Genesis Energy: Further Improvements Coming In 2023, Still Not A Fan

Summary

- Genesis Energy struggled during the severe downturn of 2020 with a slow recovery but thankfully, 2022 finally saw improvements as the year ended with positive momentum.

- When looking at their guidance for 2023, it shows further improvements but at the same time, they are accompanied by higher capital expenditure.

- Whilst not completely bad, it nevertheless once again leaves them reliant upon debt funding.

- I feel this is quite an inopportune time after central banks rapidly tightened monetary policy, thereby pushing up the costs.

- As a result, I am still not a fan of their units and thus, I believe that maintaining my hold rating is appropriate.

hallojulie

Introduction

When last discussing Genesis Energy (NYSE:GEL) back in late 2022, it was encouraging to see positive momentum heading into 2023 with their financial performance improving materially, as my previous article discussed. Now that the calendar has rolled over we have fresh guidance for the year ahead and thankfully, this sees further improvements coming in 2023 but I am nevertheless still not a fan of their units given their reliance on debt funding at this inopportune time.

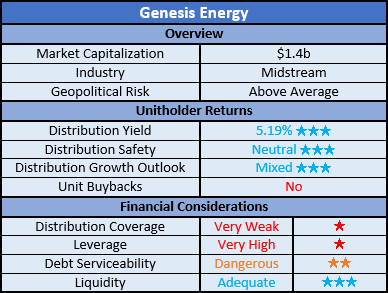

Coverage Summary & Ratings

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

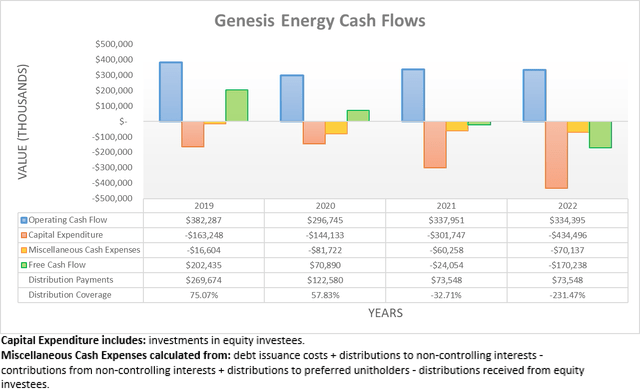

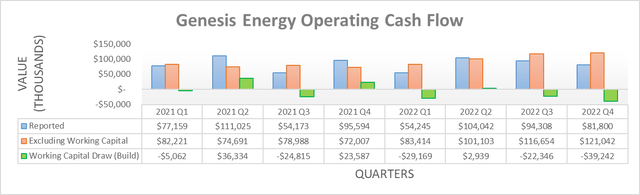

Following green shoots emerging early in 2022 with subsequent positive momentum building thereafter in the third quarter, this seemingly continued into the fourth quarter. Whilst this ultimately led the year to close out with operating cash flow of $334.4m that is essentially flat year-on-year versus their previous result of $338m during 2021, there is more to consider given their continued working capital builds that weighed down their cash generation on the surface.

Similar to previous quarters, their reported operating cash flow during the fourth quarter of 2022 was once again influenced by working capital movements. This time, their result of $81.8m would have otherwise been significantly higher at $121m if these were excluded. In fact, this underlying result is actually their highest quarterly result in recent history, at least since the beginning of 2021 and thus it further builds upon their positive momentum heading into 2023.

Genesis Energy Barclays Select Series Midstream Corporate Access Day February 2023 Presentation

