PRNT: 3D Printing Is At The Intersection Of Robotics And Artificial Intelligence

Summary

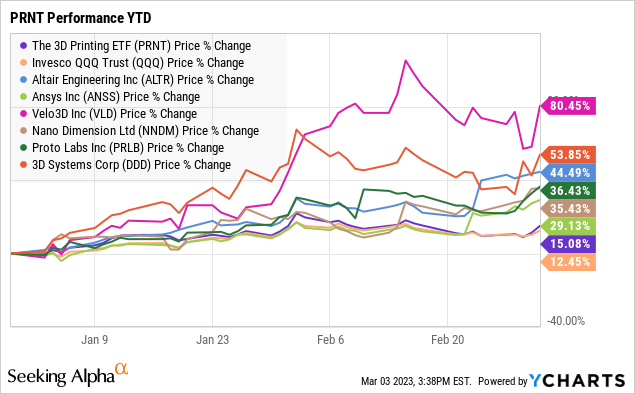

- The PRNT ETF has gained momentum to start the year.

- 3D Printing technology incorporating artificial intelligence is adding to growth opportunities.

- We are bullish on PRNT with the underlying holdings set to benefit from accelerating market adoption.

- This idea was discussed in more depth with members of my private investing community, Conviction Dossier. Learn More »

Hispanolistic

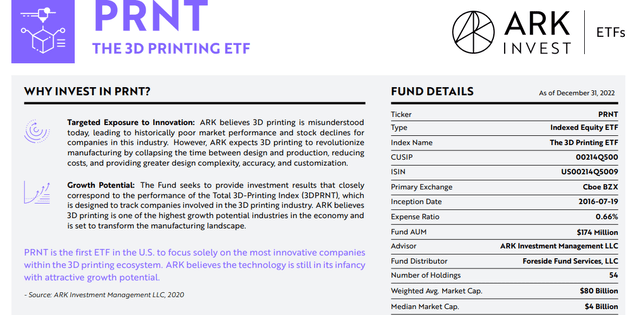

The 3D Printing ETF (BATS:PRNT) invests in companies benefiting from the growth in 3D printing applications. In many ways, PRNT with a trading history since 2016 is a precursor to many thematic exchange funds that have gained prominence in recent years covering broader trends in automation, robotics, and even with a connection to artificial intelligence.

While lines can get blurred when we start thinking about "next-generation technologies", the attraction of 3D Printing is that the group is differentiated enough to capture some unique market factors in what remains a high-growth disruptive industry.

Indeed, we last covered PRNT back in 2020 ahead of what was a spectacular rally at the time, which got ahead of itself based on some exuberance, before a deeper correction based on a valuation reset amid the broader market selloff.

The update today highlights current developments while reaffirming a long-term bullish outlook. We like the trading setup in PRNT which is well-positioned to rebound higher based on the underlying momentum of key holdings.

What Is The PRNT ETF?

PRNT technically tracks the "Solactive Total 3D Printing Index". The index and fund consider both U.S. and other developed market companies are either directly engaged or with ancillary exposure to 3D printing businesses.

This covers not only the manufacturing and commercialization of related hardware but also computer-aided design and simulation software, scanning and measurement tools, along with specialized printing materials.

The criteria are that at least 80% of the companies in the Index derive at least 50% of their earnings or revenues or at least 50% of their assets are connected to 3D printing. This range provides some flexibility to include some other names that would not typically be considered a "pure play" on the theme.

Notably, while PRNT is part of the ARK Invest fund family, the passively-managed PRNT strategy is in contrast to other high-profile funds from the group, like the ARK Innovation ETF (ARKK), which are actively managed. On this point, Cathie Woods stepped down from her direct role as the PRNT portfolio manager in 2022.

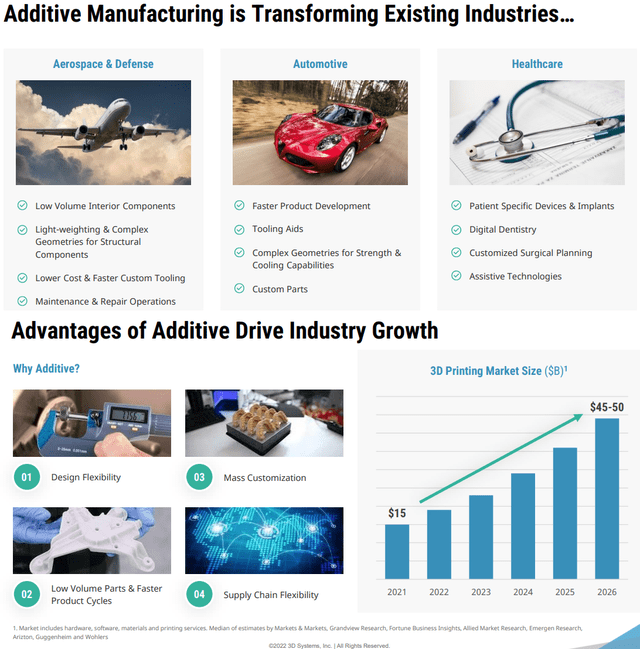

Growth in Additive Manufacturing

The attraction of the PRNT is a view, which we share with ARK, that 3D printing is "one of the highest growth potential industries in the economy and is set to transform the manufacturing landscape".

