Best Time In Years To Buy Quality REITs - Top Picks In 5 Sectors

Summary

- REITs have sold off hard recently because of rising interest rates.

- But for multiple reasons, REITs are not nearly as hurt by rising interest rates as the panicky market seems to think.

- High-quality, fast-growing REITs are rarely ever as discounted as they are today.

- I highlight 5 high-quality REITs in five different property sectors that represent great values today.

- Looking for a helping hand in the market? Members of High Yield Landlord get exclusive ideas and guidance to navigate any climate. Learn More »

NicoElNino

There are times we look back on and think, "Why didn't I buy those excellent stocks when I had the chance?"

I believe now is one of those times.

Real estate investment trusts ("REITs") have been punished with another selloff as interest rates have surged again recently on positive economic news.

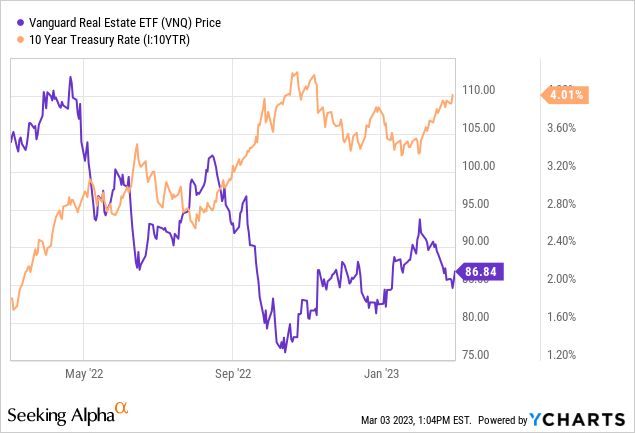

As you can see from the chart above, REITs move in an almost perfectly inverse correlation with interest rates. Rates go up, REITs go down, and vice versa.

But amid the panicked selloff in REITs from rising interest rates, keep the following points in mind:

- Higher interest rates make corporate ownership of their own real estate via debt financing more expensive, and thus renting/leasing their real estate becomes more attractive.

- Interest rates for construction loans are among the highest in the lifecycle of a real estate property, so higher rates constrict the development of new properties, making existing properties more valuable.

- Heavily leveraged private real estate owners are hurt far worse than public REITs, and thus these private landlords are more likely to become distressed sellers. This offers the better capitalized REITs the chance to scoop up high-quality properties on discount.

