Workday: Revenue Beat With Many Competitive Advantages

Summary

- Workday is a leading Human capital management platform which has over 10,000 customers globally, including 25% of the Fortune 2000.

- The company reported strong financial results for the fourth quarter of FY23, as it beat both revenue and adjusted earnings growth estimates.

- Workday has a number of competitive advantages which include its high retention rate of 95%, its high switching costs, its technology, and its partners.

- When I capitalize the company's R&D expenses using my valuation model, WDAY stock is actually positive on a GAAP basis.

putilich

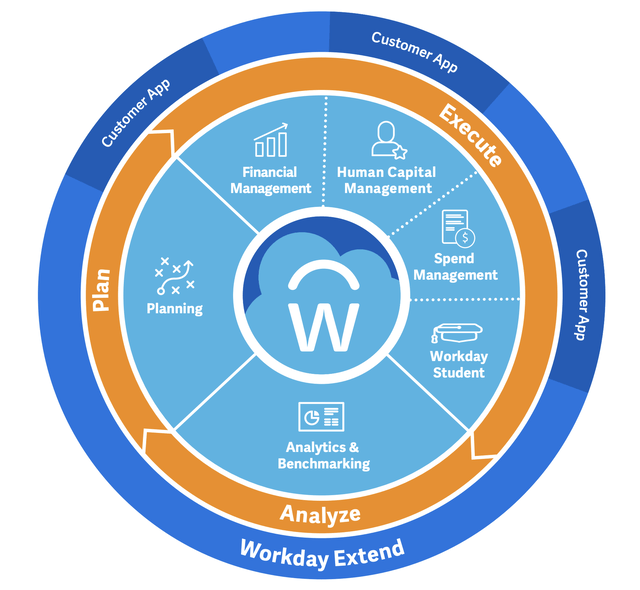

Workday (NASDAQ:WDAY) is a software as a service company which is a leader in human resources management software, according to G2. This is an industry which was historically governed by legacy players, including Oracle (ORCL), SAP (SAP), etc. However, Workday has effectively made the industry "sexy" and took a consumer-focused software approach to what was previously considered "back office" admin. Since that point, the business has scaled massively to serve over half of the Fortune 500 and gain over 10,000 customers globally. In the fourth quarter of FY23, Workday has continued to execute well as the company beat both revenue and adjusted earnings expectations. In this post, I'm going to break down its financial results and competitive advantages before revealing my valuation model and forecasts for the business. Let's dive in.

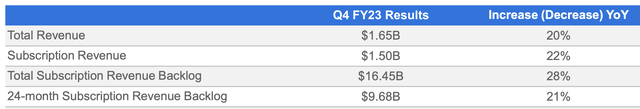

Solid Financial Results

Workday reported solid financial results for the fourth quarter of fiscal year 2023. Its revenue was $1.65 billion, which increased by a rapid 19.6% year over year. If I compare this growth rate to prior quarters, I have calculated a 20.48% growth rate for Q3,FY23, 21.85% for Q2,FY23, 22.1% for Q1,FY23, etc. Therefore, the growth rate has been slowing down over the past few quarters. The good news is this is a common trend I have noticed across my study of most companies (see my other posts) and is mostly driven by the macroeconomic environment. Workday generates the vast majority (90%) of its revenue from subscription services, which came in at $1.5 billion, up 21.7% year over year. This is a positive sign as subscription services tend to offer greater revenue consistency, no matter what the economic environment. In this case, Workday has a staggering subscription revenue backlog of $16.45 billion, up 28% year over year while its 24-month subscription backlog was $9.68 billion, up 21% year over year.

Competitive Advantage?

Workday has a few competitive advantages, with the first being the quality of its product/technology. The company's Human Resources management [HRM] software is rated as the number one leader by G2. Gartner peer reviews also boast its integrated Payroll solution, its flexibility, and ease of use, while Trust Radius has rated the company 8 out of 10.

