Buy Tesla's $10 Trillion Master Plan 3

Summary

- Being down about $600 million as compared to the Tesla stock's all-time-high valuation, Tesla shareholders eagerly anticipated Elon Musk's 2023 Investor Day.

- During the event, Elon Musk touted a $10 trillion investment target to develop opportunities for sustainable energy coverage worldwide.

- After reporting FY 2022 deliveries of approximately 1.31 million vehicles, Tesla’s updated ambition now calls for 20 million electric vehicles per year by 2030.

- Working on a new vehicle manufacturing platform, the "New Generation Vehicle," Tesla voiced an opportunity to materialize a 50% reduction in EV production cost.

- The EV maker confirmed that the long-awaited Cybertruck will be available for sale in 2023, with volume production expected in 2024.

jetcityimage/iStock Editorial via Getty Images

Thesis

After losing almost $1 trillion of equity value as compared to the stock's all-time high valuation (now down about $600 million), Tesla, Inc. (NASDAQ:TSLA) shareholders eagerly anticipated Elon Musk's 2023 Investor Day. But after 4 hours of discussion, with arguably little "new" content, Tesla investors left the event somewhat disappointed -- punishing TSLA shares down by 6% in afterhours trading. The selloff is not justified, in my opinion, as I believe Tesla shared some exciting ambitions for business growth.

I have followed the investor day presentation from the first second to the last, and in this article, I will share with you my key insights.

$10 Trillion In CAPEX

Perhaps the most attention-catching statement from Elon Musk was made in relation to an ambitious $10 trillion investment target to develop opportunities for sustainable energy coverage worldwide. That said, Musk hopes to build out a mining and refining supply chain for raw materials, paired with an extensive energy storage and batteries strategy. Expressed in numbers, Musk's worldwide energy strategy targets an energy generation footprint that could cover as much as 0.2% of the Earth's land and a global energy storage capacity of 240,000 gigawatt hours. With that frame of reference, Musk also voiced optimism that the energy-transition is achievable.

There is a clear path to a sustainable-energy Earth. It doesn’t require destroying natural habitats. It doesn’t require us to be austere and stop using electricity and be in the cold or anything

... In fact, you could support a civilization much bigger than Earth, much more than the 8 billion humans could actually be supported sustainably on Earth.

20 Million EVs By 2030

Another truly attention-grabbing statement was (again) made also regarding Tesla's production/ deliveries target. After reporting FY 2022 deliveries of approximately 1.31 million vehicles, Tesla’s updated ambition now calls for 20 million electric vehicles ("EVs") per year by 2030. If successful, Tesla's 2030 target would imply a unit CAGR of slightly more than 40%.

Without a doubt, Tesla's ambition to sell 20 million EV units by 2030 is stretched. But, investors should consider that, in theory, the market could offer room for it. In fact, various estimates predict that the EV market could grow to 40 million units by 2030, which would imply a market share for Tesla of about 50%. For reference, Tesla's 2022 market share for EVs is 65%.

Implications For Valuation

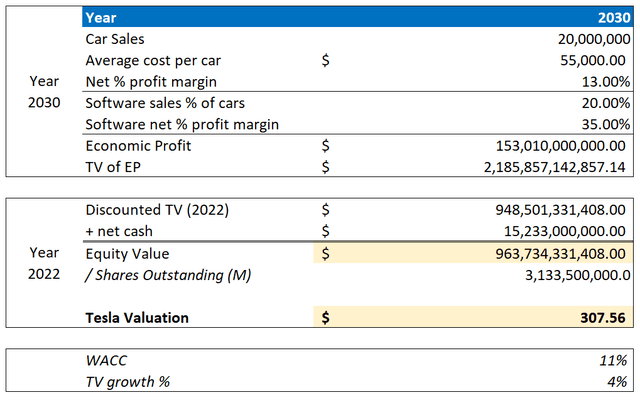

For reference, I have previously estimated that Tesla will...

sell about 10 million cars by 2030, resulting in a $146.2 billion economic profit based on a 15.5% net-profit margin, as well as various profit-accreditive software sales.

Now, while I certainly need more time and information to model a more accurate valuation based on 20 million cars, as a quick back-of-the-envelope calculation readers may reference my valuation update below, implying a fair implied share price of about $307.

- car sales 20 million, as compared to 10 million prior

- average cost per car down to $55,000, versus $65 prior

- net % profit margin down 250 basis points, to 13%.

Author's Estimates & Calculation

Cut Costs By 50 Percent...

Tesla already claims industry-leading profit margins with a very cost-efficient production process. But according to management commentary, Tesla may capture an opportunity to make EVs even more cost-effective. Working on a new vehicle manufacturing platform, the "New Generation Vehicle," Tesla has stated that the firm expects a 40% reduction in the factory's manufacturing footprint and a 50% reduction in cost.

...And Market A New EV Model

Anchored on the 50% unit-based cost reduction, Tesla has voiced ambitions to build and market a new EV model that could be as chap as $25,000/ car (sales reference, not production price!). For reference, the lowest-priced Tesla as of early 2023 is the Model 3, with a price tag of approximately $43,000.

Needless to say, a $25,000 car would aggressively expand Tesla's Serviceable Addressable Market. With that frame of reference, I would like to point out commentary from Tesla's head of production Tom Zhu:

As long as you offer a product with value at affordable price you don’t have to worry about demand. We try everything to cut costs... and pass down that value to our customers.

Elon Musk then added (emphasis mine):

Demand is a function of affordability not desire... even small changes in the price have a big effect on demand.

However, which has been somewhat of a disappointment for investors, Tesla did not share specifics on the carmaker's new and cheaper EV -- nor did management share a development/ production schedule. Tesla did announce, however, that its next generation vehicle will likely be produced at the Mexico plant, which has been announced only recently.

The Cybertruck Is (Finally) Coming

During the Investor Day event, Tesla showcased a pre-production beta version of their Cybertruck. Moreover, the EV maker confirmed that the long-awaited Cybertruck will be available for sale in 2023, with volume production expected in 2024.

Conclusion

With reference to the 2023 Investor Day, Tesla, Inc. investors were arguably disappointed that Tesla did not announce any new exciting product initiatives. But as I see it, the disappointment is not justified. In context of event, Tesla did announce some exciting ambitions that could, if successful, push Tesla's market capitalization towards a multi-trillion dollar valuation. I reiterate a "Buy" rating on Tesla, Inc. stock.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is not financial advise, but expresses the opinions of the author only.