PIMCO CEF Update: Rolling Horror Show

Summary

- We provide a January update for the PIMCO CEF taxable suite.

- Taxable and Muni funds continued to deleverage in January despite rising NAVs - in effect PIMCO is deleveraging over and above what is already done by NAVs.

- This dynamic is likely due to the poor economics of holding credit assets financed with leverage.

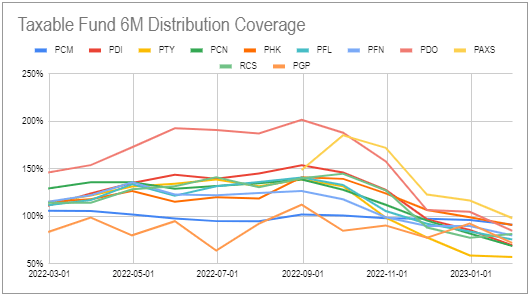

- Coverage falls accelerated across all funds with average coverage now 78%.

- We also take a brief look at the PDI SOFR futures position.

- We're about to raise prices at my private investing ideas service, Systematic Income, where members get access to portfolios, market alerts, real-time chat, and more. Learn More »

Darren415

This article was first released to Systematic Income subscribers and free trials on Feb. 21.

In this article, we provide an update on the PIMCO CEF suite. Specifically, we discuss the changes in leverage and distribution coverage for the month of January. We also highlight the significant changes in the interest rate swap portfolios of the funds. Although this may seem like an esoteric topic, changes in the swaps portfolio have a significant knock-on impact on the funds' income profile. The taxable suite has traded up strongly this year, with most of the rally due to a rise in valuations. We expect better entry levels for new capital over the coming year.

Leverage Update

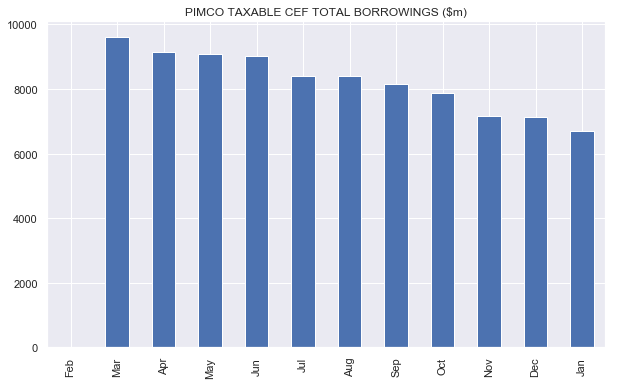

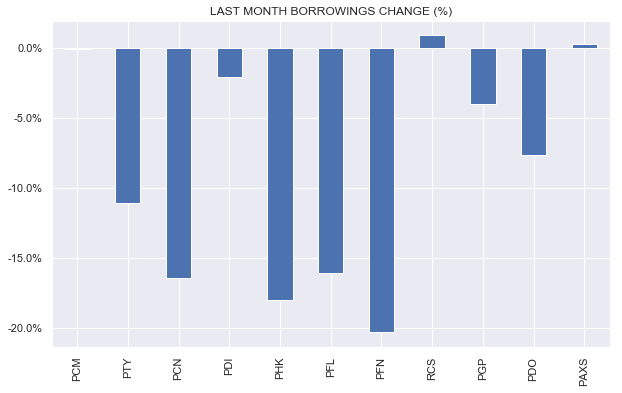

It was another month of falling borrowings for the PIMCO taxable suite in January.