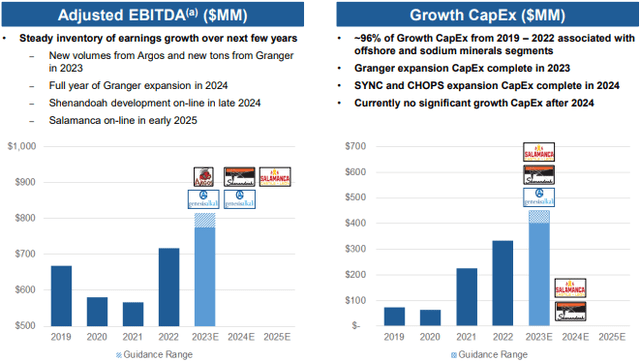

When looking at their guidance for 2023, it shows their adjusted EBITDA hitting $795m at the midpoint and thus a solid circa 8% higher year-on-year versus their result of $736.3m during 2022, as per their fourth quarter of 2022 results announcement. In theory, their operating cash flow should scale higher to a similar extent given their positive correlations. If excluding their working capital movements that weighed upon their results during 2022, their resulting underlying result is $422.2m and thus, it should reach circa $455m during 2023 that if forthcoming, would see their highest-ever cash inflow.

Whereas on the cash outflow side of the equation, their guidance for 2023 also sees higher growth capital expenditure of $425m at the midpoint. On top is their relatively smaller maintenance capital expenditure and whilst they do not provide guidance for this component, it was $57.4m during 2022 and $53.2m during 2021 and thus, it should be somewhere around $60m to $65m during 2023 given inflation and the growth of their partnership. In total, these see capital expenditure of circa $485m for the year ahead and thus once again the partnership will not generate any free cash flow.

Whilst this already means their distribution payments are going to require debt funding once again during 2023, they also normally see various miscellaneous cash expenses, as noted beneath the first graph above. These vary each year but have averaged circa $70m during 2020-2022 since issuing their preferred units, the distribution payments of which form the majority of the total. As for their distribution payments on their common units, they clocked in at $73.5m during 2022 and should do so once again given their same quarterly rate is being sustained, as far as presently known. If aggregated, all of these moving parts during 2023 see their estimated total cash outflows at circa $630m against accompanying estimated cash inflows of only $455m, thereby leaving a circa $175m gap to be plugged via debt funding.

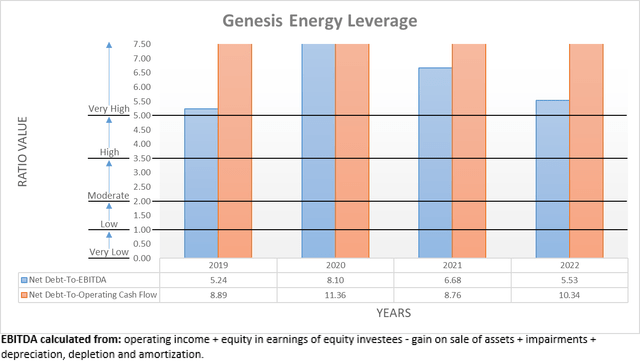

In keeping with their usual trajectory throughout 2022, the fourth quarter once again saw their net debt increase, this time now hitting $3.456b versus its previous level of $3.371b following the third quarter. Going forwards into 2023, their guidance for materially higher growth capital expenditure all but ensures this continues unabated in the year ahead, despite their otherwise solid earnings guidance and given the aforementioned gap between their estimated cash inflows and outflows, this stands to add circa $175m to their net debt that equates to circa 5%.

Quite unsurprisingly, their leverage once again remains above the threshold for the very high territory following the fourth quarter of 2022, as was normally the case throughout recent years. This sees their net debt-to-EBITDA at 5.53 barely changing versus its previous result of 5.74 following the third quarter. Concurrently, their accompanying net debt-to-operating cash flow increased to 10.34 versus 8.40 between these same points in time, largely due to their aforementioned continued working capital builds during the fourth quarter.

Going forwards into 2023, their solid earnings guidance for a circa 8% year-on-year increase should help ease this pressure. Although at the same time, it will be forced to battle against circa 5% higher net debt on the back of their accompanying higher capital expenditure. Since the former should increase more than the latter, it should see their leverage trend lower but this will be important to review as the year progresses given the small difference, especially as the weak economic outlook could prove a hindrance. In my eyes, the extent their earnings are translated into cash will be even more important because their net debt-to-operating cash flow of 10.34 is quite alarming and seldom observed elsewhere. Whilst everyone can debate exactly how non-GAAP metrics such as EBITDA are calculated, there is significantly less scope when it comes to cash-based metrics and thus, seeing it decrease significantly would bode very well for their partnership.

