Ryman Hospitality Properties: Country Lifestyle That Pays You Income (Technical Analysis)

Summary

- Ryman has benefitted from the pandemic by renewing its assets and investing in new acquisitions, adding to niche hotels, convention centres, and iconic entertainment base.

- A low payout for the reinstated (in 2022) and increased attractive dividend is supported by the confident guidance for 2023.

- The 2022 acquisitions will be accretive along 2023, banking on the return of the private and corporate clients for years to come.

Maskot/DigitalVision via Getty Images

Investment thesis

Ryman Hospitality Properties, Inc. (NYSE:RHP) is back on track with more rooms, pre-pandemic occupancy rates, higher prices, enhanced and upscaled facilities, and some new iconic venues. Moreover, the reinstated (mid-last year) dividend has just been increased to $0.75 per share, providing the current forward yield of 3.14% with a very low payout ratio below 15%. Last but not least, their price currently is just below $100 dollars ($96.30 at the time of writing). Once the word of that juicy dividend spreads around, the current price might be one that you may not see for long. It may pull back to one of the support lines but for me, it is a Buy.

FY 2022 results

The year 2022 has been a fantastic year for Ryman. The company has established a number of all-time records; consolidated revenue of $1.8 billion, an all-time record; a full-year record in operating income of $327.2 million and reported operating income margin of 18.1% in 2022; the net income available to common shareholders was $129.0 million in 2022, as compared to a net loss available to common shareholders of $177.0 million in 2021; and the number of Gross Definite Room Nights Booked in full-year 2022 was nearly 2.7 million room nights for all future years (current and 4 years into the future), representing a 6.8% increase over 2021. Moreover, in Q4 of 2022, the Hospitality segment achieved revenue of $484.5 million, a record for any quarter, driven by continued strength in the leisure room rate. That number was aided by the return of holiday ICE! Programming: 1.2 million tickets were sold - 115,000 more than the last time in December of 2019.

During the same quarter, the Company booked over 1 million Gross Definite Room Nights for all future years, at an Average Daily Rate (ADR) of nearly $254, an increase of 11.0% over Q4 2021 ADR.