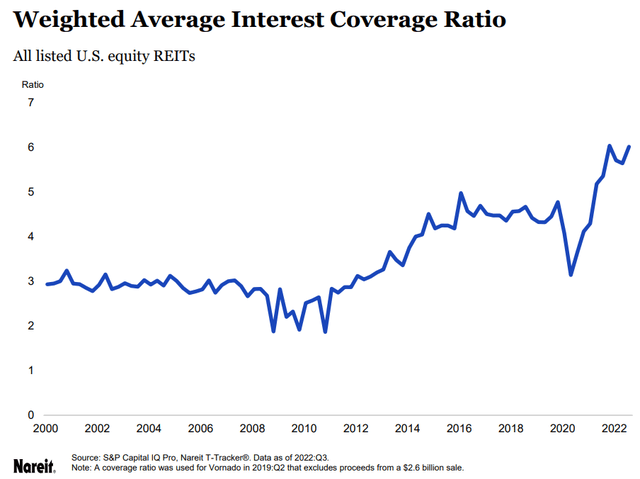

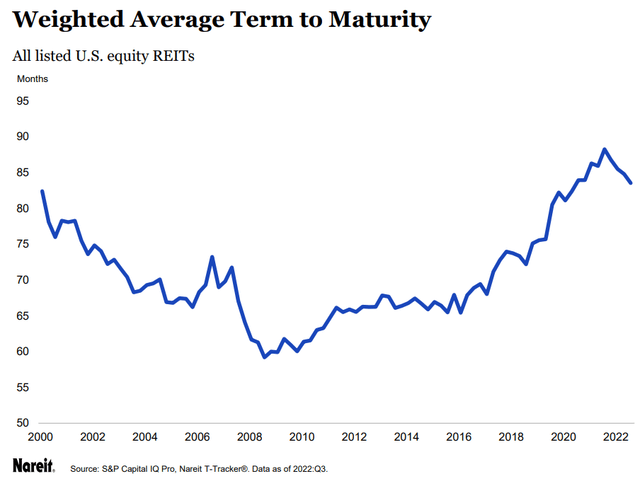

- Today, REITs on average have nearly their lowest leverage ratios in history as well as their highest interest coverage ratios and longest weighted average remaining terms to maturity.

(The chart below shows REITs' weighted average debt term to maturity of about 7 years, as of the second half of 2022.)

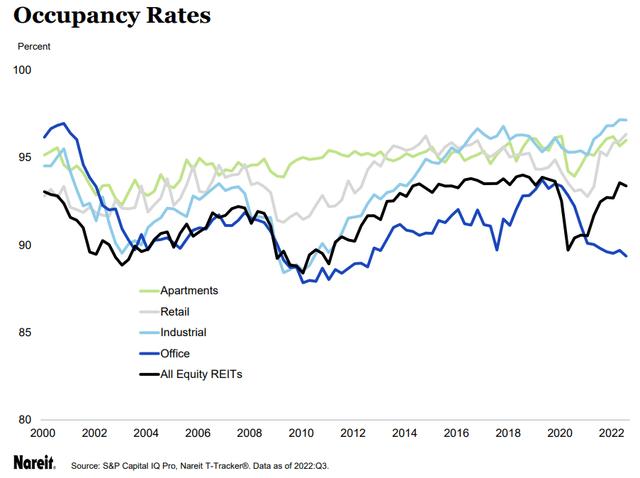

- Occupancy for most real estate sectors is very high, indicating high demand from tenants and the high probability of further rent growth ahead.

Notice that while office occupancy has unsurprisingly been trending downward since the beginning of the pandemic, apartment occupancy is around its pre-pandemic high while retail and industrial are near their all-time highs.

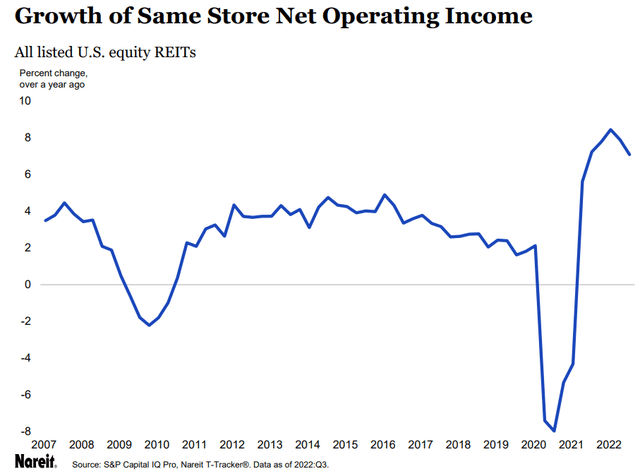

Continued demand from tenants combined with limited availability of vacant space should continue to produce strong same-store (i.e. comparable property) net operating income growth, even if this organic growth rate does come down from its unsustainably high level from 2021 and 2022.

In short, the backdrop remains strong for REITs. Higher interest rates are not nearly the threat that the market assumes them to be, and inflation is a powerful and immediate tailwind pushing rents higher.

If these points are true for REITs generally, they are all the more true for the blue-chip REITs with the highest quality property portfolios, balance sheets, and management teams. And yet, many of the highest quality and fastest growing REITs have been punished the worst, despite often being the best positioned to handle higher rates and benefit from inflation!

