Alibaba: Q3 Earnings Display Its Cash Cow Potential

Summary

- Alibaba continues repurchasing shares at an aggressive pace, with over 45 million share repurchases done during the quarter.

- BABA significant free cash flow generation continues to enhance its liquidity position and give it flexibility to invest in growth segments such as Alibaba Cloud and Cainiao.

- BABA workforce reduction and cost optimizations deliver improvements in net income and liquidity.

maybefalse/iStock Unreleased via Getty Images

Business Overview and Investment Thesis

Alibaba (NYSE:BABA) is a dominant player in the growing Chinese cloud computing and e-commerce markets. The market continues to punish the company's market valuation since its peak at $835 billion to its current market valuation at $230 billion. This valuation places BABA at a very attractive entry point for a long-term investment opportunity. BABA continued delivery of strong results, strong fundamentals, and significant runway of growth ahead, make me consider BABA a buy. Let's dive into the quarter results.

BABA 3Q-22 Results

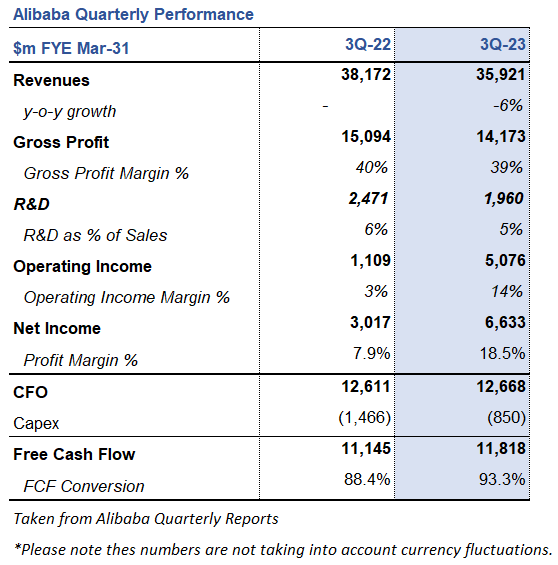

Alibaba Quarterly Financials (Alibaba Quarterly Report)

Please note that the numbers presented throughout the tables in the article are not taking into consideration currency fluctuations. I am presenting numbers in US Dollars; however, I will make notes along the article presenting numbers in RMB to present a clearer picture.

During the third quarter of FYE 2023, BABA reported revenue of $35.9 billion. In RMB terms, BABA saw an increase of 2% on a year over year ("y-o-y") basis. This increase was primarily driven by BABA International Commerce segment which saw an increase of 18% y-o-y and Cainiao which reported a 27% revenue increase compared to the same period last year. Despite this overall weak increase in revenues BABA was able to significantly increase its operating income to $5.1 billion for the period. This increase was driven by a reduction in costs in research and development which saw a 20% decrease compared to the same period last year, a reduction in workforce and more importantly a significant reduction in impairment of goodwill which stood at $394 million compared to $3.9 billion during the same period last year. Further to this, BABA saw an increase in interest and investment income of $2.3 billion as a result of changes in fair value of equity investments. It is important to understand, that this are not cash inflows, they are simply the change in value of investments. This cash does not actually impact the cash flow going into the company but impacts the balance sheet position of these investment. As a result BABA posted a net income of $6.6 billion for the period.

BABA posted an incredible cash flow from operations totaling $12.7 billion for the quarter. After capital expenditures, which amounted to $850 million, the company yielded a handsome free cash flow for the period of $11.8 billion. Management used this cash to repurchase 45.4 million shares for about $3.3 billion as part of the company´s ongoing commitment to improve shareholder returns. Furthermore, management enhanced its cash and cash equivalents position by investing in short-term investments and other treasury investments which led to an increase in BABA cash and cash equivalents position to $78.2 billion compared to $68.2 billion during the previous quarter.

Cainiao Results

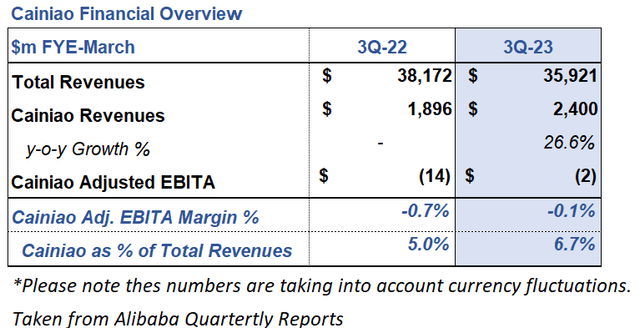

Cainiao Financial Overview (Alibaba Quarterly Report)

During the third quarter Cainiao reported a y-o-y revenue increase after inter-segment elimination of 27% to $2.4 billion. This increase was primarily driven by revenue from domestic consumer logistics services as a result of its service model upgrade since late 2021. This model upgrade enhances customer experience, and international fulfillment solution services. Important to note that Cainiao has increased revenues steadily during the past years and is on pace of finishing the year with revenues after inter-segment elimination close to $10 billion. Furthermore, Cainiao is becoming a more significant part of the company´s overall top line, with the segment now accounting for approx 7% of total revenues. Finally, it should be mentioned that Cainiao has expanded operations with five new international sorting centers, bringing the number of overseas sorting centers in operation to fifteen.

