Builders FirstSource: Building A High-Performing Portfolio

Summary

- Builders FirstSource is the largest supplier and manufacturer of building materials and construction services in the United States.

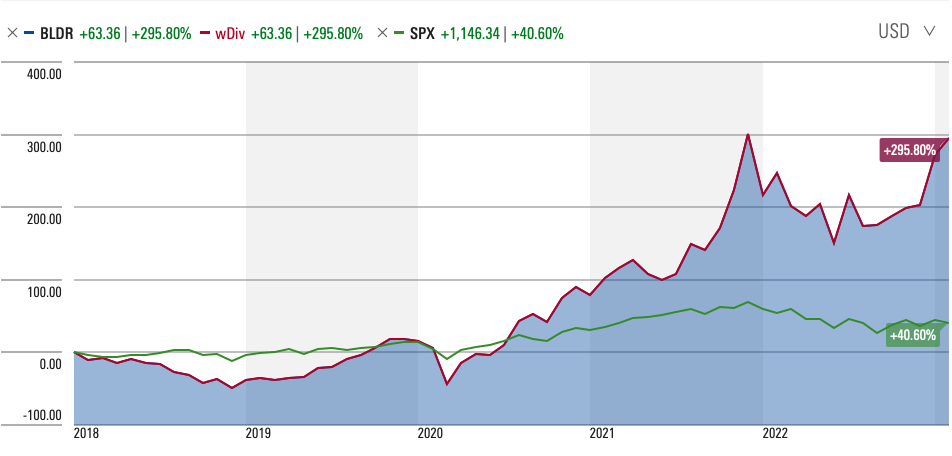

- In the last five years, the company has earned investors a total shareholder return of nearly 296%.

- The company has an exceptional history of growth and profitability.

- The compensation structure aligns shareholder interests with those of managers.

- BLDR stock is trading at very attractive multiples.

Michael M. Santiago

Over the last five years, Builders FirstSource (NYSE:BLDR) has enjoyed exceptional growth and profitability, with a revenue compound annual growth rate of 24.11% and a gross profitability ratio that exceeds the threshold for attractive stocks, and free cash flow that is over a third of the value of the business. As we shall see, its success is a function of incentives that encourage good capital allocation and prudential management, and in spite of it operating in a highly fragmented and competitive market. It is not surprising that the total shareholder return over that period has been nearly 296%. Builders FirstSource is not just a great business, it is also a great investment.

Overview of the Business

Builders FirstSource is the largest supplier and manufacturer of building materials and construction services to professional contractors, sub-contractors, and consumers. The company operates over 565 locations in 42 states, organized into three geographical divisions, namely East, Central, and West. Despite its vast geographical reach, they have only one reportable segment, as all its operating segments share similar economic characteristics, product categories, distribution methods, and customers.

Builders FirstSource offers an all-encompassing solution to its customers, providing them with an array of structural and related building products, manufacturing, supply, and installation services. Its manufactured products include factory-built roof and floor trusses, wall panels, vinyl windows, custom millwork and trim, and engineered wood, which they design, cut, and assemble according to each home's specific needs. The company also assembles interior and exterior doors into pre-hung units. Additionally, it supplies its customers with a broad range of professional-grade building products, such as dimensional lumber and lumber sheet goods, various window, door, and millwork lines, and other miscellaneous building products. Its construction-related services include professional installation, turn-key framing, and shell construction, encompassing all our product categories.

Builders FirstSource classifies its building products into six distinct categories, including Lumber & Lumber Sheet Goods, Manufactured Products, Windows, Door & Millwork, Gypsum, Roofing & Insulation, Siding, Metal, and Concrete, and Other Building Products & Services.

Strong Stock Market Performance

In the last five years, Builders FirstSource total shareholder return (TSR) has been nearly 296%, compared to nearly 41% for the S&P 500 (SPX).