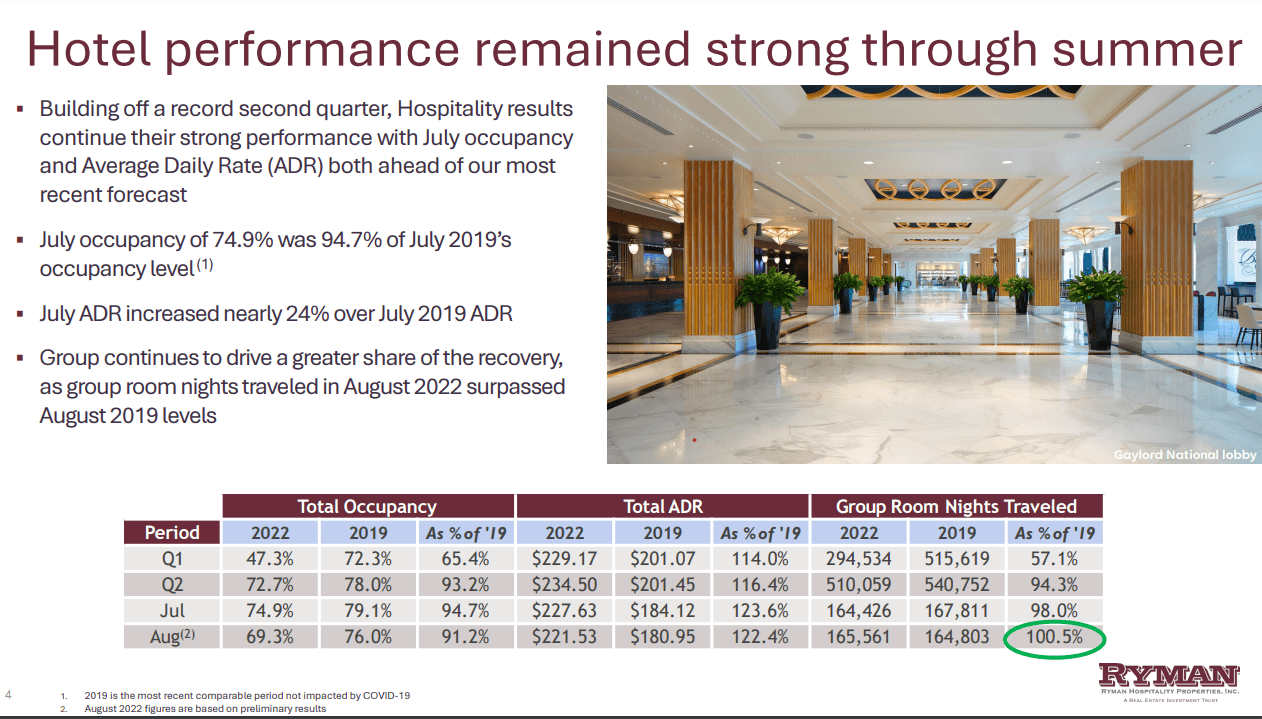

I could not find a more recent slide deck than the one from September 6, 2022, where Ryman's management indicates the record mid-2022 results. August 2022 set a new individual monthly record for ADR on new bookings at approximately $252, up approximately 13% from August 2021 and approximately 20% from August 2019; while group room nights traveled in August 2022 surpassed August 2019 levels, demonstrating the demand recovery in group travel.

Hotel performance (Ryman Hospitality Properties (RHP) Investor Presentation - Operational and Dividend Update)