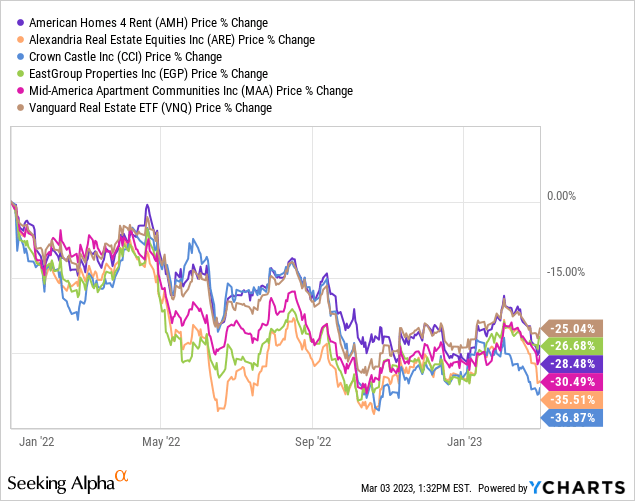

Since the beginning of 2022, five of my favorite high-quality REITs have sold off worse than the broader real estate index (VNQ):

This selloff presents a rare opportunity to buy these high-quality REITs on discount.

Each of these 5 REITs features best-in-class assets, management, balance sheets, and costs of capital, and each of them enjoys a long growth runway ahead. They are positioned well to capture a sizable share of those growth runways.

In what follows, I'll briefly give my pitch for each name.

American Homes 4 Rent (AMH)

- Dividend Yield: 2.8%

- Credit Rating: BBB

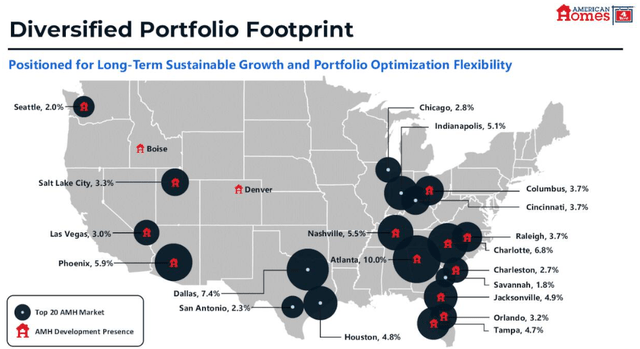

AMH is the leading landlord and developer of single-family rentals in the Sunbelt region of the United States with a portfolio of about 59,000 homes.

Though not exclusively located in the Sunbelt, AMH's geographic footprint is overwhelmingly focused there, especially in fast-growing states like Texas, Florida, Georgia, Arizona, and the Carolinas.

The US in general has a housing shortage, and the areas within the country where Americans are moving in droves (like Texas, Florida, and Phoenix, AZ) have a particularly acute supply shortage.

Plus, the large Millennial generation is now reaching the age in which people typically move out of apartments and into single-family homes. Given the lack of affordability of homeownership for most Millennials, however, this demographic transition indicates that single-family demand will instead be channeled into SFRs such as those owned by AMH.

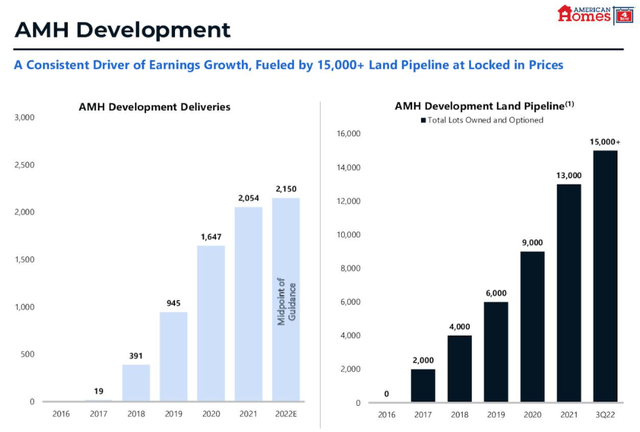

Moreover, AMH is unique in that it is the only SFR REIT (and among the only large corporate SFR landlords generally) with an in-house home development platform. Rather than merely buying up homes and adding to the difficulty of would-be homeowners, AMH is actively developing new homes to help gradually alleviate the housing shortage.