Source: Morningstar

Not only has Builders FirstSource outperformed the S&P 500, it has also handily outperformed its Peer Group, whose equal-weighted average TSR over that time was 84.5%. The Peer Group consists of Ball Corporation (BALL); Beacon Roofing Supply, Inc. (BECN); Carrier Global Corporation (CARR); Core-Mark Holding Company, Inc. (by way of parent company, Performance Food Group (PFGC); Fastenal Company (FAST)); Fortune Brands Innovations (FBIN); Genuine Parts Company (GPC); Lennar Corporation (LEN); LKQ Corporation (LKQ); Masco Corporation (MAS); Mohawk Industries, Inc. (MHK); Owens Corning (OC); PulteGroup, Inc. (PHM); Trane Technologies plc (TT); Univar Solutions Inc. (UNVR); Veritiv Corporation (VRTV); WESCO International, Inc. (WCC); and W.W. Grainger, Inc. (GWW).

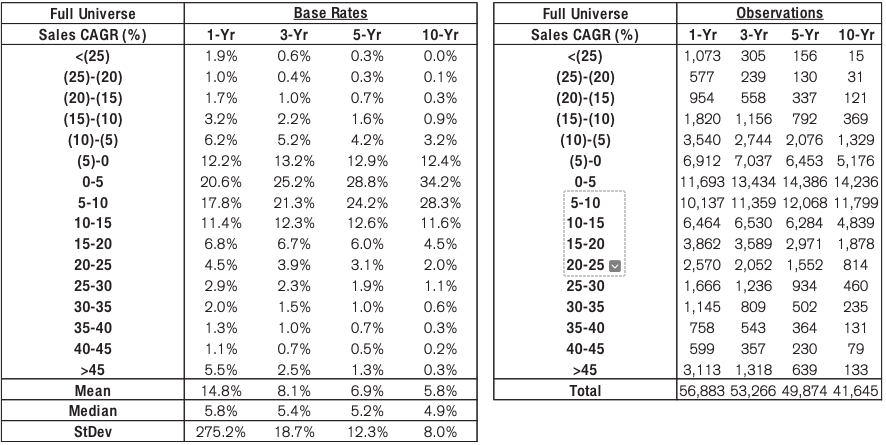

Exceptional Growth, Exceptional Profitability

Over the last five years, management has been able to grow in a profitable way, while earning elite levels of ROIC. Between 2018 and 2022, Builders FirstSource grew revenue from $7.72 billion to $22.73 billion, at a 5-year revenue compound annual growth rate (CAGR) of 24.11%. According to Crédit Suisse's "The Base Rate Book", just 3.1% of firms enjoyed a similar rate of growth over a 5-year window, with the mean 5-year revenue CAGR being 6.9%, and the median being 5.2%.

Source: Crédit Suisse

Obviously, what this tells us is that the company's rate of growth is high on a historical basis, when compared to that of the typical business' rate of growth.

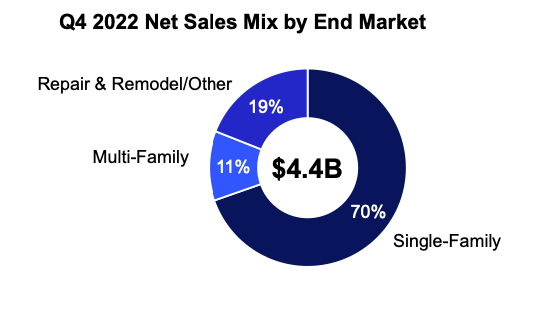

In terms of end market, the single-family market makes up 70% of revenues, with repair & remodel accounting for 19% and multi-family accounting for 11%.