Alibaba Cloud

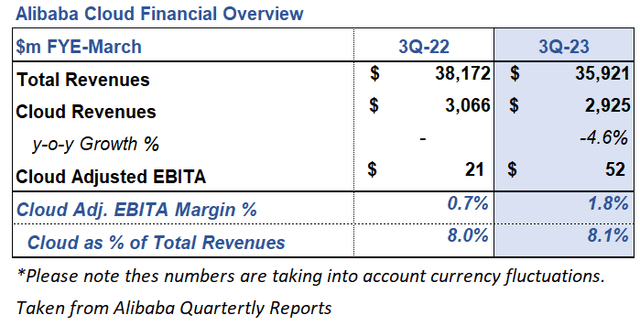

Alibaba Cloud Financial Overview (Alibaba Quarterly Report)

Please note that the table above is considering currency fluctuations which make it seem like the cloud segment actually saw a decrease in revenues. In RMB terms Alibaba Cloud reported revenue growth.

During the third quarter Alibaba Cloud reported revenues of $2.9 billion. In RMB terms total revenue from Alibaba Cloud segment after inter-segment elimination grew by 3% y-o-y. Growth was mainly driven by healthy public cloud growth and partially offset by declining hybrid cloud revenue.

Alibaba Cloud revenue is seeing large contributions from non-Internet industries which grew by 9% y-o-y and contributed to 53% of the overall revenue. The industries driving this growth are financial services, education and automobile industries. Growth was partially offset by a decline in revenue from the public services industry. Important to note that revenue from customers in the Internet industry actually declined by 4% y-o-y. This decrease is mainly a result of one of the top Internet customers by Alibaba Cloud gradually stopping to use the overseas cloud services for its international business. This decrease was somewhat offset by improving demand from Internet industry customers in China.

On a final note it should be mentioned that Alibaba Cloud continues to ramp up its international presence now offering cloud computing services in 28 regions and 86 availability zones. It should be highlighted that Alibaba Cloud continues to expand its footprint and has just started operations of its third data center in Japan and has added new data centers in countries such as Saudi Arabia, Germany, Thailand, and South Korea.

Shareholder Returns

As mentioned during my previous article on BABA, just a few months ago the company´s management announced a total share buyback program of $40 billion. During this latest quarter, BABA repurchased 45.4 million shares for approximately $3.3 billion as part of the company´s ongoing commitment to improve shareholder returns.

As of December 31, 2022, the company had approximately 20.7 billion ordinary shares which is equivalent to 2.6 billion ADRs outstanding. Furthermore, BABA still has $21 billion remaining under its share buyback program, effective through March 2025.

It should be noted here that since the peak of ADS shares outstanding in June of 2021 when the number of shares outstanding stood at 2.7 billion, the company has steadily decreased this number by 120 million to 2.6 billion. This are welcomed news by investors as with higher earnings and lower outstanding shares the company´s EPS will be enhanced by two different sides. I will continue monitoring this development during the following quarterly results.

Workforce Reduction and Cost Optimizations

A final note on BABA´s strong quarter results is the fact that the company has laid off a significant portion of its workforce. In 2022 BABA laid off 19.000 workers as a result of its cost efficiency strategy. During the latest quarter BABA laid off 4000 employees which puts its total workforce at just about 240.000 employees. Furthermore, BABA reduced research and development as well as sales and marketing expenses by about 20%. These initiatives have helped reduce pressure on profitability and cash generation and have actually enhanced the company´s bottom line and free cash flow generation.

Conclusion

Despite a recent decrease in market valuation of almost 10%, BABA has continued to deliver strong results posting a whopping free cash flow for the quarter of $11.8 billion and a nine month free cash flow generation of $20.2 billion. Further to this, management keeps repurchasing shares which has reduced share count by about 120 million in the last 6 quarters. We are also seeing management being more aggressive with the share buyback program, reducing share count by 45 million during the latest quarter. It is true that revenue has slowed down in the previous quarters, nonetheless the company keeps delivering strong results, it has approx. $80 billion in cash and cash equivalents which gives it the financial flexibility to pursue growth through different segments such as Cainiao and Alibaba Cloud. Both of these segments continue to enhance its offerings and continue to become of greater importance to the company´s top line. BABA continued delivery of strong results, strong fundamentals, and significant runway of growth ahead lead me to consider BABA stock a buy.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.