Morgan Stanley: Capital Markets-Centric Infrastructure Supports Superior Growth

Summary

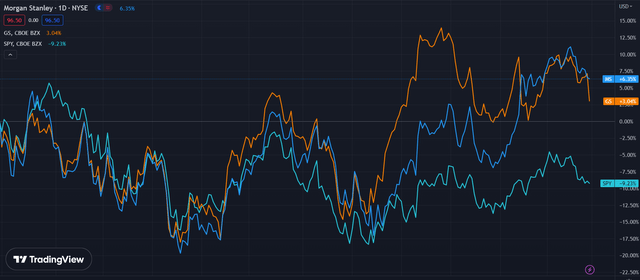

- In the past year, Morgan Stanley's stock price has appreciated 6.35%, relative to a -9.23% decline in the S&P 500 alongside superior returns to rivals Goldman Sachs, with 3.04% 1Y growth.

- This growth has been built upon the bank's streamlined business practices, focusing on vertical integration-centric M&A, and reducing their stake in unsecured retail credit, fringe markets, etc.

- Despite 40-year high inflation and rate increases, and the continued impact of the Invasion of Ukraine, Morgan Stanley yet sustained >$300bn in net new assets and record pre-tax wealth management profits.

- The acquisition and integration of E*TRADE and Eaton Vance have supported Morgan Stanley's circular capital model, which connects individual, institutional, corporate, and government with respective demands.

- Due to a streamlined revenue set, the potential for synergetic growth, and chronic relative undervaluation, I rate Morgan Stanley a 'buy'.

Nikada

Morgan Stanley (NYSE:MS) is a global investment bank with significant operations in trading, and wealth and asset management, recording $53.67bn in 2022 revenues alongside a net income of $11.18bn.

Over the past few years, Morgan Stanley has shifted their approach from a broad-based approach, historically aiming for market share in verticals across the financial industry, but now working towards a streamlined strategy of facility across the capital 'supply chain'.

Introduction

The bank segments itself into three primary divisions; Institutional Securities, which comprises investment banking, equity, and fixed income, generating $24.39bn in 1Y revenues; Wealth Management, which generated its $24.42bn through client asset flow fees and interest; and Investment Management, which generated $5.38bn in 2022 revenues.

Morgan Stanley Strategic Update 2023

Morgan Stanley's consistent focus on unifying its financial platforms enables greater access to capital and flexibility in subsequent capital allocation and meeting client demands.

Valuation & Financials

General Overview

As aforementioned, Morgan Stanley has experienced superior 1Y returns to both the broad market, and their principal rivals, Goldman Sachs (NYSE: GS).

In spite of this outperformance, I believe Morgan Stanley has more room to run, due both to yet continued underpricing as well as the value generation and efficiencies their acquisitions look to yield.

Comparable Companies

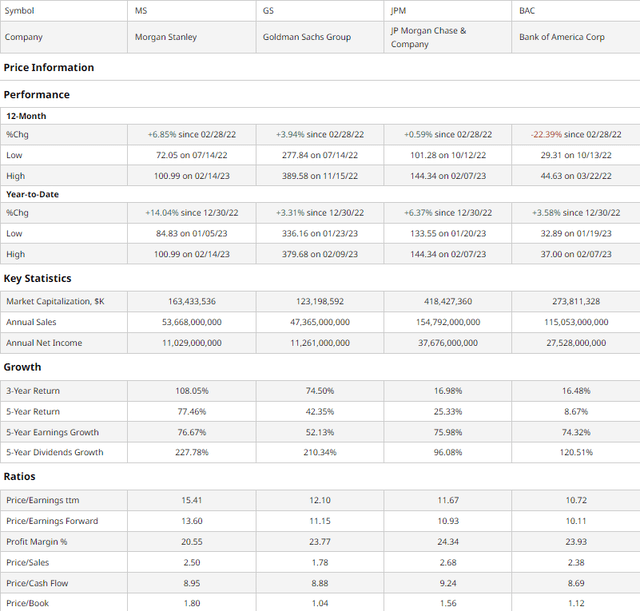

The highly consolidated financial industry landscape leads to a consistent group of rivals in the industry; Goldman Sachs is a more aggressive variant of the company, though recently undergoing a divergent strategy (as I've outlined in my Goldman Sachs article); JPMorgan Chase (NYSE: JPM) is the largest universal bank in the US; and Bank of America (NYSE: BAC) has a major presence across financial platforms.

As demonstrated above, on an absolute multiples basis, Morgan Stanley is actually slightly overvalued relative to peers. However, this likely reflects a more comprehensive undervaluation of the industry as a whole, a product of the financial industry's sensitivity to interest rate changes and inflationary pressures.

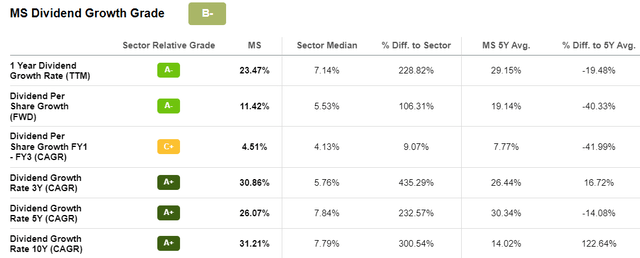

When identifying 3-year or 5-year price performance, in addition to 5-year earnings growth, Morgan Stanley presents a superior value proposition. Additionally, with their 3.19% dividend and greater 5-year dividend growth, Morgan Stanley also enables an income-based investing approach.

This value has been driven by the inorganic growth of their wealth management division, through the purchases of E*TRADE and Eaton Vance.

