The market reversed most of previous day's losses due to selling pressure in technology, banking & financial services, auto, and FMCG stocks on March 2, but the loss in broader markets was less compared to the benchmarks.

The BSE Sensex corrected 502 points to 58,909, while the Nifty50 fell 129 points to close at 17,322 and formed bearish candlestick pattern on the daily charts, with making lower high lower low formation, while taking support at 17,300.

"Nifty remained volatile with a predominant weakness, as the bears kept control throughout the session. On the daily chart, the Nifty continues to fall within a descending channel, suggesting continuation of the bearish trend," said Rupak De, Senior Technical Analyst at LKP Securities.

The momentum oscillator, RSI (relative strength index), is in bearish crossover. Over the short term, the index may move towards 17,150, whereas on the higher end, resistance is placed at 17,400, the market expert said.

On the broader markets front, the Nifty Midcap 100 index declined third of a percent and Smallcap 100 index slipped 0.2 percent on weak breadth.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks in this article are the aggregates of three-month data and not just the current month.

Key support and resistance levels on the Nifty

As per the pivot charts, the Nifty has support at 17,304, followed by 17,272 and 17,218. If the index moves up, the key resistance levels to watch out for are 17,411, followed by 17,444 and 17,498.

The Nifty Bank fell more than 300 points to close at 40,390 after trading within the broad range of 40,000-41,000 during the session, and formed bearish candle on the daily charts.

"The bears came back strong and the index witnessed stiff resistance at 41,000 where fresh Call writing was visible. The index remains in a sell-on-rise mode as long it stays below the mentioned resistance zone," said Kunal Shah, Senior Technical Analyst at LKP Securities.

He feels the index's immediate support on the downside stands at 40,000 and if breached, will lead to a further downside towards 39,500 levels.

The important pivot level, which will act as a support, is at 40,316, followed by 40,207 and 40,032. On the upside, key resistance levels are 40,668, followed by 40,776, and 40,952.

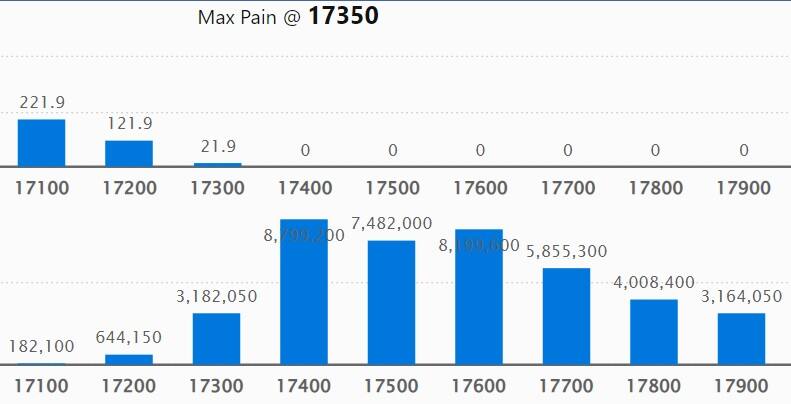

On a weekly basis, the maximum Call open interest (OI) was seen at 17,400 strike, with 87.99 lakh contracts, which may remain a crucial resistance level for the Nifty in the coming sessions.

This is followed by a 17,600 strike, comprising 81.99 lakh contracts, and a 17,500 strike, where there are more than 74.82 lakh contracts.

Call writing was seen at 17,400 strike, which added 28.08 lakh contracts, followed by 17,300 strike, which have addition of 17.55 lakh contracts, and 18,400 strike which saw 1.73 lakh contracts addition.

We have seen Call unwinding at 17,500 strike, which shed 38.66 lakh contracts, followed by 17,800 strike which shed 35.66 lakh contracts, and 18,500 strike which shed 32.93 lakh contracts.

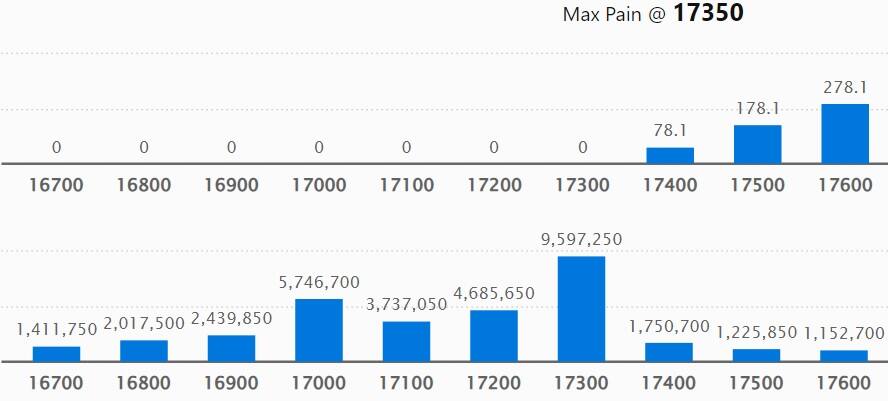

On a weekly basis, we have seen the maximum Put OI at 17,300 strike, with 95.97 lakh contracts, which is expected to act as a crucial support zone for the Nifty50 in coming sessions.

