My Oh My, You Better Not Buy

Summary

- Over the last decade, our team has had a good batting average when it comes to avoiding sucker yield stocks.

- However, nobody is perfect when it comes to predicting dividend cuts.

- It’s better to be cautious than to keep screaming �“strong buy” when things get worse.

- Looking for more investing ideas like this one? Get them exclusively at iREIT on Alpha. Learn More »

skynesher

It seems that there are quite a few real estate investment trusts ("REITs") approaching the "sucker yield" hurdle.

A few days ago, I wrote on Medical Properties Trust, Inc. (MPW), and although we maintain a Buy, we adjusted to a Spec Buy given the double-digit negative growth prospects for 2023.

We believe the company will maintain its dividend, but if there's more bad news, the risk becomes even more elevated, and the chances of a dividend cut more likely.

Healthcare Realty Trust Incorporated (HR) also just announced earnings, and this pure-play MOB (medical office building) REIT is seeing more pressure on its dividend - over 100% payout ratio in the latest quarter. Once again, another REIT in the sucker yield zone.

I just posted this on LinkedIn today:

LinkedIn: Brad Thomas

So today, I'm going to once again provide you with other "sucker yields" - all REITs to avoid. For those of you who have never heard of the term "sucker yield," let me provide my definition below:

A "sucker-yield" is based on quantifiable high yields, seemingly ridiculous, when the underlying security has a flawed or vulnerable business model. Companies that fall under the "sucker-yield" definition typically have unpredictable and unreliable earnings histories with unsafe dividend payouts.

Granite Point Mortgage Trust Inc. (GPMT)

Granite Point Mortgage Trust is an internally managed mortgage real estate investment trust ("mREIT") that specializes in originating, investing in, and managing senior floating-rate commercial mortgage loans and other forms of debt for commercial real estate.

Their investment portfolio is reviewed on a loan-by-loan basis with a focus on thorough underwriting, selectivity and diversification of properties. Their investments are comprised of over 99% senior loans with a weighted average stabilized loan-to-value ("LTV") at origination of 62.9%.

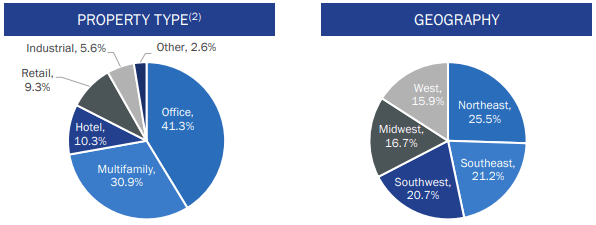

The collateral backing their loans is well diversified geographically with properties evenly spread out across different regions of the country. Their highest concentration is in the Northeast, followed by the Southeast region of the U.S.

In terms of the property type securing their loans, their largest category is office at 41.3%, followed by multifamily at 30.9%, hotels at 10.3%, retail at 9.3%, and industrial at 5.6%.

GPMT funds its investments through a variety of sources including borrowing from their credit facilities, issuing collateralized loan obligations ("CLOs"), and issuing secured and unsecured debt and equity securities.

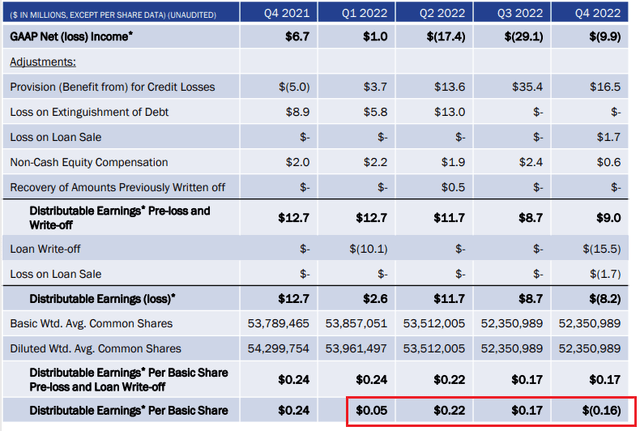

GPMT - Earnings Presentation

GPMT Earnings Release

In February, GPMT released its earnings for the fourth quarter and full year 2022. For the full year, their GAAP earnings came in at a net loss of $55.3 million, or -$1.04 per basic share, that includes a provision for credit losses of -$69.3 million, or -$1.32 per share.

