Completed houses at a Persimmon Plc residential property construction site in Harlow, U.K. on Monday, Jan. 9, 2023. Photographer: Chris Ratcliffe/Bloomberg

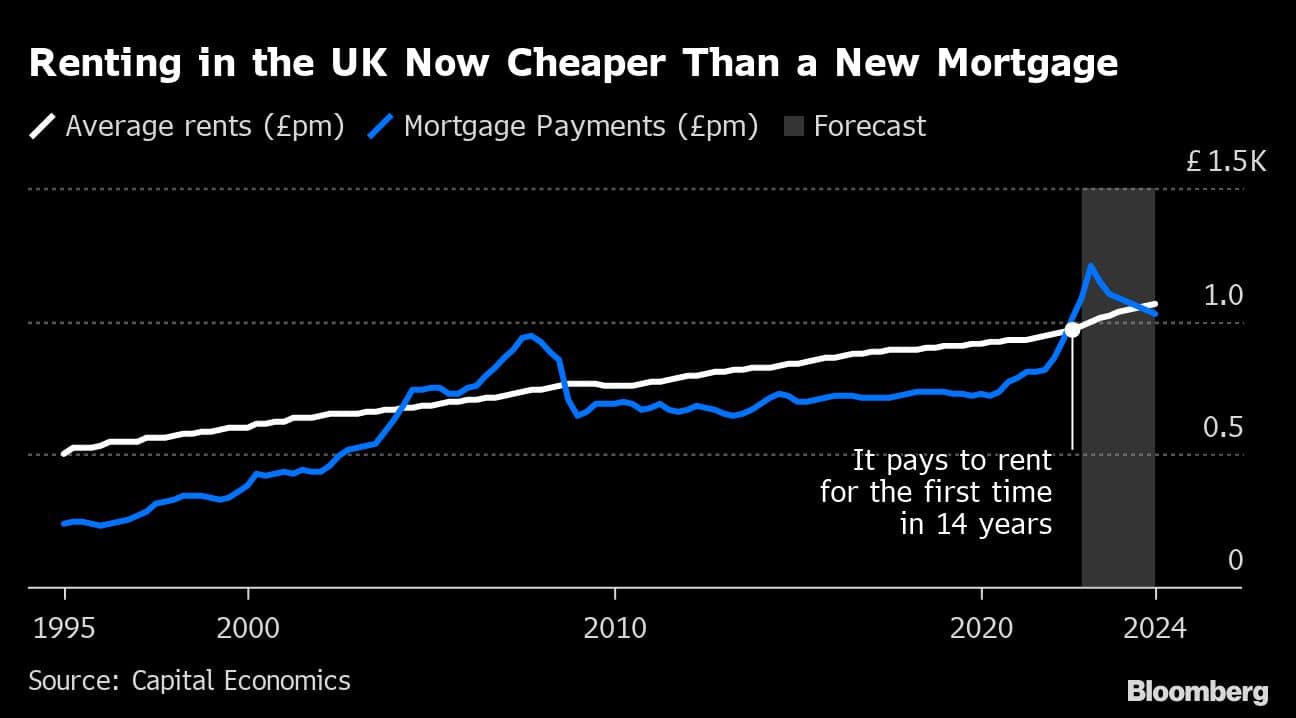

Renting a home in the UK is cheaper than taking out a new mortgage to buy one for the first time in 14 years, according to an analysis by Capital Economics.

The consultant found that the average mortgage repayment has now topped £1,000 ($1,200) a month for the first time ever after interest costs on the loans doubled in the last two years. That trend may persist until next year.

