Alibaba: At Some Point, The Buying Opportunity Will Pass

Summary

- Alibaba reported solid third-quarter results and could not only beat revenue and EPS estimates but could increase operating income and its bottom line again.

- And while risks still exist – especially political issues are concerning – we should not forget that we are dealing with a great business that has a wide economic moat.

- Even when being cautious about Alibaba’s margins and growth potential, the stock is still deeply undervalued in my opinion, and one of the great bargains in the current market.

Andrew Burton

Last week, Alibaba Group Holding Limited (NYSE:BABA) reported solid third quarter results and could beat revenue as well as earnings per share. But after a first positive reaction of the stock, we saw a sell-off once again and in the end, the stock is trading for roughly the same price as before.

And although Alibaba is trading about 60% above its 52-week (and multi-year) low, I still think investors are extremely irrational about Alibaba and the stock is still trading clearly below its intrinsic value. Of course, we must accept the price action and should take advantage of this opportunity Mr. Market is offering. I am also aware that I claimed frequently in the last few quarters that Alibaba is undervalued and so far, only the last bullish call worked out while the previous two would still have ended in a loss when sold right now. Nevertheless, I remain long-term bullish about Alibaba and will once again explain why. In my opinion, the fundamental story has not changed, and the arguments are still the same.

Third Quarter Results

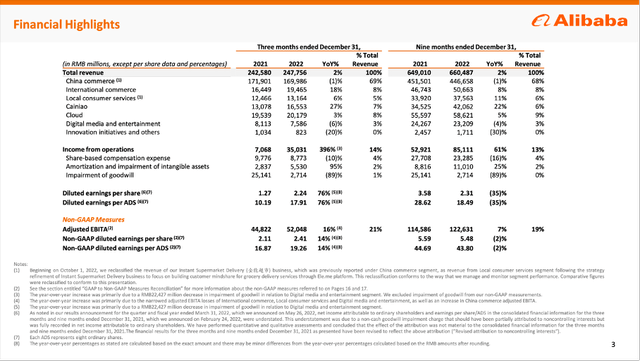

When looking at third quarter results we can start by pointing out that Alibaba could beat revenue estimates by $40 million. And while such a small revenue beat is almost not worth mentioning, Alibaba could also beat non-GAAP earnings per share by $0.39, which is a more impressive beat and could be interpreted as a good sign that Alibaba can increase profitability again.

When not only looking at estimates and expectations but at the actual results we can describe the results as solid (especially when considering the results in the previous quarters). Revenue in the third quarter could increase slightly from RMB 242,580 million in the same quarter last year to RMB 247,756 million this quarter - an increase of 2.1% year-over-year. And while the top line could increase only slightly - for Alibaba a low single digit increase is a disappointment - income from operations could increase about 400% from RMB 7,068 million in the same quarter last year to RMB 35,031 million this quarter. And net income also more than doubled from RMB 19,224 million in the same quarter last year to RMB 45,746 million this quarter.

The reason can be found in lower expenses for sales and marketing as well as product development, but the main reason is a $25,141 million goodwill impairment in the same quarter last year, which led to a low income from operations and low net income in the quarter that ended in December 2021.

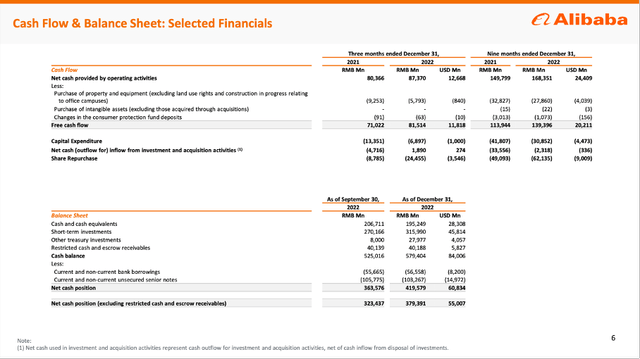

Diluted earnings per share increased from RMB 1.27 in the same quarter last year to RMB 2.24 in the current quarter - resulting in 76% year-over-year growth. When looking at the non-GAAP diluted earnings per share, we still see an increase of 14.2% YoY from RMB 2.11 to RMB 2.41. Free cash flow was RMB 81,514 million in this quarter compared to RMB 71,022 million in the same quarter last year - this is resulting in an 14.8% year-over-year growth.