Source: Builders FirstSource FY & Q4 2022 Earnings Presentation

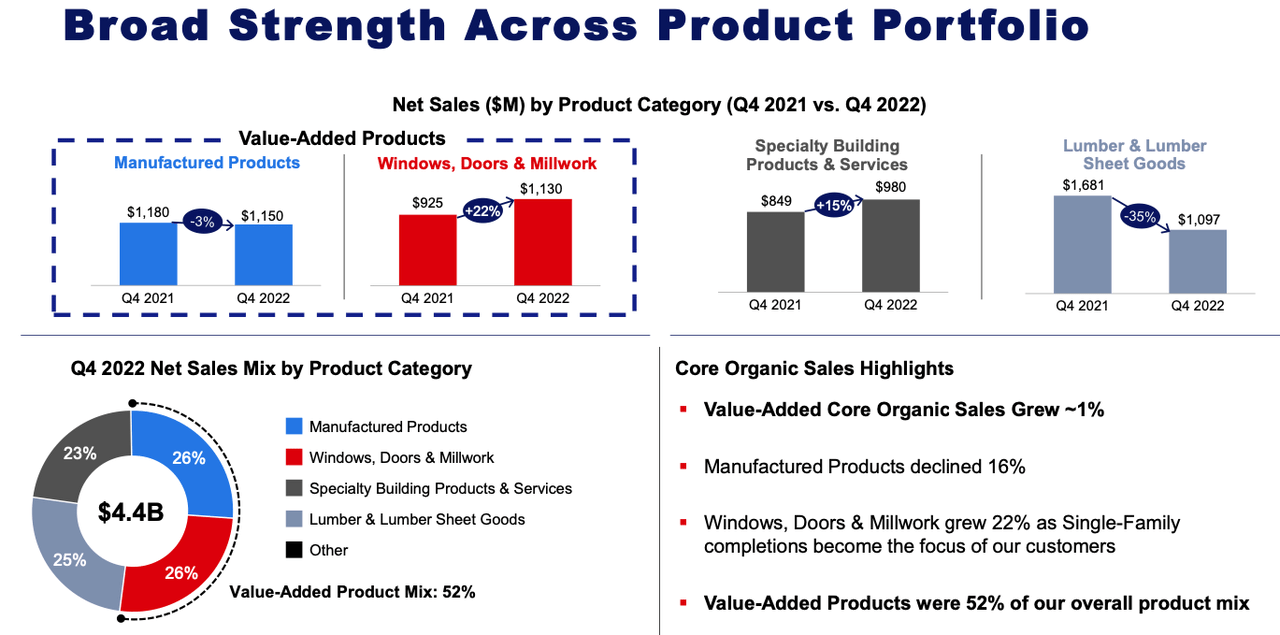

In terms of product category, windows, doors and millwork account for 26% of the product portfolio, similar to manufactured products, while lumber & lumber sheet goods account for 25% and speciality building products & services are responsible for 23%.

Source: Builders FirstSource FY & Q4 2022 Earnings Presentation

Gross profitability (gross profits/total assets) rose from 0.66 in 2018 to 0.73, indicating an improving ability to earn money. This is not all. Robert Novy-Marx' research shows that 0.33 is the threshold after which a company's profitability and the stock itself, is increasingly attractive. The mean gross profitability for industrials is 0.28 and the median is 0.3, further demonstrating the exceptional nature of the firm's profitability. Gross profitability is important as a stock screener, and is more predictive than a price-earnings (P/E) multiple. For instance, at the end of 2015, Amazon (AMZN) had a trailing P/E multiple of 540, compared to a P:E multiple of 20 for the S&P 500. However, its gross profitability was 0.54. An investor who looked at P/E rather than gross profitability, would have missed a great investment. Gross profitability is highly persistent, and so, investors should expect the company to continue to be very profitable over the next 3 to 5 years.

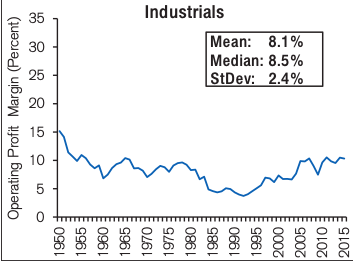

Operating income rose from $1.56 billion in 2018, to $3.77 billion in 2022, at a 5-year operating income CAGR of 19.3%. Operating profit margin, in turn, declined from 20.12% in 2018, to 16.59% in 2022. While operating profit margin has declined, it remains high considering that the company is pursuing a cost leadership strategy, which implies low margins and high capital velocity. The mean operating profit margin for industrials is 8.1% and the median is 8.5%, placing Builders FirstSource ahead of industry numbers.

Source: Crédit Suisse

Net income rose from $205.19 million in 2018 to $2.75 billion in 2022, at a 5-year earnings CAGR of 68.04%. Readers will not be surprised to learn that just 0.5% of firms achieve a similar rate of earnings growth over a 5-year period. The mean 5-year earnings CAGR is 7.3%, and the median is 5.9%. Once again, the company is far ahead of its peers in terms of its financial results.

