Ginkgo Bioworks: Solid Fourth Quarter, But The Company's Future Remains Uncertain

Summary

- Improved reporting gives greater insight into the business, but investors are still left with little visibility into potential downstream value.

- Ginkgo needs to demonstrate that they are more than a CRO by negotiating favorable contracts with customers and helping customers commercialize novel products.

- Ginkgo's valuation now appears modest, but a lack of growth and large losses in 2023 are likely to pressure the stock.

Evgenii Kovalev

Ginkgo Bioworks (NYSE:DNA) is still finding its feet as a public company, with the stock continuing to decline on the back of valuation concerns and declining Biosecurity revenue. A growing number of active foundry programs and increasing revenues from non-COVID Biosecurity projects should limit revenue decline in 2023. Despite this, Ginkgo is likely to incur large losses due to ongoing platform investments and recent acquisitions. Investors are unlikely to view this combination favorably, which could limit upside for the stock over the next 1-2 years.

Foundry

Ginkgo's foundry business continues to grow steadily, but the reliance on downstream value makes the unit economics extremely opaque. To create value for shareholders, Ginkgo must be able to negotiate favorable contracts with customers, which could be on the basis of platform costs or capabilities.

Management has stated that biotech companies outsource to CROs for work they don't want to do, whereas they outsource to Ginkgo for work they can't do. If this is the case, downstream value streams should begin to accumulate over the next few years, moving Ginkgo towards profitability.

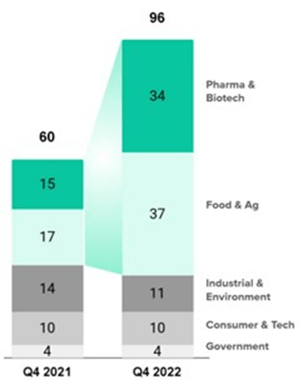

Ginkgo's foundry business is now dominated by pharma & biotech and food & ag programs, which is not surprising given the current limitations of synthetic biology. Ginkgo's approach ignores a large part of the value chain, which is fine in an industry like pharma, where there is significant experience commercializing biological products, but within many markets scaling fermentation, downstream processing and marketing remain extremely difficult. Ginkgo still believes that there is a large opportunity in industrial biotech, but that the market is still developing. This will occur over time, but Ginkgo is left waiting for someone else to do the work.

Figure 1: Ginkgo Active Programs by Industry (source: Ginkgo Bioworks)

Within biotech & pharma, Ginkgo has exposure to a range of therapy types and programs ranging from discovery to supporting manufacturing. This diversifies risk, and in the case of programs targeting manufacturing, should lead to much earlier value recognition.

Figure 2: Ginkgo Biopharma Customers (source: Ginkgo Bioworks)

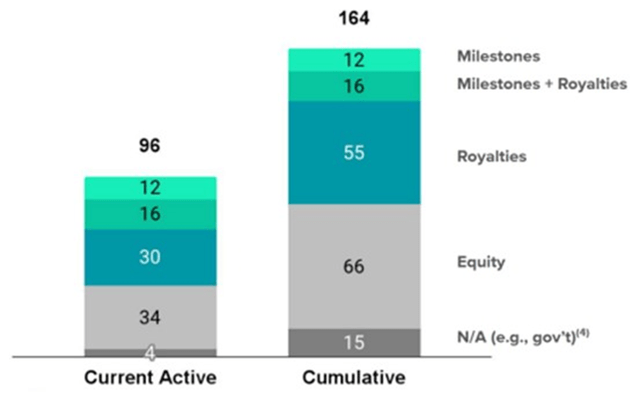

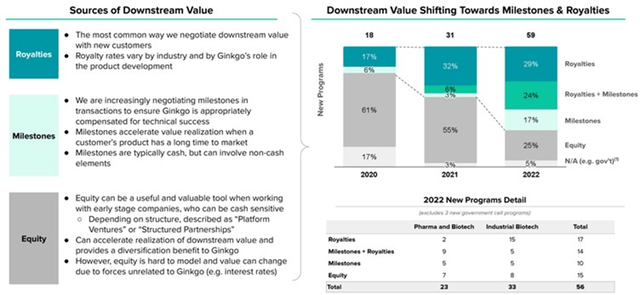

Ginkgo is now giving more information on potential downstream value (types of value and number of programs), but this is insufficient for the purpose of valuing the company. Ginkgo has previously stated that programs would on average have an NPV of 15 million USD, but small changes in assumptions could significantly alter this value. It is also not clear from the given information whether any of the programs have already failed, and hence will not generate downstream value.

Figure 3: Ginkgo Downstream Value (source: Ginkgo Bioworks)

Downstream value has shifted towards milestones and royalties over the past few years, which could just be a function of Ginkgo relying less on related parties. It would be interesting to know how much of this shift is driven by Ginkgo's preferences versus the demands of customers. Milestones should reduce exposure to commercialization risk, but may also limit upside.