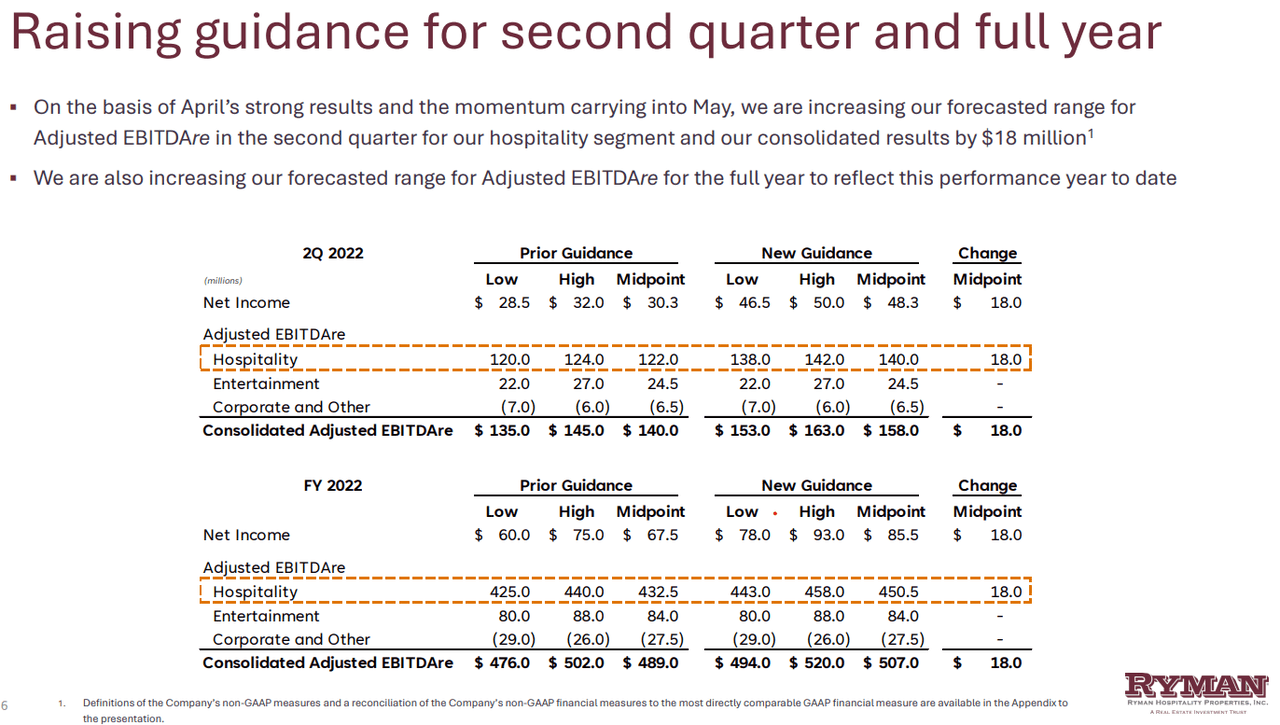

The management raised the 2022 guidance already in June 2022 by $18 million to $140 million.

Guidance (Ryman Hospitality Properties (RHP) Investor Presentation - Block 21 Acquisition and Investor Update)

Growth Drivers

Ryman is a leading lodging and hospitality real estate investment trust which specializes in upscale convention center resorts and country music entertainment experiences, which in itself is a very niche market. The Company's core holdings include a network of five of the top 10 largest non-gaming convention center hotels in the United States based on total indoor meeting space. These convention center resorts operate under the Gaylord Hotels brand and are managed by Marriott International. Those locations are Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; and Gaylord National Resort & Convention Center.

As for the Entertainment segment, a collection of iconic and emerging country music brands includes the Grand Ole Opry; Ryman Auditorium, WSM 650 AM; Ole Red and Circle, a country lifestyle media network that the Company owns in a joint-venture with Gray Television.

The tailwinds consist of a combination of contracted ADR growth on new bookings exceeding inflation-related expense growth, and the significant investments made in enhancing and repositioning room products, meeting space, pools, and resort amenities like those mentioned in the last earnings call: the 300 new rooms at the Palms, the renovated rooms at the National and a host of new ballrooms, meeting spaces, event launch, pavilions and atriums either complete or now underway across the portfolio. Innovation was also implemented in food and beverage outlets with new socialization and gathering opportunities for groups, new technologies in place, and new staffing models. The management takes advantage of the top locations relevant for their target customers both from the lifestyle and economic perspectives:

"[...] three of our five markets, Orlando, Nashville and Dallas were in the top 7 large metro areas for population growth over the last five years, and also in the top five for job growth in 2022. Denver was not far behind them as well in the top 25 for both metrics.

It's no surprise then that all four of these markets, Dallas, Orlando, Nashville and Denver were in the top 9 for hotel occupancy recovery in 2022 compared to 2019 according to STAR. Against this backdrop of limited new supply growth in rapidly expanding markets, we see ample opportunities for our capital deployment strategy ahead of us.

This includes over $69 million being spent right now to create an expansive indoor outdoor group pavilion and to completely reimagine the Grand Lodge Atrium at the Gaylord Rockies, increasing the volume of premium sellable group space and expanding food and beverage outlet selection capacity."

The entertainment business has also transformed: broken ground in Las Vegas on The Strip and closed the acquisition of Block 21, which brings Austin's iconic ACL Live at the Moody Theater into the fold. FY 2023 will reflect the contributions of these new assets.

In June, Ryman sold 30% of the Entertainment business to Atairos, who own put options on this purchase. Any exercise of the put rights would result in Atairos 30% ownership in Ole Red reverting back to Ryman.

The guidance for Entertainment for 2023 is a $92 million midpoint.

Risks

Inflation and wages increase will affect the margins, as well as the cancellation fees will normalize to the pre-pandemic levels. Similar to the mortgage pre-payment punishment fees, this type of income is built insurance but is inversely related to the revenues from the core business.

The Corporate segment continues to produce losses, with guidance for 2023 in the range of $29 million to $32 million

Full year 2023 guidance: total fully consolidated adjusted EBITDAre guidance range for the year of $605 million to $648 million, a 12.7% increase at the midpoint over 2022 and a 22.7% increase over 2019. Adjusted funds from operations (AFFO) for 2023 should be in the range of $392.5 million to $424 million.