When excluding the provision for credit losses, their earnings total $0.28 per share, which is what is reflected in their operating earnings listed in FAST Graphs.

GPMT full year distributable earnings totaled $14.7 million in 2022, or $0.28 per basic share. This figure includes realized losses of -$27.3 million, or -$0.48 per share.

No 2023 guidance was provided in their earnings release.

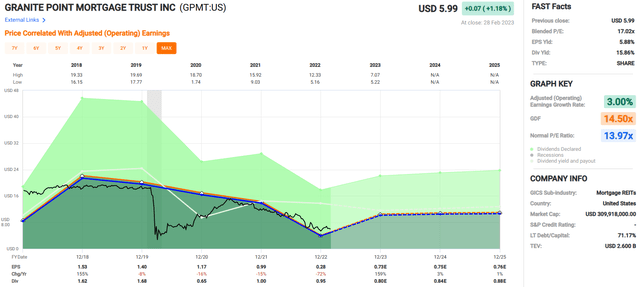

GPMT Growth

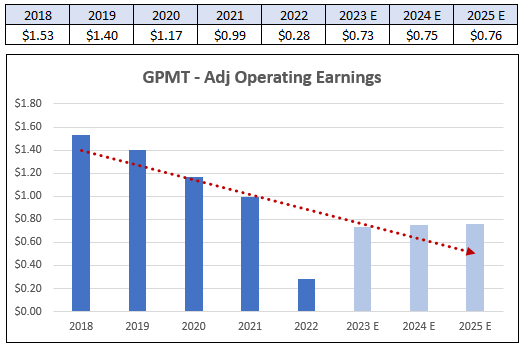

Well, this isn't what you want to see. Adjusted Operating earnings has declined each year since 2018. Earnings fell from $1.53 per share in 2018 to $0.28 per share in 2022, and this is excluding the provision for credit losses as mentioned in their earning release.

In 2019, earnings fell by -8.50%, in 2020 earnings fell by -16.43%, in 2021 earnings fell by -15.38%, and in 2022 earnings fell by -71.72%. The average annual earnings decline comes to 28.01% since 2019.

This figure does not include analysts' projections past 2022. Even if analysts' projections hold up and GPMT has operating earnings of $0.76 per share in 2025, this is still approximately half of what they earned in 2018.

FAST Graphs (compiled by iREIT)

GPMT Dividend

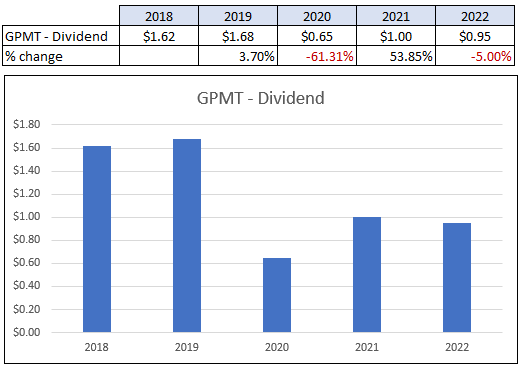

Similar to their earnings, GPMT's dividend has decreased since 2018. In 2018, their dividend was $1.68, as opposed to their dividend in 2022 of $0.95 per share. Since 2018, their dividend has declined on average by 2.19% annually.

FAST Graphs (compiled by iREIT)

GPMT pays a high yield at 15.86%, but their distributable earnings does not cover the dividend which makes it subject to a cut. GPMT's distributable earnings totaled $0.28 in 2022, but they paid a dividend of $0.95. This comes out to a payout ratio of 339.29% when based on distributable earnings.

GPMT - Earnings Presentation GPMT - Stock Data

I wouldn't go near GPMT at this point. Their operating earnings have been declining for the past several years and their dividend has been cut twice since 2018.

More importantly, their current distributable earnings doesn't come close to covering their dividend payout, which leads me to believe that another dividend cut is on the horizon. On top of that, they are trading at a P/E of 17.02x (based off operating earnings), which is a premium to their normal P/E of 13.97x. At iREIT, we rate GPMT a SELL.

