BITQ: Bitcoin Soup Recovers - A Crypto Lotto Ticket

Summary

- Bitcoin consolidates at a higher level: The $30,000 level is critical.

- Fiat currency challenges increase the potential for a rally: The dollar and the euro are losing ground.

- BITQ holds shares of pick-and-shovel companies in the cryptocurrency arena.

- A rally from the low, and plenty of room on the upside.

- Only invest capital you can afford to lose: The burgeoning asset class remains dangerous.

- Looking for more investing ideas like this one? Get them exclusively at Hecht Commodity Report. Learn More »

Olemedia

Bitcoin remains the leader of the cryptocurrency asset class. At $23,475 on March 2, Bitcoin's market cap was just over the $453.4 billion level, or around 42.4% of the total $1.069 total asset class's value.

Bitcoin plunged from over $68,900 in November 2021 to a low below $15,520 in November 2022. While the top crypto remains much closer to the recent low than the record high, it has stabilized over the past weeks. In a mid-November 2022 Seeking Alpha article on BITO, the ETF that tracks Bitcoin futures, I wrote, "explosive and implosive price moves are nothing new for cryptocurrencies." While the leading crypto fell 77.5% from November 2021 through November 2022, the decline was less than previous implosive moves. At the $23,485 level, Bitcoin is around 51% higher than the late 2022 low, but if it follows a similar path as over the past years, the next explosive move could be in the early days.

The Bitwise Crypto Industry Innovators ETF (NYSEARCA:BITQ) owns a diversified portfolio of shares in companies that tend to move higher and lower with Bitcoin's value. It could offer compelling value below the $5.20 per share level on March 2 if another explosive move is on the horizon.

Bitcoin consolidates

Since reaching the most recent low in November 2022, Bitcoin recovered and moved into a sideways trading range.

One-Year Bitcoin Chart (Barchart)

The chart highlights Bitcoin's consolidation from the low to the $18,335 level from November 21, 2022, to below $18,340 until January 11, 2023. Bitcoin then rallied and has ranged from $21,426.59 to $25,238.72 from January 23 through March 2. Bitcoin was just over the midpoint of the trading range on March 2 at the $23,475 level. As the chart shows, technical resistance stands at the May 31, $32,329.54 high, but the $30,000 level is a critical psychological level and upside target for the leading cryptocurrency.

Fiat currency issues favor cryptos

The U.S. is the world's reserve currency, with the euro as the second top foreign exchange instrument. The dollar and the euro have been the traditional currencies central banks hold for international transactions and cross-border payments.

The U.S. economy faces a debt crisis as Congress and the administration must agree to increase the debt ceiling. The potential for a default likely caused the dollar to decline against the euro since the late September low. Meanwhile, the bifurcation of the world's nuclear powers and Russia's alliance with China threaten the dollar and the euro as reserve currencies. Increasing use of non-dollar and non-euro exchange instruments to pay for international cross-border transactions threatens the U.S. and European currencies worldwide role. Therefore, the euro and dollar can weaken simultaneously, regardless of the exchange rate between the two currencies. The over two-decade rise in gold prices in dollar and euro terms is a sign that both foreign exchange instruments are weakening. Bitcoin, Ethereum, and other cryptocurrencies can benefit from the weakness in the leading fiat currencies as they provide an alternative to dollars and euros.

BITQ is Bitcoin soup

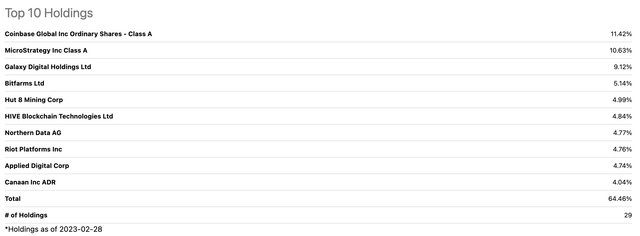

I call the Bitwise Crypto Industry Innovators ETF (BITQ) Bitcoin soup because it owns shares in a diversified group of Bitcoin and cryptocurrency-related companies. BITQ is a pick-and-shovel play on the asset class as the companies in BITQ's portfolio tend to rise and fall with the market cap. The most recent top holdings include:

Top Holdings of the BITQ ETF Product (Seeking Alpha)

At $5.13 per share on March 2, BITQ had $52.272 million in assets under management. BITQ trades an average of 130,526 shares daily and charges a 0.85% management fee.