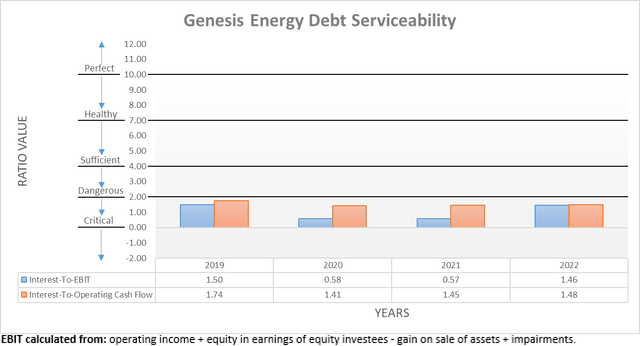

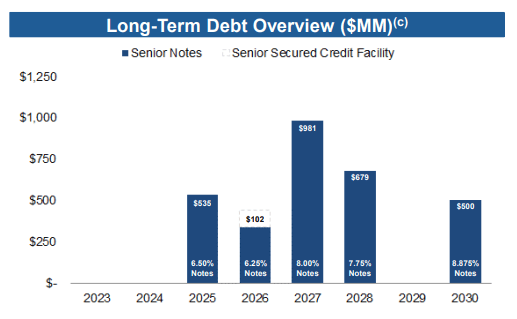

When it comes to their debt serviceability, their very high leverage made it a foregone conclusion that it would remain dangerous following the fourth quarter of 2022. To this point, their interest coverage as judged against their EBIT and operating cash flow produces respective results of 1.46 and 1.48 versus their very similar previous respective results of 1.32 and 1.50 following the third quarter. Since central banks have rapidly tightened monetary policy to the greatest extent in many years, this makes it quite an inopportune time to be issuing new debt, especially to fund their distribution payments. A prime example is their recent $500m issuance of senior unsecured notes due in 2030 that carry a coupon of 8.875%, which were partly utilized to refinance their $341.1m of senior unsecured notes due 2024 that only carried a coupon of 5.625%, as per their previously linked fourth quarter of 2022 results announcement.

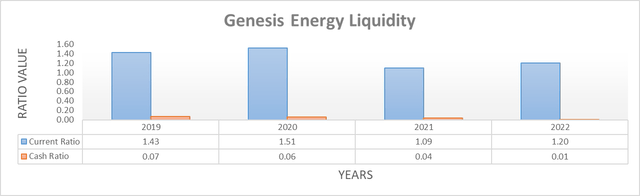

When it comes to their liquidity, the fourth quarter of 2022 saw their current and cash ratios remain broadly unchanged with respective results of 1.20 and 0.01 versus their previous respective results of 1.13 and 0.01. Since they cannot operate during 2023 without debt funding, it is positive to see they recently refinanced their credit facility earlier in the year, thereby seeing its maturity pushed out until February 2026 and leaving $748m of availability.

Even though there are no short-term issues, in the medium-term they see a very large wave of debt maturities starting in 2025 and persisting throughout 2028. Despite leaving breathing room right now in 2023, these will obviously still require refinancing ahead of time, much in the same way as they already refinanced their aforementioned 2024 debt maturity during early 2023. Unless central banks reverse course on monetary policy, this will likely be quite painful and add further pressure. Even if monetary policy eases, it is quite likely to be accompanied by weaker economic conditions that could also hurt their financial performance.

Genesis Energy Barclays Select Series Midstream Corporate Access Day February 2023 Presentation

Conclusion

Following their positive momentum during 2022, their guidance thus far sees further improvements coming in 2023 but at the same time, there is scant signs of material deleveraging as their net debt appears all but guaranteed to climb higher once again as they push their growth capital expenditure higher. Whilst growing their partnership is not necessarily bad, the resulting reliance upon debt funding comes at one of the most inopportune times with monetary policy tighter than at any time in recent history. Since this pushes up the costs at the same time as they see a very large wave of debt maturities approaching in the medium-term, I feel it hinders the appeal of their otherwise solid guidance for the year ahead and thus, I am still not a fan and once again believe that maintaining my hold rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from Genesis Energy’s SEC Filings, all calculated figures were performed by the author.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.