Technical Analysis

I will analyze Ryman Hospitality Properties from a perspective of a number of technical analysis tools and show the screenshots on the monthly and weekly Heikin Ashi candles charts - each timeframe presented through two separate sets of indicators - which I will complement with a simplified daily Renko chart to reflect the short-term price momentum

The first chart setup (I will call it Chart 1) uses Bill William's Alligator indicator and Awesome Oscillator, as well as Ichimoku Clouds and On Balance Volume indicator line. For fundamentals, I show the quarterly revenue trend which I use for quick visual triage.

The Alligator technical analysis tool uses three smoothed moving averages that are based on thirteen, eight, and five periods, called also Jaw (blue line), Teeth (red line), and Lips (green line), respectively. Due to the smoothing of each moving average, the Jaw makes the slowest turns and the Lips make the fastest turns. The Lips crossing down through the other lines signals a short opportunity while crossing upward signals a buying opportunity.

William's Awesome Oscillator (AO) is a market momentum tool that visualizes a histogram of two moving averages, calculated on median prices of a recent number of periods compared to the momentum of a larger number of previous periods. If the AO histogram is crossing above the zero line, that's indicative of bullish momentum. Conversely, when it crosses below zero, it may indicate bearish momentum.

As for the Ichimoku Cloud - I am not using a full set of lines of Ichimoku lines, only the Leading Spans A and B, whose crosses dictates the color of the cloud and whose individual lines provide levels of the strongest support and resistance lines. Ichimoku averages are plotted into the future which in its own right provides a clearer picture but have no predictive powers.

On-Balance-Volume (OBV) indicator is a volume-based tool and is supposed to indicate the crowd sentiment about the price. OBV provides a running total of an asset's trading volume and indicates whether this volume is flowing in or out, especially when viewed in divergence with the price action.

The second chart setting (Chart 2) uses 2 moving averages (10- and 50-period), volume, and volume's 20-period average. On the screenshot from top to bottom, you will see the Composite Index Divergence Indicator (CIDI), which I learned from the book of Constance Brown, as well as J. Welles Wilder's Directional Movement Indicator (DMI). I also use MACD (Moving Average Convergence Divergence) which is well known to everybody: I seek crossovers of MACD and signal, as well as above/below the zero level.

CIDI comes from a combination of RSI with the Momentum indicator. For more literature, see Brown's paper or read her book. CIDI has been developed to solve the problem of RSI not being able to show divergence. I personally use the CIDI's crossover above and below its slow and fast-moving averages, as well as the position of the averages against each other.

As for DMI, I skip the ADX line because it doesn't give me anything. Instead, I focus on the crossovers of the Positive Direction Indicator DI+ and Negative Direction Indicator DI-. When the DI+ is above DI-, the current price momentum is upwards. When the DI- is above DI+, the current price momentum is downwards.

On the use of Heikin Ashi candles and Renko boxes, I use them as tools for trend reversal and continuation identification. Renko charts do not have a time scale and they are built on price movements that must be big enough to create a new box or brick. Similar to Heikin Ashi, Renko charts filter the noise.

