First Solar Earnings: Growing Faster Than Expected

Summary

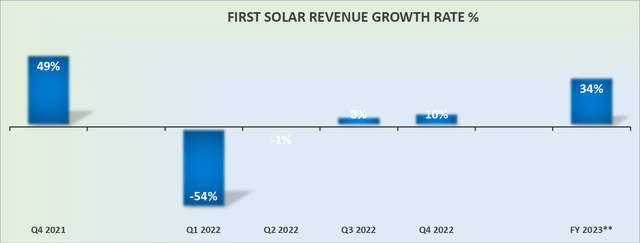

- First Solar, Inc.'s guidance for 2023 points to approximately 34% CAGR, perhaps slightly more.

- The bear case remains problematic. Notably, this business is burning through significant free cash flows.

- All that being said, I'm inclined to believe that this story stock isn't shockingly expensive, contrary to what many believe.

- Looking for more investing ideas like this one? Get them exclusively at Deep Value Returns. Learn More »

ArtistGNDphotography

Investment Thesis

First Solar, Inc. (NASDAQ:FSLR) puts out enticing guidance for 2023, where revenues are expected to grow faster than analysts expected.

That being said, its cash burn for the year ahead points to at least $1 billion. Therefore, I believe that FSLR will need to raise funds within the next twelve months.

Undoubtedly, investor concerns that this business can't survive without tax credits haven't abated.

And yet, all considered, I am bullish on FSLR stock.

Revenue Growth Rates Have Substantially Improved

FSLR has had a tumultuous start to the year. Recall, the early parts of 2022 saw its revenue turn lower as module volumes weakened. However, since the summer, FSLR's share price has been on a tear.

Consequently, even though the guidance for 2023 is enticing, investors had a relatively unenthusiastic reaction post-earnings. After all, what should one expect? The stock was already up more than 150% since the summer lows.

Nevertheless, I don't believe this is where the story ends for FSLR. In fact, consider this.

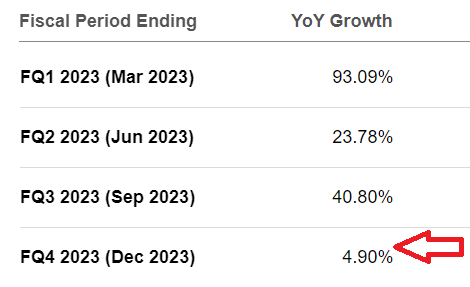

SA Premium

What you see here is that analysts following FSLR expect its growth rates to start 2023 strongly, but to massively fizzle out by the time it exits Q4 2023.

However, keep this in mind, the midpoint of FSLR's guidance is 3% higher than analysts' consensus. And on top of that, keep in mind FSLR's ability to raise their guide as the year progresses.

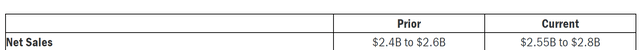

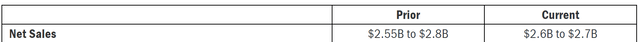

Recall, back in Q2 2022 FSLR, upgraded its full-year outlook from $2.5 billion at the midpoint to $2.7 billion at the midpoint.

Then, in Q3 2022, it upgraded its outlook once again to just over $2.6 billion at the midpoint.

And when the full year was actually reported, FSLR actually met that guidance of just over $2.6 billion.

Consequently, I believe that as FSLR progresses with 2023, we could actually end up with FSLR growing slightly higher than 35% CAGR.

And in the next is where the bull case hits a wall.

FSLR's Profitability Profile is Where Things Get Complicated

On the surface, FSLR guides for approximately $800 million of operating income. And that's really terrific when you think that its market cap is only $18 billion.

The problem is that approximately $800 million of its operating income, the vast majority, is made up of tax credits that come from the Inflation Reduction Act (''IRA''). More specifically, about $700 million of tax credits will flow through its income statement.

What's more, this profitability figure doesn't factor in the huge capital expenditure figures FSLR is likely to see in 2023. At this moment, FSLR expects its capex figures to reach $2 billion this year.

Consequently, as we look ahead to the exit from 2023, FSLR's net cash position is expected to go from $2.4 billion at the end of 2022 to approximately $1.4 billion. Simply put, FSLR expects to use around $1 billion of cash.

And therein lies the problem. For all its revenue growth rates, there are substantial questions as to the viability of this business model without tax credits.

FSLR Stock Valuation -- 5x Forward Sales

For now, this is mostly a "story stock." It's simply a question of how much investors buy into the story that the IRA bill will provide enough stimulus for this sector and for enough years to allow these companies to become viable and self-sufficient.

On the other hand, contrary to the view that many investors have expressed, I don't believe that the stock is expensive. Yes, the company isn't fully profitable or even generating enough cash to support its operations.

And yes, the business will have to raise more capital, hopefully through the debt market, within the next twelve months.

But once again, I circle back to the fact that its business is clearly rapidly growing.

The Bottom Line

Overall, I'm tepidly bullish on this company. Even though I do not believe that this quarter will have substantially changed the naysayers' minds.

Still, the main question that needs to be answered is on what terms will First Solar, Inc. raise the funds it requires in the next twelve months?

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities - stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

- Deep Value Returns' Marketplace continues to rapidly grow.

- Check out members' reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

This article was written by

DEEP VALUE RETURNS: The only Marketplace with real performance. No gimmicks. I provide a hand-holding service. Plus regular stock updates.

We are all working together to compound returns.

WARNING: Any stocks that you feel like buying after discussions with me are your responsibility.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.