Source: Crédit Suisse

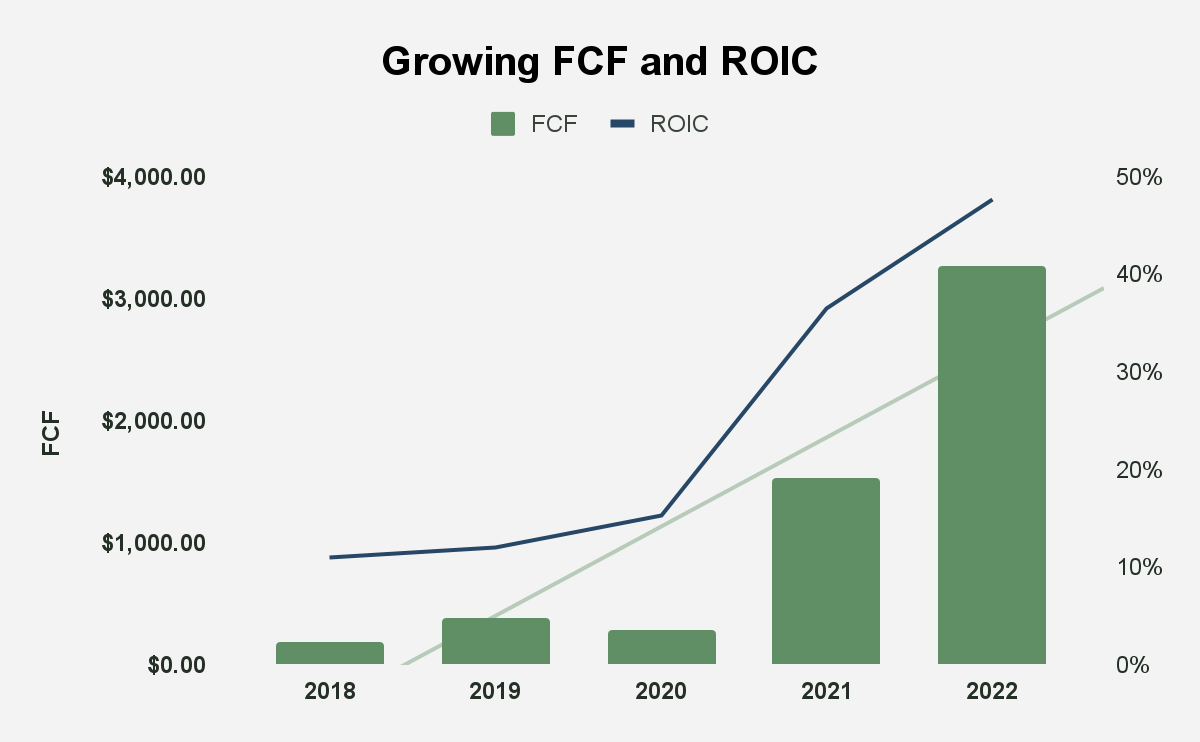

Builders FirstSource has grown free cash flow or FCF from $186 million in 2018 to $3.27 billion in 2022, at a 5-year FCF CAGR of 77.42%. This once again reflects the exceptional profitability of the business. In that 5-year period, the company has generated 35.6% of its enterprise value, in FCF. In that time, ROIC has grown from 11% in 2018, to 47.7% in 2022, with a 5-year average ROIC of 24.5. Management has a target 3-year average ROIC for the 2021-2023 period of 25%, a target it looks set to achieve. Growing ROIC will offset any possible decline in revenue, a metric which we have already discussed as being subject to decay.

Source: Builders FirstSource Filings

Aligning Management and Shareholder Interests

Managers and owners do not instinctively or even naturally have the same interests. Agent-principal problems are rife within businesses. As much as shareholders may want managers to put shareholder interests at the heart of their decision-making, often, this simply does not happen. It is important, then, for shareholders to align management's interests with their own, by tasking the compensation committee with devising a compensation scheme that rewards managers for behaving in shareholder-friendly ways. Incentives are incredibly powerful. As Berkshire Hathaway (BRK.A) Vice Chairman Charlie Munger, once remarked, "Never, ever, think about something else when you should be thinking about the power of incentives." Before thinking of anything else, we should think of management's incentives.