BITQ rallies

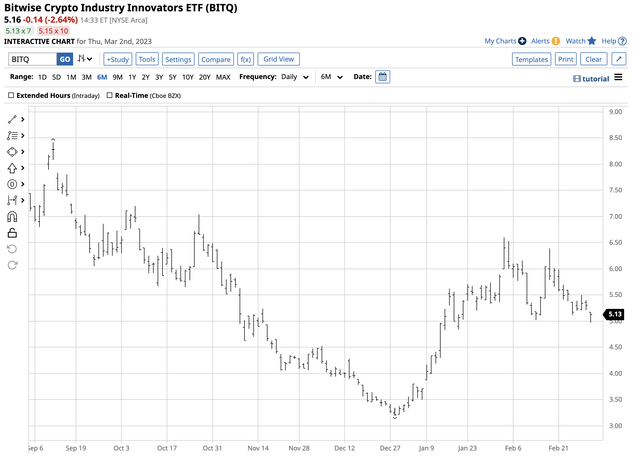

The Bitcoin rally from the November 21, 2022 low to the February 16, 2023 high took Bitcoin 62.7% higher.

Six-Month BITQ Chart (Barchart)

The chart shows BITQ rallied from $4.06 to $6.39 per share or 57.4% over the same period.

BITQ will likely follow Bitcoin's future implosive and explosive path.

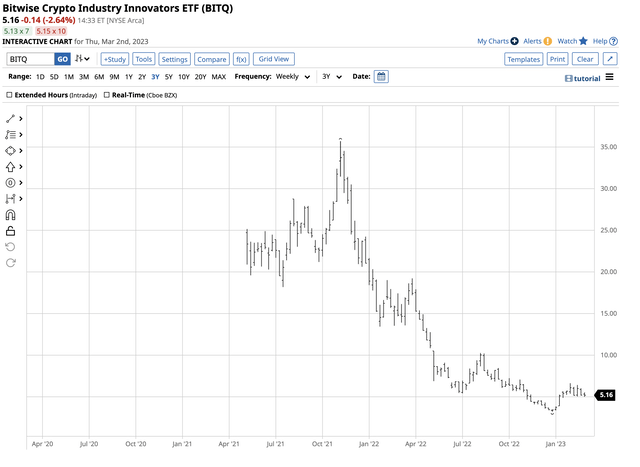

Three-Year BITQ Chart (Barchart)

As the chart highlights, BITQ began trading in May 2021 and reached an all-time $35.68 high in November 2022, the month Bitcoin traded to over $68,900 per token. The price dropped 77.5% from that peak, while BITQ provided a magnified result falling over 91% from the high to the low. If Bitcoin takes off on the upside, BITQ could outperform the leading crypto on the upside as it has a history of a leveraged relationship.

Risk vs. reward in a volatile asset class

At below $5.20 per share, BITQ is a highly speculative ETF with lots of upside potential and commensurate downside risks. If Warren Buffett, Charlie Munger, and Jamie Dimon are correct, the ETF could lose most of its value. Still, unlike Bitcoin, many companies in its portfolio have other business interests and exposures that would likely save it from becoming worthless. Even if Bitcoin were to disappear, BITQ would probably survive.

On the other hand, if Bitcoin and cryptocurrencies take off on the upside, we could see BITQ outperform on a percentage basis. Moving back to the $68,900 high would take Bitcoin 191% higher, while BITQ at $35.68 would be an over 570% rally from the current price level.

BITQ is a lotto ticket that provides exposure to the crypto asset class. As with any highly speculative investment, only invest capital you can afford to lose.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from a top-ranked author in commodities, forex, and precious metals. My weekly report covers the market movements of over 29 different commodities and provides bullish, bearish, and neutral calls; directional trading recommendations, and actionable ideas for traders. I am offering a free trial and discount to new subscribers for a limited time.

This article was written by

Andy spent nearly 35 years on Wall Street, including two decades on the trading desk of Phillip Brothers, which became Salomon Brothers and ultimately part of Citigroup.

Over the past two decades, he has researched, structured and executed some of the largest trades ever made, involving massive quantities of precious metals and bulk commodities.Andy understands the market in a way many traders can’t imagine. He’s booked vessels, armored cars, and trains to transport and store a broad range of commodities. And he’s worked directly with The United Nations and the legendary trading group Phibro.

Today, Andy remains in close contact with sources around the world and his network of traders.

“I have a vast Rolodex of information in my head… so many bull and bear markets. When something happens, I don’t have to think. I just react. History does tend to repeat itself over and over.”

His friends and mentors include highly regarded energy and precious metals traders, supply line specialists and international shipping companies that give him vast insight into the market.

Andy’s writing and analysis are on many market-based websites including CQG. Andy lectures at colleges and Universities. He also contributes to Traders Magazine. He consults for companies involved in producing and consuming commodities. Andy’s first book How to Make Money with Commodities, published by McGraw-Hill was released in 2013 and has received excellent reviews. Andy held a Series 3 and Series 30 license from the National Futures Association and a collaborator and strategist with hedge funds. Andy is the commodity expert for the website about.com and blogs on his own site dynamiccommodities.com. He is a frequent contributor on Stock News- https://stocknews.com/authors/?author=andrew-hecht

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.