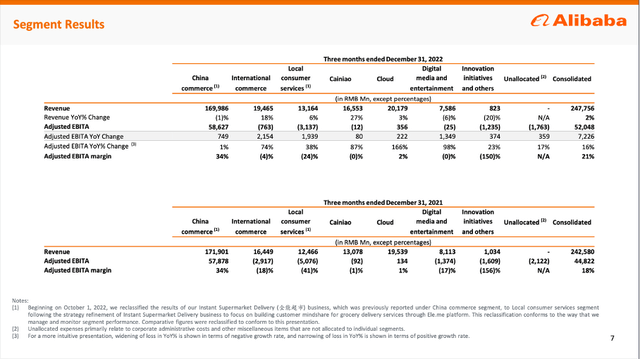

When looking at the different segments, we see a mixed picture of segments that are contributing to growth and segments that are even declining. The company's most important segment - China Commerce - which is responsible for almost 70% of revenue reported a slightly declining revenue. And the segment "Digital media and entertainment" also reported a revenue decline of 6% YoY. All the other segments contributed to growth and especially "International Commerce" could increase revenue 18% year-over-year and "Cainiao" reported 27% revenue growth year-over-year. Combined, those two segments reporting high growth rates right now are responsible for 14.5% of total revenue and could be drivers of growth in the years to come. One of the disappointments was "Cloud" which could report only 3% growth but is still seen as one of the segments with high potential to driver growth in the years to come.

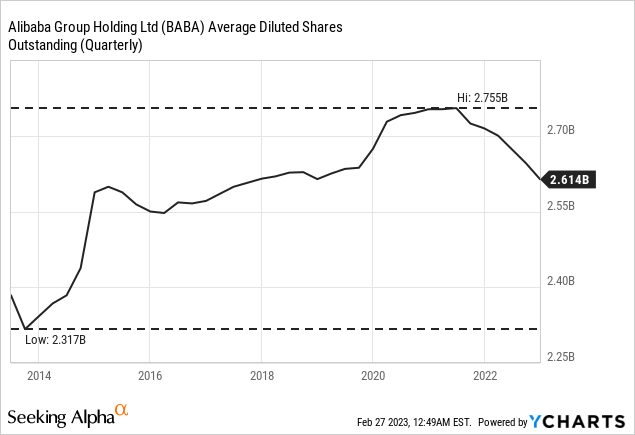

Share Repurchases

Alibaba is continuing to buy back shares. In the third quarter the company repurchased 45.4 million ADSs (the equivalent of 363.3 million ordinary shares). And the number of outstanding shares decreased from 21,716 million diluted outstanding shares on December 31, 2021, to 20,912 million diluted outstanding shares on December 31, 2022. And under the current share repurchase authorization, which will last until March 2025, $21.3 billion (about RMB 150 billion) remain.

And as I have already mentioned in my last article, Alibaba is still deeply undervalued and should buy back shares as aggressive as it can. In my opinion, Alibaba should use its free cash flow (unless it is using the amount for other investments) for share buybacks, and it could also use the liquid assets it has on its balance sheet.

The company still has huge amounts of liquid assets on its balance sheet. As of December 31, 2022, Alibaba had RMB 195,249 million in cash and cash equivalents on its balance sheet. Additionally, the company had RMB 315,990 million in short-term investments on the balance sheet. Of course, we should not ignore the debt Alibaba has on its balance sheet, but on December 31,2022, Alibaba had RMB 6,700 million in current bank borrowings and RMB 4,865 million in current unsecured senior notes. Additionally, Alibaba has RMB 49,858 million in non-current bank borrowings and RMB 98,402 million in non-current unsecured senior notes. And when subtracting about RMB 160 billion in debt from RMB 511 billion in liquid assets, about RMB 350 billion would remain that can be used for share buybacks. With a current market capitalization around RMB 1,700 billion, Alibaba can repurchase about 20% of its outstanding shares by using the cash on the balance sheet. Additionally, when Alibaba is using the annual free cash flow, it can repurchase another 10% of its outstanding shares (I used the annualized number of the free cash flow of the last nine months, which was RMB 139,396 million).

Why Still A Great Business

When looking at the last few quarters, we can't ignore that Alibaba is struggling, and the reported numbers are not great. In the last few quarters, it was difficult to argue that Alibaba is a great business with a wide economic moat and the potential to grow with a high pace. But when just looking at the last three years (annualized numbers), Alibaba could grow revenue with a CAGR of 31.30% and operating income with a CAGR of 17.96%.

