Enviva: A Gift To The Short-Sellers

Summary

- Enviva found itself in the crosshairs of short-sellers during 2022.

- Whilst they tried to dispel concerns, their inability to generate positive operating cash flow means they are yet to completely prove the short-sellers wrong.

- In fact, their cash flow performance actually worsened during the fourth quarter of 2022, thereby raising further doubts.

- They also announced an equity issuance that stands to make their already burdensome dividend payments even worse and thus even more likely to be cut.

- This pushed their share price down 10%+, effectively giving a gift to the short-sellers and in light of my concerns, I believe that maintaining my sell rating is appropriate.

Daniel Grizelj/DigitalVision via Getty Images

Introduction

Back in 2022, Enviva (NYSE:EVA) found themselves in the crosshairs of short-sellers who raised several issues and whilst management was quick to defend themselves, they were yet to completely prove the short-sellers wrong, as my previous article explained. Fast forward to the present day and sadly for shareholders, their latest results and accompanying equity issuance were effectively alike to a gift for the short-sellers as they sent their share price plunging over 10% in a single session and thus down to fresh 52-week lows.

Coverage Summary & Ratings

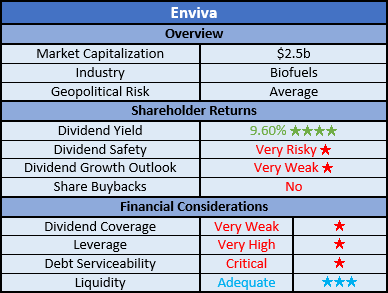

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

Following the short-seller report by Blue Orca Capital back during 2022, their full-year results were highly anticipated with shareholders hoping to finally prove the bears wrong. Whilst there were many concerns raised by Blue Orca, I nevertheless saw their cash generation to be the most pressing, as my previous article discussed.

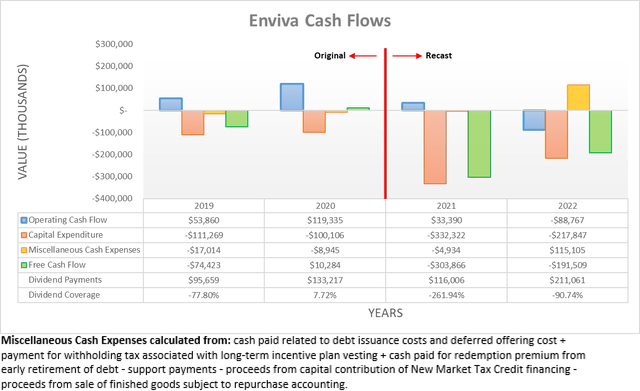

Sadly on this front, their operating cash flow not only failed to improve during the fourth quarter of 2022 but rather, it actually worsened with the full-year now seeing a result of negative $88.8m versus their previous result of negative $51.6m during the first nine months. Yes that is correct, they literally endured a cash burn to operate the company, let alone make investments or make shareholder returns, both of which proved to be hefty bills themselves. In the case of the former, their capital expenditure ended the year at $217.8m and in the case of the latter, their dividend payments required another $211.1m of cash.

Quite interestingly, the fourth quarter of 2022 also saw a new line item hitting their cash flow statement for the first time ever, as they received $102.3m pertaining to "proceeds from sale of finished goods subject to repurchase accounting", as their 2022 10-K. When constructing my graph above, this was included within miscellaneous cash expenses, thereby offsetting their other routine and relatively insignificant items, which are noted beneath. Whilst some investors may feel this offers a resolution to their cash burn, it should be noted these goods are subject to repurchase, as the line item aptly states. When taking a look at their balance sheet, they now see a $111.9m current liability pertaining to "financial liability pursuant to repurchase accounting" and thus, despite boosting their cash inflows during 2022, it could reverse during 2023.

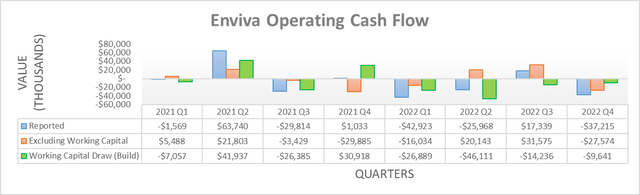

When looking into their quarterly operating cash flow, it is concerning to see no tangible signs of improvements, nor a positive overall direction. As for the reported operating cash flow, the fourth quarter of 2022 saw a negative result of $37.2m, hence their full-year result going backwards versus the first nine months.

Even more worryingly, their underlying results that exclude working capital movements do not see any improvements. When conducting the previous analysis, it was at least positive to see these improving sequentially earlier in 2022 with their respective results of $20.1m and $31.6m during the second and third quarters showing quarter-on-quarter improvements. Although, this ended with the fourth quarter and its result of negative $27.6m and thus their cash burn cannot simply be blamed on the timing of payments. If their working capital movements are excluded across the full-year, it sees an insignificant underlying result of $8m and thus, nowhere near enough to cover their dividend payments. Interestingly, they expect this otherwise dire situation to suddenly change during 2023, as per the commentary from management included below.

"For 2023, when you look at our cash flow from operations, what we expect is that our normal course of business fulfilling our contracted backlog in 2023 will generate operating cash flow that will not only cover our dividend that we've guided to, but in fact, exceed that dividend."

-Enviva Q4 2022 Conference Call.