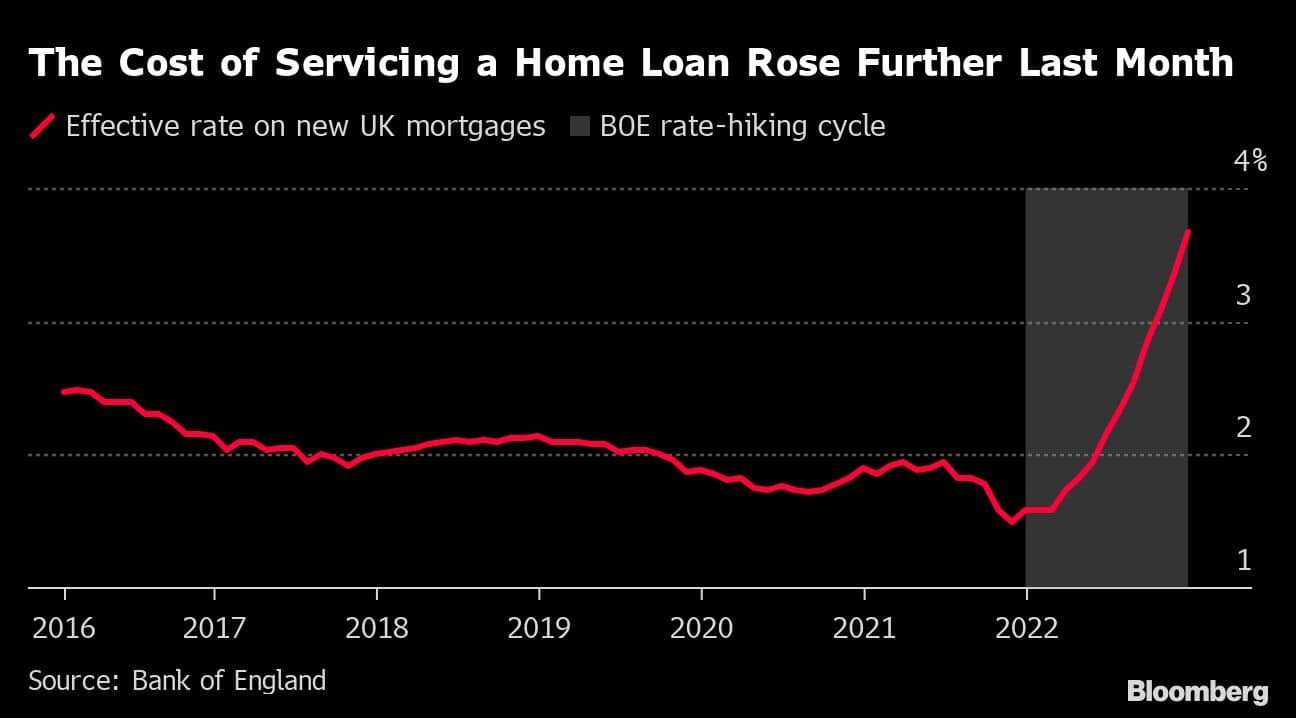

The findings contrast with reports that for years have shown that owning a home is cheaper in the UK even after a surge in prices that until late last year stretched back more than a decade. That calculus shifted abruptly in 2022 when mortgage interest rates, which averaged around 1% for the past few years, leaped above 6%.

The Bank of England’s rate rises along with a market panic following Liz Truss’s budget program during her brief term as prime minister both helped push up the cost of home loans. Mortgage rates have started to subside in recent months.

Average rent payments remained relatively stable over 2022 at £900 to £1,000 a month, according to Capital Economics.

However, they were surpassed by average monthly payments on new mortgages, which topped £1,000 in the third quarter, data provided to Bloomberg showed. The interest component of the mortgage has jumped from about £260 a month in the middle of 2020 to more than £500 in the second half of last year.

Andrew Wishart, property economist at Capital Economics, expects mortgage costs to exceed rents until the second half of 2024 with the gap predicted to have widened further in the final three months of last year.

Tenants will not be spared from higher costs, since first-time buyers struggling to get a foot on the property ladder are staying longer in rental properties.

“That’s likely to cause many would-be first-time buyers continue to rent rather than buy,” Wishart said. “That extra demand in the rental market means that rental growth will remain very strong. Indeed, after previous mortgage rate shocks rents have risen as a share of income.”