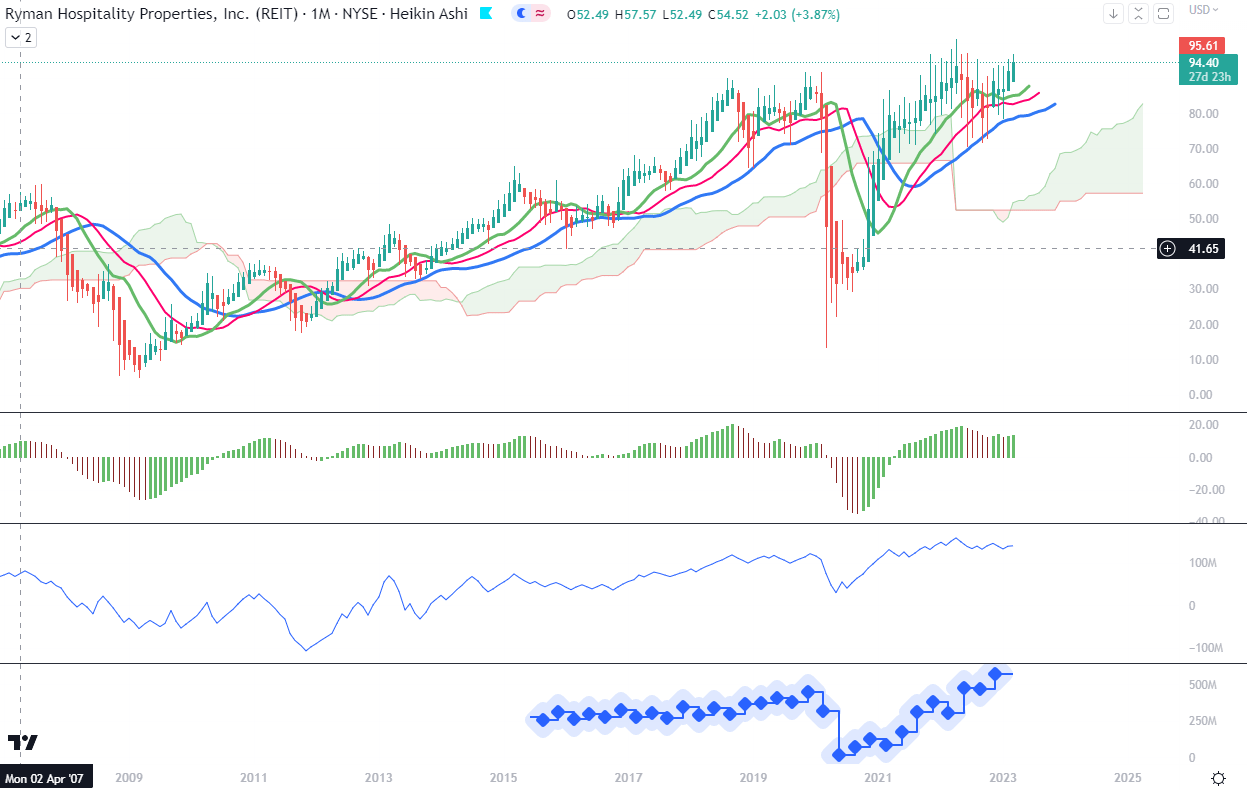

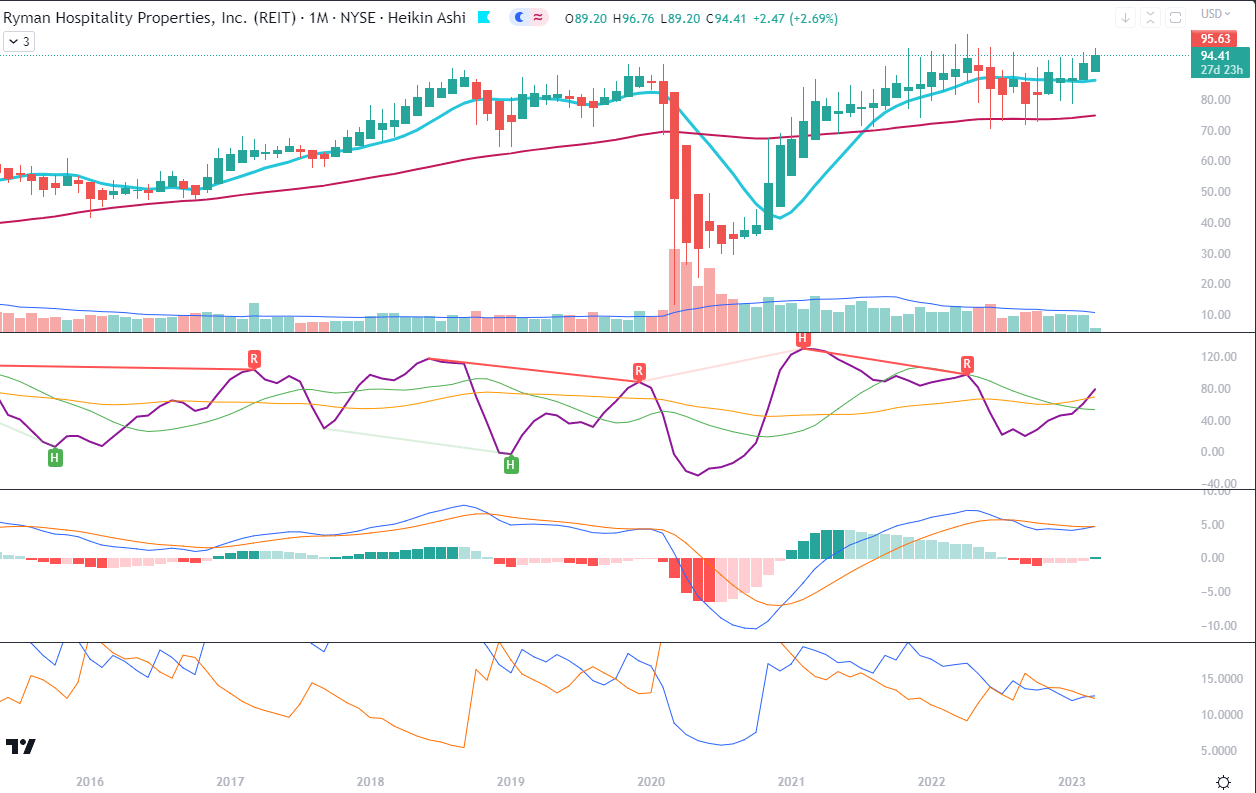

The Long-Term Trend

For the long-term trend analysis, I use monthly charts. As we see in Chart 1 below, the Ichimoku Cloud is green and its lower and upper edges are rising. The Alligator's lines have gone through a small pullback but have resumed their uptrend. The monthly AO has resumed growth (green bars) in the positive territory. OBV has not moved significantly for nearly two years now. This chart is indicating indecision which may go either way although with a positive tilt, in my opinion. If you look closer at the candles of the last year, they could be taken for a cup-and-handle formation.

Chart 1 Monthly (TradingView)

Chart 2, as I would expect, shows more dynamics in the positive direction: the 10-month Moving Average has played the role of the stepstone for the two last candles; CIDI has crossed above both averages and the fast (green line) seems to be flattening. The Monthly MACD has just crossed above its signal, both being in positive territory. The monthly DI+ is now crossing above the monthly DI-.

Chart 2 Monthly (TradingView)