CAGR | 10-year | 5-year | 3-year |

|---|---|---|---|

Revenue | 45.53% | 40.06% | 31.30% |

Operating Income | 33.30% | 14.55% | 17.96% |

Of course, when looking at data for earnings per share, the picture is a little different, but while we must acknowledge that Alibaba is struggling in the last few quarters, we should also not ignore that Alibaba is a high-growth business.

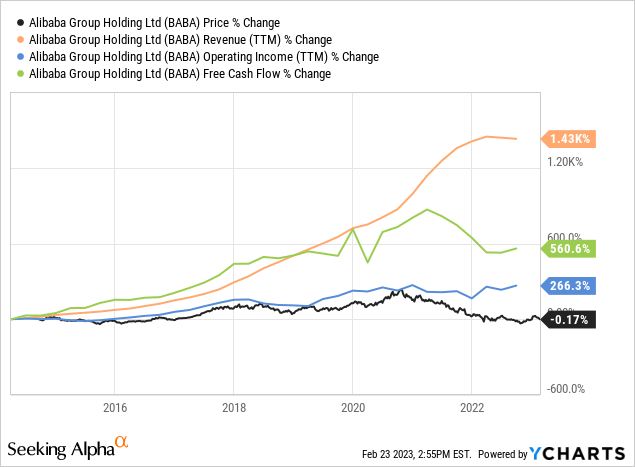

And when looking at the data since the IPO of Alibaba, we can see the huge discrepancy between the share price and fundamental numbers. While the stock is at the same price level it was on its first trading day, operating income increased 266% during that time, free cash flow increased 560% and revenue increased 1,430%.

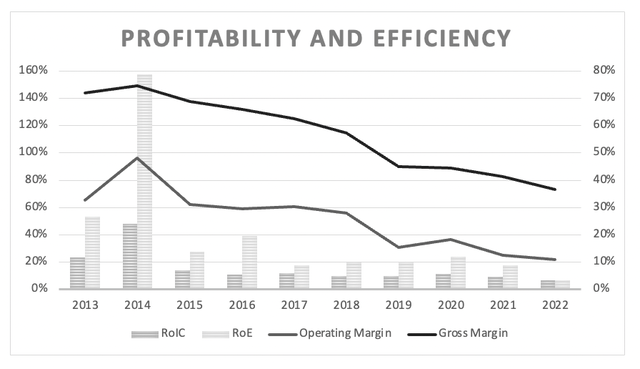

We already saw above that free cash flow and operating income could not grow with a similar pace as revenue - an aspect also reflected by the company's margins. When looking at the last ten years, the gross margin and operating margin of Alibaba declined constantly, and this is not a great sign for a high-quality business. It is acceptable for a business to have a fluctuating net income margin (which is more difficult to control) and operating margin is also sometimes fluctuating a bit, but a constantly declining gross margin must be seen as problematic.

Alibaba: Margins and RoIC (Author's work)

And when looking at return on invested capital, the numbers are also rather mediocre. Similar to gross margin and operating margin, return on invested capital also declined in the last few years. In the last five years, return on invested capital was 9.53% on average and my threshold for a high-quality business is usually a RoIC of 10%. In the last ten years however, return on invested capital was 15.61%.

When talking about Alibaba, we should also point out that the company is investing a lot into new businesses and when looking at the different business segments only "Chinse commerce" and "Cloud" are contributing to adjusted EBITDA while all the other segments are not profitable. But many of these business segments have the potential not only to grow revenue but also contribute to profits in the future.

We can also mention the comparison between Amazon (AMZN) and Alibaba once again. While Alibaba, which is profitable since its IPO, can be described as a cash cow - despite declining margins - Amazon is struggling to be profitable and is reporting a negative free cash flow and a loss per share once again. And while the pessimism surrounding Alibaba is rather high, investors seem to be more accepting of Amazon reporting a loss as the business is reinvesting in future growth. But Alibaba has a very similar strategy and is trading for a much more reasonable stock price.

And both companies are constructing similar moats around the business - based on the brand name (with Alibaba getting more and more popular even outside China), cost advantages (both companies are trying to beat competition by being able to offer the cheapest prices and both are trying to install their own distribution network) and network effects (especially for third-party seller platforms).