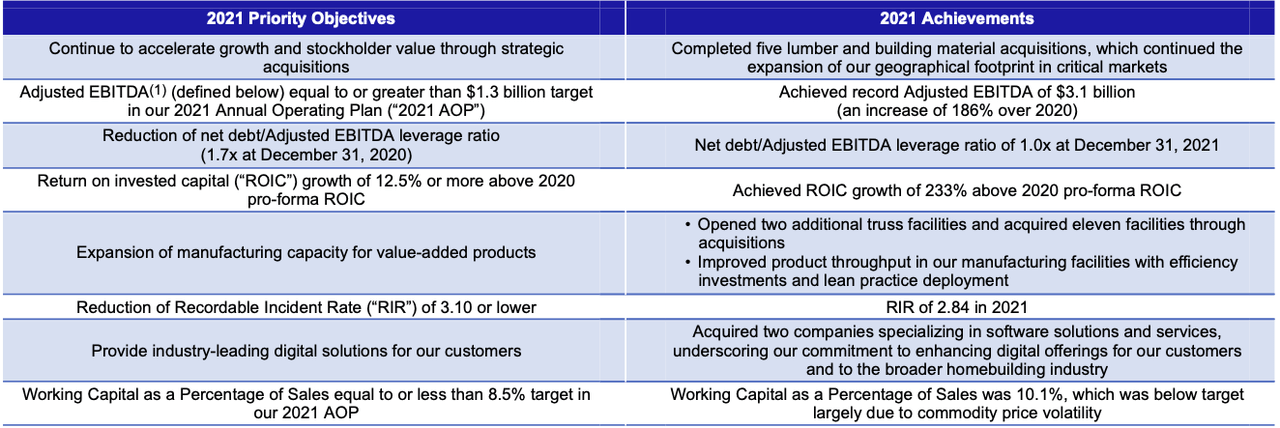

According to Builders FirstSource 2022 Proxy Statement, in 2021, the Board of Directors tasked management with the following objectives, objectives which were soundly achieved:

Source: Builders FirstSource, Inc. Notice of Annual Meeting of Stockholders and 2022 Proxy Statement

The growth in return on invested capital or ROIC was not accidental, but a function of the incentives that management has to grow ROIC. These incentives mean that, as David E. Flitman settles into his role as President and CEO of the company, we do not, in an important sense, have to ask questions about his character compared to that of the last President and CEO, Chad Crow, because the incentives in front of him will ensure that there is a continuity in the desire to grow ROIC. This gives us more confidence in the motives that drive efforts that are nominally done to "accelerate growth and stockholder value through strategic acquisitions", e.g. the BMC merger. Acquisitions may grow shareholder value, but given the quotidian interest that managers have to grow their power and empire, it is easy for managers to destroy shareholder value through acquisitions. This, in fact, is what usually happens.