An alternate term for 3D printing is "additive manufacturing" describing the process of the automated production process of layering a diverse range of materials to create complex forms and products.

According to data shared by industry leader 3D Systems Corp (DDD), which is a holding within PRNT, the expectation is for the global market size to more than double from $20 billion in 2022 to $45 to $50 billion by 2026. This would be driven by the accelerating adoption across different end-user industries, based on the advantages to supply chain flexibility and the efficiencies in the design-to-market process.

There are even use cases in healthcare moving towards bio-printing as the next generation of technology. Ultimately, lower costs are the value proposition that moves companies to seek out 3D printing solutions to replace legacy solutions. These are the types of opportunities the companies within PRNT are capturing.

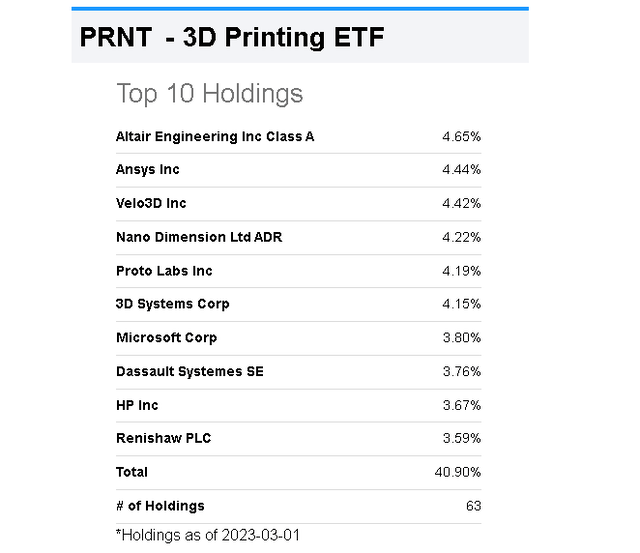

Going through the current portfolio of 63 holdings, the top 10 positions represent 41% of the total weighting. Altair Engineering Inc (ALTR) representing 4.7% of the fund is the largest current investment. In this case, the company is a leader in simulation software used as part of the design process of products that may be produced with additive manufacturing.

Altair has been incorporating more and more artificial intelligence features which highlight a trend in the industry making 3D printing "smarter" and more autonomous. Ansys Inc (ANSS) with a 4.4% weighting has a similar software profile.

On the other hand, Velo3D Inc (VLD) deals more on the hardware side by developing 3D printers that utilize metallic components with industrial applications. This is the evolution compared to the technology origin based on simpler plastics. Overall, names like Nano Dimension Ltd (NNDM), Proto Labs Inc (PRLB), and 3D Systems are good representatives of the industry.

What's Next For PRNT?

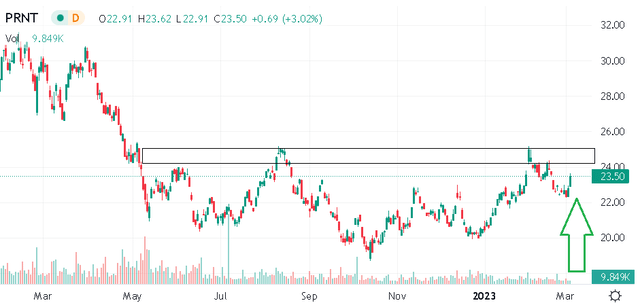

Favorably, PRNT has been a winner to start the year, up around 15% led by strong rallies among the key top holdings. Notably, the fund has outperformed the NASDAQ-100 which we believe can continue to the upside as part of the bullish case going forward, based on the momentum of the 3D printing opportunities as the market adoption of the technologies expands.

In the near term, the macro backdrop and risk sentiment towards "growth" and "momentum" stocks will be important to set the stage for the next leg higher. Consider that the component related to manufacturing is connected to global economic indicators such as industrial activity, which has faced headwinds related to stubborn inflation and higher interest rates.

With a layer of optimism, room for inflation to make a more convincing convergence lower through the rest of the year allowing interest rates to stabilize should be positive for risk assets as our baseline. Inversely, a deterioration of the outlook with a sharp decline in global trade would undermine cyclical names and reset the growth expectations for 3D printing stocks as the risk to watch.

PRNT Forecast

From the PRNT price chart, it's encouraging to see the fund make a series of higher highs since last Q3. The potential that it climbs above ~$25.00 as an area of technical resistance could mark a breakout into the highest level in a year. A bullish forecast could see the fund retest $30.00 as an upside target. On the downside, it will be important to hold $20.00 as a critical level of support.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click here for a two-week free trial.

This article was written by

BOOX Research is now Dan Victor, CFA

15 years of professional experience in capital markets and investment management at major financial institutions.

Check out our private marketplace newsletter service *Conviction Dossier* for curated trade ideas.

Disclosure: I/we have a beneficial long position in the shares of PRNT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.