This is followed by the 17,000 strike, comprising 57.46 lakh contracts, and the 17,200 strike, where we have 46.85 lakh contracts.

Put writing was seen at 17,300 strike, which added 14.8 lakh contracts.

We have seen Put unwinding at 17,400 strike, which shed 93.37 lakh contracts, followed by 17,500 strike which shed 34.95 lakh contracts, and 17,200 strike which shed 28.34 lakh contracts.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Power Grid Corporation of India, ICICI Lombard General Insurance, Honeywell Automation, HDFC, and Petronet LNG, among others.

An increase in open interest (OI) and an increase in price mostly indicate a build-up of long positions. Based on the OI percentage, 26 stocks including Power Grid Corporation of India, Adani Enterprises, Voltas, Torrent Power, and Petronet LNG, saw a long build-up.

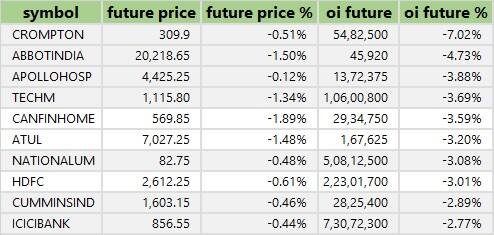

A decline in OI and a decrease in price, in most cases, indicate long unwinding. Based on the OI percentage, 51 stocks including Crompton Greaves Consumer Electricals, Abbott India, Apollo Hospital Enterprises, Tech Mahindra, and Can Fin Homes witnessed a long unwinding.

72 stocks see a short build-up

An increase in OI accompanied by a decrease in price mostly indicate a build-up of short positions. Based on the OI percentage, 72 stocks including MCX India, L&T Technology Services, Max Financial Services, ONGC, and Glenmark Pharma, saw a short build-up.

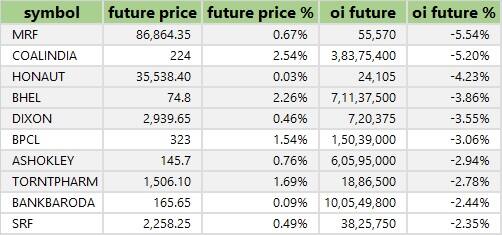

A decrease in OI along with an increase in price is an indication of short-covering. Based on the OI percentage, 45 stocks were on the short-covering list. These included MRF, Coal India, Honeywell Automation, BHEL, and Dixon Technologies.

Adani Enterprises: SB Adani Family Trust sold 3.87 crore shares in Adani Enterprises via open market transactions, at an average price of Rs 1,410.86 per share, amounting to more than Rs 5,460 crore. However, GQG Partners Emerging Markets Equity Fund acquired 90.22 lakh equity shares, and Goldman Sachs Trust II-Goldman Sachs GQG Partners International Opportunities Fund bought 1.51 crore shares at an average price of Rs 1,408.25 per share, which were total worth over Rs 3,403 crore.

Adani Green Energy: SB Adani Family Trust offloaded 5.56 crore equity shares in Adani Green Energy via open market transactions at an average price of Rs 504.6 per share, amounting to Rs 2,805.6 crore. However, Goldman Sachs Trust II-Goldman Sachs GQG Partners International Opportunities Fund bought more than 2.25 crore equity shares in the company and GQG Partners Emerging Markets Equity Fund purchased 1.38 crore shares at an average price of Rs 504.6 per share, which were total worth Rs 1,833.6 crore.

Adani Ports and Special Economic Zone: Promoter entity SB Adani Family Trust sold 8.86 crore equity shares in the logistics company via open market transactions, at an average price of Rs 596.2 per share, amounting to Rs 5,282.33 crore. However, Goldman Sachs Trust II-Goldman Sachs GQG Partners International Opportunities Fund purchased 3.87 crore shares, and GQG Partners Emerging Markets Equity Fund bought 2.04 crore shares in Adani Ports, at same average price, which were worth more than Rs 3,527.7 crore.

Adani Transmission: Promoter entity SB Adani Family Trust offloaded 2.84 crore equity shares in the power transmission company via open market transactions, at an average price of Rs 668.4 per share, amounting to Rs 1,898.25 crore. However, Goldman Sachs Trust II-Goldman Sachs GQG Partners International Opportunities Fund acquired 82.15 lakh shares and GQG Partners Emerging Markets Equity Fund purchased 88.92 lakh shares in the company at same average price, which were worth Rs 1,143.5 crore.