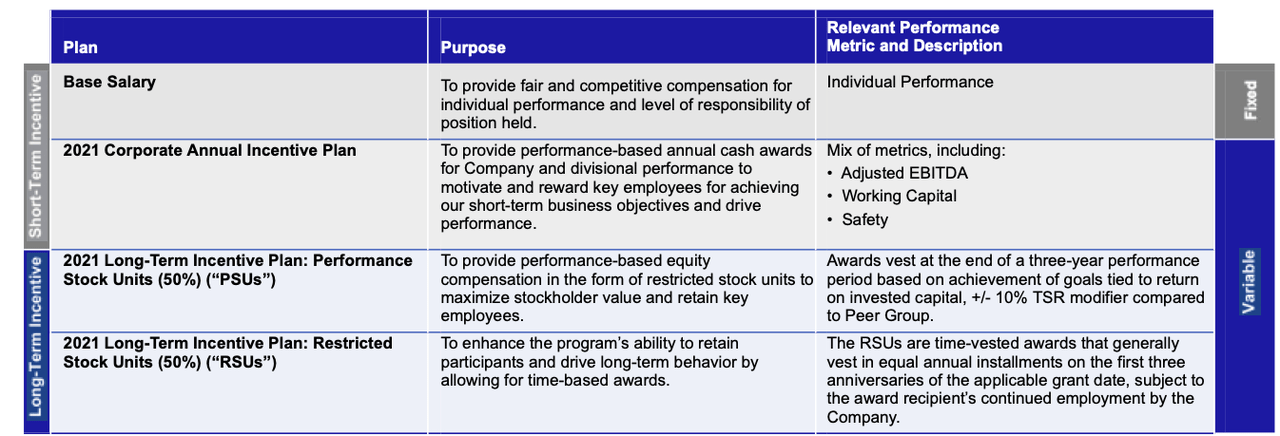

In order to align management and shareholder interests, Builders FirstSource uses its equity incentive awards in a shareholder-friendly way. The equity incentive awards are composed of performance-based restricted stock units (PSUs) and time-vested restricted stock units (RSUs). In March 2021, a new equity incentive awards were issued to key managers, and the PSUs will vest when they have attained defined annual and three-year ROIC goals, with a performance modifier based on TSR compared to its Peer Group over the three-year period from that time. The PSUs make up 50% of the Long-Term Incentive Plan.

Source: Builders FirstSource, Inc. Notice of Annual Meeting of Stockholders and 2022 Proxy Statement

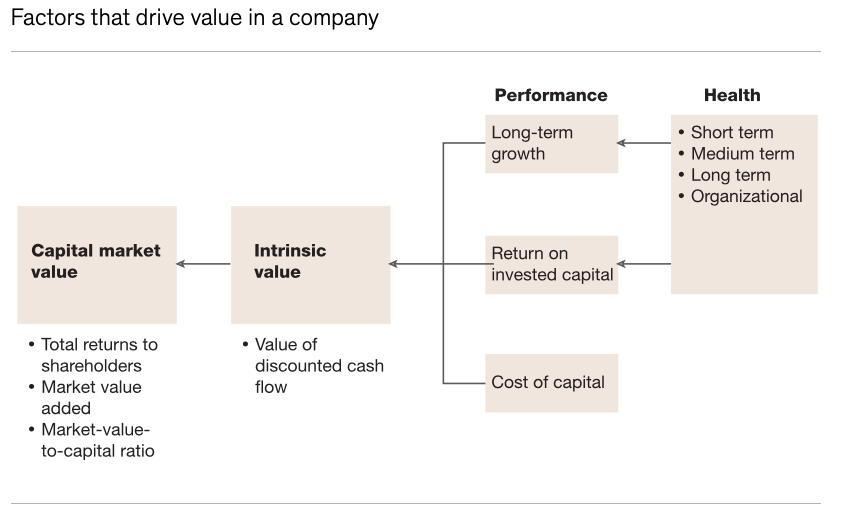

The company explains its use of ROIC in this way, "The Compensation Committee selected ROIC as the primary performance metric for the PSUs in order to better align management's financial interest with those of our stockholders over the longer term." This is because, in the long run, company value is driven by ROIC. A company has limited control over its cost of capital, and often, the pursuit of growth is value-destroying, and even where growth is value-enriching, it is arguable that high growth rates can occur regardless of the quality of a business' management, and in the long run, high growth rates are often unsustainable. The true test of management is ROIC, and it is here that management is able to grow corporate and shareholder value.