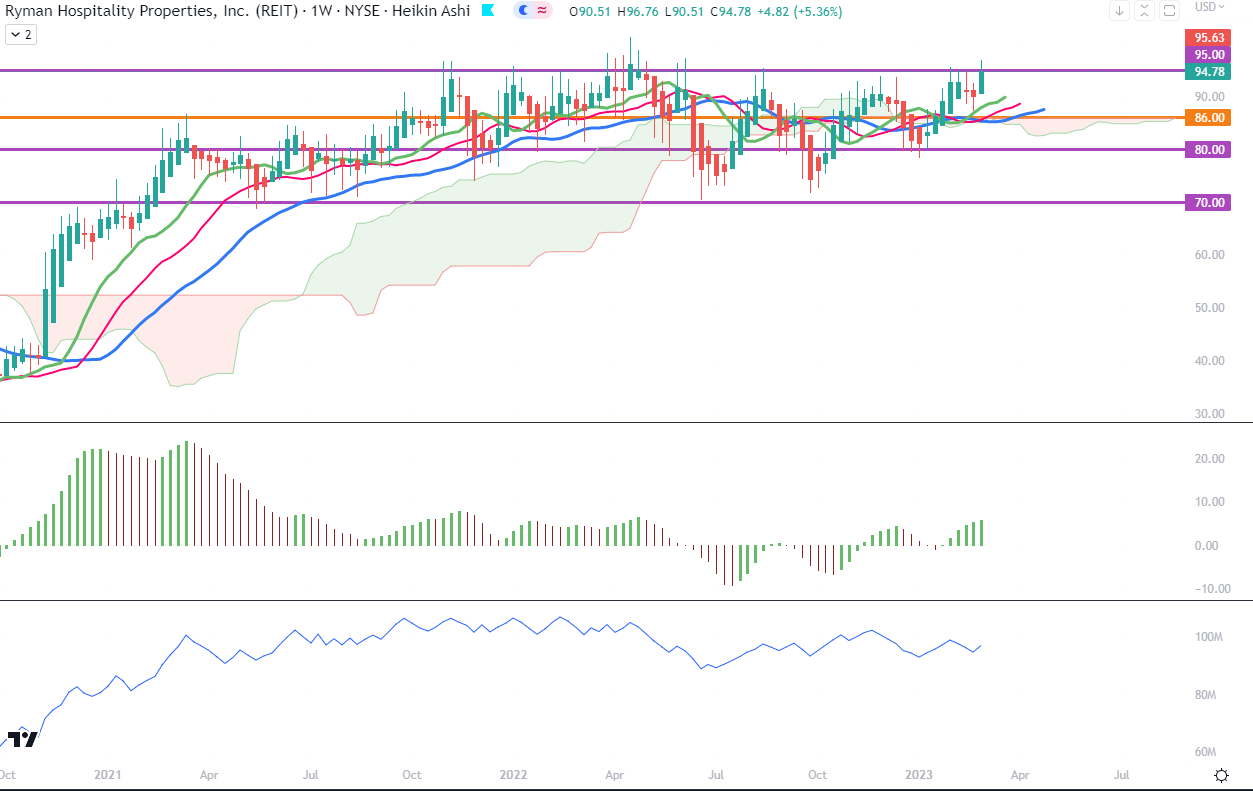

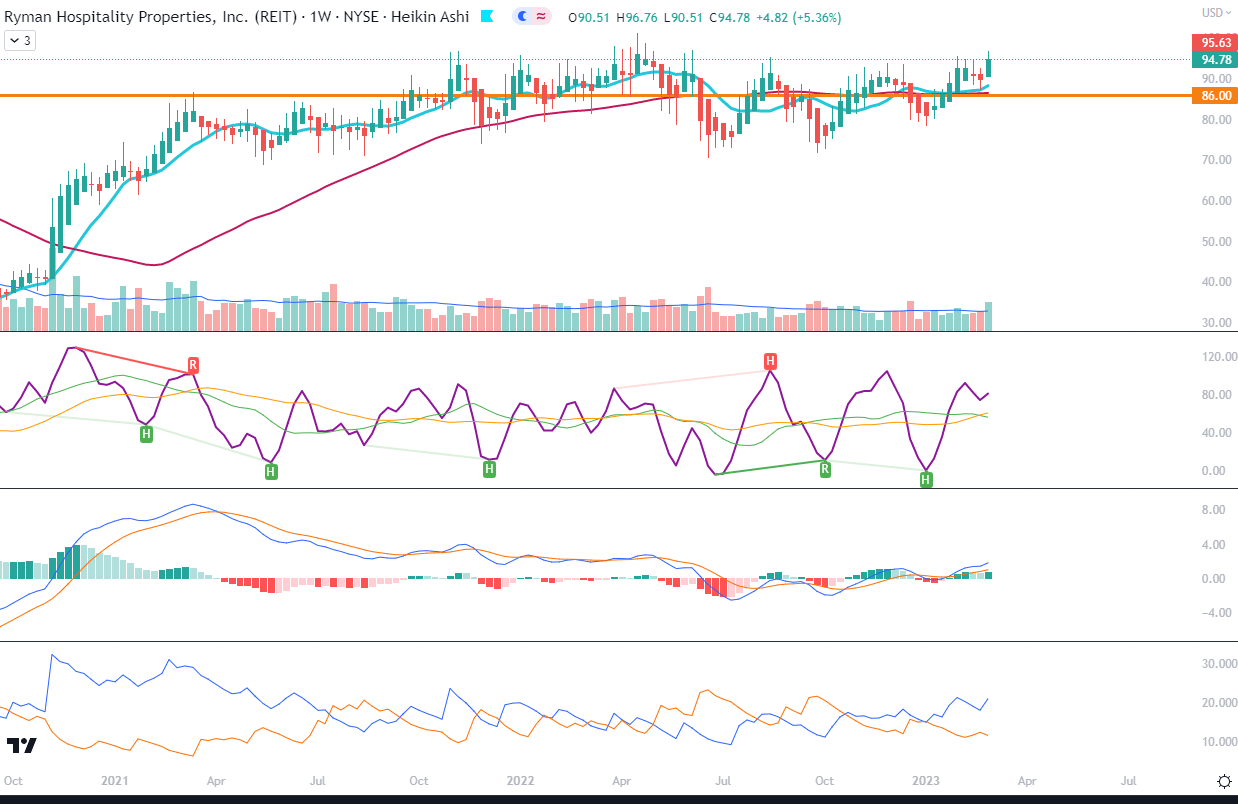

The Mid-Term Trend

For the mid-term trend analysis, I use weekly charts. In Chart 1, the red Ichimoku Cloud has narrowed and is indicating the moment of a color switch. We can see that pullback flirted with levels between $70 and $80, while the upswings usually arrived in the zone around $95. All S/R lines related to channels are indicated by thick purple lines. The orange horizontal line at $86 is a prolongation of the flat upper edge of the most recent levels of the Cloud. The Alligator's lines have performed positive crossovers and are all pointing upwards. We can also see AO in positive territory and rising; while OBV also rises slowly (higher lows).

Chart 1 Weekly (TradingView)

As we can see in Chart 2, the orange horizontal line is almost identical to the quite flat levels of the 50-week MA. The 10-week MA has just bounced off both lines. CIDI is above the averages and slightly picking up. On this timescale given the range trading, it will not be a surprise that CIDI oscillates more often. What we see as a calmer