(For more bulk deals, click here)

Investors' meetings on March 3

Tata Chemicals: Officials of the company will meet UBS Securities India.

Blue Star: Company's officials will interact with Harding Loevner.

Bharat Forge: Officials of the company will interact with Federated Hermes Investment Fund Plc.

Tech Mahindra: Investor Day 2023 to be held by the company.

Agnel One, Dreamfolks Services, Medplus Health Services: Companies' officials will participate in Investec Equity Conference.

Rallis India: Officials of the company will meet Burgundy Asset Management, USA.

PI Industries: Company's officials will participate in Investec Founders Conference.

Metro Brands: Officials of the company will interact with Sundaram Mutual Fund, and Wells Capital/All Spring Global Investments.

Hitachi Energy India: Company will hold 'Analyst Meet 2023 – Discover Hitachi Energy Technologies'.

Speciality Restaurants: Officials of the company will interact with Valentis Advisors ANG group - PMS.

Aptus Value Housing Finance India: Company's officials will interact with Morgan Stanley.

IIFL Finance: Officials of the company will interact with Mirae Asset Investment Managers (India), UTI Mutual Fund, Aditya Birla Sun Life AMC, and CLSA.

Eicher Motors: Company's officials will interact with Mirae Asset Global Management.

Grasim Industries: Officials of the company will meet One-up Financial Consultants and Metta Capital Advisors LLP.

Stocks in the news

Adani Green Energy: The company now has its fourth wind-solar hybrid power plant fully operational at Jaisalmer in Rajasthan, with generation capacity of 700 MW, taking the total operating renewable portfolio of the company to 8,024 MW. The new hybrid plant has a power purchase agreement (PPA) at Rs 3.24 per kwh for 25 years.

Mahindra & Mahindra Financial Services: The non-banking finance company estimated the total disbursement of approximately Rs 4,185 crore for February 2023, a 53 percent growth over February 2022. The loan book in February 2023 grew further by 1.5 percent over January 2023. The collection efficiency was at 97 percent for February 2023 compared to 98 percent achieved in February 2022. The gross stage 3 as at February end is maintained at similar levels compared to January 2023, while gross stage 2 has seen further improvement sequentially. The Company continued to hold adequate liquidity buffer which covers ~ 3 months' funds requirement.

Happiest Minds Technologies: The board has approved the fund raising of Rs 125 crore via issue of 12,500 non-convertible debentures on private placement basis in domestic market in three tranches. The funds will be utilized for general corporate purposes. The issue of commercial papers in domestic market on private placement basis has been deferred for consideration at an appropriate time.

Hindustan Petroleum Corporation: The oil retailer has raised Rs 1,650 crore via non-convertible taxable debentures on private placement basis. The company will utilise these funds for refinancing of existing borrowings and/or capital expenditure, including recoupment of expenditure already incurred and/or for any other purpose in the ordinary course of business.

Natco Pharma: The board of directors of the pharma company will be meeting on March 8 to consider the proposal for buyback of fully paid up equity shares.

Titagarh Wagons: Consortium of Titagarh Wagons and BHEL emerges as 2nd lowest bidder for manufacturing cum maintenance of Vande Bharat Trainsets, including up-gradation of the government manufacturing units & trainset depots. The total quantity is 200 trainsets and L2 is eligible to get 80 trainsets. The quote of L1 bidder is Rs 120 crore per Trainset.

MOIL: The state-owned manganese ore producer announced production of 1.31 lakh tonnes of manganese ore in February 2023, a 10 percent growth over the same period last year. Manganese ore sales at 1.32 lakh tonnes during the month increased by 19 percent YoY.

India Grid Trust: The Indian power sector infrastructure investment trust has completed the acquisition and management control of Khargone Transmission, from Sterlite Power Transmission (one of the Sponsor of IndiGrid), for Rs 1,497.5 crore. The addition of Khargone Transmission to the portfolio will take IndiGrid's assets under management to Rs 22,700 crore and company's overall asset base to 8,416 ckms (circuit kilometer) of transmission lines and 17,550 MVA of transformation capacity.

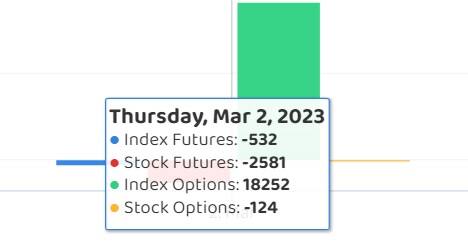

Fund Flow

Foreign institutional investors (FII) bought shares worth Rs 12,770.81 crore, while domestic institutional investors (DII) purchased shares worth Rs 2,128.80 crore on March 2, the National Stock Exchange's provisional data showed.

Stocks under F&O ban on NSE

The National Stock Exchange has not added any stock in its F&O ban list for March 3. Securities banned under the F&O segment include companies where derivative contracts have crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.