Figure 4: Evolving Downstream Value Structure (source: Ginkgo Bioworks)

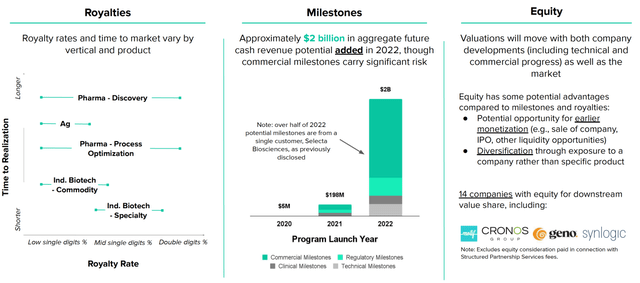

Ginkgo added approximately 2 billion USD in potential milestone revenue in 2022, but most of these milestones require clearing commercial and regulatory hurdles, which are both low probability events. In addition, over 1 billion USD of the potential milestones comes from Selecta Biosciences (SELB), a company with a 250 million USD market cap.

This data really highlights the difficulty of assessing Ginkgo at this stage. Royalty rates can vary by almost an order of magnitude and the commercial potential of different programs is likely to vary by even more. There is also a need to consider the probability of program success, which can be extremely low for drug development.

Figure 5: Ginkgo Downstream Value (source: Ginkgo Bioworks)

Ginkgo is yet to demonstrate a consistently growing stream of royalties, which raises questions about the commercial traction of the underlying products. There is a growing stream of manufacturing revenue, but this seems to run counter to Ginkgo's positioning as a platform company. Until Ginkgo builds larger streams of passive high-margin income, the company's current business model will not be validated.

Figure 6: Ginkgo Downstream Value (source: Ginkgo Bioworks)

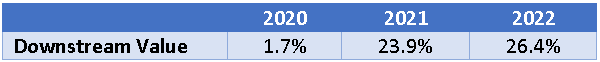

While it is still early days, downstream value is beginning to contribute more to foundry revenue. Ginkgo is likely at least several years away from this creating a sustainable business though.

Table 1: Ginkgo Downstream Value as a Percentage of Foundry Revenue (source: Created by author using data from Ginkgo Bioworks)

Ginkgo expects to add 100 programs in 2023, which is quite impressive given the uncertain macro environment. The terms of these programs is unknown though, and it is possible that Ginkgo is being forced to offer more attractive terms to customers in order to maintain growth. It is also possible that as Ginkgo's business scales, their capabilities are attracting customers who are willing to give up more value to Ginkgo. There is simply no way to know at the moment, and given the long timelines involved in drug development, this may not become clear for many years for some programs.

Biosecurity

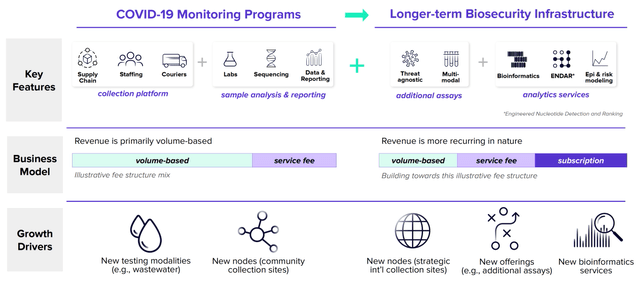

Ginkgo's Biosecurity business is now shrinking rapidly, as the boost provided by COVID fades, but it is also becoming more diversified and expanding internationally. Going forward less revenue is expected from K-12 COVID testing, but more recurring revenue is expected from threat agnostic tests.

Figure 7: Ginkgo's Biosecurity Business (source: Ginkgo Bioworks)

Ginkgo's Biosecurity gross margin declined to 33% in the fourth quarter of 2022. This was attributed primarily to an inventory reserve for purchased products. It is not clear how Biosecurity margins will evolve as COVID testing winds down, but this could be important as the Biosecurity business has helped to limit losses over the past few years.

Ginkgo is guiding for 100 million USD Biosecurity revenue in 2023, with almost half of this expected to come from emerging product lines that are more recurring in nature. This guidance is likely conservative, as it is based on programs with high visibility, but investors should not expect large beats like 2022.

Financial Analysis

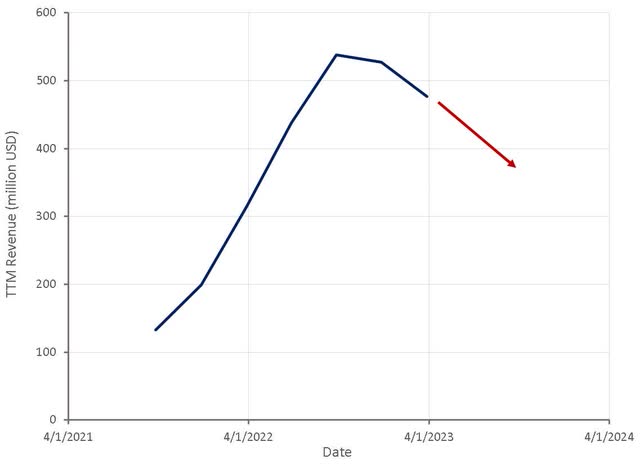

Ginkgo's revenue is likely to decline for at least the first half of 2023, due to lower revenue from the Biosecurity business. A lack of growth is likely to be frowned upon by investors, but this will be compounded by the fact that it will also contribute to larger losses.

