Amyris: Dismal Outlook, Run For The Hills

Summary

- Amyris is in dismal financial condition and will be required to raise additional capital to survive.

- This capital raise will likely be through equity, as the company would have a tough time getting affordable debt financing.

- Increasing losses and a terrible balance sheet are not a good combo.

- The company does not have a history of executing well.

- We see no reason for investors to take the leap here.

Anna Tretiak/iStock via Getty Images

Thesis

Amyris (NASDAQ:AMRS) is in terrible financial shape and will need to raise capital in order to survive. This will likely be in the form of equity, as they will have difficulty tapping the debt markets at an affordable rate. Their operating losses are increasing and their balance sheet is impressively bad. Their negative shareholder's equity suggests that the company is better at selling promises than product, and we see no reason for investors to touch Amyris with a ten-foot pole.

Burn Rate

First thing is first: Amyris was able to secure up to $350 million in cash from Givaudan. While this seems like good news on the surface, there are many caveats, the most imminent being that the agreement has not closed yet. The company will also need to spend $50 million of that cash to buy out their Aprinnova JV.

Even in the best-case scenario, the $350 million in cash will not last long given the current burn rate.

From a cash flow perspective the company used $433,017,000 of cash in operating activities over the 9 months ended September 30. The company currently has $18,489,000 of cash and cash equivalents. It is highly likely that the company will have to do at least one capital raise, as the cash gained from the Givaudan deal will not be enough to cover their cash burn, even at reduced levels.

Of course, the CEO claimed on their most recent conference call (Q3) that they don't have any plans for dilutive financing, but they ended up doing just that in Q4. Management doesn't seem to have much visibility into their business, and that is putting it lightly. Investors should expect a minimum of one round of equity financing in 2023, and potentially more.

Increasing Operating Losses

The company reported a loss from operations of $148,178,000 for the three months ended September 30, compared to a loss of $86,845,000 in the year ago period. For reference the company had total revenues of $71,129,000 for the three months ended September 30. It's difficult to imagine how it is possible for the company to have operating losses that are over twice their revenue given the business they operate in. I've followed this company for a while and it seems to be chronically mismanaged with a constant inability to show operational success. There was a time that the company was focused on a few key brands and had the potential to really focus on driving efficiencies and "growing up", but no longer.

Their gross margins stand at a pitiful 9.2%. And if you thought their operating results are bad, their balance sheet is even worse.

Balance Sheet Woes

Amyris has a debt load of around $675 million. This debt hangs like a guillotine over the firm, and reduces the present value of the company (assuming they are ever able to actually operate profitably). If I had to guess the company will eventually be sold for parts and the debt holders will try to recoup their capital that way. Even if the parts are worth more than the whole, it is unlikely that equity holders will be walking away with anything meaningful in such a scenario.

Promises for Sale

Amyris has a book value of negative $440,686,000, and accumulated losses of $2,730,381,000. Investors have been willing to watch the company set money on fire for a long time and don't have much to show for it.

Amyris has enjoyed wrapping themselves in the flag of ESG more than actually running a viable business. As great as saving the planet is, a business can't achieve that goal by going bankrupt.

For those who have not followed the company over the years I encourage you to simply visit their website and see for yourself. Investors will eventually grow tired of companies that sell promises and dreams to investors rather than operate a viable business, and it was easy to justify when the cost of money was zero. Amyris will find it difficult to raise capital in these conditions, and as such find it difficult to continue wasting money. At the end of the day Amyris either needs to grow up and profitably operate their business or they will go bankrupt. I don't have much faith in their ability to survive in the short term, let alone reward equity holders over the long term.

Price Action

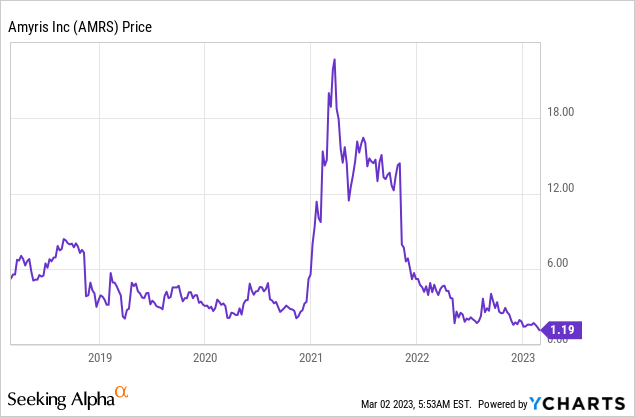

Hype is a powerful thing, and it took Amyris stock to fantastic heights in 2021. Congratulations to all investors that were able to sell during that time. For now the fundamentals and technicals point to the stock continuing to move lower. Add in the likely equity raise and there doesn't seem to be a reason for investors to buy at the moment (or ever), barring some sort of short squeeze.

Valuation

There really isn't a way to value this company using traditional valuation metrics. With a negative book value and operating losses that are twice their revenue, there doesn't seem to be a way to remotely justify an investment based on fundamentals. An investment here might as well be a lottery ticket, betting that the value of the parts are worth enough to justify the current market cap as well as pay off all bondholders. Of this I am not optimistic, but it is within the realm of possibility.

Risks

A risk to this bearish thesis is management's ability to perform a drastic turnaround. New management could pull this off, but we find it unlikely. In a way it's like expecting the fire department to remove nuclear fallout.

Doerr could take the company private and may be willing to do so at a premium to the current share price out of the kindness of his heart. He certainly could afford to do so, but hope doesn't seem like a reason for making an investment.

We view the risk/reward here to be exceptionally poor. Even in the best-case scenario the present value of the company does not justify an investment at these prices due to their low margins and debt hangover.

Key Takeaway

There is simply nothing to like regarding Amyris. Poor operational results, poor balance sheet, poor execution over their many years of operation. Investors who are considering making an investment in Amyris should run away and never look back.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.