Credit Agricole Isn't Uninteresting For The Long Term, But A 'HOLD' Now

Summary

- I retain a small position in the French bank Credit Agricole. I've held it for many years, missed some opportunities to sell, and am now looking at forecasts for 2023.

- Fundamentals for this bank are rock-solid - it's time to look at what we can expect, and whether the company's growth estimates fulfill my minimum target of a conservative upside.

- Learn why Credit Agricole is a "Hold" here, despite everything.

- Looking for a helping hand in the market? Members of iREIT on Alpha get exclusive ideas and guidance to navigate any climate. Learn More »

RobsonPL

Dear readers/subscribers,

Credit Agricole S.A (OTCPK:CRARY) has delivered attractive performance since late 2022, though let's be honest most European companies have actually managed attractive performance since that time. I've spent some capital investing in this bank - I just haven't been writing much about it, because my investment has been so small, and other investments have been more attractive to write about and to invest in, to be honest.

However, I figured now was an excellent time to start pushing Credit Agricole a bit - because the thesis is interestingly complex.

Let me show you what I mean.

Credit Agricole - The Bank and its thesis

The bank, which by the way is known in its native France as La Banque Verte, or the "green" bank, is headquartered in Montrouge in France, employs over 140,000 people, and is one of the leading banks in the nation. The "green bank" name comes not from its ESG focus, but the fact that it has very strong ties to farming in France.

What can be said, because Credit Agricole is actually the world's largest in something, is that it is the world's largest cooperative financial institution. It's also France's second-largest bank after Paribas (OTCQX:BNPQF). It's also the third-largest in Europe, and is in the top-twenty largest banks in the world, generating revenues well over €20B per year.

This bank started out very small, promoting lending to small family farms which at the time was promoted by the French government and paved the way for the company's local bank, set up by local elites and aristocrats. Farmers were the lenders, not the owners, and the initial business was primarily short-term loans such as advances on crops which enabled farmers to live more securely. This was then expanded to other types of financial loan products, which enabled farmers to buy equipment as well as other things needed to expand.

The company became nationwide in 1900-1945, survived the war and the reconstruction which encouraged the wide mechanization of farming, and became more of a universal bank in 1966. The bank was allowed to offer households similar products at the time, and the first subsidiaries were created in the late 1960s. Credit Agricole went international in 1979, when it opened a Chicago Office, and was quickly ranked among the world's leading. At the time, it became subject to the banking code - previously it had been subject to the rural code as a cooperative, and diversification went onward, with internationalization and so forth.

Still, it retains its roots as a cooperative to this day.

It hasn't been hurt-free. Credit Agricole saw a significant impact during the crisis of 2008. When the interbank lending market seized up, it forced Credit Agricole to liquidate its holding in Suez at a price of €1.3B, significantly below where the bank valued or wished to hold it. The bank was also forced to organize a nearly €6B rights issue, in addition to a disposal program of another €5B. It was a chaotic time for banks and all European institutions trying to meet Basel requirements.

At the end of 2008, the government decided to loan France's six largest banks €21 billion in two tranches, at an interest rate of 8%, to enable them to continue to play their role in the economy. However, Credit Agricole did not partake in the secondary tranche - it did not need it, and paid it back less than a year later (the first tranche). The company was actually one of the better banks to leave the crisis, and the share price bounced back over 40% in 2009 alone.

As such, it was one of the first-recovering banks in Europe - even before most Swedish ones.

Credit Agricole today, is not a bad bank in any way.

Credit Agricole IR (Credit Agricole IR)