Human Resources Software (G2 with author annotation)

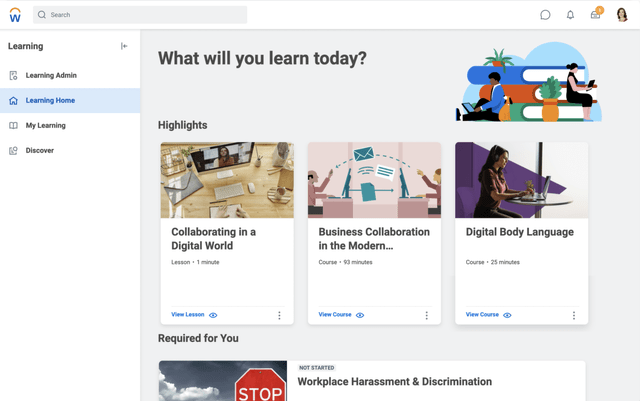

Secondly, the business has a super-high retention rate of greater than 95%, according to its Q4 earnings report. This means the majority of its customers are staying with the product. I believe part of this is driven by product "stickiness" as it is embedded deeply into core/vital business functions such as Human Resources, Payroll, and financial planning. For example, it's also used by employees to submit expense requests, request vacation, days off, etc. On the hiring side, if a "scale-up" company is growing rapidly and needs to hire fast, it needs to do this in a low-friction manner. What a decision maker doesn't want to do is try and change to an alternative provider (just to save a little on costs) at the risk of the system "breaking" even for a short period. Workday also has launched a certification program and training modules for customers. Thus, if a customer has spent a long time learning to use a specific platform, they will be unlikely to switch.

In fact, I was surprised to discover from its earnings call that approximately 50% of Workday HCM customers use its Workday Skills Cloud to help upskill team members across various areas. This also includes "mandatory" onboarding courses such as those in discrimination education, etc.

On a technical front, Workday has launched its "Extend" platform, which basically allows customer developers to build applications across its platform. I believe this will drive further "stickiness" as customers will feel a sense of ownership.

Bringing everything together, I believe Workday has "pricing power", which is vital, especially given the high inflation environment. For those enterprise customers who want to reduce costs upfront (due to limited "initial value"), Workday offers a clever "ramp-up" pricing model. For example, let's say a company would normally pay $8.5 million over 5 years but is requesting a lower payment amount upfront, Workday can reduce year 1 fees from $1.7 million to $500,000. However, the company then increases its future fees to ~$2 million per year, which effectively means Workday captures the lost value upfront.

Another feature of Workday which I don't really see in any other "back office" software is its organic (front of house) indirect advertising. For example, when you apply for a job at a company which uses Workday, you will be presented with a specific Workday platform (with logos) and even have to create a unique login, etc. I believe this is an overlooked feature of Workday as it can effectively drive viral adoption through word of mouth. Given I have a Digital Marketing background, I always like to play a little game and ask "how did I hear about x product?". In this case, I actually discovered Workday through the aforementioned process.

AI and Partnerships

Artificial Intelligence or AI has been a hot topic over the past year and is now at a "tipping point" of mass adoption. In this case, Workday has had AI embedded into its core platform for a long time and it also uses the technology for specific functions to help its customers. For example, its AI technology is utilized by retailers to help with forecasting business demand such as foot traffic and sales. Given over 50% of the retail organization in the Fortune 500 use Workday, I forecast more traction in this market.

The company has also recently announced a $250 million expansion of its Venture capital fund to focus on generative AI. I believe having a "venture fund" makes sense, as the company only needs a couple of "moonshots" to create immense business value. However, I do believe Workday should aim to keep its investments related to the core business, and not go on a tangent into Biotech as example like Alphabet (GOOG, GOOGL) or Google has done.

Partnerships are also a major advantage for Workday, as I believe there is currently a "land grab" going on in this space. The phrase "better together" is thrown around a lot but it's true on so many levels. Partnerships enable lower and more consistent costs of customer acquisition, which is essential during tough economic times. For example, Workday has partnerships with AWS (AMZN), the world's largest cloud infrastructure provider and major consultancies such as McKinsey which are effectively "in bed" with enterprises.