Systematic Income

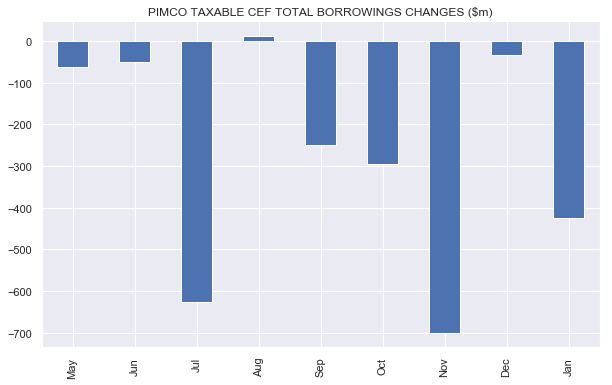

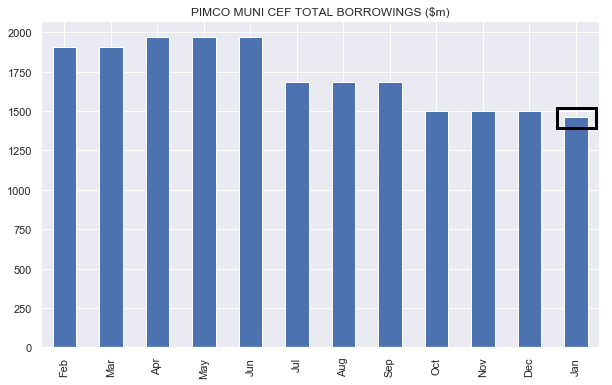

Apart from a small increase in borrowings in August, the taxable funds have consistently shed borrowings. January brought a fairly sizable drop of over $400m in borrowings.

Systematic Income

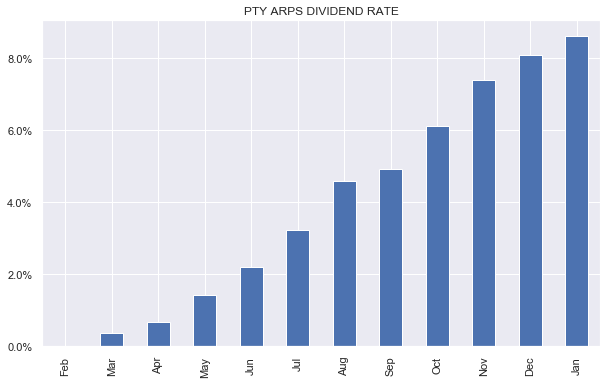

Interestingly, the cuts were larger mostly in the lower-leveraged funds which also happen to be those using more expensive ARPS for their source of leverage. This is not the first time we are seeing this dynamic. Perhaps PIMCO is trying to equalize overall borrowing cost across their funds which causes them to drop the borrowings of their ARPS funds like PTY, PCN, PHK, PFL and PFN at a faster pace.

Systematic Income

What was odd about another sharp drop in borrowings in January was that NAVs rallied. In other words, if PIMCO didn't touch the funds' borrowings the rise in the NAV by itself would have delivered a kind of organic deleveraging. We saw something similar happen in November when borrowings fell alongside rising NAVs. It's likely that PIMCO want to take leverage down even more than what has been delivered by higher NAVs, perhaps, as a response to rising leverage costs.

Systematic Income

Muni funds deleveraged slightly as well - for the third time in the last 7 months.

Systematic Income

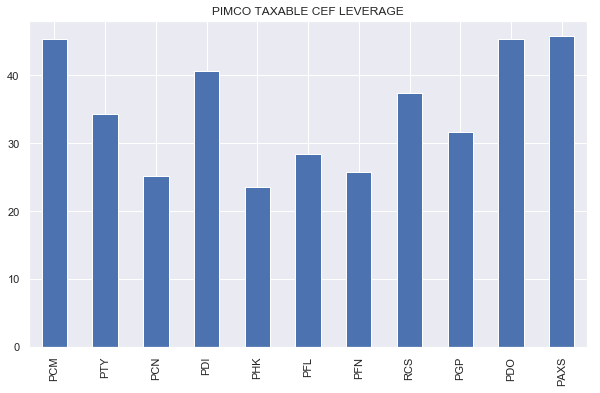

PDI coverage fell towards 40% while PTY has moved from a high-leverage fund to a modest-leverage fund. PDO and PAXS remain on the higher-leverage side in the suite.

Systematic Income

Coverage Update

Another trend that continued in January is the drop in distribution coverage in the taxable suite.

Systematic Income CEF Tool

All funds currently have coverage below 100%. The combination of low net income months and higher net income months falling out of the observation window both contributed to the drop in coverage.