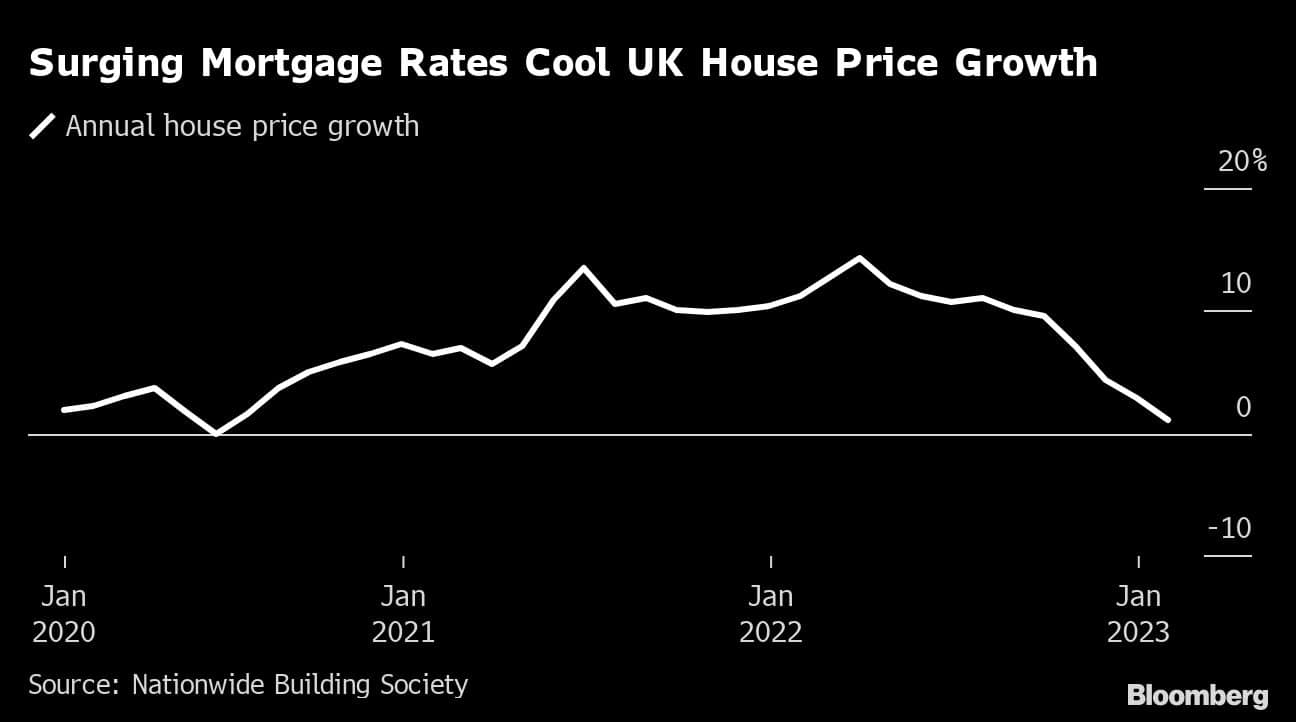

A surge in mortgage costs is expected to trigger a slump in house prices in 2023 as activity in the market cools.

The mortgage market was rattled by Truss’s budget, with the average two-year fixed rate home loan soaring to a 14-year high of 6.65% in October. It had fallen to 5.3% by mid-February.

House prices have already fallen month-on-month in official data while mortgage approvals have also slowed to the lowest level since the first Covid lockdown.

It came as Oxford Economics warned that the UK property market is at the start of a “sustained correction” that will trigger a peak-to-trough house price plunge of up to 15%. However, such a fall would only take prices back to mid-2021 levels in cash terms.

“Mortgage rates have increased significantly, household real incomes are falling, affordability remains stretched, and demand is probably suffering from some potential buyers delaying purchases in expectation of further price falls,” said Andrew Goodwin, Chief UK Economist at Oxford Economics.

However, he said that the economic damage caused by a housing slump will not be as severe as previous falls.

“Households’ housing equity is starting from a record high, reducing pressure to cut spending to repay debt,” said Goodwin.