During the fourth quarter of 2022, AMH delivered 701 newly completed homes across all of its development markets. And for 2023, the company plans to put all acquisitions of existing homes on pause to focus exclusively on its build-to-rent ("BTR") program, as AMH can generate higher yields from its own BTRs than it can from existing homes.

For a fuller analysis of AMH, see my January article "AMH: Sunbelt SFR REIT Doing Its Part To Alleviate The Housing Shortage."

Alexandria Real Estate Equities (ARE)

- Dividend Yield: 3.4%

- Credit Rating: BBB+

ARE is the industry-leading landlord and developer of Class A life science properties. These properties are irreplaceable, highly specialized laboratory and office buildings located in the nation's top research clusters on the East and West coasts.

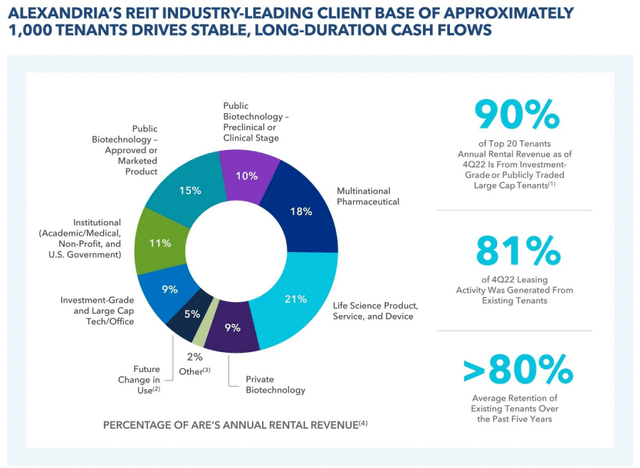

Its largely investment grade and publicly traded tenant base is made up of the world's leading pharmaceutical and biotech companies, and ARE's properties provide them with the mission-critical space needed to conduct research & development.

There are strong barriers to entry for real estate in the particular research clusters where ARE's properties are located. As such, ARE boasts a commanding market position when it comes to rent rates and lease terms. Its portfolio enjoys landlord-friendly lease terms like tenant responsibility for property maintenance and taxes, a weighted average remaining lease term of 7.1 years, average annual rent escalators of about 3%, and double-digit rent growth.

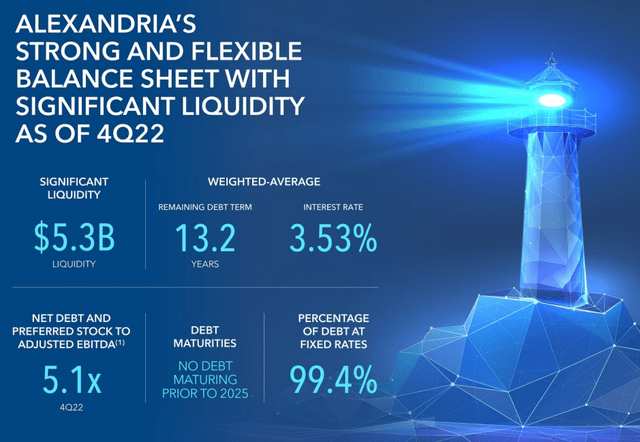

Likewise, ARE enjoys an ultra-strong balance sheet with a BBB+ credit rating (top 10% for all public REITs), over $5 billion in liquidity, >99% of debt featuring fixed rates, a modest net leverage ratio of 5.1x, and a weighted average remaining debt term of 13.2 years.

The REIT recently demonstrated its creditworthiness when, in February 2023, ARE issued $1 billion of bonds with an average term of 21 years and a weighted average interest rate of 4.98%.

ARE is one of the highest quality REIT on the public markets, and today it can be bought at a price to adjusted funds from operations under 18x. That is cheap relative to ARE's quality and growth prospects.