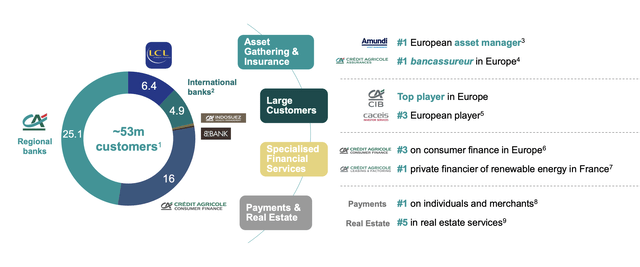

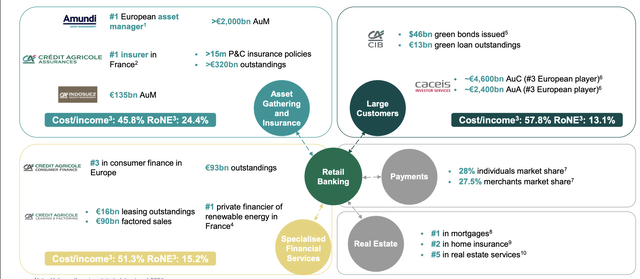

As you can see, 53M customers with segments spread in AM, Large customers, specialized, and payments/RE makes this company a major player essentially in all of Europe. Amundi, which by the way I've written about before, is the #1 European asset manager with over €2T in AUM, complemented by the largest insurer in all of France. This bank is a well-oiled machine that covers the entire spectrum and it is all centered around its retail banking operations.

Credit Agricole IR (Credit Agricole IR)

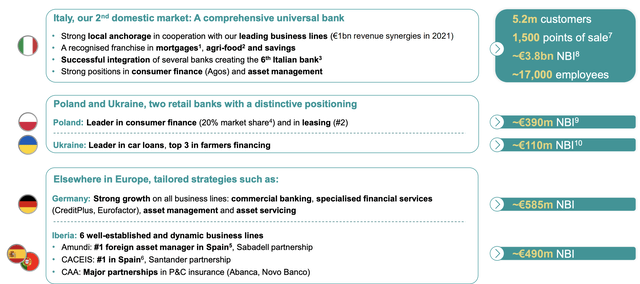

Want some impressive stats? 1 out of 3 individuals, 8 out of 10 farmers, and 1 out of 2 corporations have a customer relationship with Credit Agricole. It's the #10th largest bank on earth, the largest retail bank in the entire EU, and not just in France with its exposure. Take a look at some of the non-France exposure, in what we can call the company's "growth markets".

Credit Agricole IR (Credit Agricole IR)

The company has a very proven business model and was one of the primary providers of SGLs in France during COVID-19 - nearly a quarter of the total volume.

What's more, the bank's recent results for 2021 and early 2022 pretty much all meet their targets well ahead of the planned schedule that the bank initially worked with. The company has normalized its payout to 50% of earnings, a near-12% phased-in CET1, significant cost reduction, net income above €5B with a CAGR of above 4%, at 7% for 2021, and an underlying ROTE above 11% both in 2021 and 2022.

The bank has liquidity at €140B and above, and a loan coverage ratio of above 85% - one of the best in the business. It's also trying to market itself to HNWI, professionals, and entrepreneurs, which seems to be working, though I'm personally hoping the bank does not overly focus on this. One of the dangers, when banks diversify too much, is their growth or expansion into non-core segments which turn out to be nonprofitable, but the bank keeps shovelling capital in to try and make it work. I'd rather see any company focus on what it can do, rather than trying to become a master of none.

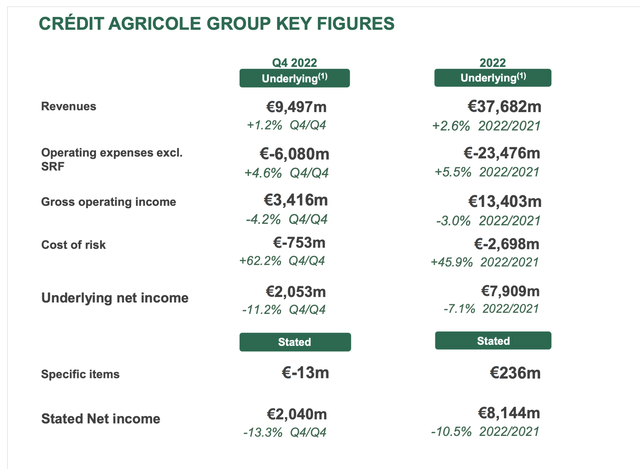

We have 4Q22 results. Those results were excellent. How were they excellent?

Record high 4Q income, up almost 7% YoY, almost a 4.5% increase in revenues, which came from every single business line out there. And again, the bank once again beat its overall targets.

Credit Agricole IR (Credit Agricole IR)

And, as you can see, a good dividend for the year, which brings the company's yield well into competitive levels on a European and international basis. Take a look at the high-level results, and you'll see why I'm positive about most things for the company here.

