Hormel: Bears Proven Right Again

Summary

- Hormel produced lower earnings per share than what we saw 7 years back.

- Double-digit volume drops and heavy price increases were not enough to rescue the operating margins.

- Look lower.

- Conservative Income Portfolio members get exclusive access to our real-world portfolio. See all our investments here »

ra2studio

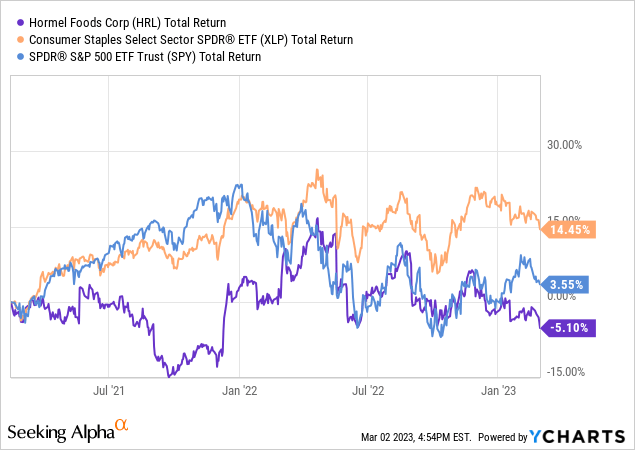

We have been in the bear camp for Hormel Foods Corporation (NYSE:HRL) all the three times we have covered it on this platform, starting from February 2021. Since then, HRL stock has underperformed the Consumer Staples Select Sector SPDR ETF (XLP) as well as the broader market.

The three metrics we expected to move downward in our initial piece have all acquiesced but we are not there yet. The price to earnings, price to sales and EV to EBITDA are still on the "pre-drop" portion of the 2020-2021 bubble rollercoaster that investors gleefully rode. The main drop is around the corner.

Despite our dour outlook, the most recent piece had us upgrading this stock to a "sell" from a "strong sell". While the fiscal fourth quarter was a dampener, it had delivered decently on an annual basis, despite the pressures of higher commodity prices. While earlier we expected negative returns for a decade, thanks to the valuation moving in the right direction, we changed our mind on that. We explained our sell rating in the conclusion.

You can predict the ending valuation and if you are correct, you will generally have no idea when it gets there. Hormel's returns will thus vary, depending on when the correct valuation is reached. If we take a long drawn out move where things just slowly compress over time, you could just see poor returns out over the next 5-7 years. If the market comes to its senses and things compress down to good numbers quickly, we could see a brutal 1-2 years. Obviously the stock is less expensive today than what we saw 2 years back. Thanks to big dividend hikes, the dividend yield is now 2.4%. So this brings us to a good news, bad news situation.

Source: Hormel: A mini Spam Bubble Becomes Less Expensive

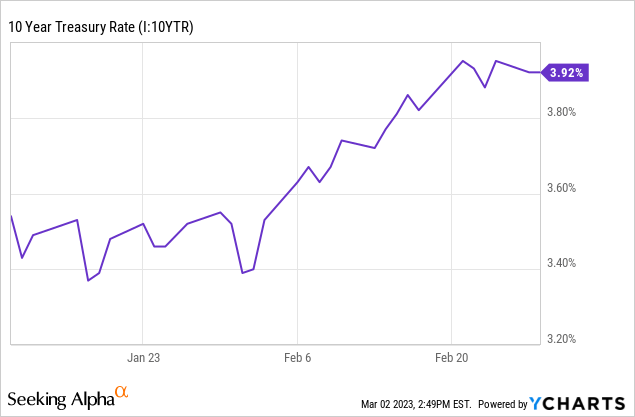

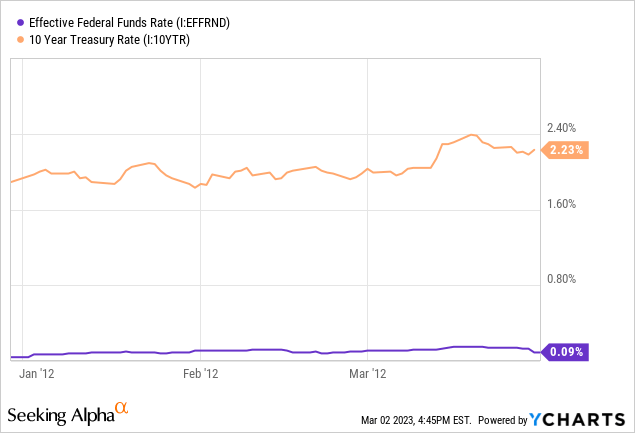

With a dividend yield of 2.4% at the time, the bad news was its total returns relative to the risk free rate looked worse than before. And that trend has not changed as the 10 Year Treasury rate has come back to the psychologically important 4% mark.