Annaly Capital Management, Inc. (NLY)

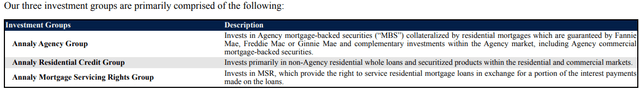

Annaly Capital Management is an internally managed mortgage REIT that invests in a variety of debt instruments backed by residential real estate. Annaly has three investment groups in which it does business.

Their largest group is the Annaly Agency Group that invests in Agency mortgage-backed securities ("MBS") that are collateralized by residential mortgages and backed by Fannie Mae, Freddie Mac, or Ginnie Mae.

Their second largest group is the Annaly Residential Credit Group that invests in non-Agency residential whole loans as well as securitized loans in residential markets. Their final group is their Annaly Mortgage Servicing Rights ("MSR") Group that invests in MSRs and allows them to service a pool of residential mortgages in exchange for a percentage of the interest payments made.

NLY Earnings Release

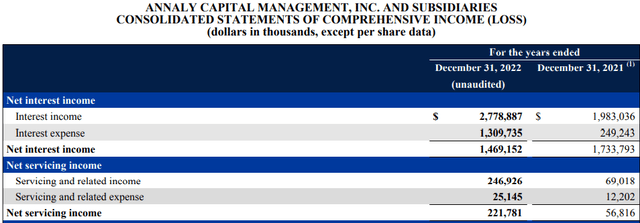

Annaly released its fourth quarter and full year 2022 earnings on February 8, 2023. For the full year, they reported GAAP net income of $3.93 per share in 2022 vs. $6.40 in 2021, and Earnings Available for Distribution ("EAD") of $4.23 per share in 2022 vs $4.65 in 2021. They had an economic return of 8.7% in the fourth quarter but an economic loss of -23.7% for the full year in 2022.

They highlighted an upward shift in their Agency portfolio's coupon rates with the share of the portfolio in 4.0% or higher coupons increasing from 27% to 69% year-over-year.

Their MSR portfolio grew by almost 3x in 2022 to $1.8 billion, while their Residential Credit Group grew assets by more than 9% in 2022 to approximately $5.0 billion, primarily by the purchase of whole residential loans during the year for $4.1 billion.

They completed the sale of their Middle Market Lending portfolio for $2.4 billion and they were added to the S&P MidCap 400 Index in 2022, making them the only mortgage REIT in the index.

Additionally, they reported their book value per share at $20.79 for the fourth quarter of 2022 vs. their book value of $31.88 in the fourth quarter of 2021. Likewise, their EAD decreased from $1.14 in the fourth quarter of 2021 to $0.89 in the fourth quarter of 2022 and their net interest income went from $1.7 billion for the full year 2021 to $1.4 billion for the full year 2022.

On a positive note, their net servicing income increased from $56.8 million in 2021 to $221.7 million in 2022. No 2023 guidance was provided in their release.

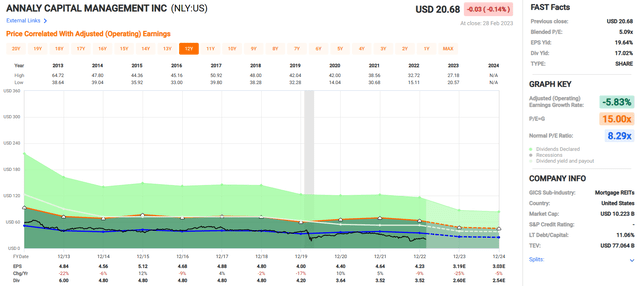

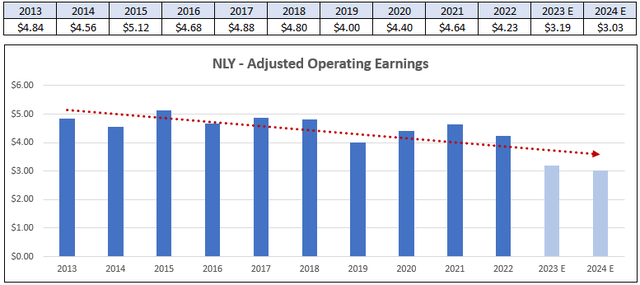

NLY Growth

Since 2013, Annaly has had a downward trajectory in their adjusted operating earnings. Their average "growth" rate over this period has been a negative -5.83% per year. Their operating earnings fell by 9% in 2022 and are projected to decrease by 25% in 2023.

