Cronos Group: Better Than Those It Competes With

Summary

- Cronos is still burning cash. And there is no end in sight.

- But they are in a better position than their peers thanks to the cash injection from Altria's acquisition and the absence of debt.

- The question now is how this will play out in the future, and when adult use of cannabis will be legal in most countries.

ArtistGNDphotography

Thesis

Cronos (NASDAQ:CRON) has improved quite a lot in 2022. Unfortunately, they are still burning cash and have a long way to go to reach profitability. But compared to their peers, they are still the best of the bunch. At the moment, I don't see a strong investment case for Cronos for the following reasons, which I will explain in the next chapters.

Short Introduction

Cronos Group Inc. is a cannabinoid company engaged in cannabis research, technology and product development. Its largest markets are Canada and Israel. Smaller activities are located in the USA, Germany and Australia.

Altria acquired a 45% stake for $1.8 billion, with the right to acquire a further 10% in March 2019. This has really helped the company to achieve a healthy balance sheet compared to its peers.

Analysis

Investors Presentation Cronos Group

These are the brands that Cronos is trying to establish. The plan is to use Canada as a "test market" and then use the blueprint to launch in new markets. According to the Q4 earnings call, these are the market shares in Canada at the end of 2022.

- Edibles: Number 1

- Base: Number 6

- Flower: Number 3

- Pre Rolls: Number 9

As you can see, they are doing well and are likely to improve their positions in some markets, but they are nowhere near a truly dominant position. But the cannabis market should be interesting in the future. If we compare it to the cigarette market, there is the possibility of creating a real moat, like Altria (MO) did with Marlboro.

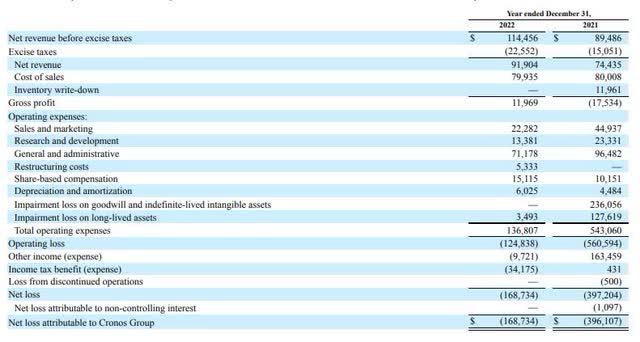

If we look at the 2022 year-end results, we can clearly see that they improved net sales while cost of sales remained flat. This is definitely a positive sign. And they did it while spending less on sales and marketing. This resulted in a real improvement in gross margin. An operational profit is far away at the moment, but they are getting closer.

SBC has risen quite a lot over the period, but they are nowhere near the extremes of the tech companies these days. R&D costs decreased due to the withdrawal from the US beauty market, as the US Cosmetic Regulation of 29 December 2022 made this market more complex.

10-k 2022 Cronos Group

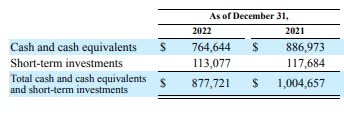

They have a comfortable cash position as a result of the Altria investment and will benefit from interest income in 2023 as interest rates rise. As of today, the total cash position is larger than the market cap. But you have to take into account their money-losing operation, as the cash position is likely to decline by ~100m next year to fund the business.

In 2021, they had to write down some inventory and to prevent this in 2022, they let GrowCo produce some of their products to be more efficient. As Cronos is in a growth phase, it is really hard to say whether they can allocate capital efficiently as their ROC and ROE are both negative.

Growth Opportunities

There is a lot of room for cannabis companies to grow. Europe will be a very big market. At the moment they are using coffee shops for adult use in the Netherlands, but it is a tricky situation there. But Germany will probably be the trendsetter in terms of legislation. If they allow the legal sale of cannabis to adults, the other European countries will probably follow. The question now is how they will react when Europe is open for business. Will they set up a distribution network in Europe? Will Israel be their main base of operations in Europe?

Peers

Seeking Alpha Peers Tab

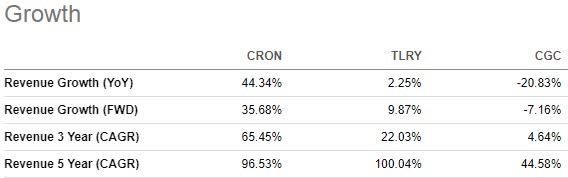

For a peer comparison, I chose Tilray (TLRY) and Canopy (CGC). If we look at the 5-year revenue CAGR, we can see that Tilray and Cronos are much better than Canopy, and on a 3-year basis Cronos also beats Tilray quite comfortably. But as a result, Cronos is a bit more expansive than its peers. If we compare price/sales, we get the following figures:

- Cronos: ~8

- Tilray: ~2.5

- Canopy: ~3

Seeking Alpha Peers Tab

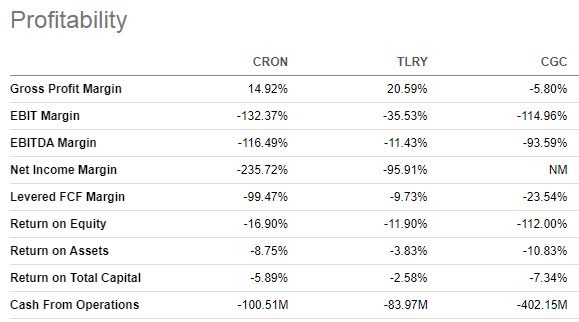

From a pure profitability perspective, Tilray may be in the best position right now. Although, it is hard to talk about the best position when all the numbers do not look very good at the moment. But the big advantage for Cronos is its cash position combined with zero debt. They have 877 million in cash, compared to 433 million for Tilray and 588 million for Canopy. And they both have debt. Considering this, particularly Canopy is in a dangerous position.

Risks

A major risk is that 3 customers account for 28%, 17% and 10% of total net revenues. This means that 55% of total net revenue was concentrated in just 3 customers. The loss of any one of them would have a significant impact on revenues. It will also be interesting to see how cannabis companies compete with the black market. Because they have some advantages over their legal counterparts. They don't have to pay the heavy taxes and probably have lower costs because they don't have to comply with regulations.

It should also be mentioned that they have been charged by the SEC for accounting fraud committed by the former CCO. There is also a risk that the legalisation of cannabis for adult use will take longer than expected and that they will burn through all their cash in the meantime.

Conclusion

I think the cannabis market has the potential to deliver phenomenal returns for some companies over a 10-year period. Whether Cronos is the best company to bet on is hard to say at the moment. But at the moment they are in a better position than their competitors thanks to Altria. They have Altria's support in terms of their financial position, and they also have Altria's expertise in terms of brand and product development in a highly regulated environment. But Altria has also shown with its Juul investment that it is not flawless in its capital allocation.

As there are many ways this could play out and most companies are still in their growth phase, I would stay on the sidelines for now until I get a clearer picture of how this will play out.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of MO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.