Figure 8: Ginkgo Revenue (source: Created by author using data from Ginkgo Bioworks)

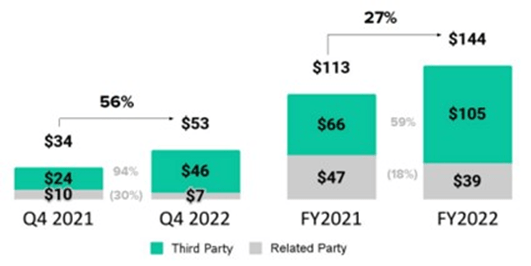

Ginkgo's foundry business continues to expand though, and is now far less reliant on related parties for revenue. This is important, as the foundry business should be where the real value lies, if management can fulfill their own vision.

Figure 9: Ginkgo Cell Engineering Revenue by Party (source: Ginkgo Bioworks)

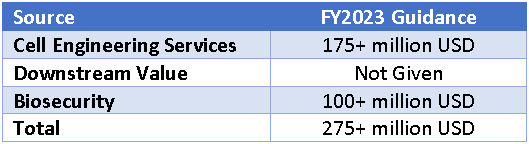

Management has guided to 275 million USD revenue in 2023, although this is likely a conservative estimate and it does not include downstream value. Even with downstream value and a strong 2023, Ginkgo's revenues are likely to decline YoY.

Table 2: Ginkgo Bioworks FY2023 Guidance (source: Created by author using data from Ginkgo Bioworks)

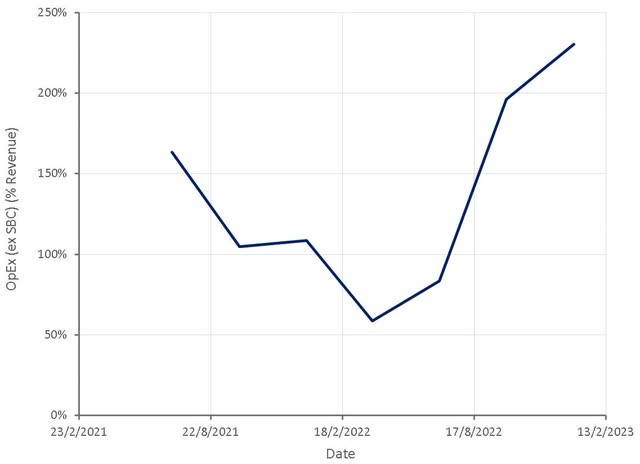

Operating expenses are likely to increase substantially in 2023 due to investments in the platform and the burden of recent acquisitions. Stock-based compensation is now normalizing, but even outside of this, Ginkgo operates a relatively high cost business that will need to grow significantly before breakeven is achieved.

Figure 10: Ginkgo Bioworks Operating Expenses (source: Created by author using data from Ginkgo Bioworks)

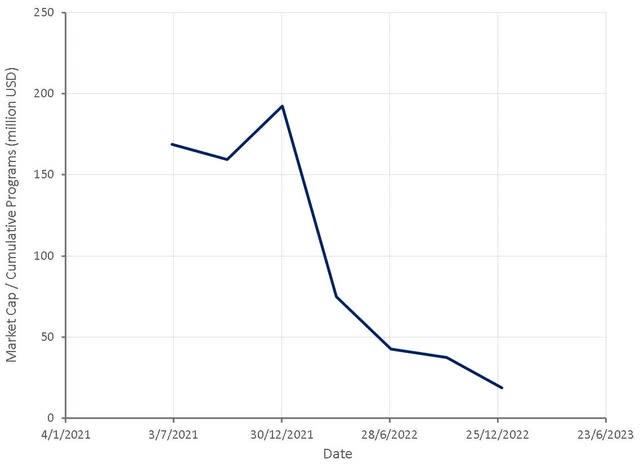

Valuation

Ginkgo's reliance on downstream value makes valuing the business difficult, but for investors that believe royalty and milestone payments will flow in the future, Ginkgo's stock is beginning to look reasonably priced.

Figure 11: Ginkgo Valuation Based on Downstream Value (source: Created by author using data from Ginkgo Bioworks)

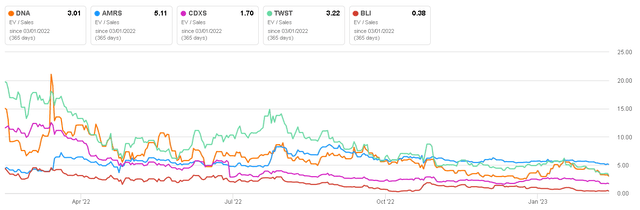

Based on current revenue, Ginkgo is priced broadly in line with synbio peers, but this is a less relevant metric, as management has stated that foundry service revenues are only supposed to help the company breakeven.

In any event, Ginkgo's valuation may not matter much over the next 1-2 years. Declining revenue and large losses will not be viewed favorably by investors in the current environment, and until Ginkgo begins to demonstrate growth and progress towards profitability, the stock will likely have limited upside.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.