6 Deep Value Microcaps With Decent Trading Momentum

Summary

- With the overall U.S. stock market struggling for direction, stock picking is now of paramount importance.

- Little-followed microcaps offer an area where bargains can be found.

- This article focuses on names with low price-to-book value and earnings ratios.

- Strong technical momentum and accumulation trends are also reviewed.

Dilok Klaisataporn

I thought I would write a quick research note on a number of companies trading near book value, with strong earnings currently, crossed with some interest by investors using my quant-momentum formulas. Many of them have been mentioned before today in my articles since late summer.

If you own a basket of them, an investor can reduce the higher-than-normal volatility swings of individual small capitalization names, while getting real value for your buck (and hopefully outsized investment returns the rest of 2023). For this article I am keeping the picks to around $100 million or less in equity market capitalization.

My process for finding them starts with high momentum scores and rankings from my daily quant searches on all U.S. stocks through a large, continuously updated database. I focus on the top 20-50 momentum picks using my proprietary sorting formulas, engaging in additional research on their fundamentals.

The current list of "best buy" microcaps includes Comstock Holding (CHCI), L.S. Starrett (SCX), Bridgford Foods (BRID), Amrep (AXR), Wilhelmina International (WHLM), and Barnwell Industries (BRN). Comstock manages and develops real estate in the Washington DC area. L.S. Starrett manufactures tools for the construction industry, with worldwide customers. Bridgford Foods is in the snacks, bread, and ready-to-eat sandwich business. Amrep is a real estate holding company in New Mexico selling land for new construction. Wilhelmina is a modeling agency focused on U.S. and London markets. And, Barnwell is a drilling company out of Hawaii, with a majority of its assets focused on oil/gas production in Canada.

Basic Valuation Stats

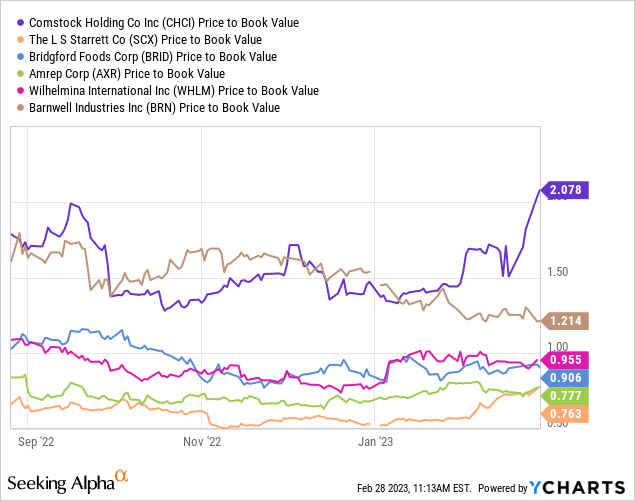

My first fundamental sort variable is low price to book value, especially tangible book value. They all score well, with many selling for less than the net depreciated accounting cost of assets, minus all liabilities. Comstock scored better several weeks ago, but has bumped higher in price already. Most of the firms carry limited to no debt also, which is important to control operating risk at smaller businesses.

YCharts - Deep Value Microcaps, Price to Book Value, 6 Months

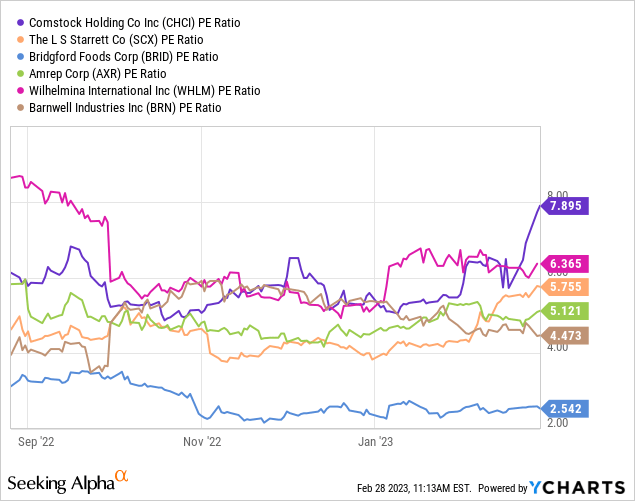

Then, I searched for a low price to earnings ratio on trailing 12-month results. Not all of the companies will be able to repeat the positive operating performance of 2022. However, I do not foresee any of them losing serious money from operations in 2023. Bridgford Foods did have a one-time gain not to be repeated this year. The good news is 60% of the stock price is now backed by short-term working capital.

