Banco do Brasil: A High-Yield Bombshell

Summary

- Banco do Brasil S.A. is an emerging market banking stock that presents a cyclical opportunity to risk-seeking investors.

- The bank's operational prowess and dominant market position allow it to monetize high-yielding credit.

- During the past year, Banco do Brasil expanded its consumer debt portfolio by 11%, which added nearly $100 million to its interest-bearing asset base.

- Credit risk remains stable, with non-performing loans still under control. In addition, the bank's fee-based business is head above shoulders.

- A value gap is in play. However, investors should consider that Banco do Brasil is a high-risk stock.

- Looking for a helping hand in the market? Members of The Factor Investing Hub get exclusive ideas and guidance to navigate any climate. Learn More »

Leonidas Santana

Today's article presents readers with an alternative to mainstream banking stocks by covering Banco do Brasil S.A. (BDORY), a Brazilian government-controlled bank emphasizing credit-based activities.

The concept of elevated interest rates and their influence on banking stocks is a well-known phenomenon. Yet, too many investors focus on investing in mainstream bulge-bracket banks whenever interest rates exceed their moving averages. There is much value to be captured in emerging market banks with dominant market positions, so we decided to cover Banco do Brasil in today's analysis.

Despite its more than 17% year-over-year gain, we think Banco do Brasil's stock is set to gather further momentum amid the bank's ongoing operational prowess. Moreover, we have identified a value gap that investors have yet to exploit.

Qualitative Analysis

The analysis flows through Banco do Brasil's operations by assuming a hybrid approach that analyzes from both top-down and bottom-up viewpoints. Banco do Brasil generates approximately 74.75% of its income from interest-bearing activities. Thus, the analysis primarily focuses on debt. Nonetheless, equity markets have recently pivoted, and FX rates remain volatile, lending valuable debate to the research report.

Also, notice that Banco do Brasil operates cross-border. However, the vast majority of its income and assets are situated within Brazil. Therefore, this analysis primarily focuses on Brazil with references to noteworthy outside events.

Debt Segment

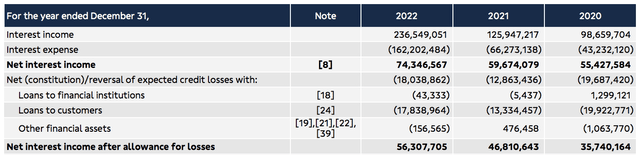

Interest rates in Brazil are staggeringly high at 13.75%, providing an opportunity for astute debt investors such as Banco do Brasil. Although the bank has dealt with its fair share of credit losses, its net interest income has surged by 23.8% in the past year.

Even though the company has benefitted from sustained interest rates, an inflection point could occur, disabling it from passing down its borrowing costs to a struggling Brazilian economy, which contracted by 2% in Q4. Nevertheless, it has to be considered that the bank is essentially generating profits out of high-yielding assets and charging exorbitant credit spreads; for example, Brazil's lending interest rate has surpassed the 30% mark to reach 30.2%.

In our opinion, Banco do Brasil's cost of credit remains respectable at 2.9%, allowing for a disparity between its sales price and cost of capital.

A look at Banco do Brasil's balance sheet communicates the current interest rate scenario in Brazil and the bank's other operating jurisdictions. Deposit inflows have increased exponentially, which is not surprising given the allure of today's money market interest rates. Although a sudden draw on capital might occur in a recession, deposit financing is a cheap source of financing for the bank.

Banco do Brasil's consumer loans have increased exponentially over the past year due to onboarding more loans. As a matter of fact, the firm's quarterly consumer loans portfolio expanded by 11% year-over-year, and Banco do Brasil owns 20% of the Brazilian consumer loans market, placing it in a robust position.

Click on Image to Enlarge - Q4 Balance Sheet (Banco do Brasil)

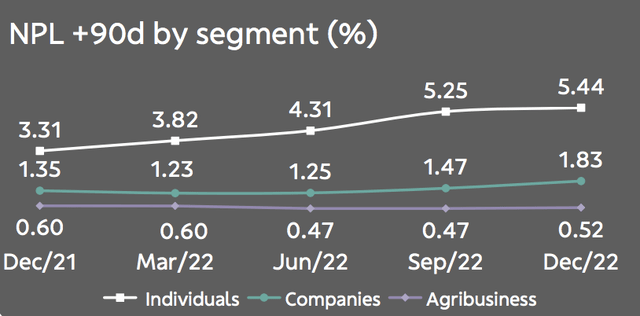

Banco do Brasil's income generated from debt instruments granted to corporations and financial institutions are also in a good territory from an asset-based viewpoint. However, investors should be aware of the gradual increase in credit risk, as non-performing loans (90 days+) have increased steadily during the past few quarters, which might continue to exacerbate given the current economic climate.