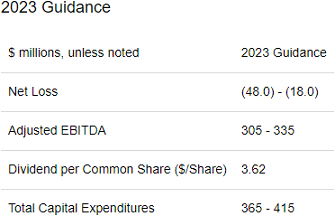

Whilst shareholders are obviously hoping for such a dramatic and very positive change, it nevertheless is difficult to see how their operating cash flow could see such a dramatic change. Due to their equity issuances throughout 2022, achieving this goal will require more operating cash flow than the $211.1m their dividend payments cost during 2022. Even if ignoring their subsequently discussed equity issuance that is yet to be completely finalized, their latest outstanding share count is 67,610,102, which means their quarterly dividends of $0.905 per share will cost at least a staggering $244.7m during 2023. In reality, the cost to fund their dividend payments during 2023 is going to blow out closer to circa $270m given their subsequently discussed equity issuance. Despite their very strong earnings guidance, it is difficult to see this goal being achieved given they did not generate any material operating cash flow during 2022 nor even 2021, ever since restructuring with their former parent company and thus changing from a Master Limited Partnership into a company.

Enviva Fourth Quarter Of 2022 Results Announcement

When looking at their guidance for 2023, they are forecasting adjusted EBITDA of $320m at the midpoint, which is roughly double their result of $155.2m during 2022, as per their fourth quarter of 2022 results announcement. Whether this leads to a sudden change in their cash generation remains to be seen but like it or not, they are still yet to completely prove the short-sellers wrong on this front.

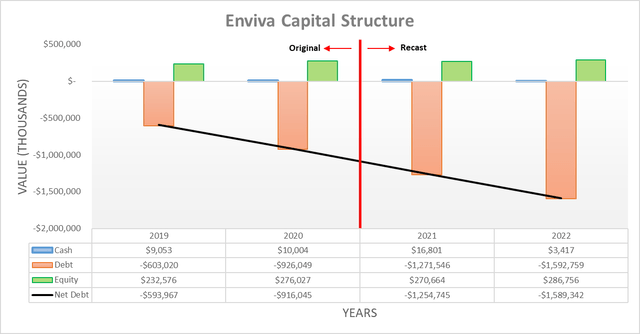

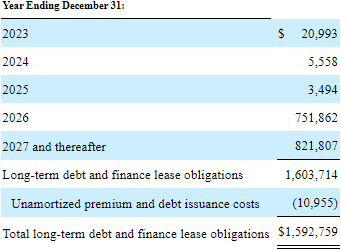

Due to the aforementioned $102.3m cash inflow from the sale of finished goods that are subject to repurchase agreements, their cash burn during the fourth quarter of 2022 only had a small impact on their net debt. That said, it still was insufficient to stop any increases with it climbing to $1.589b versus its previous level of $1.526b following the third quarter.

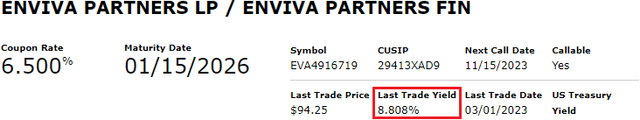

Even if they manage to turn their operating cash flow around and cover their dividend payments during 2023, their capital expenditure guidance for $390m means they will remain dependent upon external capital. On this front, they have also recently announced a $250m equity issuance that will help plug some of this gap but comes at a hefty cost given it represents about 10% of their current market capitalization of approximately $2.5b. The last thing their company needs is pushing the bill to fund their already burdensome dividend payments another circa 10% higher, which only makes their aforementioned operating cash flow goal even more difficult to achieve. Elsewhere, monetary policy is expected to remain tight throughout the entire year and possibly into 2024 and thus the cost of debt will remain elevated, as evidenced by their bonds trading with a high near-9% yield.

Similar to when conducting the previous analysis, their negative operating cash flow during 2022 makes it pointless to assess their leverage in detail, as it renders such ratios useless with logically invalid negative results. Instead, their gearing ratio can serve as a backup measure and given their net debt of $1.589b and equity of only $286.8m, it presently stands at 84.72%. Unsurprisingly, this once again represents another increase versus its previous result of 80.00% following the third quarter and therefore, pushing it further past the threshold of 50.01% for the very high territory. This same logic also applies elsewhere to their debt serviceability because their negative cash flow performance obviously leaves it critical with interest expense requiring a continued mixture of debt and equity issuances.

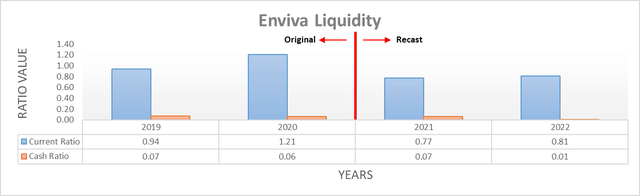

Following the fourth quarter of 2022, their liquidity remains adequate despite their current and cash ratios seeing their respective results decrease to 0.81 and 0.01 versus their previous respective results of 1.09 and 0.04 following the third quarter. More importantly, their credit facility did not see its availability suffer and in fact, it actually increased slightly to $133m versus its previous amount of only $97.9m following the third quarter, largely due to the issuance of a further $98m of tax-exempt green bonds, which were discussed when conducting the previous analysis. It will be important to monitor this during 2023 but at least one bright spot is their debt maturity profile, which only sees minor maturities until 2026 and thus provides a degree of breathing room.

Enviva 2022 10-K

Conclusion

Unless they flip a metaphorical switch during 2023 and turn on their cash generation, it is difficult to see how a company with no history of generating material operating cash flow can possibly turn a deep negative result into a strong positive result within one year. If this goal is achieved, it would be extremely impressive but even if forthcoming, their leverage is still very high and thus continue to hinder the appeal of their shares. To make matters even worse, their upcoming equity issuance is effectively a gift to the short-sellers by pushing down their share price via dilution whilst simultaneously making their dividend payments even more burdensome. Since I feel their dividends are very risky and likely to be cut, I believe that maintaining my sell rating is appropriate and look forward to publishing a follow-up analysis later in the year once subsequent results land.

Notes: Unless specified otherwise, all figures in this article were taken from Enviva's SEC filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.