YCharts - Deep Value Microcaps, Price to Trailing Annual Earnings, 6 Months

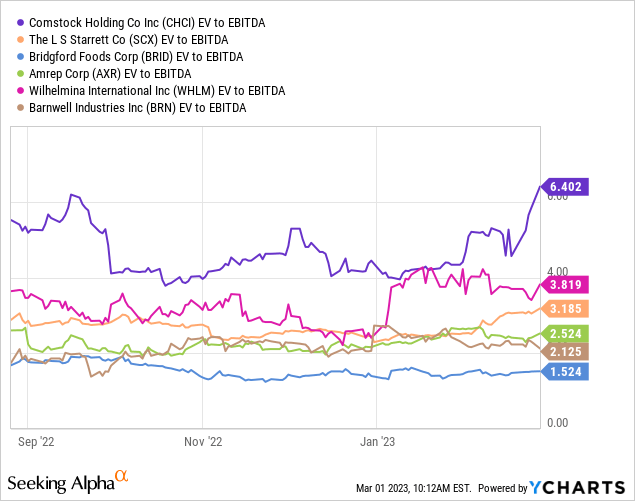

Plus, each scores quite well on low EV to EBITDA readings, which is the purest form of stripped-down cash generation vs. the company's total value (including debt minus cash holdings). The good news is each of the 6 are well positioned financially, with no cash burn or debt/share issuance expected in 2023 as currently configured.