Systematic Income CEF Tool

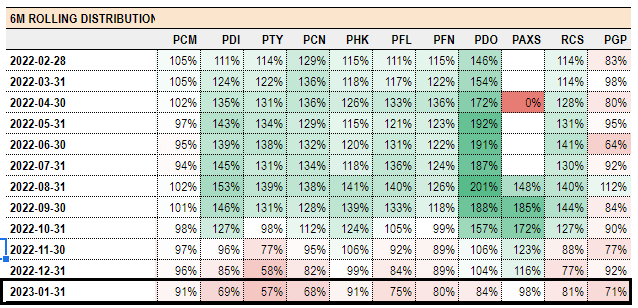

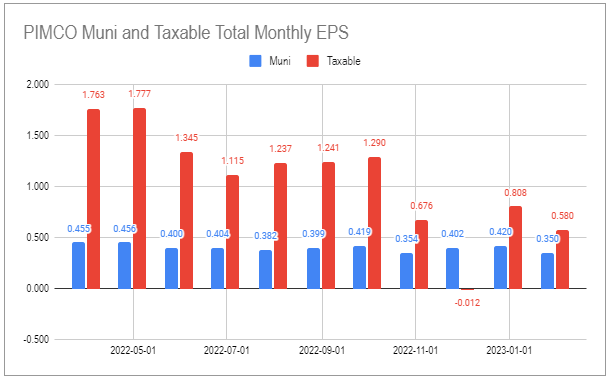

If we look at the monthly net income figures over the past year there is a clear downward trend. As we discussed over the past year this is due to the combination of deleveraging, rising leverage costs (particularly in the ARPS).

Systematic Income CEF Tool

Another way to look at the trajectory of net income is to add up total EPS across the tax-exempt and taxable suites (taxable suite excludes PAXS) which shows a clear downtrend across both suites.

Systematic Income CEF Tool

The interest rate on the ARPS continues to grow and is not far from 9% for a fund like PTY. On top of its management fee that means a typical high-yield corporate bond is generating a net yield of -1% in the fund's portfolio.

Systematic Income

Market Themes

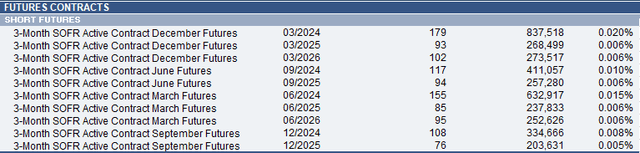

A reader pointed out a number of SOFR futures in the PDI portfolio. These have been in the portfolio at least from September or so.

There could be several reasons for these in the portfolio.

One is a simple bet by PIMCO that 3-month term SOFR will end up being higher than the market expects. Short positions in the futures gain if the futures price goes down i.e. the yield goes up. The mark-to-market suggests the fund has made money on the position already.

Another could be that it's an economic offset to the Libor-receive legs of the interest rate swaps in the PDI portfolio of which there are many.

A third reason could be that the fund uses futures to keep net income from falling further while keeping the paid short rates position. In other words, there are many ways for PIMCO to "pay" short-term rates. Doing so in cash instruments like short-dated bonds (though not T-Bills which have no coupons) has a direct and negative impact on net income because it requires the fund to pay out bond coupons. Doing so in cashless instruments like futures retains the economics but without the poor optics of negative income.

Overall, this position, while interesting, is not a key driver of the fund's net income profile.

