USRT: Risks Against The Market Make This ETF Unworthy

Summary

- USRT invests in a variety of REITs in the United States, most of which are specialized or residential in nature.

- USRT is susceptible to the effects of private REITs reporting incomplete results and possibly prompting investor speculation.

- The real estate industry’s recent underperformance with limited signs of rebounding make me skeptical of this ETF.

FangXiaNuo

iShares Core U.S. REIT ETF (NYSEARCA:USRT) may be an effective way to gain exposure to the United States real estate market. However, it is hard to take a bullish view on the real estate market given the current condition of the economy. I rate USRT ETF a Hold for its high volatility and inability to outperform the market during economic downturns.

Inflation is still high and the prospect of economic recovery is at least partially attributable to overoptimism and speculation. Long-term treasury yields are reaching new highs, contributing to the implied capitalization rates of residential REITs (real estate investment trusts) returning to levels seen most recently during the onset of COVID-19 in early 2020. The real estate sector has historically been very sensitive to economic changes, taking off during bull markets but suffering greatly during bear markets. The near future could be grim for many companies held in USRT.

This ETF could be potentially attractive to investors that are more confident in the ability of private REITs to hedge economic downturns. I believe that the risk is too high and that the real estate market is in for at least a few more rough months. Given that the real estate market is exerting some of its worst performance since the onset of COVID-19, some investors may need to rethink their confidence in private REITs.

Strategy

USRT tracks the FTSE Nareit Equity REITs TR USD Index and uses a representative sampling technique. USRT invests in both value and growth stocks of varying market capitalization. USRT was launched by BlackRock Inc. and is currently managed by BlackRock Fund Advisors.

Holdings Analysis

USRT invests only in companies in the real estate sector, specifically REITs. USRT invests only in United States companies, so investors are probably best not relying on this ETF for geographical diversification. Furthermore, investors should also recognize that changes in the United States economy could directly and significantly impact this ETF's returns.

The top 10 holdings account for 44% of total holdings and the top 25 comprise 68% in this ETF of 143 holdings, making it somewhat top-heavy. Given the high volatility of this ETF and the sensitivity of the real estate sector to economic changes, investors may want to highly consider any possible concentration risk.

Strengths

USRT has a high dividend yield of over 3%, making it a potentially attractive option for more income-oriented investors. Many fixed income securities currently offer low returns, meaning more investors might consider resorting to dividends for profits. Therefore, high dividends serve as a sort of silver lining in USRT.

USRT also has a relatively low expense ratio of only 0.08%, making it less costly than some of its peers. Though investors' returns may already be at risk as the economy slides, investors can rely on expenses not further contributing to this degression.

Weaknesses

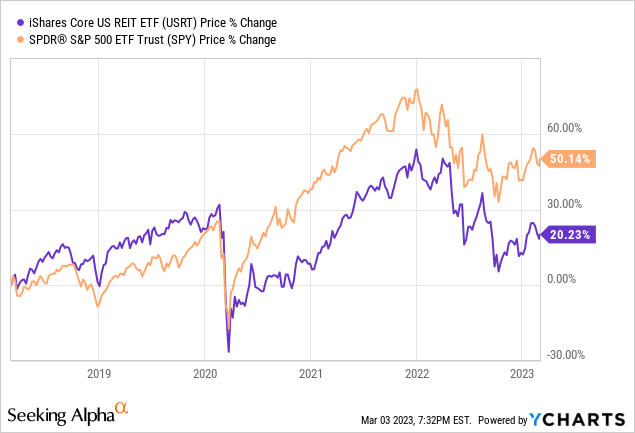

USRT is highly volatile, which could be particularly unfavorable amid the aura of uncertainty surrounding the economy. USRT has a 3-year and 5-year beta of 1.07 and 1.09, respectively, indicating high sensitivity to economic changes. Additionally, USRT has historically underperformed compared to the S&P 500 during bear markets. Though past performance is not a primary indicator of ETF quality, one might have a hard time arguing that USRT can hedge any economic declines.

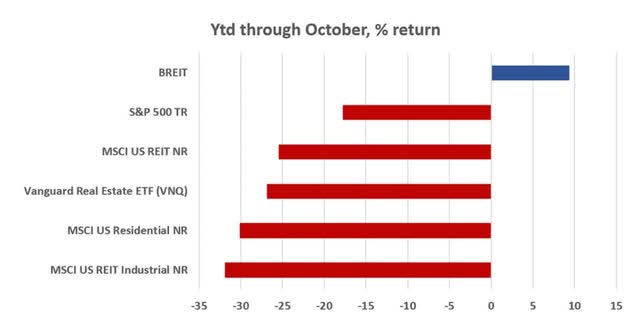

The performance of private real estate funds may be harder to assess as they're evaluated during periodic appraisals rather than during daily trading. For example, Blackstone's BREIT was reporting exceptional results during October 2022 despite poor economic conditions. This prompted many gratuitous investments that inflated the BREIT's net asset value (NAV). BREIT gated redemptions two months later, leading many investors to lose faith in not only BREIT, but similar funds, some of which are held in USRT. As Warren Buffet once said, "Only when the tide goes out do you discover who's been swimming naked."

Blackstone's BREIT performance, October 2022, two months before gating redemptions (CityWire)

Opportunities

Potential economic recovery could increase corporate activity and catalyze the inception of new businesses and startups. This could increase the demand for office spaces, further benefiting office REITs like the ones held in USRT. While the sensitivity of REITs to economic changes is a primary concern in this ETF, real estate is an industry that has historically outperformed during periods of market restoration. Therefore, the same REIT investors that might be suffering now could transcend in the event that the economy recovers soon.

Threats

Though the demand for and income from office spaces could increase in the event that corporate activity accelerates in the next couple years, the increasing prevalence of remote work could counteract this benefit. The number of individuals working from home tripled from 2019 to 2021 as many were initially forced to but then realized the upsides. Furthermore, COVID-19 killed many in the workforce, making employee health and safety a greater priority and concern to this day. This trend continuing or even the emergence of another global pandemic could reduce demand in the office REIT sector and hurt the returns of USRT.

USRT is also at risk because a renowned fund curbing its investors could cause a chain reaction among similar funds. For example, the previously described redemption gating in BREIT also forced SREIT and many other REITs to sell their assets. Ultimately, the misbehavior and untruthfulness on one larger REIT could end up hurting the returns of several other REITs held in USRT.

Conclusions

ETF Quality Opinion

USRT could be an effective way for investors to gain exposure to a variety of REITs within the United States real estate market. However, the real estate market in the United States is currently bearing the brunt of high interest rates. Therefore, this ETF is somewhat strong at its core, but the current economic conditions make it a contemporarily uncompelling investment.

ETF Investment

USRT is Hold when considering a 3-5 year time frame. I don't believe one could benefit from buying it now, as I think some of the harsher bearish periods are yet to come for this ETF. Simultaneously, I don't believe selling to be optimal, as I still hold a bullish view on economic conditions in the long-term. I discuss this in greater detail in my piece on the Financial Select Sector SPDR ETF (XLF). Investors should be aware of the real estate industry's risk against the broader market, but also foresee the upsides during potential bullish periods.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I believe that the real estate market's current condition make investments in REITs unworthy, however, the quality of this ETF is still quite good.