Margins and Balance Sheet

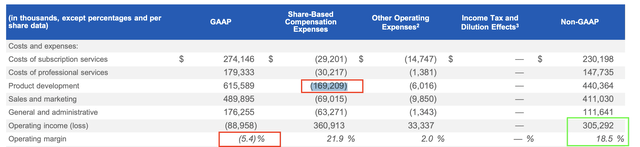

For Q4,FY23, Workday reported an operating loss of $89 million or negative 5.4% of total revenue. A positive is this is an improvement over the loss of $101 million or negative 7.3% of total revenue in the equivalent quarter last year. This was mainly driven by operating leverage improvements and top line revenue growth. General and Administrative expenses have still been growing, but not as fast as revenue. On a Non-GAAP basis, the company has a positive 18.5% operating margin, which is up 1% year over year. This was driven by lower stock-based compensation [SBC] in its Sales and Marketing and G&A areas, while SBC continued to rise in its product development segment by 15% year over year. This makes complete sense in my mind, as retaining technical talent is harder than ever, so stock-based compensation is a vital part of the package. However, overall I would like to see a reduction (as a portion of revenue) across the board long term. For extra information, its common share count has increased from 251 million to 259 million year over year, which dilutes shareholders by ~3%, which isn't substantial but something to be aware of.

Stock-based compensation (Financials)

Workday also announced some "team restructuring" as it reduces its workforce by 3%. I feel bad for those let go in this situation, but this is not a massive reduction, which is a positive sign, given the company is still growing.

Overall, Workday's non-GAAP earnings per share [EPS] was $0.99, which beat analyst expectations by $0.09.

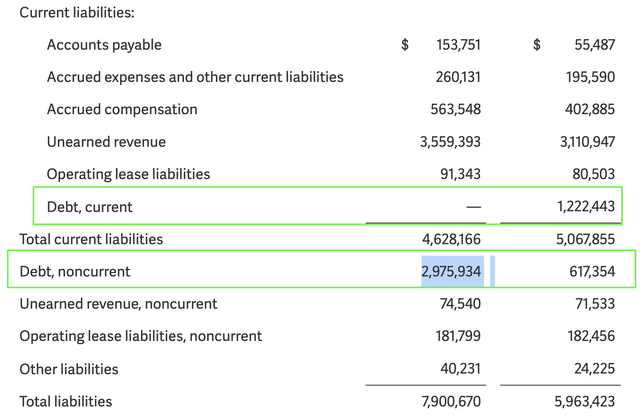

The company has a strong balance sheet with $1.886 billion in cash and cash equivalents in addition to solid $4.2 billion in marketable securities, which is up from "just" $2.1 billion in the prior year. I believe this may have been driven by the recent (small rebound) in the stock market, which has increased the valuation of some of Workday's investments. In terms of debt, the company has fairly high non-current debt of $2.975 billion. However, a positive is its "current debt", which is the debt due within the next 2 years, which seems to have been reduced to mostly zero, which is a positive sign, as its payment schedule looks to have been transferred over to future years.

Debt Workday (Created by author Deep Tech Insights)

Valuation and Forecasts

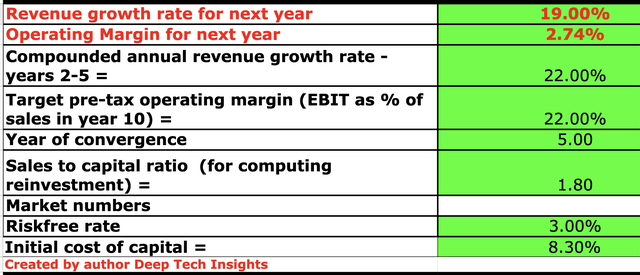

In order to value Workday, I have plugged its latest financial data into my valuation model, which uses the discounted cash flow method of valuation. I have forecast 19% revenue growth for "next year", which refers to the next four quarters. This is based upon an extrapolation of management's forecast for Q1 FY24 subscription revenue of between $1.517 billion to $1.520 billion. As Workday generates ~90% of its revenue from subscription services, I have upscaled this to the top line, as an estimate. I expect this growth to be slightly offset by the uncertain macroeconomic environment, which may delay new customer sign ups. However, in years 2 to 5, I have forecast a faster growth rate of 22% per year, which I expect to be driven by continued leadership in the Human Capital Management [HCM] market, which is estimated to be $52 billion TAM, according to IDC data (cited by Workday). In addition, I expect continued traction across the Financial management and related services market.

