Increase Operational Capacity to ~$950 Million in Revenues in the Second Quarter of 2023 -

- Introduces Full Year 2023 Growth Outlook for Adjusted EBITDA of $300 Million to $320 Million on Total Revenues of $790 Million to $830 Million -

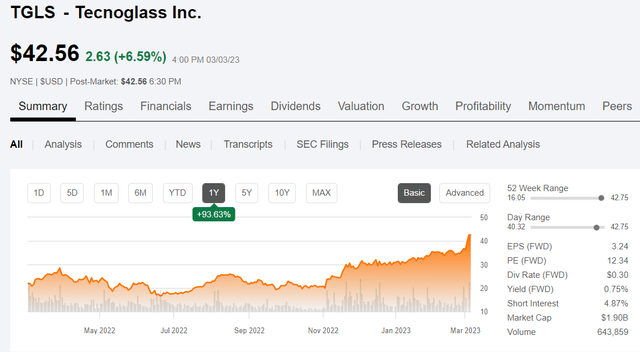

The stock price jumped to a 52-week high of $42.75 before closing at $42.56 on March 3.

Like the outlook for BXC, the repair and remodel activity in 2023 is expected to drive most of the revenues for single family residential, which the company states are responsible for about 65% of that business segment, while new builds make up the other 35%. The majority of the $725M backlog at the end of Q422 was weighted toward medium and high rise residential, such as condo towers in southern states especially.

BXC investor presentration

With a significant presence in Florida already, the company is expanding into the rest of the South and Southeast and as far north as Maine up the eastern seaboard. Meanwhile, the company continues to improve the balance sheet and pay down debt, with no significant debt maturities until the end of 2026.

As CEO, Jose Daes stated on the earnings call, 2022 was a phenomenal year for TGLS. And heading into 2023, the company is well positioned to continue that outperformance.

We achieved eight straight quarters of strong double-digit organic revenue growth. We see record results in each quarter as we continue to outperform our end markets even during this uncertain time for the industry. We entered 2023 as a much stronger company, supported by a record backlog and improved cash flow position. We have further extended our leadership position in the architectural glass industry. As we look forward, we will continue to leverage Tecnoglass vertically integrated platform a strategic geographical positioning and proven growth investments to maintain our industry-leading margins, gaining additional market share and create additional value for all our stakeholders.

Furthermore, to address the growing demand the company has plans to expand capacity at their manufacturing facilities in Colombia. According to COO, Christian Daes, the company plans to increase capacity to the equivalent of nearly $1 billion in annual sales by the 2nd quarter of 2023.

We -- first of all, with the capacity that we're adding on this year by June, July, it will be ready. And I mean, we could increase sales of laminated glass by 60% and of insulated glass by 200%. So the extra capacity could easily take us over the $1 billion in sales.

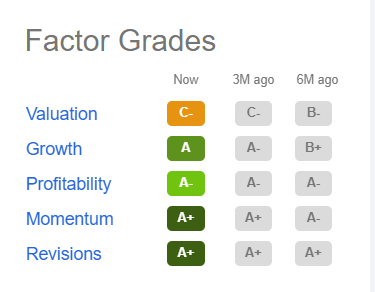

Even though the stock price has doubled in the past year, it is still trading at a good value at about 12x forward earnings. TGLS receives Strong Buy ratings from Wall Street Analysts, SA Authors, and the Quant rating system. The only quant factor grade that is not an A- or better is Valuation which gets a C- only because the stock has run up so much in the past month.

Seeking Alpha

I continue to rate TGLS a Strong Buy as well for all the reasons mentioned here and which I go into in more detail in my January article. What I wrote at the time when the stock was trading for around $32 seems to be a not too optimistic forecast given the strong Q4 results and outlook for 2023.

If the earnings estimates for 2023 increase as I expect due to the rising demand and increased capacity a more optimistic price target might be closer to 12x earnings of $4, or as high as $48 by the end of the year, representing about 50% upside from the current price.

Summary and Conclusion

Whether the US heads back into another recession in 2023 or not, the current outlook for the home construction industry looks quite positive in the first two months of the year and the trend based on earnings reports from a few high quality, growth companies is demonstrating that the macroeconomic factors are favorable for a recovery. As supply chain and labor shortage issues continue to sort themselves out, there are also favorable demographics for home construction and remodeling, especially in the Southern and Eastern states in the US. TGLS is well positioned to take advantage of the momentum that they have created, especially in the medium to high rise residential markets.

BLDR is expanding their geographic footprint as well with multiple acquisitions along with organic growth in value-added products and services. Newly appointed CEO, Dave Rush, is committed to executing the strategy to fuel long-term growth while managing through a difficult economic environment.

BXC is also demonstrating good fiscal responsibility going into 2023 despite a challenging macro environment. According to the Q4 press release, the company is in a strong financial position and may be looking at additional M&A activity to take advantage of opportunities that may arise to strategically grow the business.

As of December 31, 2022, total debt was $573 million, including $300 million of senior secured notes that mature in 2029 and $273 million of finance leases. Available liquidity was $645 million which included an undrawn revolving credit facility that had $346 million of availability plus cash and cash equivalents of $299 million. Net debt was $274 million, resulting in a net leverage ratio of 0.6x on trailing twelve-month adjusted EBITDA of $478 million.

These 3 picks should benefit from current trends in the US housing market and are worthy of consideration for risk-tolerant, growth-oriented investors.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TGLS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.