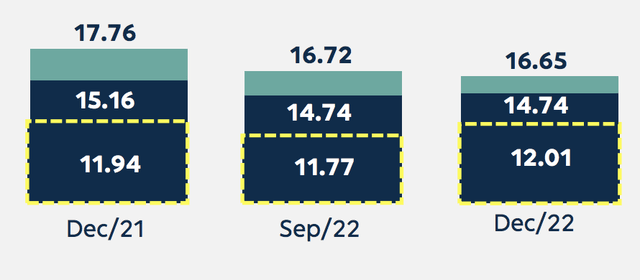

To end off the debt section, I outline Banco do Brasil's CET1 Ratio of 12.1%, which is considered respectable and proves the bank's solvency given a stress event. However, Brazil's sharply downward-sloping yield curve implies a pending recession, which could drag down the CET due to excess credit and market risk (we think the operational risk will remain as is). Nonetheless, as stated in the article's title, Banco do Brasil is a high-yield bet, and we think the firm's market stronghold in a high-interest rate environment will overpower macroeconomic headwinds.

Fee-Based Business

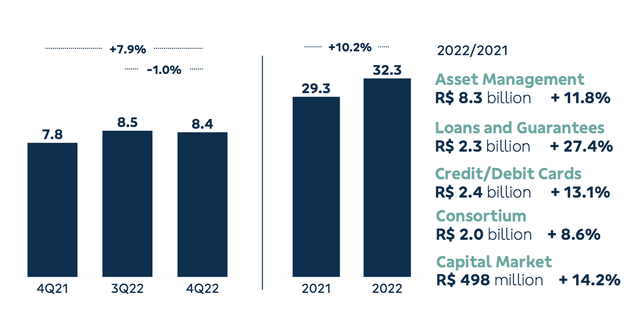

Apart from its exposure to the Argentinian financial markets, Banco do Brasil's operations were faced with unfavorable market conditions, yet, the firm managed to produce year-over-year growth in asset management fees and capital market activities.

Global financial markets have generally recovered. However, Brazil's stock market has remained in negative territory since the turn of the year, meaning there is a risk that the bank's asset management and capital market segments might feel a pinch soon. However, as discussed earlier, the debt market remains resilient; therefore, it will be no surprise if Banco do Brasil's credit card fees and loans/guarantees resume their upward trajectory in the coming quarters.

Lastly, it is worth mentioning that Banco do Brasil's financial market activities are typically long-duration solutions with an emphasis on commercial operations and pension credit, posing minor cyclical risks. Its consumer goods financing unit, consortium, does pose risks in today's fragile economy; however, nothing that suggests a complete derailment of the bank's fee-based business.

Valuation

Output

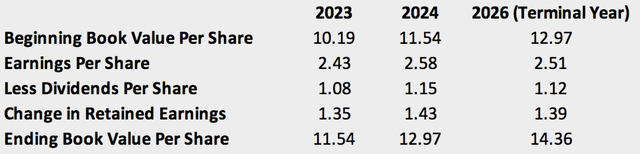

Banking stocks are highly sensitive to the underlying entity's book value. Fortunately, Banco Do Brazil's stock has a price-to-book ratio of 0.71x, which looks good on paper. However, I had to utilize a partial residual income model to see whether the firm's future book value was in-check.

Ignoring the impact of the market risk premium, Banco Brasil could reach a book value per share of 14.36x by 2025, which is near twice the value of its current stock price. Therefore, I deem Banco do Brasil S.A. stock undervalued.

Input Variables

As mentioned before, a partial residual income model was used to value Banco do Brasil. The rationale behind the partial model was to consider the firm's book value, future earnings, and dividends. Given the inflationary environment, I phased out the second part of the residual income equation as Brazil's market risk premium is in sixes and sevens. As such, the discount rate would have deterred the model's worth.

The starting book value was computed by dividing the stock price by the firm's price-to-book ratio. Furthermore, the forecasted earnings and dividends for 2023 and 2024 were drawn from Seeking Alpha's database. For the year 2025, I used normalized values by averaging the previous values.

Final Word

Banco do Brasil S.A. is a stock that presents risk-on investors with cyclical exposure. The company has a strong market position in a high-yielding credit environment, which it is monetizing to maximum effect. Furthermore, Banco do Brasil's fee-based business is in top form, despite a year-over-year equity market drawdown.

Although risks are embedded, a partial residual income model suggests Banco do Brasil S.A. stock is undervalued and underestimated.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Looking for structured portfolio ideas? Members of The Factor Investing Hub receive access to advanced asset pricing models. Learn More >>>

This article was written by

Quantitative Fund & Research Firm with a Qualitative Overlay.

Coverage: U.S. & EM Stocks, ETFs, CEFs, and REITs.

Methods: Quantitative modeling, Top-Down, and Street Gossip.

While we encourage debate, we no longer regularly respond to comments on our articles, as direct dialogue is primarily restricted to our marketplace subscribers.

Our articles do not constitute any financial advice.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.