Credit agricole IR (Credit agricole IR)

Credit Agricole is also interesting because it plans to, likely due to its Polish exposure, be one of the first major banks to really enter Ukraine once the conflict is resolved. There is likely to be a retail banking expansion in the geography once things die down overall in terms of conflicts.

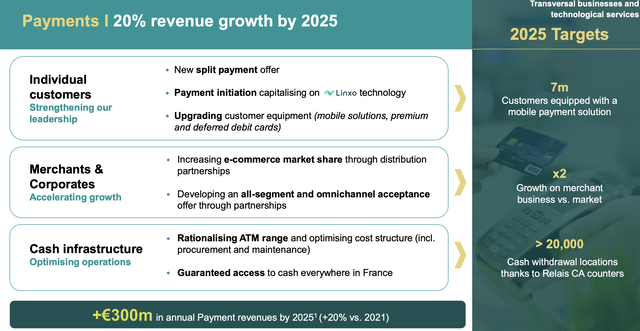

And Credit Agricole has very ambitious targets going forward, with a double-digit 20% revenue growth once we hit 2025E.

Credit Agricole IR (Credit Agricole IR)

Credit Agricole isn't doing anything unique per se, what gives the company an edge is its already-market-leading position and fundamentals, which are beyond solid here. The company is introducing a fully-digitized customer journey, with real-time KYC, but this is not unique in banking today any longer. And speaking for myself and many people I know, especially in the HNWI/VHNWI-segment, most of the clients there demand and want a personal touch in their banking and overall service sectors - so banks like this one should keep that in mind.

Risks to this bank are few - at least on the higher level. There are some valuation concerns- more on those in a bit, but aside from valuation concerns, there really isn't much to complain about here.

Credit Agricole is exposed to some high-level risk, but this is not unique to this bank. I'm talking about things like the cost of risk, NPL's and other delinquencies, and whether the bank's level of capitalization is sufficient for what's coming. Because Credit Agricole has a multitude of exposures both in insurance and other fields, this comes with its own subsets of segment-specific risks, but again - there isn't anything specific that's non-performing to any worrying level here.

So instead, let's focus on where the crux of the matter is.

Credit Agricole's valuation isn't that attractive

So, first off. Credit Agricole is followed by 20 analysts, which give the company a range starting at €5.55 and a high of €17.3 - an extreme range here, with an average about €12/share. The company currently trades at €11.56. This puts the company at a small upside of around 4%.

This is the company's current forecast.

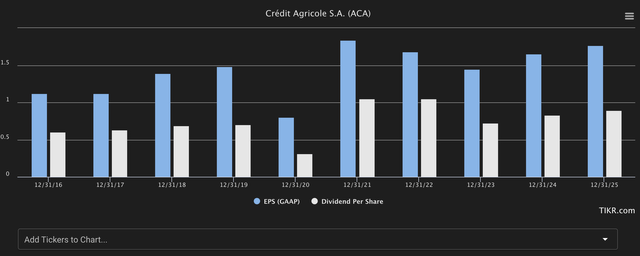

TIKR.com Agricole forecasts (TIKR.com Agricole forecasts)

As you can see, the company has no problem quickly adjusting its dividend to account for momentary shortfalls. This is what Agricole does, when necessary. We're expecting a small downturn in this fiscal, but only a momentary one - however, the combination of a very high valuation coupled with this downturn has only 4 of the analysts calling this one a "BUY" here. Agricole traded at below €9/share less than a year ago, which would have been an excellent time to "BUY", but unfortunately, this is not the case any longer.

Agricole trades at a peer group that includes several banks and financial companies, and it is neither particularly overvalued compared to peers like the National bank of Canada, Canadian Imperial (CM), Truist (TFC), and others. It is also not, however, particularly cheap. There is not much to like here from a peer perspective in terms of undervaluation.

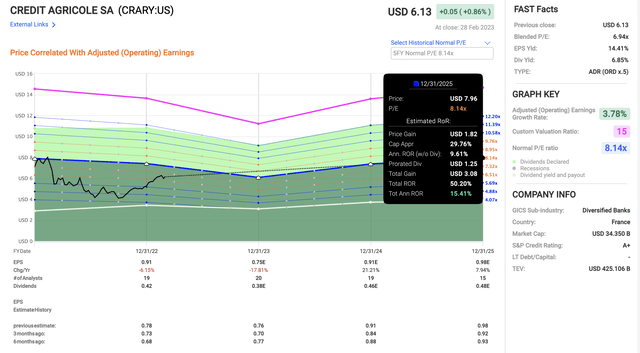

The same is true from a forecast upside perspective. Because of an expectation of a double-digit decline, this caps the potential upside we're able to see here, and a forecast to the average of 8-10x gives us a negative RoR for this year, or close to it. However, due to EPS growth expectations to 2025 in accordance with the company's forecasts, this is what we're seeing on an 8.1x P/E.