Crown Castle (CCI)

- Dividend Yield: 4.8%

- Credit Rating: BBB+

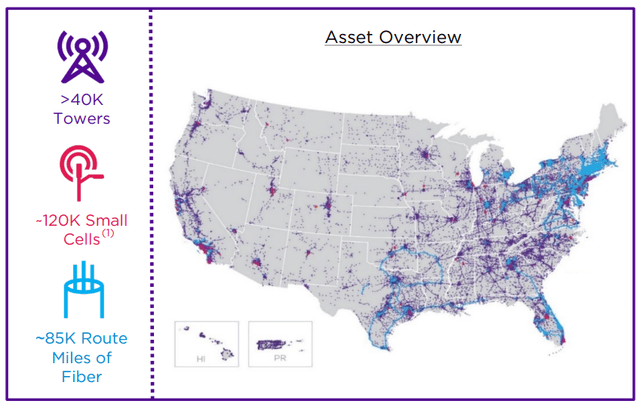

CCI is the leading wireless telecommunications infrastructure landlord in the United States.

The entirely US-based portfolio consists of over 40,000 towers, ~120,000 small cell nodes, and ~85,000 route miles of fiber lines connecting it all. Unsurprisingly, 75% of CCI's rental revenue derives from the big three wireless carriers: AT&T (T), Verizon (VZ), and T-Mobile (TMUS).

Small cells are basically mini-cell towers placed in dense urban areas with high traffic where additional capacity is needed. These assets are critical in the rollout of 5G services. Starting this year, management aims to roughly double its deployments of small cells from around 5,000 in 2022 to 10,000 or more in 2023 and beyond.

Just as for wireless towers, returns on these small cells start out relatively low in the mid-single-digit range, but over time, more tenants are co-located onto them, causing returns on investment to rise significantly.

In the long run, the growth prospects of CCI remain extremely bright. According to research put out by Swedish telecommunications company Ericsson, mobile data traffic in North America should more than triple in the next 6 years from 2022's 17.4 GB per smartphone to 2028's expected 55 GB per smartphone. And this doesn't even take into account additional traffic from automated vehicles, the internet of things, and various other uses of the wireless network.

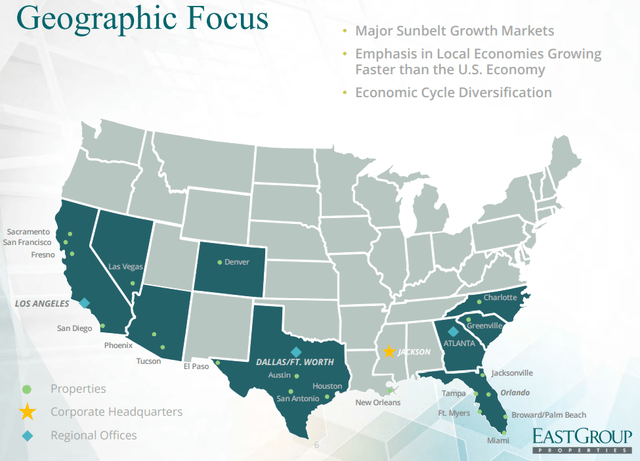

EastGroup Properties (EGP)

- Dividend Yield: 3.0%

- Credit Rating: BBB

EGP is a leader in owning, operating, and developing multi-tenant industrial complexes in the Sunbelt. Though there are some markets more supply-constrained than EGP's, most notably the Inland Empire area of California, EGP has demonstrated an expertise in delivering solid and consistent returns from its hand-picked markets.

The REIT's largest states by net operating income are Texas (34%), Florida (24%), California (21%), Arizona (7%), and North Carolina (6%).

EGP's growth comes from three channels: organic rent growth, acquisitions, and in-house development of new properties. The REIT's development platform drives a significant amount of value, as it is able to build new industrial buildings from the ground up at stabilized yields in the high 6% territory, compared to cap rates for existing properties in the high 4% or low 5% range.