Source: McKinsey & Company

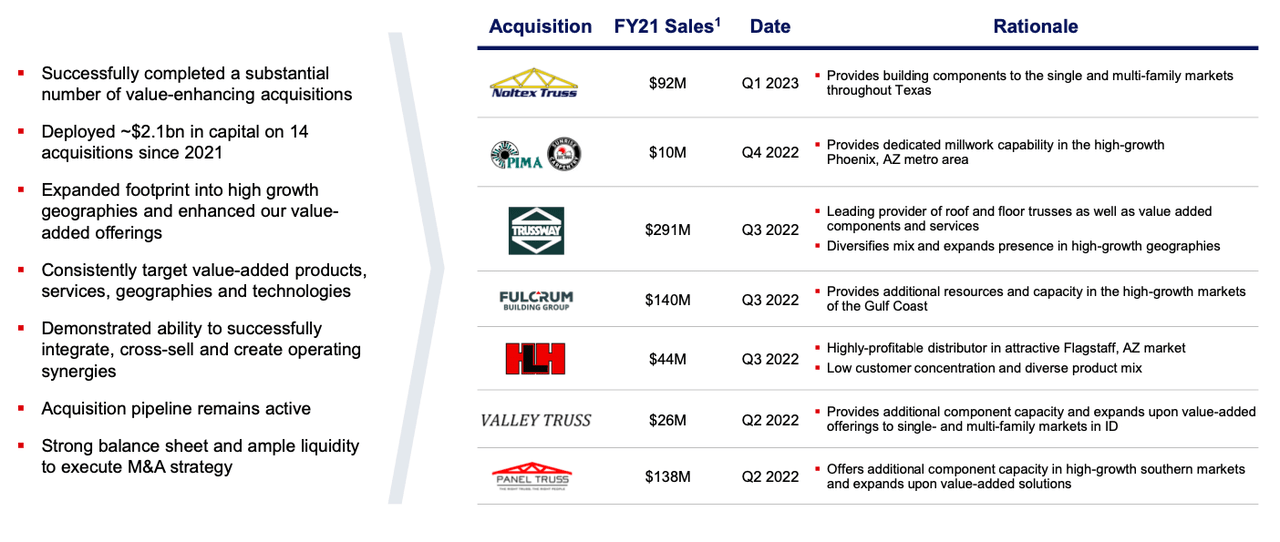

Strategic Tuck-In Acquisitions

That focus on ROIC has been important in driving management's thinking on acquisitions and it is clear from the rationale given that there is a clear idea of growing economic profits. Target acquisitions are strategic tuck-in acquisitions that will grow value, expose the company to high-growth opportunities, grow the company's portfolio of products, and technologies, and expand its geographical reach.

Source: Builders FirstSource FY & Q4 2022 Earnings Presentation

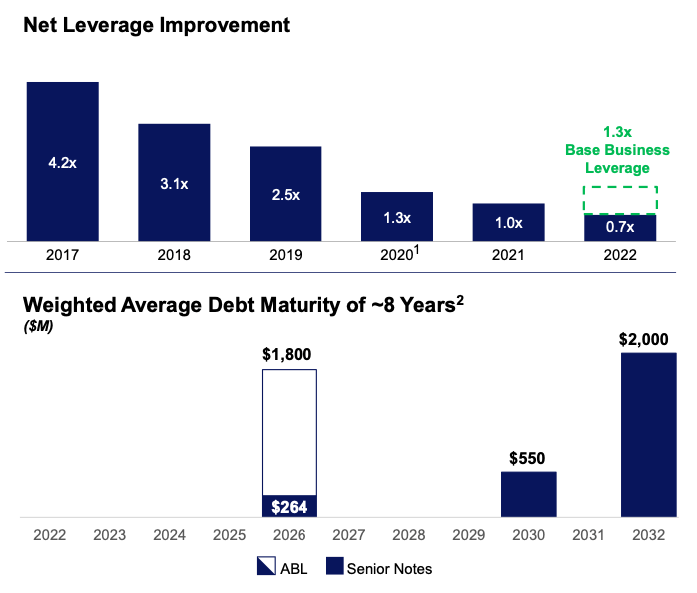

Prudential Risk Management

Over the last few years, the company has been extremely conservative in how it has managed its leverage. While debt can be cheaper than equity, and there are certainly instances in which companies have successfully opted for debt over equity in their search for capital, debt can increase the existential risks a company faces. In that light, the company has been careful to improve its net leverage and give itself breathing room with a weighted average debt maturity that is now around 8 years, so that there are no payments due until 2026, and then 2030, and then 2032, enough time to further strengthen the balance sheet.