FAST Graphs (compiled by iREIT)

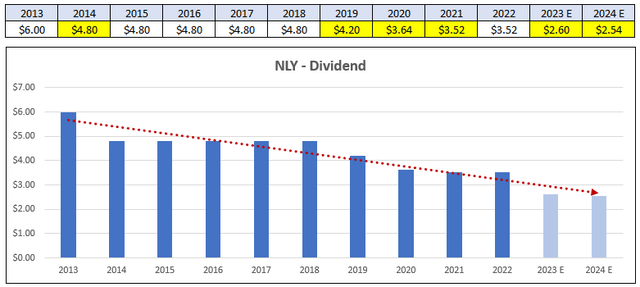

NLY Dividend

Annaly's dividend looks even worse. Currently they have a dividend yield of 17.02%, but this is what I would call a "suckers yield." Since 2013, they have cut the dividend four times and are expected to cut it again in both 2023 and 2024. In 2013, the dividend rate was $6.00 per share, whereas in 2022 the dividend rate is $3.52 per share.

Their Earnings Available for Distribution in 2022 is $4.23, so on that basis their dividend payout ratio is approximately 83%, but in order to maintain their payout ratio they have either been maintaining the dividend with no increase or cutting the dividend. If analysts estimates hold up, the dividend will go from $3.52 in 2022 to $2.60 in 2023 for a 26.13% dividend cut.

FAST Graphs (compiled by iREIT)

Annaly is not within our coverage, so we don't have an official rating on them, but I would stay away from NLY stock. Over the years their earnings have decreased, and they have habitually cut the dividend.

If analysts' projects are correct, Annaly will have several more years of reduced earnings, which will lead to more dividend cuts. They are priced at a discount to their normal P/E multiple, but in this case I think it is for good reason.

In Closing…

Over the last decade our team has a good batting average when it comes to avoiding sucker yield stocks, and I would like to think we helped thousands of investors stay away from names like…

- EPR Properties (EPR)

- Macerich (MAC)

- Washington Prime

- CBL Properties

- PREIT (PEI)

- Diversified Healthcare (DHI) - formerly Senior Housing Properties.

That's not to say we bat .400, because we should have downgraded to SELL instead of HOLD for these two REITs:

- American Realty Capital Properties

- Broadmark Realty (BRMK).

So, nobody is perfect when it comes to predicting dividend cuts, but the point I want to make here is that it's better to be cautious than to keep screaming "strong buy" when things get worse. So, consider this my first in the series of My Oh My You Better Not Buy.

"In the end each one must make his own decision and accept responsibility therefor. We suggest, however, that if the investor is in doubt as to which course to pursue he should choose the path of caution." - Benjamin Graham.

PS: Whoever gave me the name of the title, please send me a DM so I can send you a copy of my REIT book.

Get My New Book For Free!

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREIT, Preferreds, BDCs, MLPs, ETFs, and we recently added Prop Tech SPACs to the lineup. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus my FREE book.

This article was written by

Brad Thomas is the CEO of Wide Moat Research ("WMR"), a subscription-based publisher of financial information, serving over 10,000 investors around the world. WMR has a team of experienced multi-disciplined analysts covering all dividend categories, including REITs, MLPs, BDCs, and traditional C-Corps.

The WMR brands include: (1) iREIT on Alpha (Seeking Alpha), and (2) The Dividend Kings (Seeking Alpha), and (3) Wide Moat Research. He is also the editor of The Forbes Real Estate Investor.

Thomas has also been featured in Barron's, Forbes Magazine, Kiplinger’s, US News & World Report, Money, NPR, Institutional Investor, GlobeStreet, CNN, Newsmax, and Fox.

He is the #1 contributing analyst on Seeking Alpha in 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, and 2022 (based on page views) and has over 106,000 followers (on Seeking Alpha). Thomas is also the author of The Intelligent REIT Investor Guide (Wiley) and is writing a new book, REITs For Dummies.

Thomas received a Bachelor of Science degree in Business/Economics from Presbyterian College and he is married with 5 wonderful kids. He has over 30 years of real estate investing experience and is one of the most prolific writers on Seeking Alpha. To learn more about Brad visit HERE.Disclosure: I/we have a beneficial long position in the shares of MPW, HR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Author's note: Brad Thomas is a Wall Street writer, which means he's not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.