Lets talk about the recently released Q1 results next.

Q1-2023

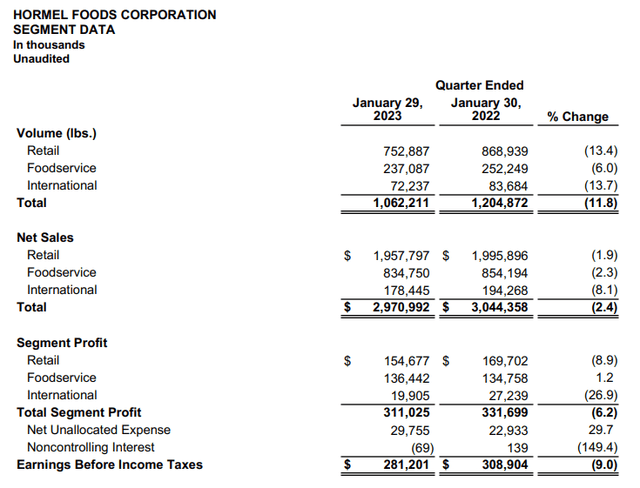

HRL's challenges came from many factors, some out of their control. Volume challenges were from lower pork and turkey availability. In the first case it was due to the new supply agreement, while avian flu played into the turkey shortfall.

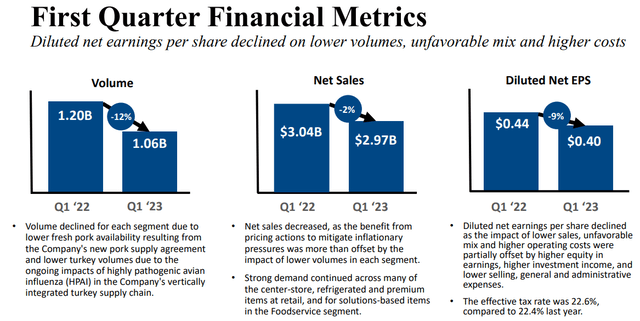

Hormel Presentation

Nonetheless, the company's net sales were down just 2.4% versus the 11.8% volume drop. This is the real inflation factor playing out. HRL was able to raise prices effectively to negate 80% of the volume drop. If you see consensus estimates, they were right around the $3.0 billion mark for sales. Analysts tend to set up low bogeys for the company to clear. So none of this was a surprise. What was a surprise was the earnings per share of $0.40, which missed by 5 cents.

Hormel Presentation

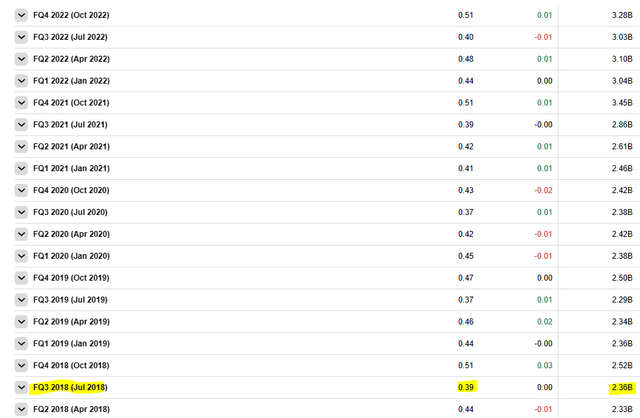

Operating margins contracted to 9.7% from 10.96% in the previous quarter. HRL has struggled with expenses and as much as the bulls have repeatedly denied this, there is no real counterargument to the numbers. Of course bulls might argue as to who cares about 5 cents a share? That might be true if this was a one-off trend. Let's show you what we mean. Here are HRL's quarterly earnings. Notice that HRL was at nearly 40 cents on $2.36 billion of sales almost 5 years back.

Seeking Alpha

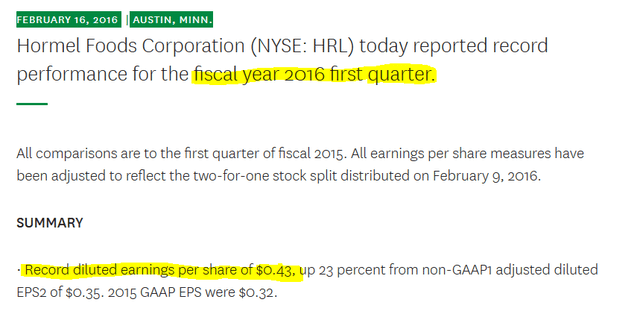

Seeking Alpha does not go back as far as we like so here is another jolt from the past for your revered "growth story".

Hormel

This all was of course way, way before the Planters acquisition, which many bulls argued was a game changer.