Workday stock valuation 1 (Created by author Deep Tech Insights)

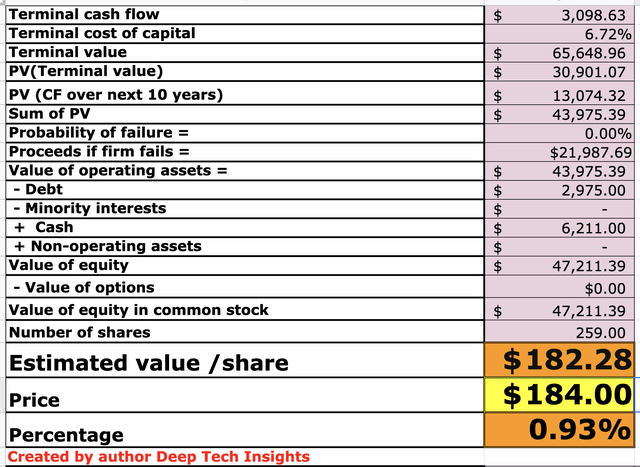

To increase the accuracy of my model, I have capitalized the company's R&D expenses, which has actually lifted its net income into profitable territory, which is a positive sign that most investors will have likely overlooked. Over the next 5 years, I have forecast a pretax operating margin of 22%, which is fairly optimistic but is 1% lower than the average margin for the software industry. I forecast this to be driven by operating leverage improvements, as well as economies of scale from its enterprise customers and the increasing number of cross-sells via its financial product range.

Workday stock valuation 2 (Created by author Deep Tech Insights)

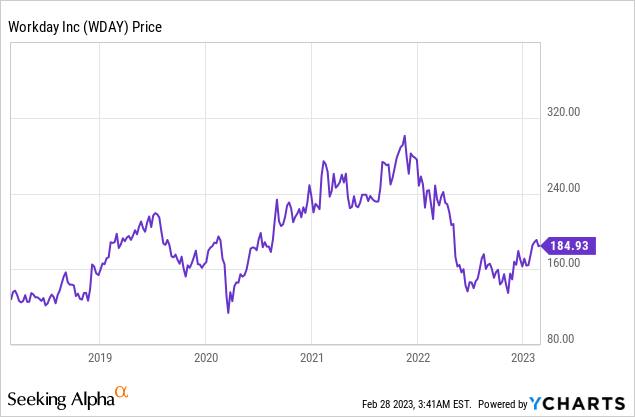

Given these factors and forecasts, I get a fair value of $182 per share, WDAY stock is trading at ~$184 per share at the time of writing and thus is ~0.93% overvalued intrinsically. Given the quality of the company and its "sticky" enterprise customer base, I will label this stock as "fair value" at the time of writing.

As an extra data point, Workday trades at a forward price-to-sales ratio = 7.59, which is over 28% cheaper than its 5-year average. Relative to its peers in the industry, the stock trades at a mid-range valuation, as you can see on the chart below.

Risks

Recession/Longer Sales Cycles

As mentioned in the introduction, many analysts have forecast a recession in 2023. Therefore, I expect longer sales cycles, as business decision makes "wait to see" how the economy plays out. I have reflected this in my forecast for the company, but of course, nobody knows if we will have a "deep" or "shallow" recession. I personally believe it will be "shallow" as the "recession" has been effectively manufactured by the Fed through first excess stimulus, then interest rate hikes.

Final Thoughts

Workday is a tremendous company, which is truly a leader in the Human Capital Management industry. The business has continued to execute well despite a tough macroeconomic backdrop. In addition, I believe its focus on a partnership strategy and expanding its TAM will also have a positive benefit. The only issue with this company is its valuation is a little "spicy" intrinsically, especially given the macroeconomic environment and a number of "value" opportunities in big tech stocks (see my other posts). Therefore, I will label WDAY stock as a "hold" for now, but definitely one for the watch list.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.