As more people and businesses move into the low-tax and business-friendly Sunbelt, demand for EGP's well-located, infill properties should remain high for the foreseeable future.

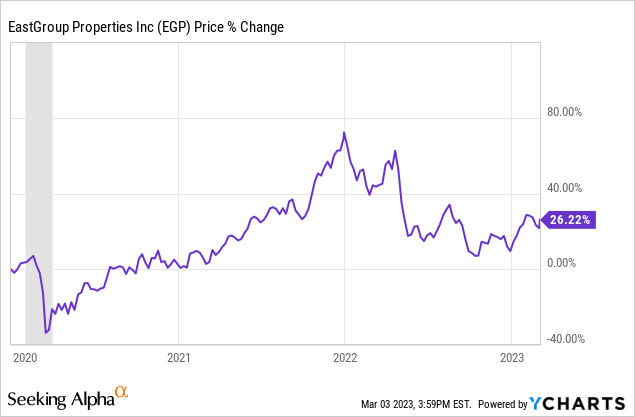

What's more, EGP is cheap. You may not realize it, because the share price has risen 26% since the beginning of 2020...

...but if you consider that from Q4 2019 to Q4 2022, FFO per share surged 43% from $1.27 to $1.82, the REIT's value proposition becomes clearer.

With new and renewal leases being signed at 49% spreads (on a straight-line basis that includes future rent escalations), same-property NOI growth of 8.7% on a cash basis, and portfolio leased occupancy of 98.7%, EGP does not appear to be losing momentum anytime soon.

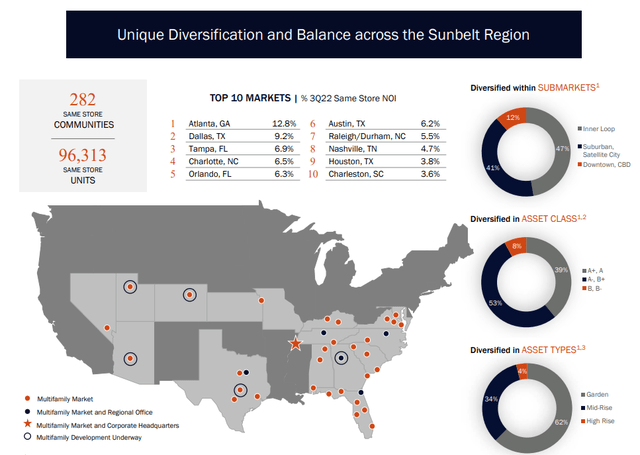

Mid-America Apartment Communities (MAA)

- Dividend Yield: 3.5%

- Credit Rating: A-

MAA is the largest and strongest of the exclusively Sunbelt-focused multifamily REITs. Its net debt to EBITDA of 3.7x to end 2022 showcases its judicious use of debt and the quality of its balance sheet, which sports an A- rating.

The REIT's diversified portfolio spans over 100,000 apartment units across 16 states. These apartments typically offer "affordable luxury" to middle- and upper-middle income individuals, many of whom recently moved into the Sunbelt from more expensive coastal cities.

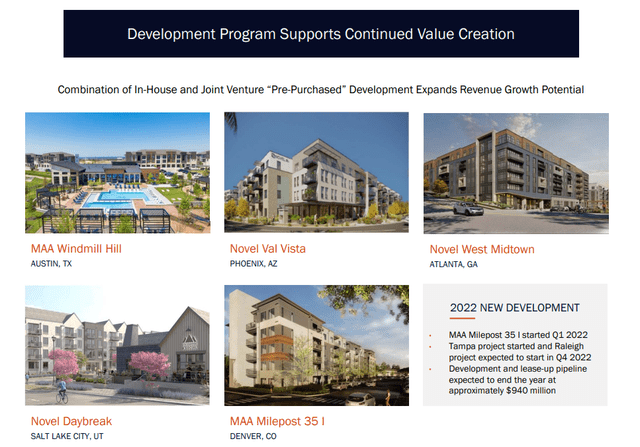

MAA also has an in-house development platform capable of delivering brand new properties to market at stabilized yields at least 100 basis points above the market cap rates for equivalent properties. This gives MAA the ability to continue investing in portfolio expansion during times (like now) when there is too narrow of a spread between acquisition cap rates and its cost of capital.