Stance And Takeaways

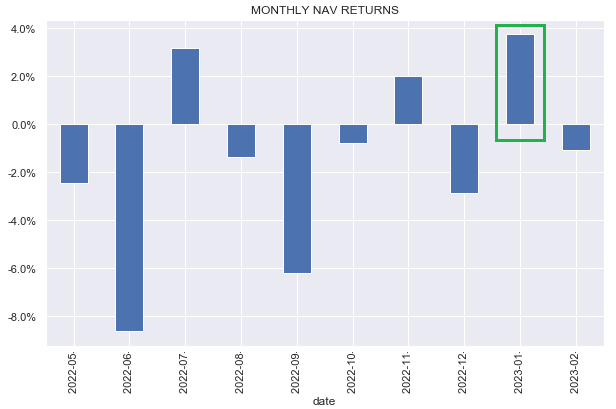

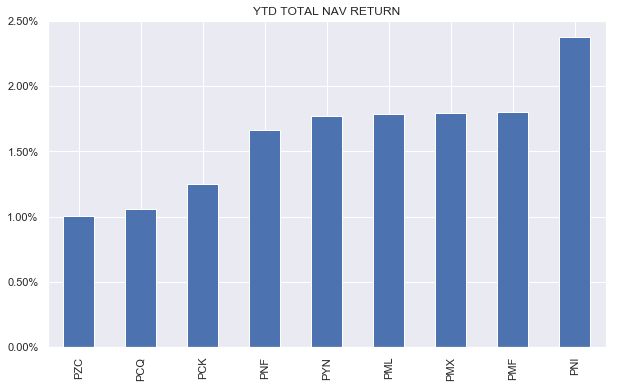

Despite the poor optics of low distribution coverage and continued deleveraging, the taxable funds have performed well this year with PGP in the lead given its large equity position. RCS has performed well given the sharp rally in Agencies while PTY has outperformed in spite of its modest leverage profile.

Systematic Income

PIMCO Muni funds have done ok as well.

Systematic Income

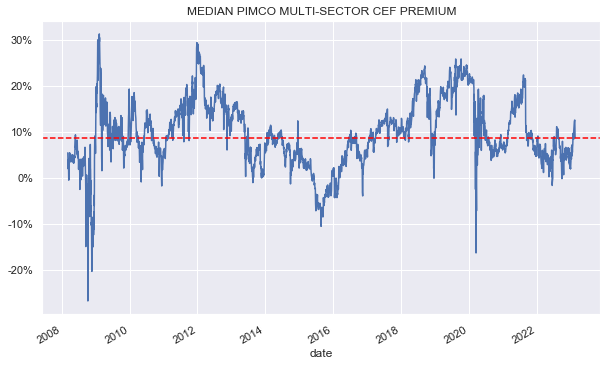

PIMCO taxable CEF premiums are close to their highs over the past year although they are in the middle of the historic range.

Systematic Income

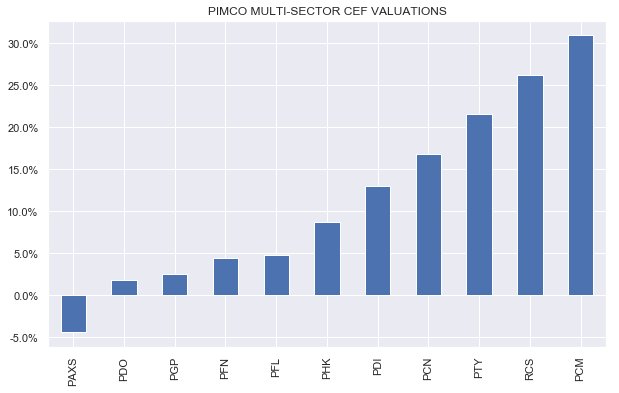

PCM has moved out to feature the highest premium which is extremely expensive for the fund - its historic discount percentile is 99%, meaning its premium has only been higher 1% of the time in its history. PAXS remains more reasonably valued.

Systematic Income

Looking at recent developments across the PIMCO CEF suite it's tempting to feel bipolar about PIMCO CEFs. Many investors cannot get enough of the funds when they perform well and can't sell them fast enough when they don't. Ultimately, PIMCO managers don't control the market environment and these funds, while they have many bells and whistles, are easily tossed around by market waves. In our view, valuation and market environment are better guides for investing in these funds than their recent track record.

Overall, while we have reduced our own exposure to PIMCO taxable CEFs in December in favor of floating-rate asset funds, these funds are far from uninvestable in the current environment. Coverage has always been very noisy across the suite and current levels are unlikely to be indicative of actual coverage just as very high coverage levels in 2022 were also not indicative of actual coverage. Distribution cuts are always a risk for the suite, particularly across the higher NAV distribution rate funds such as PCM, PDI and PTY, not in the sense of imminent timing but in the sense of potential premium deflation in case of a cut - something we have seen time and time again across the suite. Permanent economic losses arising from premium collapse can be hard to make up and require attention on the part of investors.

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

This article was written by

At Systematic Income our aim is to build robust Income Portfolios with mid-to-high single digit yields and provide investors with unique Interactive Tools to cut through the wealth of different investment options across BDCs, CEFs, ETFs, mutual funds, preferred stocks and more. Join us on our Marketplace service Systematic Income.

Our background is in research and trading at several bulge-bracket global investment banks along with technical savvy which helps to round out our service.

Disclosure: I/we have a beneficial long position in the shares of PAXS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.