Market Gets A Reality Check

Summary

- Despite hitting its highest levels since last August early last month, the U.S. stock market retreated for most of February.

- Tech was the only S&P 500 sector with a positive return last month, while energy took the biggest step back.

- Interest rates climbed in February, with intermediate- and longer-term yields rising more than short-term rates.

Jacobs Stock Photography Ltd/DigitalVision via Getty Images

If January appeared to erase many of 2022’s bear-market themes, February suggested those pressures had hibernated rather than disappeared: Stocks gave back more than half of their fast start to the year, bond prices retreated as yields climbed, and the Federal Reserve reminded everyone that it’s not about to back off from raising interest rates.

Inflation—and the Fed’s response to it—remained at the center of the market conversation last month. All the major barometers came in higher than expected, and the minutes from the Fed’s most recent policy meeting showed the central bank believed additional rate increases (beyond the expected hike later this month) would be necessary to tame prices.

Not surprisingly, these developments re-energized the recession debate—an unnecessary distraction for investors. Markets are forward-looking: if the economy is in for a “hard landing,” it will likely be reflected in the stock market before a recession is officially identified. And if you have a long time horizon, periods of market volatility have proven to be opportune times to add to positions.

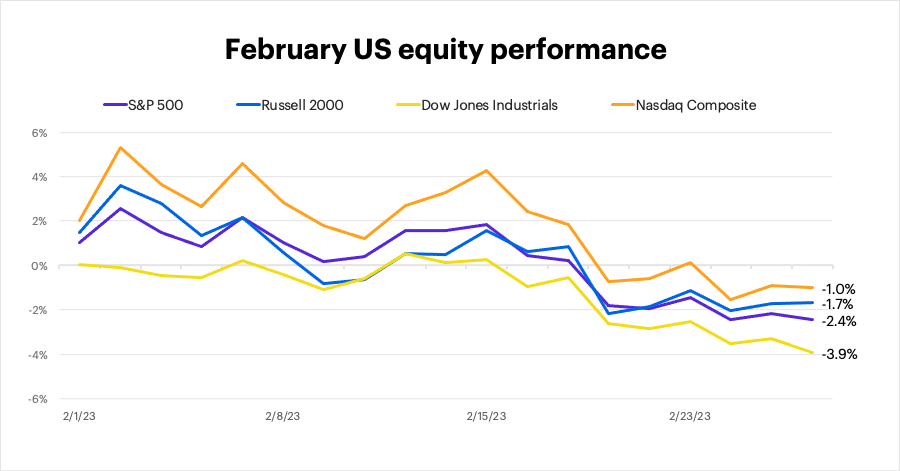

U.S. equities

Despite hitting its highest levels since last August early last month, the U.S. stock market retreated for most of February. The S&P 500 (SP500) fell 2.4%, while the tech-heavy NASDAQ Composite (COMP.IND) and the small-cap Russell 2000 (IWM) both lost less ground:

FactSet Research Systems

Sectors

Tech was the only S&P 500 sector with a positive return last month, while energy took the biggest step back:

FactSet Research Systems

International equities

International markets lagged the U.S. in February, with emerging markets (Asian and Latin American stocks were notably weak) underperforming developed markets:

FactSet Research Systems

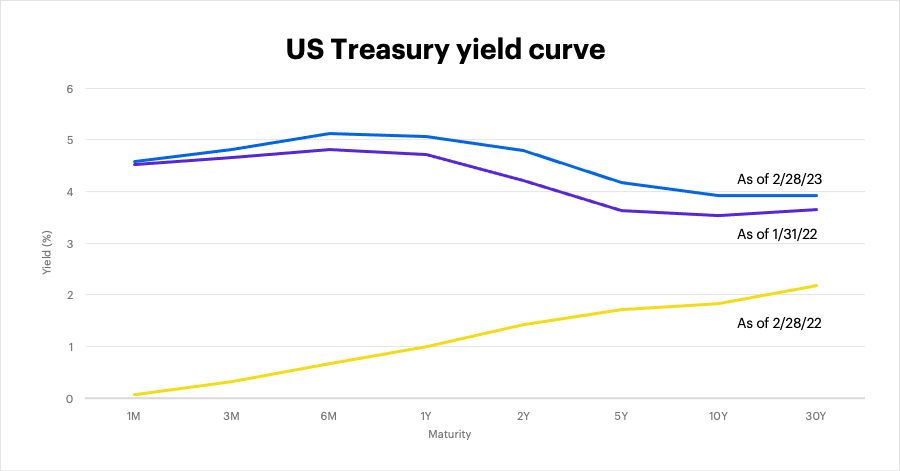

Fixed income

Interest rates climbed in February, with intermediate- and longer-term yields rising more than short-term rates. (Morgan Stanley & Co. recently discussed the potential ripple effects of high short-term rates, especially their possible implications for the stock market.) The benchmark 10-year T-note yield ended the month at 3.92%, up from 3.53% a month earlier:

FactSet Research Systems

Looking ahead

A month ago, we warned investors against thinking January’s rally meant the market’s struggles were behind it. Here are a few thoughts in the wake of February’s reality check:

- Keep fixed income in the mix. The upside of rising interest rates is “real yield.” The six-month Treasury bill, for example, has gone from yielding 0.06% in November 2021 to 5.1% at the end of February—the highest it’s been since July 2007. Such returns provide ballast to a portfolio.

- Don’t give up on global. International equities may have underperformed the U.S. in February, but they outperformed a month earlier. Because they’re unlikely to move in lockstep with domestic equities, they remain a valuable portfolio diversifier.

- Choose quality over momentum. Just as last month’s economic data suggested inflation hadn’t suddenly disappeared, the stock market’s retreat showed volatility wasn’t dead. Avoid chasing what could be fleeting momentum and concentrate on “quality” stocks—those with proven cash flow, and/or a consistent record of raising dividends.

Getting out of our inflation predicament was never going to be easy or quick. The good news about February was that a market that goes down as well as up is normal, as is a Fed that raises rates in response to high inflation. History shows the market has overcome similar challenges. Benefiting from an eventual recovery requires patience and discipline—a commitment to value, diversification, and long-term investment goals.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.