Tandem Diabetes: Top-Line Growth Remarkable, Not At 0.04% FCF Yield

Summary

- Remarkable top-line growth coupled with pump shipments.

- Higher average sale price illustrating improved unit economics for the year.

- Valuations unsupportive, profitability also a headwind for growth in bottom-line fundamentals.

- Net-net, rate hold.

naphtalina/iStock via Getty Images

Investment Summary

As the new year pushes forward, I've maintained exposure to selective names with the diabetes management pocket of the med-tech sphere. My ratings on Insulet (PODD) and DexCom (DXCM) and Medtronic (MDT) [via its MiniMed device] remain unchanged. Check out coverage on the former two here:

At the same time, I had debated ad nauseam in FY22' on how to potentially allocate towards Tandem Diabetes Care, Inc (NASDAQ:TNDM). In the publication, titled "Overpriced, Underdelivering" I recommended a neutral view and opted to wait on the sidelines, until the company demonstrated meaningful upsides in its installed base and patient base and how this converted through to the top and bottom-lines. The company posted its Q4 and FY22' numbers last week, and quoting the CEO's language on the call, "sales efforts focused on expanding the worldwide insulin pump market as well as introducing the benefit of TNDM's technology to existing pumpers". The company's latest numbers were another repeat of this, with a greater share of total revenue obtained from its international markets, with margin compression throughout the P&L. Net-net, whilst top-line momentum has been remarkable for TNDM, with a rising cost of capital, combined with unsupportive valuations, I rate TNDM a hold.

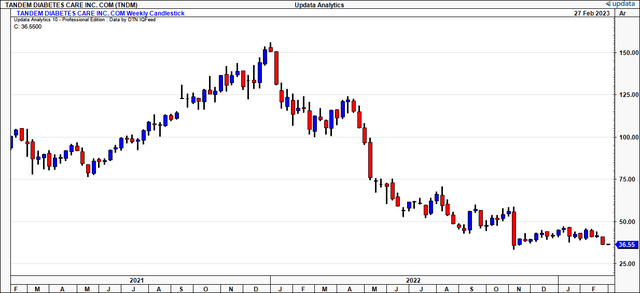

Fig. (1) TNDM Weekly Price Action, FY21–date

TNDM FY22 analytics

To further elaborate on TNDM's FY22' numbers, it was another mixed result throughout the P&L and cash flows. It clipped full-year sales exceeding $801mm, reflecting a doubling in top-line sales over the last 3 years. Underscoring the upside, TNDM's pump products were the key driver of growth, accounting for ~54% of turnover. To this point, the company has been expanding its presence in the insulin pump market, which it says is "just over 35% penetrated in the U.S. and typically only 10–20% in the geographies [it] serve outside the U.S.". Looking to Q4 specifically, it clipped top-line sales of $221mm, booked from 36,000 pump shipments worldwide, a 12.5% quarterly increase from the last publication.

Breaking down the company's 2022 sales by geography, the following points are noteworthy:

- TNDM's U.S. sales were $589mm, underscored by growth in supply sales that witnessed a 20% YoY increase in the U.S. installed base, now totalling 290,000 patients. TNDM is also seeing strong renewal numbers, with a c.60% increase in renewal shipments for the year. Added to that, >50% of customers whose warranties expired in FY22' already renewed, creating a potential tailwind for the following periods. Overall, the company shipped 84,000 pumps in the U.S. in 2022, representing an average sale price ("ASP") of $6,848.80. Importantly, on its $166mm in U.S. revenues, it shipped 24,000 units, therefore at an ASP of $6,916 [above $6,250 in Q2 FY22']. Hence, the unit economics began to improve towards the back end of FY22', illustrating momentum in that regard.

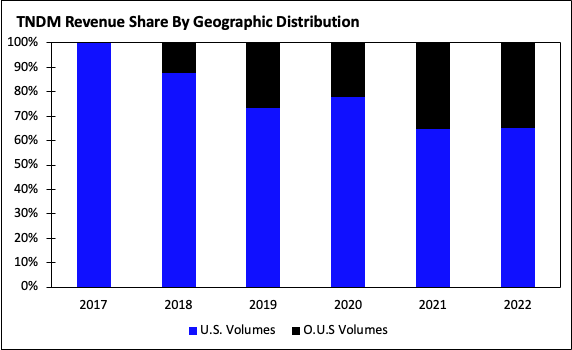

- Outside the U.S. ("OUS"), TNDM's sales in FY22' came to $212mm, growing 19% YoY. This growth was also underlined by a 35% increase in supply sales, where the OUS installed base reached 130,000 by the end of the year. Additionally, TNDM benefited from overall price increases here as well. Still, whilst placements grew ~20% YoY, actual pump shipments were flat YoY. Management say the difference relates to the variation and timing of orders from TNDM's distributors, whose ordering patterns have been impacted significantly by logistics challenges with the supply chain headwinds from last year. To this point, the company expects to see higher order fulfilment relative to demand when it transitions to its European distribution centre, which began in late Q3 FY22'. Furthermore, TNDM has been increasing its OUS revenue market, with the revenue share from ex-U.S. sales increasing since FY18' [Figure 2].

Fig. (2)

Data: Author, data from TNDM 10-K

Looking at the marginal analysis, full-year gross margin compressed by 200bps to 52%. This is surprising given the higher ASP shown above, and, given the company's liquidity preservation measures throughout the year. Alas, it wasn't immune to inflationary pressures, and this could be a major headwind to revenue and NOPAT upside looking down the line, should the cost of raw materials remain high this year. Moving down the P&L, operating margin pulled to negative 12%, pressured by a $31mm charge in Q3 tied to the closing of the Capillary Biomedical acquisition, along with a $12mm outflow recognized for facility consolidation costs. Backing these out, I came to an adj. EBITDA margin of 7% for the year.