Valuation

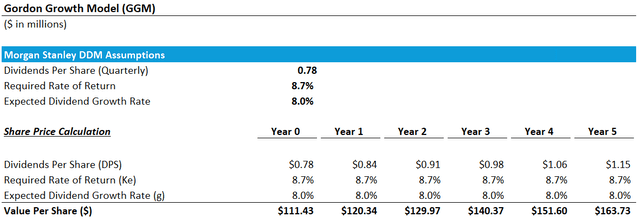

Morgan Stanley Gordon Growth Model (Morgan Stanley Q4 Earnings)

According to my Gordon Growth Model, Morgan Stanley should be valued at $111.43, a ~12.9% increase from today.

Walking through my model, it assumes a RRR of 8.7%, in line with the industry average expected growth rates. Additionally, the expected dividend growth rate is in line with the historic industry average, rather than Morgan Stanley's current forward dividend per share growth of 11.42%, accounting for potential regression in dividend growth due to macro turbulence.

Sustained Vertical Expansion Leads to Resilience & Growth

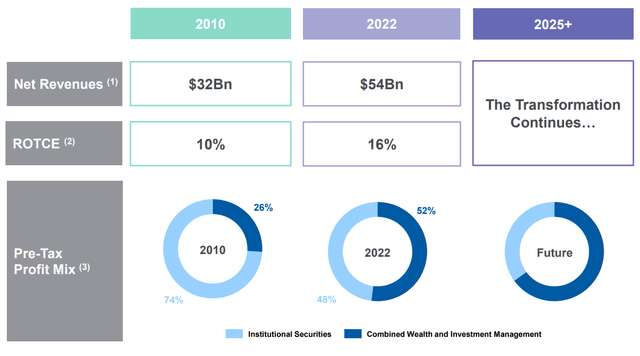

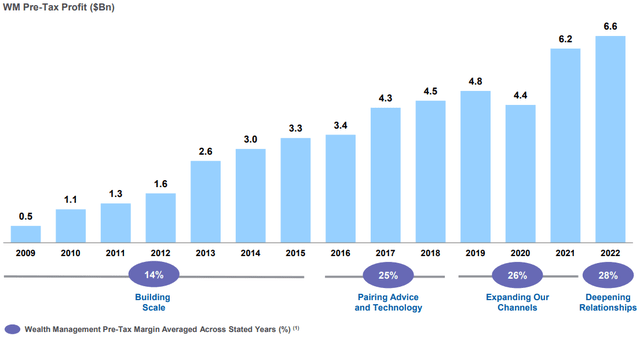

While reputationally known for investment banking, a bulk of Morgan Stanley's growth has been derived from its Wealth Management and Investment Management divisions- as a result of recent acquisitions- in which the company has seen pre-tax profits grow from $500mn to $6.6bn over the past 13 years.

Wealth Management Change in Profit (Morgan Stanley Strategic Update 2023)

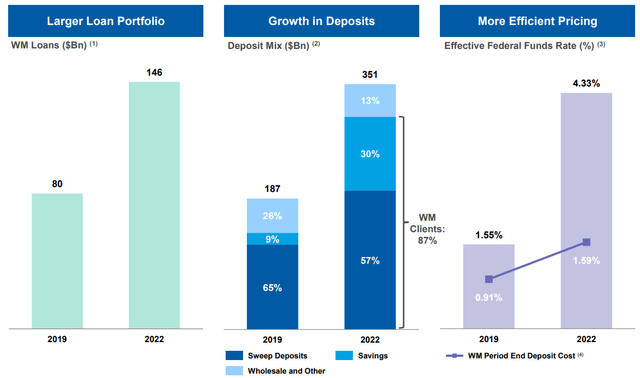

In attempting to do so, Morgan Stanley has expanded their access to retail capital, thus increasing their AUM and their ability to attract capital and invest across all platforms.

Their expansion into wealth management has additionally facilitated significant margin expansion, with Morgan Stanley experiencing 76.67% 5-year earnings growth.

Morgan Stanley Strategic Update 2023

We have thus, in spite of the increase in the federal funds rate, seen accretive growth in deposits, with the convexity of retail or institutional or government or corporate deposits in different circumstances.

As such, Morgan Stanley has developed a corporate strategy of long-term AUM growth, aiming for $1tn in net new Wealth Management assets every 3 years in spite of macro conditions.

Wall Street Consensus

Analysts largely support my bullish attitude on Morgan Stanley, forecasting an average 1-year price increase of 5.45% to $102.00.

Though, due to the aforementioned sensitivity of financial companies to volatility the minimum projected price is $84.00, down 13.16% from now.

Risks

Third-Party Risk

While Morgan Stanley is working towards synchronizing their business through vertical integration, third parties remain paramount to the execution of Institutional Securities dealings; thus, any exposure to market failure through third parties may have material impacts on the companies' ability to conduct business.

Continued Rate Rises

YoY, margins have declined ~13%, with this margin compression defended by the extensive rise in interest rates. Therefore, with higher interest rates reducing M&A activity and demand for wealth and asset management services, it can be surmised that further rate increases will only serve to further hinder profitability.

Financial Risks Based on Illiquidity and Market Movement

With an increasing focus on exclusively capital market-centric activity, Morgan Stanley additionally increases counterparty risk in transactions, or the inability to operate effectively given the broader market. And with a relatively high debt-to-assets ratio, Morgan Stanley retains lower flexibility in such an environment.

Conclusion

In the short term, Morgan Stanley's resilient market position, intermediate undervaluation, and margin growth demonstrate the company's ability to operate well in a poor market.

In the long term, the company's focus on synergetic growth driven by streamlined business practices and M&A promises high degrees of AUM growth alongside subsequent revenue and profit expansion in wealth and investment management.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.