Source: Builders FirstSource FY & Q4 2022 Earnings Presentation

Market Leader in a Highly Fragmented Industry

Builders FirstSource's results are even more remarkable when you consider that the Pro Segment of the residential building products supply market in the United States is highly fragmented, with competition for homebuilder business being intense and ongoing. However, because of the scale of the company, it has an advantage over its competitors, who are mostly privately held local or regional businesses with limited access to capital, poor information technology systems, and procurement capabilities. With consolidation among large homebuilders occurring, the demand for the company's services is growing, because large homebuilders prefer to deal with a few suppliers. In turn the company's scale economies and deep, rich logistical networks, lead to extensive customer relationships, local market knowledge, and competitive pricing further widening Builders FirstSource's lead over its smaller competitors. The company's chief competitors are 84 Lumber Company, Carter Lumber Company, and US LBM Holdings, LLC, all of whom are private.

The company's customers are largely professional homebuilders and those who provide them with construction services. Builders FirstSource strives to create long-term relationships with its customers by providing them with a complete range of high-quality products, timely delivery, competitive pricing, and integrated service and product packages such as turn-key framing, shell construction, manufactured components, and installation. As a result of its strong market position in the Pro Segment, they are able to supply their customers cost-effectively, which increases their profitability and reduces the risk of losing customers to competitors.

There is also a trend of consolidation in the building products supply industry, which has improved segment profitability and driven down costs of capital, although the industry remains highly fragmented and competitive, and there is likely to continue to be significant competition from local and regional suppliers.

Achieving a position as a profitable market leader within a highly fragmented industry, is a testament to the capital allocation skill of the company's management.

Valuation

As we have seen, the company has a very attractive gross profitability of 0.74, and, with $3.27 billion in FCF in 2022, and an enterprise value of $15.89 billion, Builders FirstSource has an FCF yield of 20.58%. That FCF yield is far in excess of the 1.8% average FCF yield of the 2000 largest companies in the United States, according to New Constructs' data. That the company has a P/E multiple of 5.04 compared to the S&P 500, with an P/E multiple of 21.22, only adds to its attractiveness. The company holds up well against its Peer Group, as well. The Peer Group average FCF yield is 4.8%, the P/E multiple is 29.24 and the gross profitability is 0.39.

TSR | FCF Yield | P/E Multiple | Gross Profitability | |

Builders FirstSource, Inc. | 295.80% | 20.58% | 5.04 | 0.74 |

Ball Corporation | 46.84% | -7.64% | 24.98 | 0.13 |

Beacon Roofing Supply, Inc. | 7.44% | 7.58% | 11.71 | 0.37 |

Carrier Global Corporation | 161.04% | 3.70% | 10.98 | 0.21 |

Performance Food Group | 64.75% | 3.50% | 32.71 | 0.42 |

Fastenal Company | 87.63% | 2.65% | 27.28 | 0.71 |

Fortune Brands Innovations | 8.47% | 3.41% | 10.96 | 0.34 |

Genuine Parts Company | 69.94% | 5.11% | 21.98 | 0.47 |

Lennar Corporation | 54.39% | 11.76% | 6.15 | 0.19 |

LKQ Corporation | 36.31% | 6.78% | 13.84 | 0.43 |

Masco Corporation | 17.40% | 5.23% | 14.44 | 0.52 |

Mohawk Industries, Inc. | -63.41% | 1.35% | 263.72 | 0.21 |

Owens Corning | 13.15% | 14.80% | 7.70 | 0.24 |

PulteGroup, Inc. | 83.47% | 4.51% | 4.97 | 0.33 |

Trane Technologies plc | 173.85% | 2.88% | 24.73 | 0.27 |

Univar Solutions Inc. | 16.38% | 7.29% | 10.66 | 0.39 |

Veritiv Corporation | 430.19% | 11.29% | 6.50 | 0.78 |

WESCO International, Inc. | 142.96% | -1.04% | 10.80 | 0.31 |

W.W. Grainger, Inc. | 170.13% | 3.21% | 22.24 | 0.77 |

Peer Group Average | 84.50% | 4.80% | 29.24 | 0.39 |

(Source: Company Filings, Author Calculations)

Conclusion

A good business is not always a good investment, but Builders FirstSource is both a good business and a good investment. Management has overseen a period of exceptional growth and profitability, guided by incentives that align shareholder interests with those of managers, and which lead to superior capital allocation, risk management and operational and financial performance. The company is very clearly ahead of its competitors from a financial and operational point-of-view, and presents a wide margin of safety despite its excellent economics and historical results.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.