Splunk Delivers A Blowout Quarter, We Maintain Accumulate Rating

Summary

- Splunk Inc.'s successful transition from perpetual license to subscription revenue continues apace.

- The company reported its Q4 of FY1/2023 yesterday after the close. It was a superb quarter on every measure.

- Analyst reaction on the earnings call was muted, and the stock sold off on the print.

- We beg to differ. We think the stock can move up nicely from here - and the company remains a prospective M&A target to boot.

- We're long Splunk Inc. in staff personal accounts.

- Looking for a helping hand in the market? Members of Growth Investor Pro get exclusive ideas and guidance to navigate any climate. Learn More »

phototechno

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note's date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

On The Way To Becoming A Business School Case Study

If you really have nothing better to do, read up on our prior notes on Splunk Inc. (NASDAQ:SPLK), dating back to when the company was in difficulties. Start by reading the stuff we posted on the free side of Seeking Alpha a hundred years ago. You can find that here.

Read the oldest article first, where we are very critical of SPLK's failure to keep up with the shift from perpetual licensing to subscription in the enterprise software world. And watch how our view changes as the company gets ahold of the problem over time.

Over and above those notes, we've covered the stock extensively and in real time in our Growth Investor Pro subscription service here on Seeking Alpha, where our fundamental and technical analysis is enriched and added to by one of our community members, who has a professional background in technology company turnarounds.

Now, recently the company fired its old CEO and CFO and replaced them with new, hard-charging blood. The new CEO, Gary Steele, was formerly CEO at Proofpoint, a cybersecurity company which enjoyed success as a public company before being sold to the buyout firm Thoma Bravo. The choice of such a background is not, we suspect, a coincidence. The Splunk shareholder register includes two Thoma Bravo peers, being Silver Lake and Hellman & Friedman, and the financials are setting the company up perfectly to be acquired by a buyout shop or shops. The company is, as we have said many times, an M&A target sat right there in plain sight.

The company just reported a killer quarter. We see the adverse stock reaction as an opportunity to consider adding to existing positions if you've been looking for a moment to do so, or to open a new position if you're minded to do so. You doubt us? Check the numbers below.

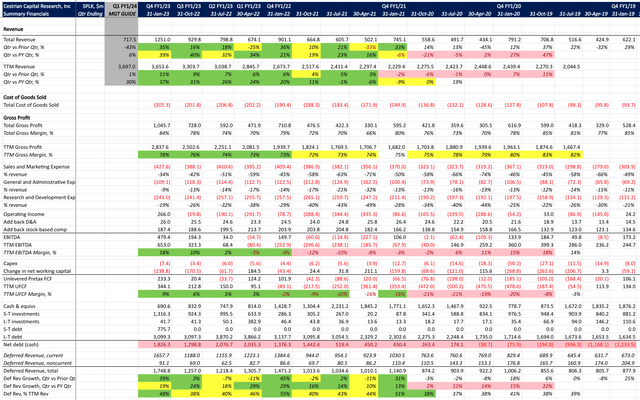

SPLK Fundamentals (Company SEC Filings, YCharts.com, Cestrian Analysis)

Let's draw out a few Q4 highlights:

- Revenue growth came in at +39% which is not only a huge rate of growth vs. the majority of software companies' fourth-quarter numbers, it's barely down on Q3 - whereas most other software names have seen material declines in growth rates.

- TTM revenue growth moved up to +37% vs the same quarter a year ago. This is not at all the norm in software right now where by and large companies are showing decelerating rates of growth.

- Gross margin is up to 78%, a level not achieved since the July 2020 quarter.

- EBITDA margins stand at 18% on a TTM basis and the margin progression is a thing of beauty - look at peak margins of +18% in the October 2019 quarter which then dip down into the negative as the transition from upfront licenses to subscription takes hold, then stepwise up every single quarter since the trough of -12% in the October 2021 quarter. If like us you have no outside interests and just like studying this kind of thing? That's a work of art right there.

- The same is true of unlevered pretax free cashflow (= EBITDA minus capex minus change in net working capital) which was at negative 21% on a TTM basis in the July 2020 quarter and is now up to positive 9% on a TTM basis.

- Balance sheet stands at net debt of $1.8bn which means leverage of 2.8x TTM EBITDA - that looks a lot for a public company but it's negligible for a leveraged buyout, and since this is an LBO-by-stealth, hiding in plain view on the public markets, that's just fine.

- Deferred revenue growth could be better at 19% up vs prior year - the company has some work to do in winning new prepaid orders, which is likely the source of Wall Street's ire on this name at present.

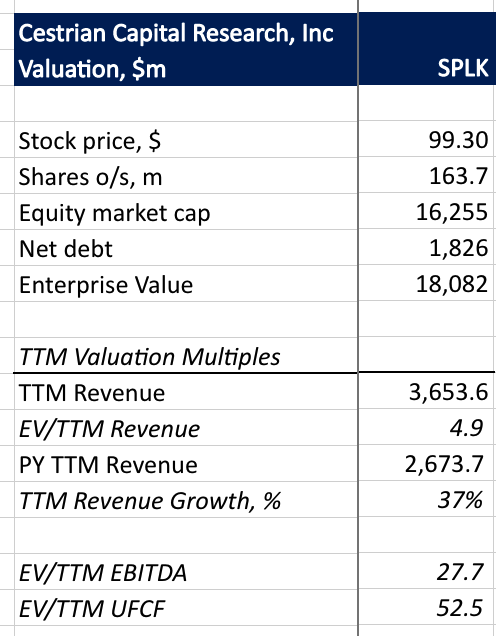

Valuation is unchallenging in our view.

SPLK Valuation (Company SEC Filings, YCharts.com, Cestrian Analysis)

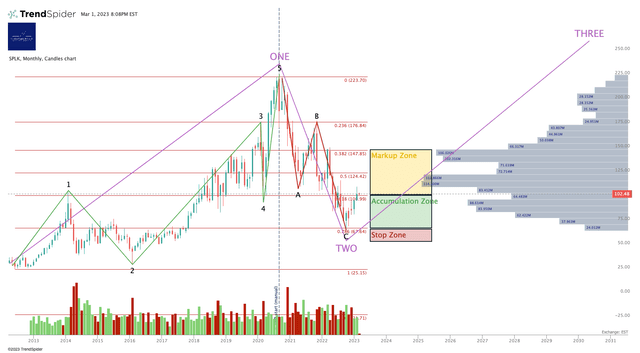

And finally the stock chart. You can open a full page version, here.

SPLK Chart (TrendSpider, Cestrian Analysis)

We rate Splunk Inc. at Accumulate. Either no buyout takes place but the stock should move up by sheer force of that growth rate and the uptick in margins - or Splunk Inc. is in fact sold, in which case a one-time pop is likely to come shareholders' way.

Cestrian Capital Research, Inc - 2 March 2023.

NEW - LOW COST NEWSLETTER FROM CESTRIAN CAPITAL RESEARCH

Our Growth Investor Pro service remains the #1 trending service on all of Seeking Alpha. Choose from the basic newsletter at just $99 for your first year, or the full real-time service. You can learn all about it here including the wall of 5-star reviews we've received in bear and bull markets alike.

This article was written by

Regulated by the Securities & Exchange Commission.

Cestrian Capital Research, Inc

5000 Birch St, West Tower, Suite 3000, Newport Beach, CA92660

Disclosure: I/we have a beneficial long position in the shares of SPLK either through stock ownership, options, or other derivatives. Business relationship disclosure: See disclaimer text at the top of this article.

Additional disclosure: Cestrian Capital Research, Inc staff personal accounts hold long positions in SPLK.