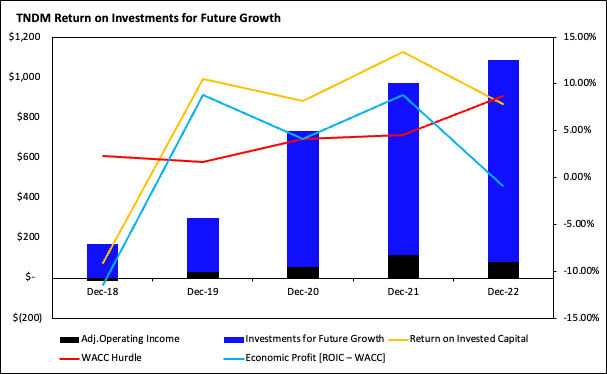

Meanwhile, with respect to cash flows, TNDM generated $50mm in CFFO for the year, and, followed by $17mm from its employee stock programs, was able to allocate $35mm towards financing its strategic growth initiatives. It's important to reconcile TNDM's GAAP earnings to reflect a truer measure of where it is investing for future growth, namely in its R&D, and then compare this to the adj. operating income afterwards. Doing so, we see the company has exhibited a positive ROIC since FY19' onwards [Figure 3], but the challenge in FY22'–date has been the increasing cost of capital, given the macro climate. As a result, the company's economic profit for FY22' [ROIC – WACC hurdle] was negative 86 basis points, below an impressive 8.86% the year prior.

Fig. (3)

Data: Author, data from TNDM SEC Filings FY18–date

Looking ahead to the coming year, TNDM expects to generate revenues of $900mm at the upper range, calling for a growth rate of ~12% at the top line. I'd note this growth rate doesn't include sales from anticipated new product launches, so we could see some upside on this if the company converts on its pipeline. I'd also highlight that the guidance range also takes into account some timing impact related to its distribution centre in Europe expanding. U.S. non-GAAP sales are projected at $650mm–$660mm, assuming that the macro environment doesn't turn sour. Meanwhile, OUS are forecast for $240mm at the upper bound, baking in a $25mm headwind for its Europe distribution centre discussed above. It looks to these top-line numbers on an adj. EBITDA margin of~ 5%–6% of turnover. Importantly, the R&D investment for its new acquisitions is anticipated to come in at ~300bps of sales.

Future growth levers in TNDM's growth engine

Looking to the coming periods, there are two main talking points that must be factored into the investment debate:

- TNDM recently announced a pipeline of new innovations that are scheduled to move from development phase to potential commercialization. The company is currently focused on the commercial launch of the t:slim X2 with G7 integration, which is expected to be available worldwide in the latter half of Q2 this year. With this integration, TNDM aims to have first move advantage with G7 integration in an AID system. Oftentimes, I've seen diabetes management devices incur notable delays through the FDA process. So if it can roll this out, it will be a meaningful tailwind in my estimation. The company plans to deliver the software update to its existing in-warranty t:slim X2 customers, for no charge.

- In addition to its near-term growth initiatives, TNDM has clinical momentum in FY23' worth mentioning. The company has started enrollment in its 2nd feasibility study for Control-IQ 2.0. Further, the company is also in the woks to commence a pivotal study to support a type 2 diabetes indication for its Control-IQ segment. It's also worth noting that the company's work with Abbott (ABT) to integrate the t:slim X2 with its FreeStyle Libre segment. As a side note, ABT is currently awaiting FDA clearance for Libre for an automated insulin delivery indication, so this is a point to watch going forward.

Valuation and conclusion

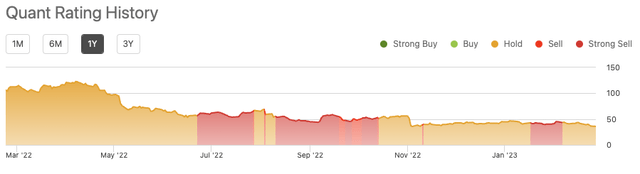

Any hope of a buy call falls apart with the valuation debate for TNDM in my estimation. The stock trades at >5x book value and is priced at more than 46x trailing CFFO, whilst trading at a FCF yield of just 0.04%. Yet, it is priced at a discount to the industry at 2.4x forward sales, and I would expect to see TNDM grow sales by ~2.5x over my 3-5 year investment horizon. Nevertheless, these aren't attractive numbers on face value, and I'd expect TNDM to face continued pressures with respect to valuation upside, until it can start to feed more down the P&L and improve its bottom-line fundamentals. Further, that its ROIC was behind the hurdle rate this year, the growth TNDM achieved wasn't accretive to shareholder value. Finally, the quant system has it rated as a hold as well, further supporting a neutral view.

Fig. (4)

Data: Seeking Alpha TNDM see: "Ratings".

Net-net, TNDM's commitment to innovation and development of new products in the diabetes care space bodes well for the company's future growth prospects. Whilst momentum garnered to date has been remarkable in this date, I believe the company has more to do to demonstrate its propensity as a viable investment case given the abundance of selective opportunities available to investors right now. Clamping the buy case are current valuations, and the lack of long-term profitability whilst the cost of capital continues shifting higher. Net-net, this warrants a hold.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.