Though apartments tend to be a sleepy, slow-and-steady growth sector, MAA's well-located mix of communities has performed extraordinarily well over the last few years. Core adjusted FFO per share surged over 21% from 2021 to 2022, facilitating dividend growth of 19.8%. MAA expects another 6-7% of AFFO per share growth in 2023.

Though the post-COVID surge in rent growth has come to an end for MAA and lots of new multifamily supply is hitting the market, I remain bullish on the long-term growth prospects of this top-notch Sunbelt apartment REIT. Population and job growth in its markets should remain above the national average, and MAA is positioned phenomenally well to capitalize on that growth.

Bottom Line: Quality Product On Discount

Warren Buffett once said, "Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

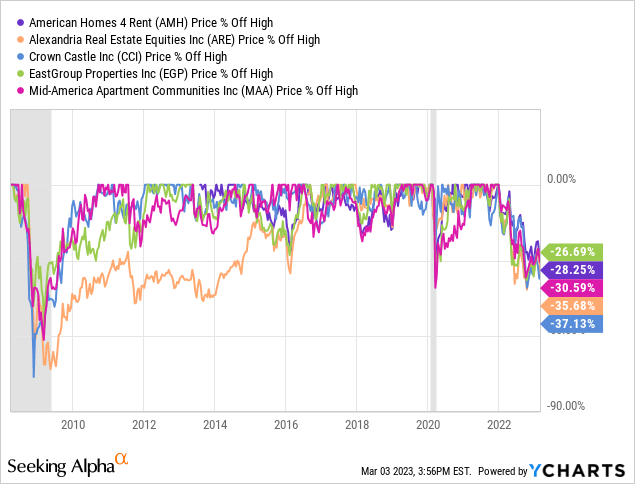

All five of the above REITs would qualify as "quality merchandise," in my view. And despite strong fundamentals and continuing growth, all five now trade between 27% and 37% below their all-time highs.

This kind of situation has scarcely been seen for such quality REITs since the Great Recession of 2008-2009.

Discounts like this are truly rare. Join me in taking advantage of them.

If you want access to our entire Portfolio and all our current Top Picks, feel free to join us for a 2-week free trial at High Yield Landlord.

We are the largest real estate investment community on Seeking Alpha with over 2,000 members on board and a perfect 5/5 rating from 400+ reviews:

For a Limited Time - You can join us at a deeply reduced rate!

This article was written by

My adult life can be broken out into three distinct phases. In my early 20s, I earned a bachelor's degree in Cinema & Media Arts (emphasis in screenwriting), but I hated working in Hollywood. Too much schmoozing and far too much traffic. So, after leaving California, I earned a Master of Fine Arts in Creative Writing from Western State Colorado University. I loved writing fiction, but it didn't pay the bills.

In my mid-20s, I became a real estate agent and gained some very valuable experience in residential and commercial real estate. But my passion for writing never went away.

Now, in my early 30s, I write for Jussi Askola's excellent marketplace service, High Yield Landlord, as well as its sister service, High Yield Investor. I also perform freelance research for a family office that owns and manages over 40 net lease commercial properties in Texas and Arkansas. Writing about finance and investing scratches that creative itch while paying the bills - the best of both worlds.

I'm a Millennial with a long-term horizon and am fascinated with the magic of compound interest and dividend growth investing. I also have an interest in macroeconomic trends, though I am but an amateur in that field.

Disclosure: I/we have a beneficial long position in the shares of AMH, ARE, CCI, EGP, MAA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.