Hims & Hers Health: Just Getting Started

Summary

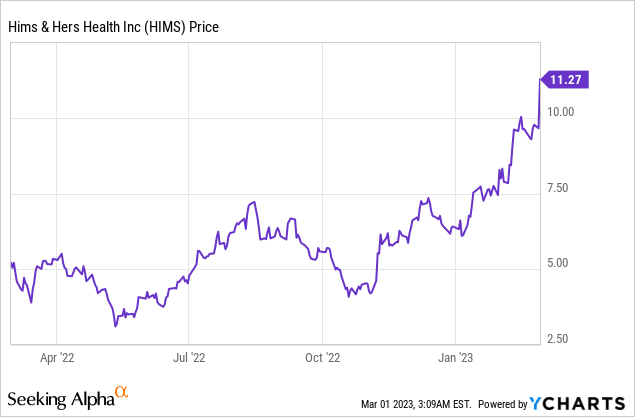

- Hims & Hers Health is up 260% from its 52-week low.

- The digital-first company operates in a massive market that should continue to drive growth.

- Its fourth-quarter earnings showed strong revenue growth and improvement in the bottom line.

- Current valuation looks cheap considering its growth.

- I rate the company as a buy.

AsiaVision

Investment Thesis

Hims & Hers Health (NYSE:HIMS) has been one of the best-performing stocks in the past few months, with shares up over 260% from its 52-week low. Despite the recent rally, I still think the company is a decent buy. Its digital approach is generating strong traction and the market opportunity ahead is massive. The company’s latest earnings continue to show strong execution with exponential revenue growth and improved profitability. HIMS stock's current valuation still looks attractive and I believe there should be meaningful upside potential.

Why Hims & Hers Health?

Hims & Hers Health is a relatively new company founded by Andrew Dudum in 2017. It is a DTC (direct-to-consumer) brand that offers health and wellness products to consumers in the US. The company adopts a digital approach as users can receive evaluations online and have their prescriptions or medications delivered to their doorstep directly. It has gained a lot of traction quickly as this is much more convenient and efficient compared to the traditional process which is tedious. The company has recently surpassed the one million subscribers mark. The digital approach also allows the company to gather massive amounts of data and provide more personalized treatment options, which improves retention and engagement rates.

Hims & Hers Health also focuses on high-growth segments such as mental health and wellness. The mental health market has been expanding rapidly in the past few years, as more and more people are having mental illnesses due to social media and the pandemic. The World Health Organization estimates that approximately 280 million people in the world have depression. The increasing figure provides a huge market opportunity for the company. According to Allied Market Research, its TAM (total addressable market) is forecasted to grow from $383.1 billion in 2020 to $538 billion in 2030, representing a CAGR (compounded annual growth rate) of 3.5%. Wellness is another emerging segment that could drive growth, as society is now emphasizing heavily on better sleep and better nutrition. According to McKinsey, the wellness market is expected to grow at a CAGR of 5% to 10%.

Q4 Earnings

Hims & Hers Health just reported its fourth-quarter earnings and the results are once again superb, as revenue growth took off and profitability improved.

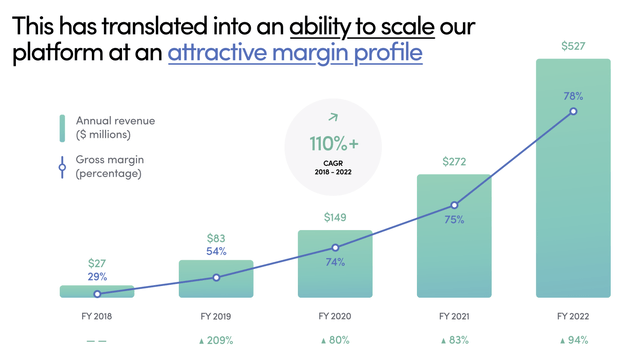

The company reported revenue of $167.2 million, up 97% YoY (year over year) compared to $84.7 million. Online revenue grew 106% from $78.3 million to $161.2 million while wholesale revenue dipped 5% from $6.4 million to $6 million. The growth is mainly driven by the increase in subscribers which increased 88% from 554,000 to 1.04 million. This resulted in subscriptions up 83% from 609,000 to 1.1 million and net orders up 75% from 1.06 million to 1.12 million. The average order value was $87 compared to $74, up 18%.

The company continues to improve on costs through higher operation efficiency and increased business mix from online revenue. The cost was only up 54.4% this quarter, resulting in gross profit increasing 113% from $62.1 million to $132.3 million. Gross margin was 79% compared to 73%, up 600 basis points.

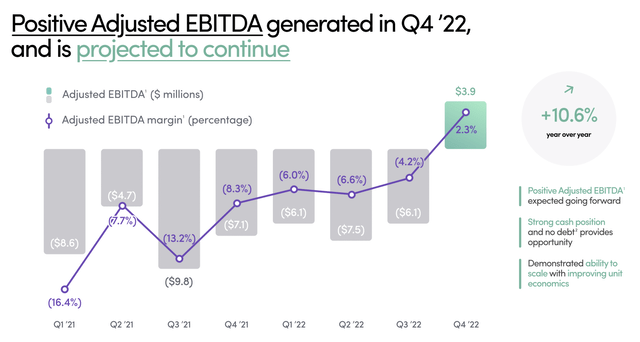

Spending was also very disciplined, as operating expenses only grew 72% to $144 million which is much slower than revenue growth. Most of the increase is attributed to marketing expenses, which increased 100% from $42.7 million to $85.5 million. The increase is due to new product launches during the quarter. Thanks to great operating leverage and cost management, adjusted EBITDA flipped from negative $(7.1) million to positive $3.9 million, with an adjusted EBITDA margin of 2.3% Net loss improved 65.7% from $(31.2) million to $(10.7) million. Net loss per share was $(0.05) compared to $(0.15).

The company also initiated guidance for FY23 and expects revenue to be $735 million to $755 million, or revenue growth of 42% at the midpoint. Adjusted EBITDA is expected to be $20 million to $30 million, representing an Adjusted EBITDA margin of 3% to 4%.

Investor Takeaway

Overall, this quarter’s results are very impressive in my opinion. Revenue and subscribers growth continues to see strong momentum while the bottom line is starting to see significant operating leverage, as net loss contracted over 60%. The guidance also suggests further improvement in profitability and its long-term target adjusted EBITDA margin of 20% to 30% is very encouraging. Despite the rally, the company’s valuation is still compelling. It is only trading at a mere EV/sales ratio of 4.1x which is pretty cheap considering its growth and gross margin of nearly 80%.

I believe Hims & Hers is just getting started. The top-line growth should be durable given the massive size of its TAM and the bottom line should continue to improve thanks to better leverage. This along with its conservative valuation should offer solid upside potential. Therefore I rate the company as a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.