Outlook

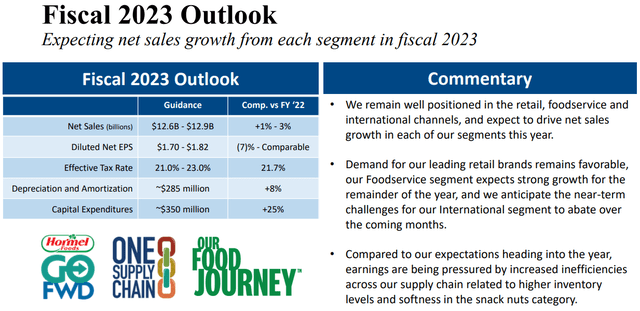

HRL brought home our thesis in the guidance with a range of flat to negative 7%.

Hormel Presentation

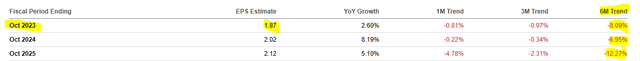

Even with the furious cuts to earnings estimates, analysts remain hopelessly offside.

Seeking Alpha

We suspect that by the time this fiscal year is over, HRL's actual earnings will break through that low end of guidance. Of course that is our take, not theirs. At the low end of a $1.70, HRL is trading at 24.7X earnings. For a company that has had flat earnings since Q1-2016, a whole 7 years back, we think that is incredibly rich. Yes, if you want to look around and find sillier valuations you can. We will give you a hand with that. The Clorox Company (CLX) is trading at 37X and not covering even its dividend from earnings. So if you want to win the argument that HRL is not the most expensive company we can find, even in the staples sector, you win. Congratulations. Your award though, will be just a slight less poor performance than some others.

Verdict

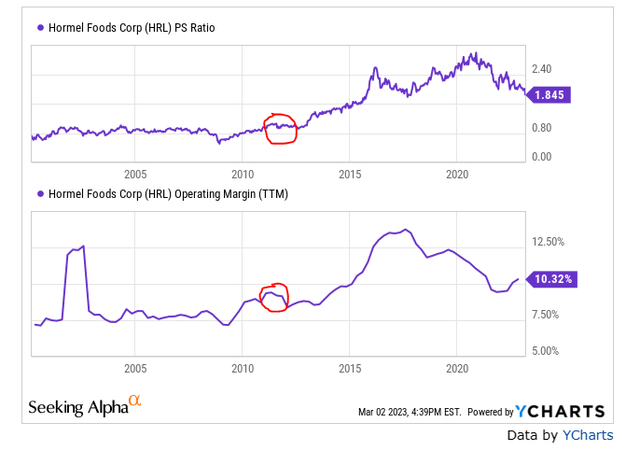

We are maintaining our Sell rating. We like to double down here. Our price target remains that same number we called before, 1X sales. Sure the bulls have argued that 1X sales does not fit HRL today. HRL has better operating margins than it did before. Well reality will be the ultimate decider on that. What we want to point to is that the company traded right at the 1X sales mark with an operating margin right near the 9.5% mark.

Y-Charts

One factoid missing from the chart is that interest rates were far lower back then.

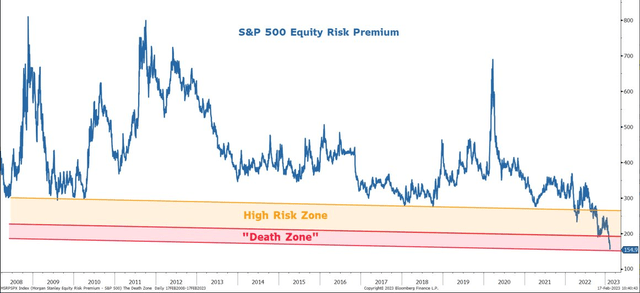

So to suggest that a company that has produced zero growth over the last 7 years, cannot trade at a normal valuation, when interest rates are so (relatively) high, is dangerous thinking. Of course, we freely admit that the alternative is that HRL frustrates the bulls and bears and stays around the $40 mark for the next 7 years as earnings catch up to where they need to be. We think the latter possibility is unlikely considering where equity risk premium is for the market as a whole.

Mike Wilson-Morgan Stanley

Look for at least $35 on the downside in 2023.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.

This article was written by

Conservative Income Portfolio is designed for investors who want reliable income with the lowest volatility.

High Valuations have distorted the investing landscape and investors are poised for exceptionally low forward returns. Using cash secured puts and covered calls to harvest income off value income stocks is the best way forward. We "lock-in" high yields when volatility is high and capture multiple years of dividends in advance to reach the goal of producing 7-9% yields with the lowest volatility.

Preferred Stock Trader is Comanager of Conservative Income Portfolio and shares research and resources with author. He manages our fixed income side looking for opportunistic investments with 12% plus potential returns.

Disclosure: I/we have a beneficial short position in the shares of CLX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.