Intrinsic Value Calculation

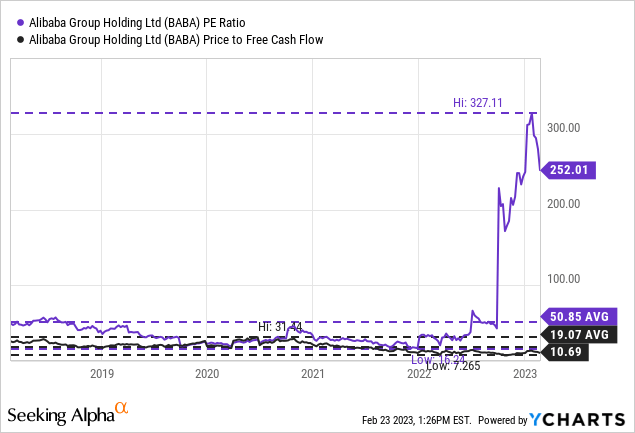

When looking at the price-earnings ratio, Alibaba is still trading for an extremely high P/E ratio - similar to the last article. Right now, Alibaba is trading for 250 times earnings, but that metric is rather misleading. Instead, I would focus on the price-free-cash-flow ratio, which is painting a completely different picture. While Alibaba is trading for 250 times earnings, it is trading only for 10.69 times free cash flow - a very low valuation multiple and clearly below the average of 19.07 in the last five years.

And not only the valuation multiples are showing that Alibaba is cheap. Using a discount cash flow calculation is leading to the same conclusion. As Alibaba is reporting in Renminbi, I also wrote this article using these numbers - however, I will switch to USD now as it makes more sense to calculate an intrinsic value in USD as the asset we are mostly looking at (the ADS) is also trading in USD.

In the first nine months, Alibaba generated $20,211 million in free cash flow leading to an annualized free cash flow of $26,948 million we can take as basis in our calculation. And as always, we use a 10% discount rate and assume 2,646 million outstanding shares (for the ADS). Even when assuming no growth potential for Alibaba and the company just being able to generate a similar free cash flow in the years to come in the last few quarters, the stock is undervalued (intrinsic value would be $101.84 in such a scenario).

But as I have pointed out several times, these growth assumptions are ridiculous (in my opinion) and we can at least calculate with 6% growth from now till perpetuity. The combination of using share buybacks, top line growth and probably improved margins (when other segments are getting profitable) should easily lead to mid-single digit growth. When calculating with these assumptions, we get an intrinsic value of $254.61 for Alibaba - making the stock deeply undervalued. And as always - you must decide for yourself if these assumptions are realistic.

Risks

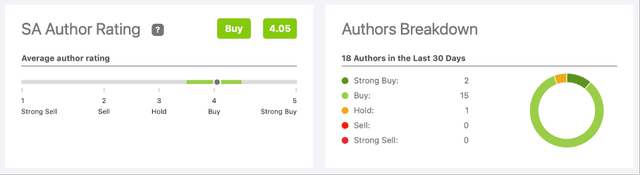

And when looking at the ratings, I am obviously not the only author being bullish about Alibaba right now. In the last 30 days, 18 authors published an article about Alibaba and no single author was bearish about the stock.

Alibaba: SA Author Rating (Seeking Alpha)

But of course, we should not ignore that Alibaba is also facing risks and there still must be reasons why Alibaba is trading for such a low stock price and valuation multiple.

We can start by mentioning COVID-19, which is still an issue in China. But the country is now accepting higher numbers of COVID-19 cases and higher number of deaths as it is reopening, which should be bullish for many Chinese companies - including Alibaba.

To be honest, I don't worry much about the Chinese economy and also not about Alibaba's growth potential in the years to come. The biggest risk in my opinion is the political situation. It still seems to be unclear what position China will choose in the Russia-Ukraine conflict (with Europe and the United States and most other countries supporting Ukraine). In the last few weeks, it seemed like China is leaning more and more towards supporting Russia. In combination with allegations of China spying in the United States it could lead to new conflicts between the United States and China - including sanctions and economic consequences for China and Chinese companies.

But I still believe all the risks mentioned above are more than reflected by the current stock price, which is reflecting so much negativity right now.

Conclusion

As long as these mostly political risks are not occurring, Alibaba is a great investment as we can purchase a high-quality business with the potential to grow at a high pace for an extremely low price. And even if Alibaba should face some additional risks in the years to come and continue to struggle, such a scenario is more than reflected by the low valuation multiples.

This article was written by

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.