YCharts, Deep Value Microcaps, EV to Trailing EBITDA, 6 Months

Technical Charts

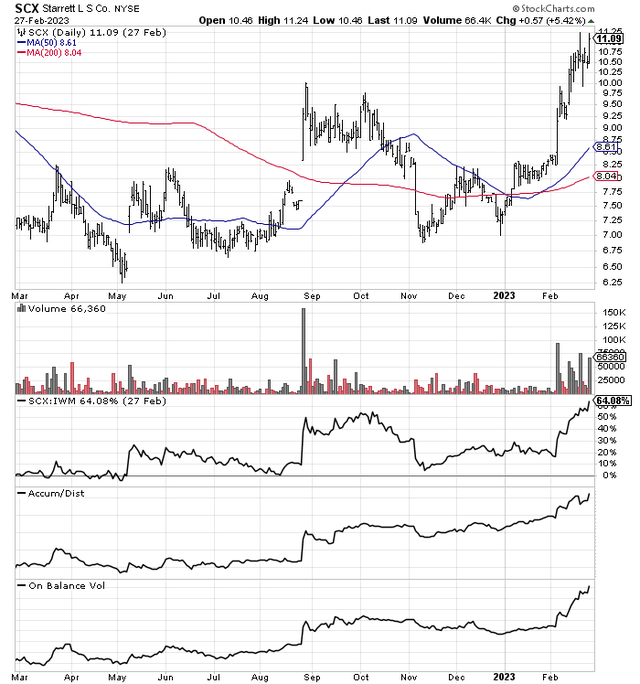

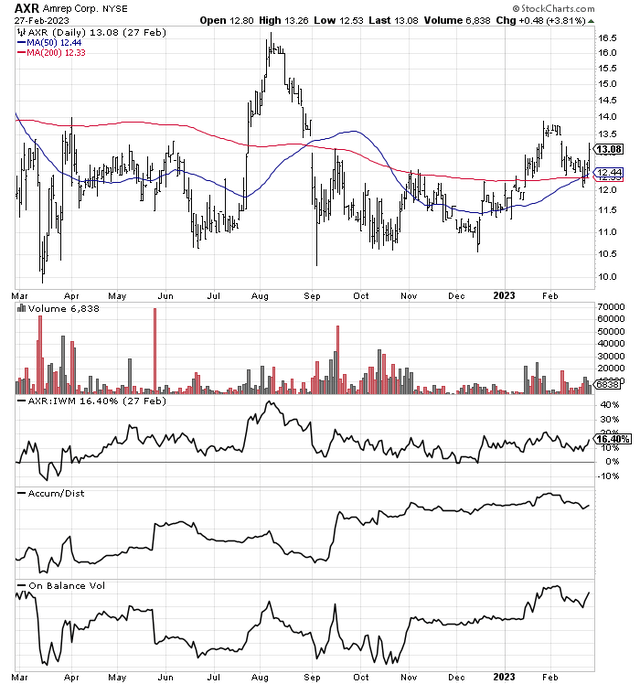

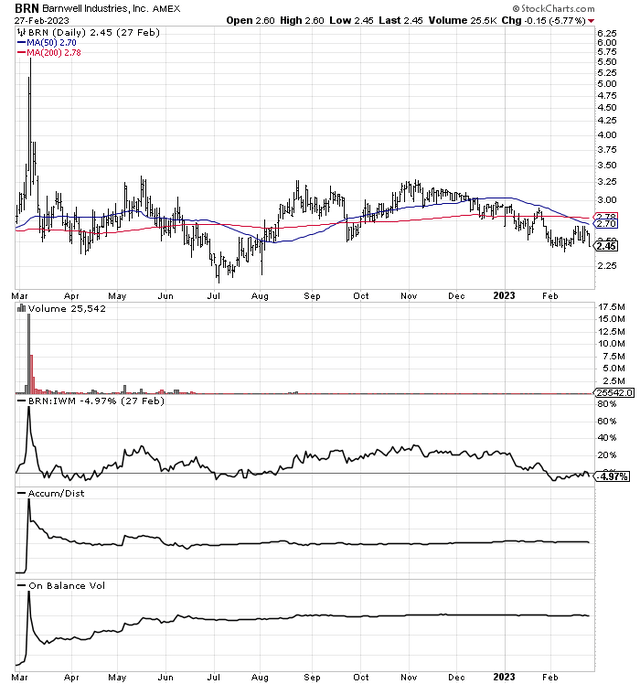

Again, the main sort is based on my proprietary momentum formulas, directly looking at trading action in each name. The weakest technical setup is Barnwell, but it is a little-known and very inexpensive way to play potential "black swan" spikes in crude oil prices this year. The company began paying a dividend for the first time last year.

I run a bunch of different formula creations daily, hunting for turns in momentum or unrecognized underlying strength (before analysts and investors discover a rising price trend). The formulas can review and rank as many as 20 different momentum indicators (or variations of them created by yours truly).

For this effort, I will draw a relative strength line of price changes vs. the iShares Russell 2000 ETF (IWM) small company index, alongside Accumulation/Distribution Line and On Balance Volume momentum readings. The three indicators represent just a fraction of what I am reviewing. I am listing them in order of total buying pattern strength over the last two weeks.

StockCharts.com - Comstock Holding, 12 Months of Daily Price & Volume Changes StockCharts.com - L.S. Starrett, 12 Months of Daily Price & Volume Changes StockCharts.com - Bridgford Foods, 12 Months of Daily Price & Volume Changes StockCharts.com - Amrep, 12 Months of Daily Price & Volume Changes StockCharts.com - Wilhelmina, 12 Months of Daily Price & Volume Changes StockCharts.com - Barnwell Industries, 12 Months of Daily Price & Volume Changes

Final Thoughts

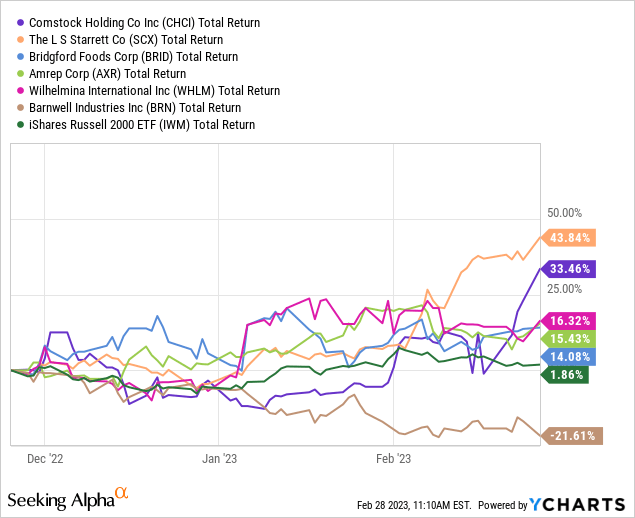

Out of the group, only Barnwell has underperformed the peer small-cap Russell index over the past 3-month period. Yet, BRN may have some of the best upside available for investment today, if energy prices spike again in 2023. The 6 names are an intelligent place to start a microcap portfolio, with sound underlying asset values and profitable business operations.

YCharts - Deep Value Microcaps, Total Return Performance vs. Russell 2000 Index, 3 Months

There are different/additional risks to consider when investing in small caps. Be careful with buy orders as minor amounts of capital can swing price. If you want to add capital beyond $10,000 to any of these minor outfits, I definitely suggest using a layered, patient approach with multiple orders over days or weeks. Plus, if you want to sell and get your money out quickly, you may have to accept an additional drop in price on your order of a few percent vs. the current trading level to find enough buyers.

Volatility is part of the holding equation also. You can see on the charts 10% or 20% price moves take place all the time, often without rhyme or reason. Part of the excuse is low pools of liquidity exist daily for each. Many in the group have large family or single shareholders, so the float of available supply is even lower than total market caps.

Another risk is minimal news flow and analyst coverage means retail investors are largely left in the dark when company-specific bad news arrives. Management and insiders may sell or shy away from buying shares, but you will not get the memo to do the same. All of the above argues in favor of a diversified approach to owning microcaps. 20 to 50 stocks should be considered for this portion of your portfolio.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of AXR, CHCI, BRN, SCX, WHLM either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication, and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.