directional signal is the weekly MACD rising from flat dips under the zero level to the positive territory and pointing upwards. The weekly DI+ is widening its distance from and above the weekly DI-.

Chart 2 (TradingView)

Price Momentum

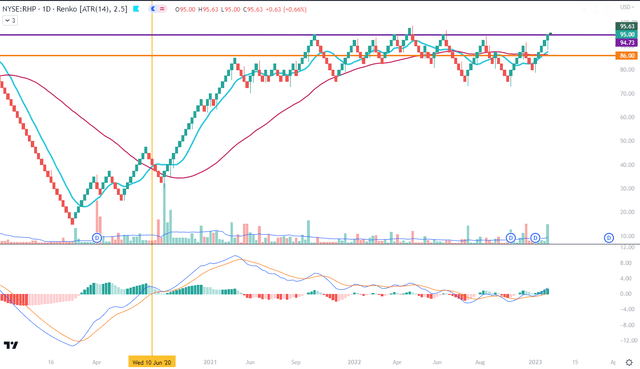

The daily Renko chart is presenting a setup of a potential breakout. Not only the levels of resistance at $86 and £$95 are quite clear, but also the 10-box MA has crossed above the 50-box MA, while MACD and its signal have crossed above the zero line - similar to the picture from weekly Chart 2. The last time a similar signal was given was in June 2020 at a level around $40 (yellow vertical line)

Conclusions

Ryman has benefitted from the pandemic by renewing its assets and investing in new acquisitions. It has a low payout for an attractive dividend and provides confident guidance for 2023. It is still uncertain when a potential move of the price will go, if anywhere, in the near term but with improved profitability, Ryman can offer both capital appreciation and dividend income.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.