F.A.S.T graphs Credit Agricole (F.A.S.T graphs)

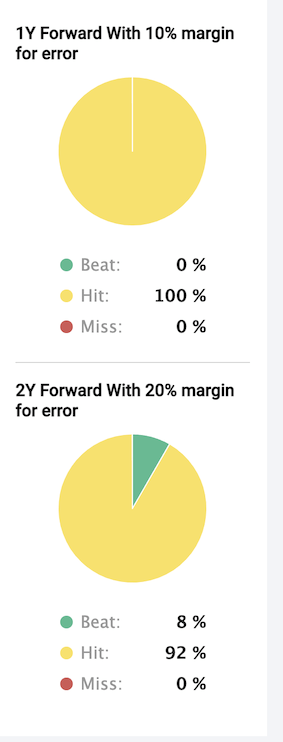

So, that's more decent. However, I have a problem with this. The company has been on a climb for the past few quarters, but I believe this is premature, and we'll see a decline in the company's valuation as a result of the more negative quarterly earnings we'll likely see in 2023. I believe this to be accurate, because analyst accuracy for this company is nothing short of superb. FactSet analysts have not missed estimates for this business.

Credit Agricole analyst accuracy (F.A.S.T graphs)

So, the reason that I believe this company isn't a "BUY" here is simply because of the valuation, which I see as being too expensive in part from historicals, in part from peers, and in part from the near-term forecasts. I believe that we will be able to buy Credit Agricole cheaper than we're currently seeing.

For that reason, this is my thesis on the bank at this particular time - and my first official rating for Credit Agricole.

Thesis

- Credit Agricole is a great bank, with solid fundamentals and good long-term growth prospects. It's one of Europe's leading banks, and it's also the largest cooperative financial institution on earth. It has a great yield and an A rating in terms of credit. At the right valuation, this company becomes a definite "BUY".

- However, at this particular valuation, the company has already realized much of where I would see its growth potential. For that reason, I would be very careful here, even if the longer-term potential is very decent.

- I believe we'll be able to buy it cheaper, which means I have a "HOLD" rating here, with an €11/share PT.

Remember, I'm all about:

- Buying undervalued - even if that undervaluation is slight and not mind-numbingly massive - companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn't go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

I say this company currently fulfills 3 out of 5 criteria, which means I'm at a "HOLD" here.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

The company discussed in this article is only one potential investment in the sector. Members of iREIT on Alpha get access to investment ideas with upsides that I view as significantly higher/better than this one. Consider subscribing and learning more here.

This article was written by

Mid-thirties DGI investor/senior analyst in private portfolio management for a select number of clients in Sweden. Invests in USA, Canada, Germany, Scandinavia, France, UK, BeNeLux. My aim is to only buy undervalued/fairly valued stocks and to be an authority on value investments as well as related topics.

I am a contributor for iREIT on Alpha as well as Dividend Kings here on Seeking Alpha and work as a Senior Research Analyst for Wide Moat Research LLC.

Disclosure: I/we have a beneficial long position in the shares of CRARY, CM, TFC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: While this article may sound like financial advice, please observe that the author is not a CFA or in any way licensed to give financial advice. It may be structured as such, but it is not financial advice. Investors are required and expected to do their own due diligence and research prior to any investment. Short-term trading, options trading/investment and futures trading are potentially extremely risky investment styles. They generally are not appropriate for someone with limited capital, limited investment experience, or a lack of understanding for the necessary risk tolerance involved.

I own the European/Scandinavian tickers (not the ADRs) of all European/Scandinavian companies listed in my articles. I own the Canadian tickers of all Canadian stocks i write about.

Please note that investing in European/Non-US stocks comes with withholding tax risks specific to the company's domicile as well as your personal situation. Investors should always consult a tax professional as to the overall impact of dividend withholding taxes and ways to mitigate these.