IUSB Is Too Correlated To Equity Markets

Summary

- The high duration of IUSB means that in a time of changing rates, IUSB will trade together with equity markets which have downside on higher rates.

- Fixed income is supposed to provide some protection in normal markets, but IUSB doesn't accomplish this.

- Moreover, we expect that the Fed will be heavy-handed in dealing with inflation due to their concerns about wage-price spiral risks not being assuaged with current inflationary easing.

- IUSB is not the right pick for the current environment.

- Looking for a helping hand in the market? Members of The Value Lab get exclusive ideas and guidance to navigate any climate. Learn More »

TERADAT SANTIVIVUT

The iShares Core Total USD Bond Market ETF (NASDAQ:IUSB) is a broad ETF that follows various credit instruments of different risk in a representative basket of the US bond market. The issue here is still duration, and with the latest wave of Fed comments, speculators need to be aware that the Fed's narrative leans heavily on structural risks associated with inflation and interest rates. They will be heavy handed and IUSB doesn't provide safety from equity market movements as fixed income has in the past. No big reason to dip into this one.

Fed Comments and Inflation

Ordinarily you'd want the fixed income markets to not be correlated to equities, as a place to hide when you want to wait out issues that could be affecting business performance like recession. In the current recession, dictated by productivity issues and rates, duration is correlated to equity market returns.

The Fed is going to be very heavy-handed in its approach to fighting inflation because they continue to be worried about wage-price spirals and consumer expectations. Not only is the level of inflation a problem, the speed at which it is easing can also be a problem as long periods of high rates could still cause expectation revisions. Consumer expectations for inflation are around 3.2% based on the Michigan Report, and that's fine for the coming year, but it cannot be allowed to set a new inflation level above the safe 2% target.

The yield curve has shifted up again and that has appropriately erased some of the rally seen in IUSB which has a duration over 6 years, as well as in other longer duration equities, giving up around half of their gains since the lows in November.

Bottom Line

Since there is a structural force that risks the economy if the Fed doesn't risk overshooting with rates, IUSB and other longer duration instruments are a problem. There's also other concerns with IUSB because it's not all AAA rated, and has some lower quality corporate credit. Then there's also the whole debt ceiling issue.

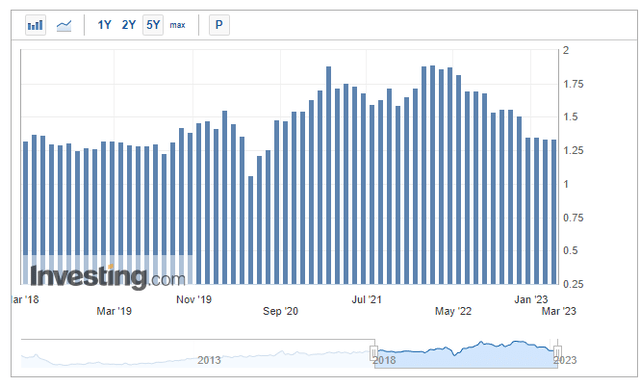

On the other hand, a recession will pull off the demand breaks from inflation, where supply has been the only thing really retreading steps since the beginning of the pandemic, and the majority of the relief. Some suggest that construction declines will bring the economy down once unfinished inventory is exhausted. If this happens, rates aren't going to be going up as much as they might have. However, permitting rates, which involve larger scale renovation and newbuilds, could be much worse considering that there's still a backlog situation in housing, and this indicates construction could be doing worse given everything.

Number of Permits Issues in the US (Investing.com)

However, on top of other countries' reopening likely to reflate some commodity markets, the structural risks in the economy to do with inflation, which is an extraordinarily pernicious and networked force, tips the balance in favor of caution on longer-duration instruments with quite a margin.

Thanks to our global coverage we've ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We've done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it's for you.

This article was written by

Valkyrie Trading Society seeks to provide a consistent and honest voice through this blog and our Marketplace Service, the Value Lab, with a focus on high conviction and obscure developed market ideas.

DISCLOSURE: All of our articles and communications, including on the Value Lab, are only opinions and should not be treated as investment advice. We are not investment advisors. Consult an investment professional and take care to do your own due diligence.

DISCLOSURE: Some of Valkyrie's former and/or current members also have contributed individually or through shared accounts on Seeking Alpha. Currently: Guney Kaya contributes on his own now, and members have contributed on Mare Evidence Lab.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.